Last updated: April 12, 2024

Hop in, folks! It’s time to hit the road of mileage deductions. We’re cruising at 70 cents per mile this year, so buckle up and let’s take a joy ride through the ins and outs of the 1099 mileage deduction.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Gas Tank Half Full or Half Empty? Understanding the 1099 Mileage Deduction

No doubt about it, being a 1099 worker comes with its fair share of bumps in the road. But, there’s a silver lining hiding in your gas tank! You’ve probably heard whispers about the 1099 mileage deduction and claiming mileage on taxes. Now, you might be scratching your head, thinking, “What’s the big deal about keeping track of my miles?” Buckle up, dear reader, because this is one journey you don’t want to miss out on.

A Penny Saved is a Penny Earned: The 1099 Mileage Deduction

It’s all about that Benjamin – or rather, a good chunk of Benjamins. As a 1099 contractor, each business-related mile you drive puts a shiny penny (well, 67 of ’em, to be exact) back in your pocket in 2024. That’s right, the 2024, 1099 mileage deduction rate is a whopping 67 cents per mile. Think of it this way: every mile is a small treasure chest you can stash away come tax time.

Pit Stop: Who Is Eligible for the 1099 Mileage Deduction?

Hold your horses! Before you start daydreaming about all those pennies adding up, let’s make sure you’re eligible to claim the 1099 mileage deduction. This pit stop is for the self-employed, freelancers, gig workers, and independent contractors. If you’re shaking hands with Uncle Sam under a 1099 agreement, you’re in the right place.

Filling Out the Paperwork: The Schedule C (Form1040)

The open road is fantastic, but every ride requires a pit stop. For 1099 mileage deductions, that pit stop is the Schedule C (Form 1040). This handy piece of paper is where you record your mileage for your deductions. It’s a tax form, yes, but think of it as a roadmap guiding you to your treasure trove of deductions.

Green Light: The 1099 Mileage Deduction Process

As they say, the devil is in the details. It’s not enough to just tell the IRS, “Trust me, I drove a lot!” They’re going to need some proof. And that’s where MileageWise becomes your co-pilot. More on the topic in our self employed mileage deduction post.

How to Calculate Your Deduction with a 1099 Mileage Deduction Calculator

Calculating your deduction might seem tricky, but it’s made easier with a 1099 mileage deduction calculator. This tool helps you determine how much you can deduct based on the standard IRS mileage rates. For instance, the 1099 mileage deduction 2023 rate is 65.5 cents per mile and the 2024 it is 67 cents.

FAQs About 1099 Mileage Deductions

- Q: Can I claim mileage on my 1099?

- A: Yes! If you’re a 1099 contractor, you can claim mileage for business-related trips.

- Q: What if I’m a 1099 employee?

- A: As a 1099 employee, the mileage for 1099 employees rule allows you to deduct your business mileage too.

- Q: Can a 1099 employee write off mileage?

- A: Yes, as a 1099 independent contractor, you can deduct business-related mileage on your taxes. This includes travel for meetings, job sites, and other work-related activities. However, commuting miles are not deductible. To claim this deduction, keep a detailed log of your business trips, including dates, distances, and purposes, and use either the IRS’s standard mileage rate or actual vehicle expenses for the calculation.

- Q: Are parking and tolls deductible?

- A: Yes, parking and tolls are tax deductible. However, the Standard Mileage Rate does not cover them, so they are separately deducted on your tax form

Start Your Journey of IRS-Proof Logging

Mileage Reimbursement vs. Mileage Deduction

There’s a difference between mileage reimbursement for 1099 employees and taking a mileage deduction. Reimbursements are when your client or employer pays you back for mileage. However, reporting mileage reimbursement on 1099 is not required if it’s done under an accountable plan. Otherwise, it might be considered income.

1099 Gas Mileage Deduction: The Nitty-Gritty

The 1099 gas mileage deduction is part of the overall mileage deduction and focuses specifically on the fuel cost for business travel. Remember, it’s more beneficial to use the standard mileage rate, which already accounts for gas, depreciation, and wear and tear.

Tips for Maximizing Your 1099 Mileage Deduction

- Keep Detailed Records: Log every business-related trip with dates, mileage, and purpose.

- Understand Eligible Trips: Not all driving counts. Commuting, for instance, is not deductible.

- Stay Informed: Keep up with the latest IRS updates, as rates and 1099 taxes can change yearly.

In summary, for 1099 contractors, learning how to deduct mileage and understanding the 1099 mileage tax deduction can lead to significant savings at tax time. Whether you’re tracking your miles for reimbursement or preparing to write off mileage, staying informed and organized is key.

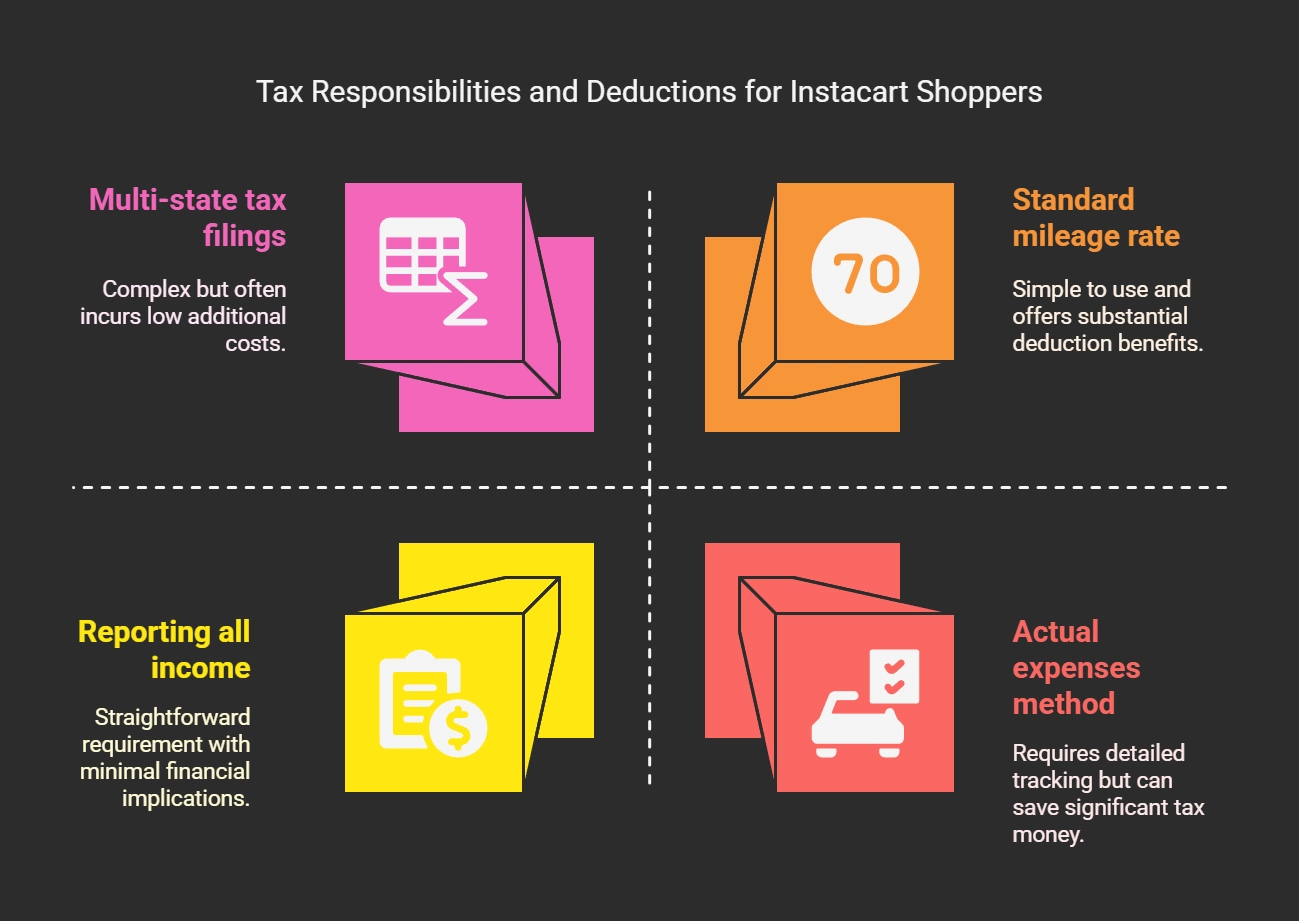

Standard Mileage Rate vs. Actual Expense Method

When it comes to claiming mileage on your taxes, you have two options: the standard mileage rate or the actual expense method. Each approach has its advantages, and understanding them can help you maximize your tax deductions.

Comparing the Two Methods

The standard mileage rate is straightforward—you simply multiply your business miles by the IRS rate. It’s hassle-free and requires minimal record-keeping. In contrast, the actual expense method tracks all vehicle-related costs, which can lead to a higher deduction but demands more detailed documentation.

| Method | Pros | Cons |

|---|---|---|

| Standard Mileage Rate | Easy to calculate, Less paperwork | May not reflect actual costs, Limited vehicle eligibility |

| Actual Expense | Potential for a larger deduction, Reflects true costs | Requires meticulous records, More complex process |

When to Use the Standard Mileage Rate

The standard mileage rate works best for those driving fuel-efficient vehicles or covering a high number of business miles. It’s an ideal choice for taxpayers who prefer a simple and efficient tax filing process.

Calculating Deductions with the Actual Expense Method

If you opt for the actual expense method, you’ll need to track all vehicle expenses, including gas, maintenance, insurance, and depreciation. This method is particularly beneficial for those with high-maintenance or expensive vehicles. To determine your deduction, calculate the percentage of business use and apply it to your total vehicle expenses.

Whichever method you choose, accurate mileage tracking is essential to ensure you receive the full tax benefits.

Mileage Deduction Record-Keeping Requirements

Keeping precise mileage logs is crucial for tax deductions. The IRS has specific guidelines requiring you to document:

- Odometer readings at the start and end of each trip

- Total miles driven for business purposes

- Dates of travel

- Business destinations

- Purpose of each trip

A mileage tracking app can streamline this process by automatically recording trips and categorizing them as business or personal. These apps also generate IRS-compliant reports, simplifying tax filing.

The IRS mandates retaining mileage records for at least three years after filing taxes. In the event of an audit, these records are critical for verifying your deductions.

| Record-Keeping Method | Advantages | Disadvantages |

|---|---|---|

| Paper Logbook | Simple, No technology needed | Time-consuming, Prone to errors |

| Spreadsheet | Digital, Easy to update | Manual entry, Potential for mistakes |

| Mileage Tracking App | Automatic logging, IRS-compliant reports | Requires a smartphone, Possible battery drain |

By maintaining accurate records and choosing the right tracking method, you’ll be well-prepared to claim your mileage deductions and stay compliant with IRS requirements.

Your Road Trip Companion: MileageWise

Talk about your guardian angel on the highway! With MileageWise, you’ve got the best co-pilot for keeping track of your miles and helping you nab that 1099 mileage deduction. It’s the tool of choice for 1099 employees because it creates 100% IRS-Proof mileage logs.

Going the Extra Mile with MileageWise

Not only does MileageWise make understanding 1099 mileage deductions a breeze, but it also guides you through the process of maximizing those deductions. It’s like having a savvy accountant riding shotgun, helping you navigate the complex twists and turns of tax season.

Now, let’s face it, taxes are about as exciting as watching paint dry. But when it comes to putting money back into your pocket, we’re all ears (and wallets). The 1099 mileage deduction is a key tool in your tax-saving arsenal. And with MileageWise on your side, you’ll be ready to ride into the sunset, knowing you’ve claimed every penny that’s rightfully yours. So, tighten that seatbelt and get ready to zoom through tax season!

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Similar blog posts:

1099 Tax Calculator: Easily Calculate Self-Employment Taxes

Are you confused about taxes from your 1099 income? A 1099 calculator helps freelancers, rideshare drivers, and other self-employed workers easily figure out taxes. Let’s see how

Instacart 1099 Taxes: Complete Guide for Shoppers in 2025

Are you one of the thousands of Instacart shoppers hustling to make deliveries across town and confused about Instacart 1099? Are you wondering about those pesky

Overpaying Taxes? Here’s How to Stop Losing Money

Every year, millions of taxpayers unknowingly pay more than they owe. Are you one of them? Overpaying taxes happens when you miss out on deductions,

Should I File My Small Business Taxes Separate from Personal?

As a small business owner, you might wonder, “Should I file my business taxes separately from my personal taxes?” This decision can have significant implications

Understanding US Marginal Tax Rates 2025

Did you know your next dollar could be taxed at a completely different rate? Knowing about US marginal tax rates is key to saving money.

1099 Tax Deductions List For 2025

Filing taxes can be tough, even for those who get a 1099 form. In 2024, knowing the 1099 tax deductions list is key to saving on taxes. This