Oct 6, 2023

Stride Mileage & Tax Tracker is a free app designed for self-employed individuals such as freelancers, delivery drivers, and small business owners to track their expenses and mileage for tax purposes.

It offers mileage recording using GPS, expense imports from your bank, and receipt photo storage. The app also suggests tax deductions, integrates with tax filing software, and is available for both Android and iOS.

Here at MileageWise, we set out to understand Stride’s offerings and compare them to ours. This review delves into the app’s functionality, its features, its web dashboard, and examines if Stride’s free mileage tracker can match the convenience, IRS-compliance, and savings potential of MileageWise’s premium features.

Using Stride: A Quick Overview

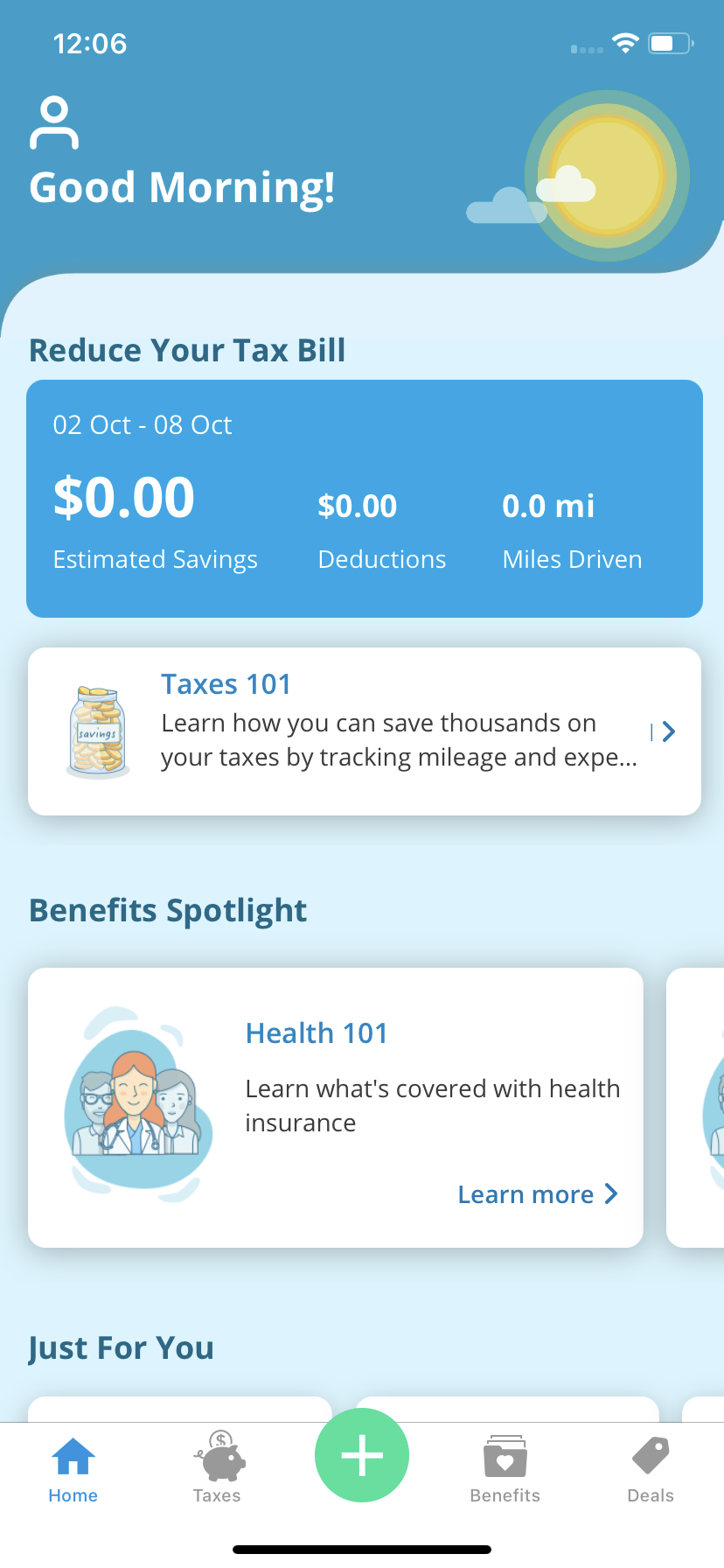

The Stride Tax app and dashboard work together to help you track your mileage, expenses, and income for tax purposes.

As mentioned before, getting started with the app doesn’t require any financial transactions or providing your credit card details.

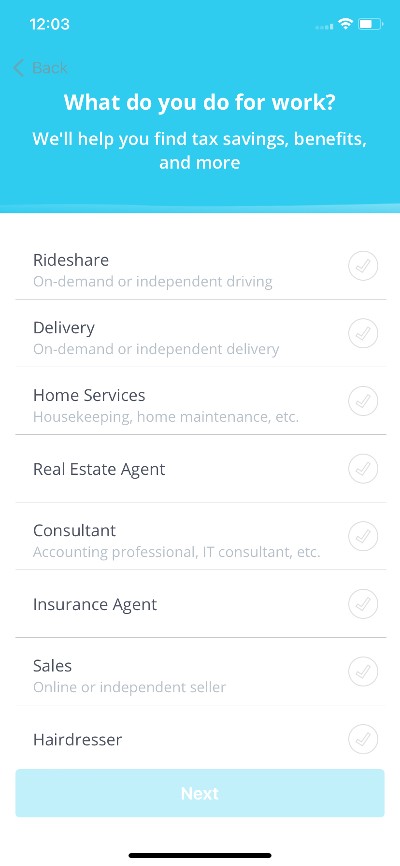

To get started with Stride, you simply need to create an account and enter some basic information about your business. For the sake of the testing, I’ve selected the Delivery option and modeled short trips as if I were an Instacart driver delivering goods in a small neighborhood.

Once you’ve done that, you can start tracking your mileage.

To track your expenses, you can either take photos of your receipts or enter them manually. Stride can also automatically categorize your expenses for you.

To track your income, you can manually enter your earnings or connect your Stride account to your PayPal or Stripe account.

Once you’ve entered your mileage, expenses, and income, you can view your tax dashboard to see how much you can expect to save on taxes. The dashboard also provides you with a variety of reports that you can use to file your taxes.

Let’s Ride with Stride

For the review, I will focus on the app’s mileage tracking section to highlight the good and the bad so that you can make an informed decision when deciding whether to use Stride for your business mileage tracking.

If you’ve used other mileage-tracking apps before, the first thing you’ll notice is that Stride needs manual input to track mileage. The trigger can work in two ways:

Hook up your phone: The app can automatically track your mileage when you’re driving by recognizing when you plug in your phone. If you’re driving for business, you can respond to its prompt to start tracking your work-related miles.

Tap to start: Just tap the + button on the home screen and select “Track Miles” from the list to start a new trip. Once you’re done tracking, just tap on the “I’m done driving” button.

What are the notable mileage tracking features?

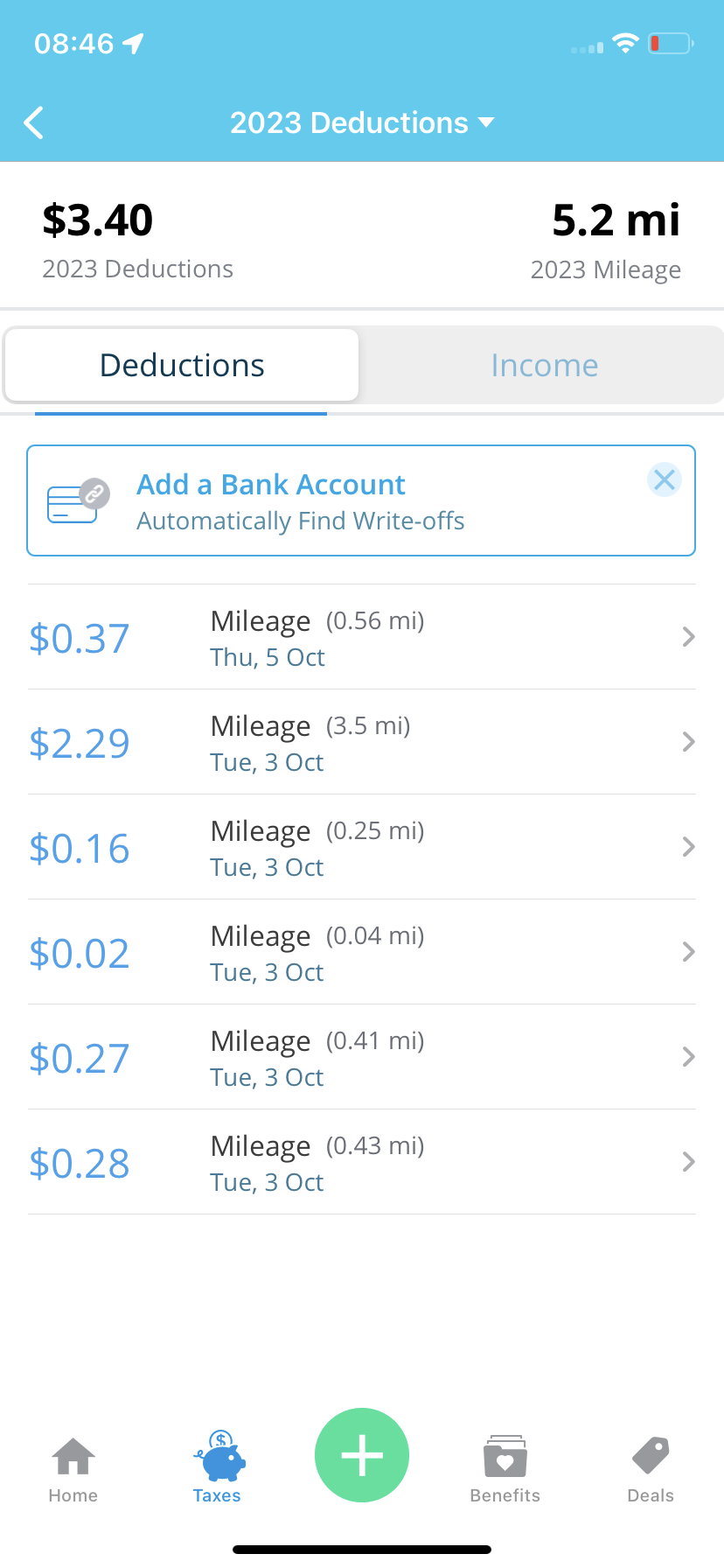

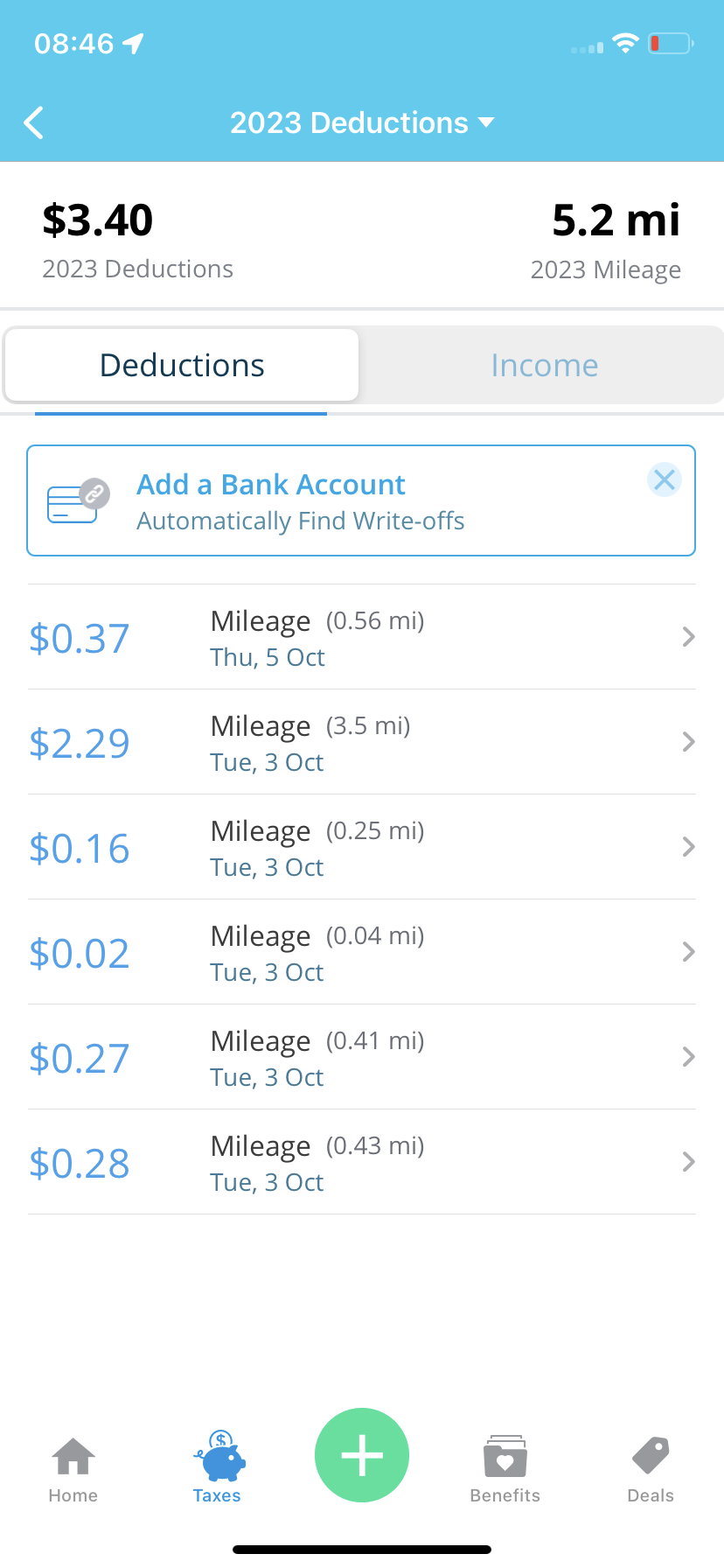

Immediate Tax Deduction Reporting

Besides offering a free tracking option, Stride also provides some further noteworthy features in the mileage tracking compartment. One great feature is that right after you’ve done driving, your trip gets evaluated for possible tax deductions and the figure gets added to your trip log right in the app:

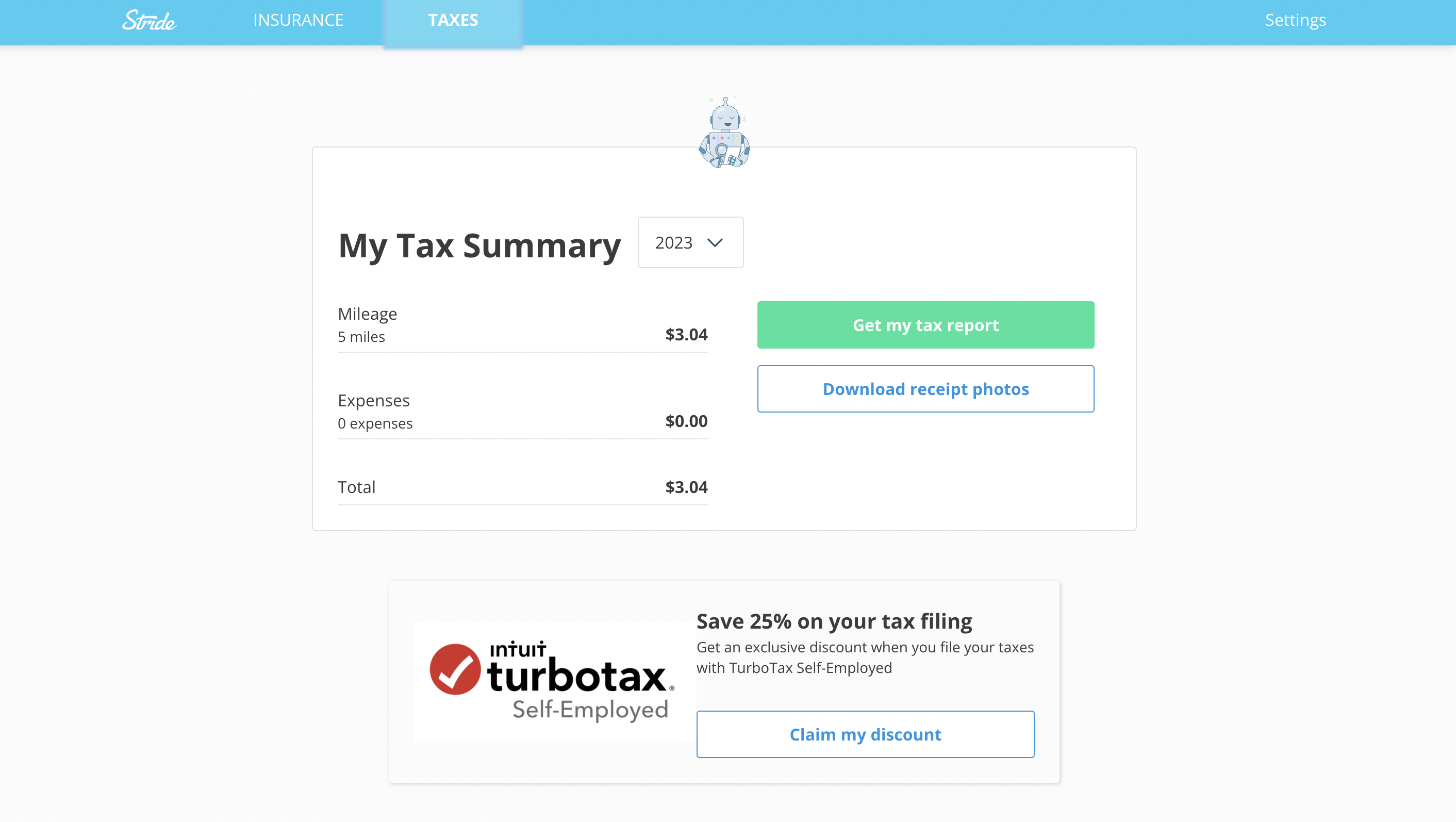

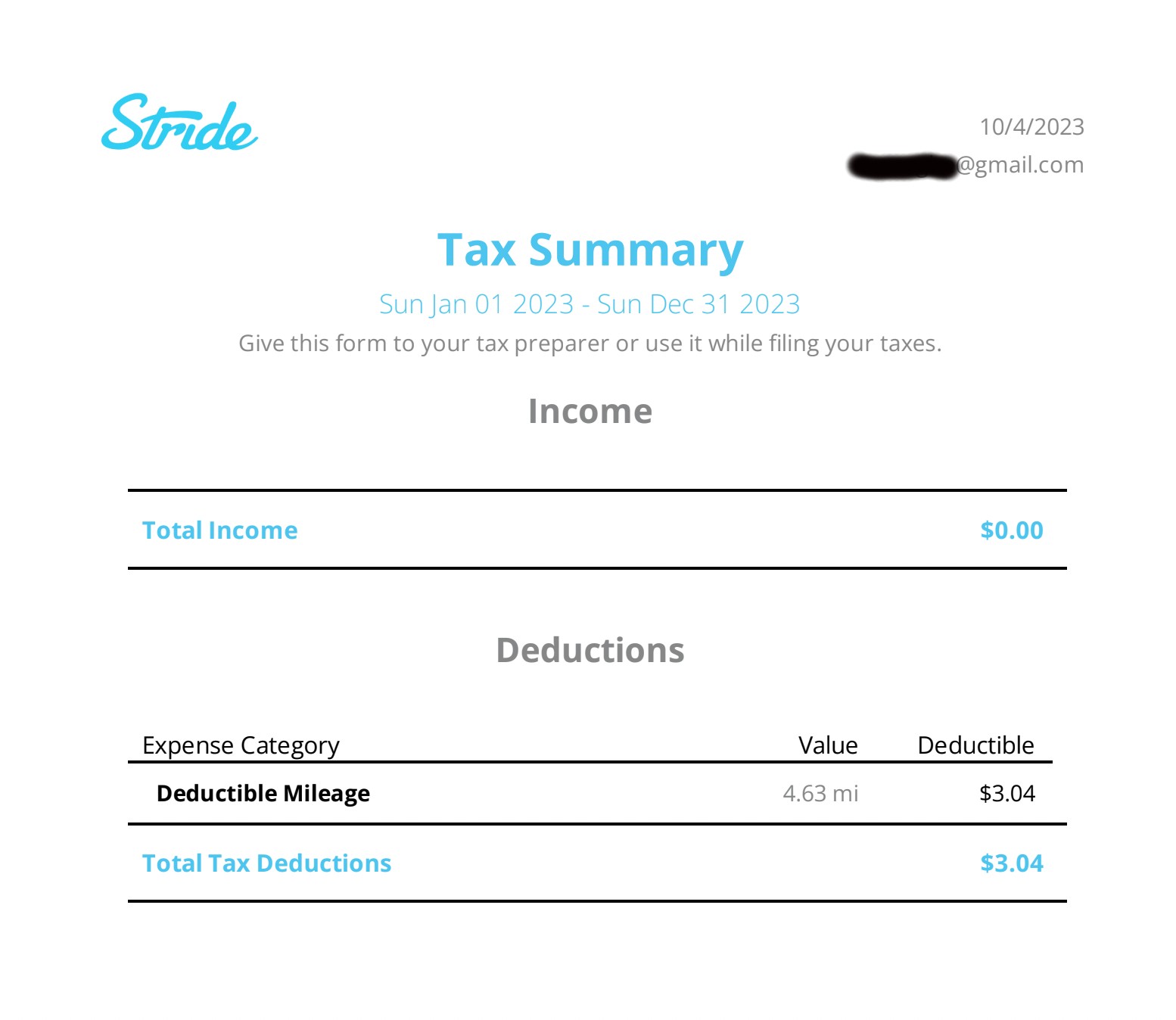

Email Your Tax Report

There’s another handy feature here. If you go now to your web dashboard and click “Get my tax report”, you can also have your tax summary emailed to you or your accountant straight away. Alternatively, you can also upload it to TurboTax directly.

Offline Mileage Tracking

Another notable feature is the offline mileage tracking protocol. If you begin and end tracking when your mobile is connected to a familiar WiFi network, it works even without continuous mobile internet. When you return to that WiFi spot, simply refresh the reporting page, and any trips recorded offline will appear in the report.

Automatic Write-Offs

The app also allows linking a bank account for automatic write-off detection, though regular check-ups are recommended for accuracy.

Looking at the bright side so far, Stride does offer freelancers a great free alternative to be able to record the basics, however, there’s a trade-off. Stride Tax lacks several features that could make your life easier and your records IRS-Proof.

What’s lacking?

No Editing Options for Recorded Trips

One of the disappointing facts is that you just can’t edit previously recorded trips in any way. You can’t update the locations, you can’t change the client/partner visited, or the purpose of the trip.

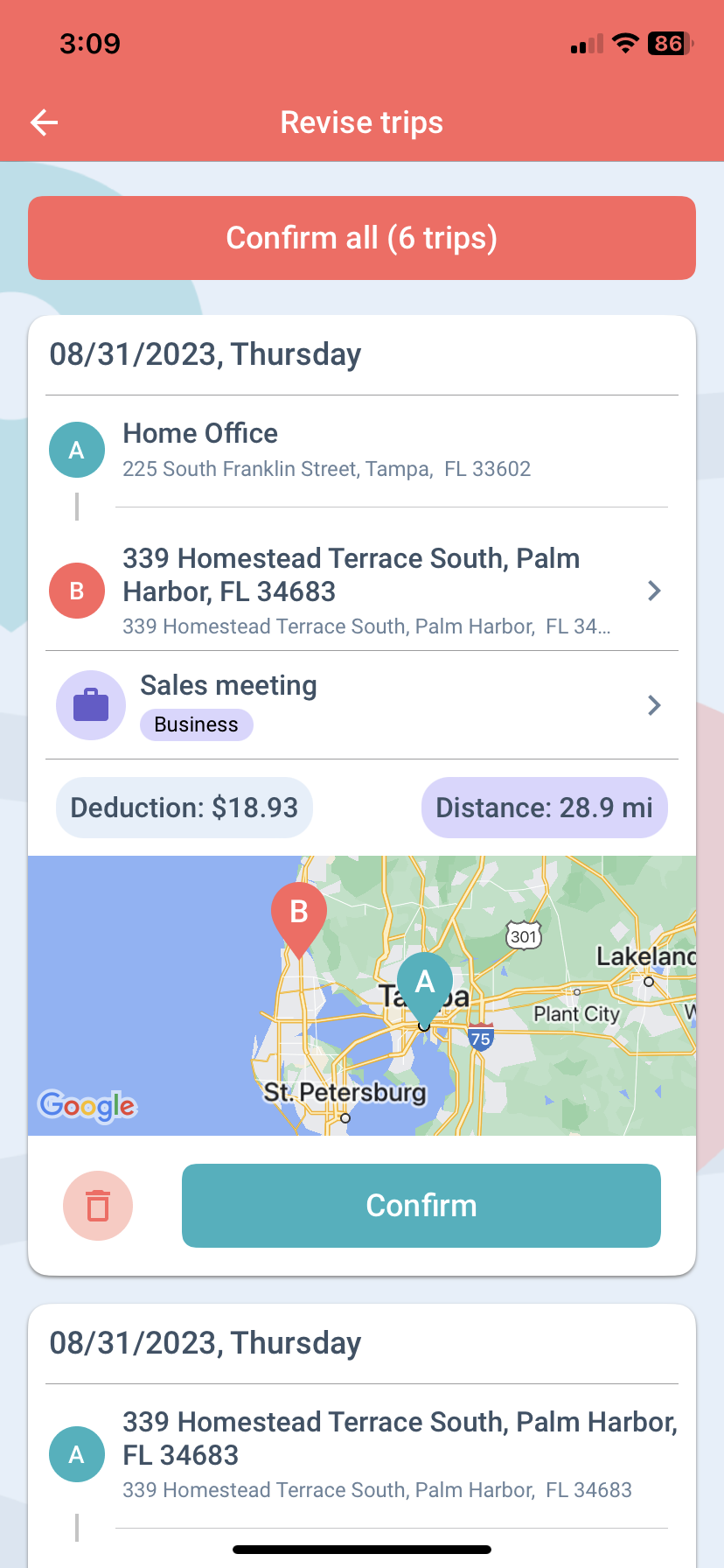

MileageWise, on the other hand, offers you a range of options to revise your trips right from the app, if needed.

No Retrospective Recovery

Stride also lacks the crucial feature of accurately recovering or recreating trips retrospectively. While it permits manual trip additions, this method still poses a significant risk of inaccuracy.

MileageWise to the rescue! MileageWise offers you a couple of impressive solutions to this problem so that your trip gaps won’t compromise the quality of your final mileage log.

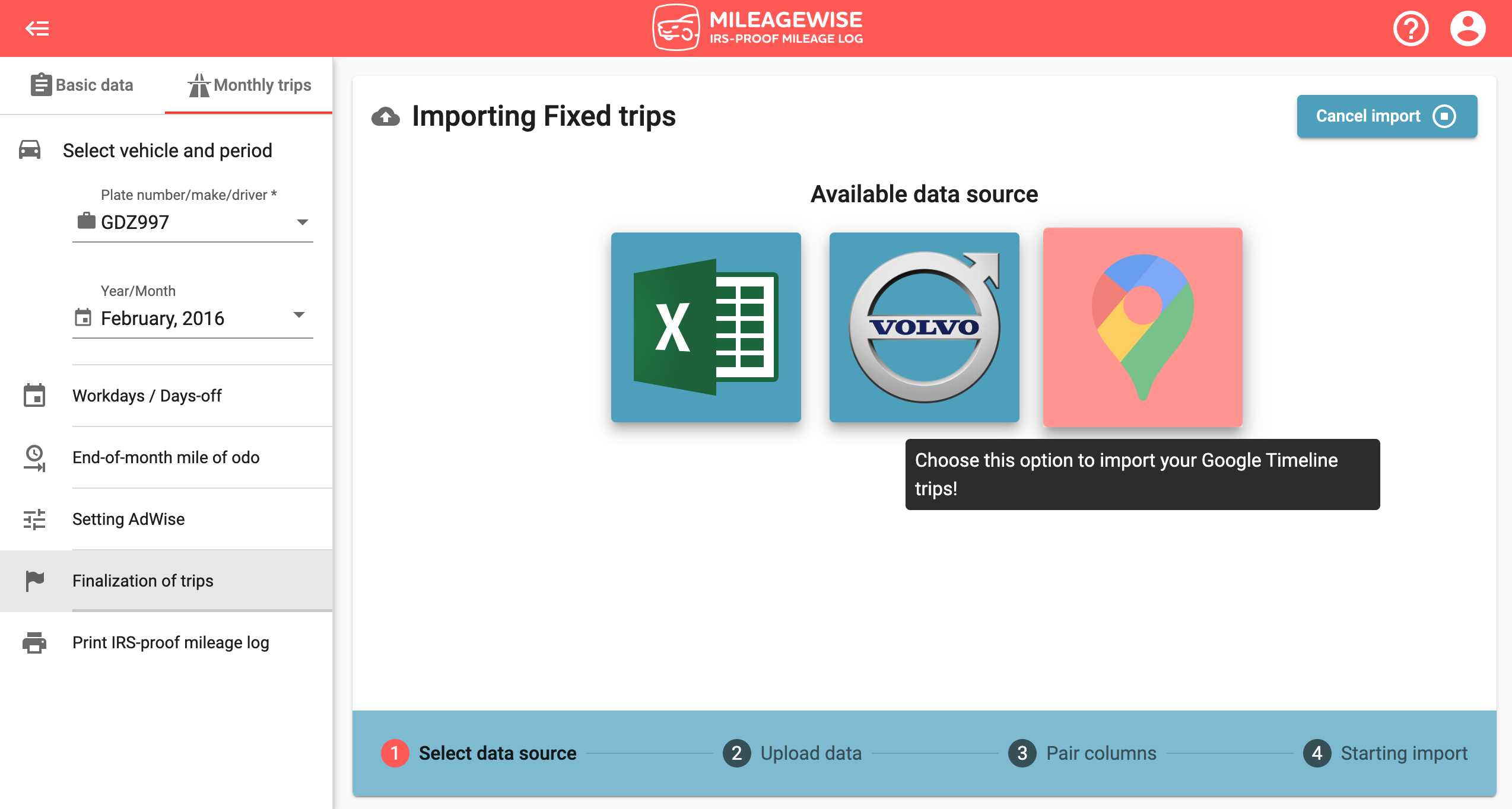

- Google Timeline Import: Google Maps Timeline logs daily trips and while it’s not fully compliant with IRS mileage logs on its own, with some tweaks, it can be converted into an IRS-approved mileage log.

Simply enable Google Location History for added security and protection against data loss. If audited, the data from Google can be exported via Google Takeout and converted into an IRS-approved format with the help of MileageWise.

2. AI Wizard: MileageWise also offers you another way to recreate logs retrospectively. Its AI-powered wizard can suggest realistic trips based on your past driving patterns and the list of clients/locations visited. These recreated logs can then be incorporated into your final IRS-Proof submission.

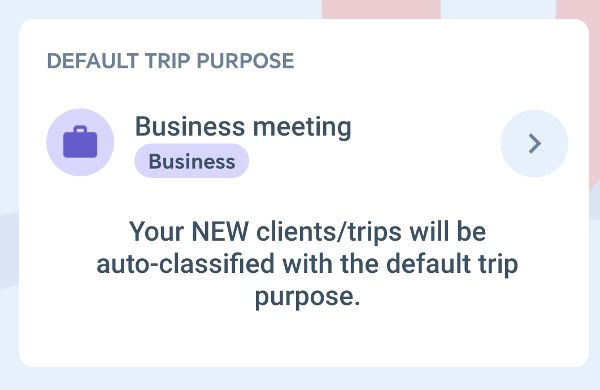

No Trip Classification

Another area for improvement in Stride is the trip auto-classification feature, or, to be precise, even the bare possibility of classifying your trips manually as anything other than business.

MileageWise, on the other hand, offers both auto-classification and manual editing options (as mentioned above in the trip revision section)

Stride “Loses” You After Battery Drain

While testing the app, an interesting and surprising incident occurred. Accidentally, my battery had gone dead so I hooked my iPhone up to a charger. After a short but sufficient charging, I wanted to start tracking a new trip again, but Stride didn’t recognize me and didn’t ask for a login either!

Instead, I needed to re-do the whole setup once again by entering my name, the purpose of using the app, my ZIP code, and so on. That was quite a disappointment, and to be honest, it’s never happened to me while testing or using other mileage tracker apps.

No Instant IRS-Proof Mileage Log

Even though Stride allows you to file your taxes right through it, you need to judge the reliability of the mileage report it produces. Quite frankly, it seems basic and requires some further work by your accountant to arrive at an IRS-Proof version.

Take a look at the report I was emailed:

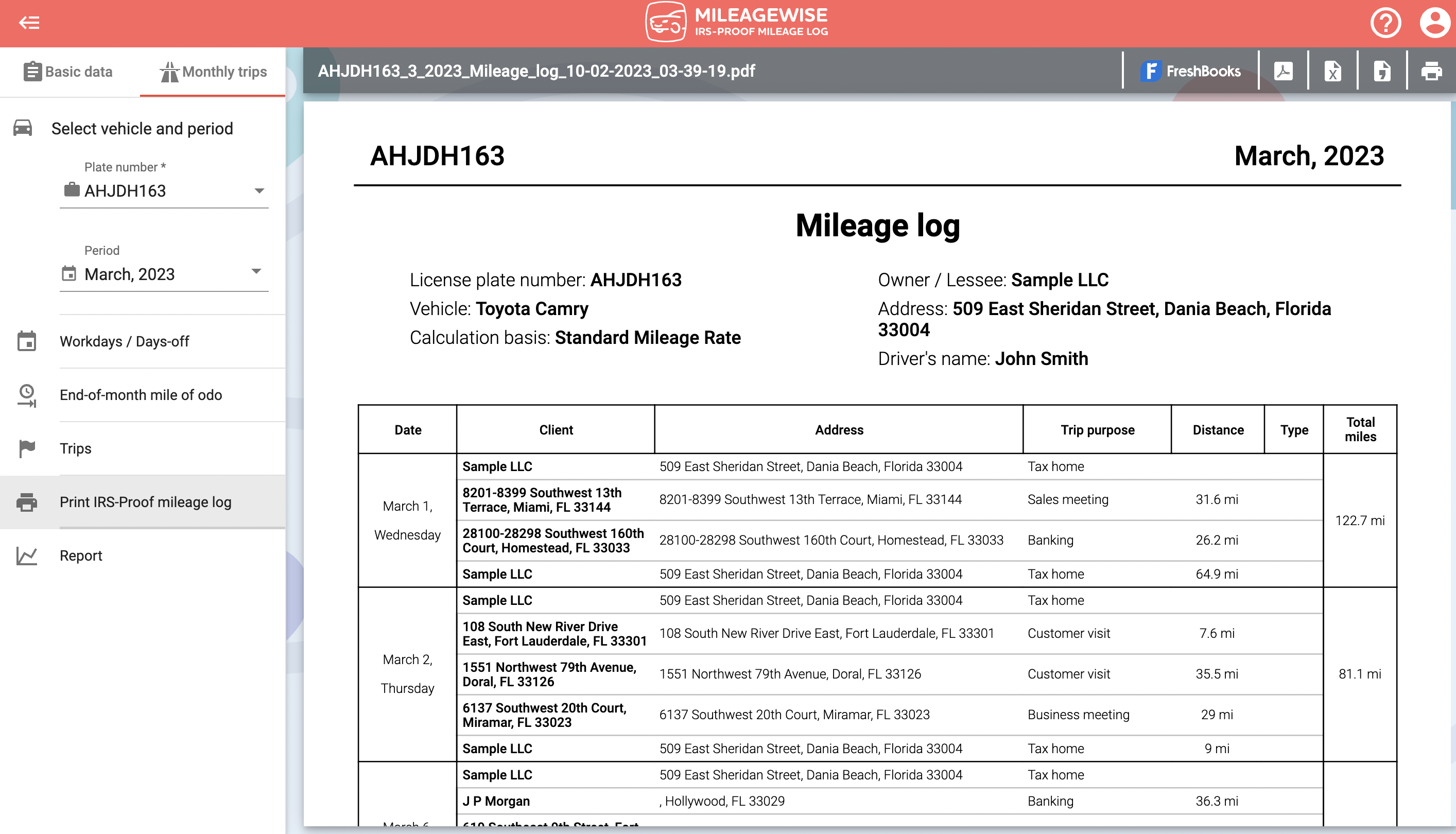

Now, take a look at the MileageWise alternative. The difference is quite obvious if you compare Stride’s report with the IRS-Proof mileage log MileageWise provides you.

Also, without timestamps, the original app record doesn’t help you decide which trip was actual business mileage and which was a personal trip, for instance, to grab a bite. Just imagine the mess you need to deal with in a month or several months!

Vehicle Expense Tracker

Even though Stride Tax offers some expense tracking options like car or health insurance, oddly enough, it doesn’t offer tracking for vehicle-related expenses, such as fuel or maintenance.

If you opt for MileageWise, you get a dedicated Vehicle Expense Tracker feature. It allows you to enter costs related to car repairs and other vehicle-associated business expenditures. These are then reflected in your IRS-Proof mileage log, simplifying deductions based on vehicle ownership expenses and the business use proportion.

Integrations

While Stride does help your tax claiming procedure with its Turbo Tax, H&R Block and similar accounting and expense-related integrations, when it comes to ensuring that you produce IRS-Proof logs consistently throughout the year, it might not be your best ally.

MileageWise lets you rely on your Google Timeline records to back up your claims, provides accounting help with its Freshbooks integration, and helps your everyday driving with Waze integration.

So Is It Worth To Ride With Stride?

If you’re open to manually recording your mileage, giving up some essential features, and willing to manually tweak your logs to meet IRS standards, this free tax and mileage tracker can be ideal.

MileageWise, the Superior Alternative to Stride

In conclusion, while Stride Tax offers a commendable range of services for a free mileage and expense tracker, it comes with several shortcomings that can potentially compromise its users’ IRS compliance. The app falls short in areas such as editing recorded trips, retrospective recovery, trip classification, data retention after battery drain, and a thorough IRS-Proof mileage log.

On the other hand, MileageWise, albeit a paid service, addresses these deficiencies with innovative solutions like Google Timeline Import, the AI Wizard, and enhanced trip classification, ensuring thorough IRS compliance. Additionally, its feature set includes a Vehicle Expense Tracker and integrations with platforms like Freshbooks and Waze, emphasizing the app’s holistic approach to mileage tracking.

All of these factors solidify MileageWise’s position as a superior and more comprehensive alternative to the Stride Tax app. In the world of mileage tracking, it’s clear that sometimes, free might not mean carefree, especially when dealing with the meticulous requirements of the IRS.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |