April 16, 2024

As a Shipt driver, keeping track of your mileage and vehicle expenses is crucial for tax purposes. However, it can often be a time-consuming task, especially when you’re busy handling orders, navigating traffic, and serving eager customers. Manual mileage logging might not be the most efficient way to go about it.

But fret not, because we have the perfect solution for you! If you’re a Shipt driver, consider using MileageWise as your go-to mileage tracking app.

Simplify Mileage Tracking with MileageWise

Say goodbye to the hassle of tracking your Shipt mileage manually. The MileageWise app not only automates and streamlines your mileage tracking but also ensures that your monthly logs are IRS-Proof, ready to withstand any tax audit. With the help of your personal Web Dashboard, you can easily compile and print your monthly logs in a format that meets IRS standards. Additionally, MileageWise helps you monitor your vehicle-related expenses effectively.

The Preferred Mileage Tracker for Shipt Drivers: MileageWise

As a Shipt delivery driver, accurate mileage tracking is essential for maximizing tax deductions and managing expenses.

This is because Shipt drivers are not employees, but self-employed individuals. Unlike employees who receive a W-2 form from their employers showing income with taxes already deducted, self-employed Shipt workers are given a 1099 form, which does not have taxes withheld. Meaning, it is their responsibility to pay taxes and to file an annual income tax return.

MileageWise offers a cutting-edge mobile application and web dashboard ensuring effortless tracking and maximization of Shipt mileage reimbursements.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

No More Manual Mileage Logging

Forget about hastily scribbling down your miles on random pieces of paper only to lose them later. Say goodbye to the anxiety of missing out on recording the mileage for your last Shipt order.

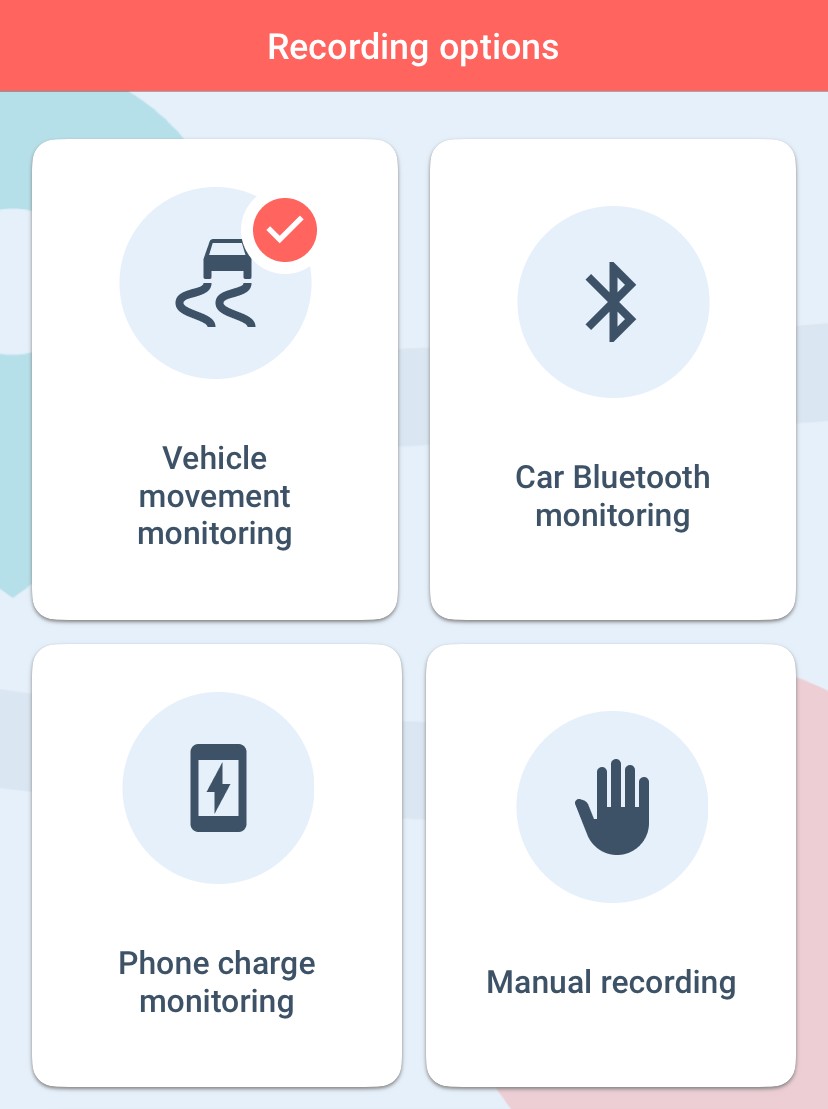

MileageWise offers three automatic trip recording options (vehicle movement monitoring, Bluetooth monitoring, Plug’N’Go monitoring, and, if you need at times, manual recording), allowing you to choose the mode that suits your needs. You can even customize when the app records your trips, limiting it to working hours if you prefer.

MileageWise Prioritizes Your Privacy

Rest assured that using MileageWise won’t subject you to constant GPS tracking during auto-trip recordings. Instead, the mobile app connects your points of arrival, ensuring compliance with privacy laws while conserving battery and data. Meanwhile, MileageWise’s server handles trip distance calculations in the background.

Fine-Tune Your Recording Settings

The app also includes an automatic categorization feature for business versus personal trips, eliminating the need for manual input.

Tired of constantly starting and stopping your mileage tracker after each Shipt delivery? Take advantage of the Standby-timer feature.

Additionally, with Waze integration, you can plan your routes to reach your saved clients more efficiently, reducing fuel expenses.

Stay Organized and Maximize Tax Deductions

With MileageWise, you can boost your Shipt income by leveraging tax deductions, reducing costs, and maintaining an organized tracking process.

Embrace precise mileage logs and enjoy stress-free, seamless tracking.

Keep More of Your Earnings

Count on MileageWise for a fatter wallet come tax time. With thorough and 100% IRS-compliant mileage logs, you’ll retain a larger portion of your hard-earned money.

Who can resist extra cash?

AI Wizard Feature: Fill in the Gaps for Unrecorded Miles or Trips

Delivery driver forums reveal that many new drivers are unaware of the importance of logging the mileage they drive for work.

If you’re new to Shipt and didn’t realize the importance of mileage tracking, with MileageWise’s retrospective logging feature, every journey is accounted for. Even if you’ve missed a delivery or two, this tool guarantees that your records are IRS-compliant.

One of the ways MileageWise can help you with retrospective logging is the AI-powered AI Wizard. Based on your recent driving patterns and the locations you visited, it suggests realistic trips to cover any untracked miles, ensuring a complete mileage log.

Import Your Journeys from Google Timeline

Let’s say you started driving for Shipt last week and only realized now that you can claim a tax deduction for the mileage you drive for work. Even if you haven’t used a mileage tracker app recently, as long as you have your Google timeline data, MileageWise can help you out.

You can import your Google Timeline data into MileageWise, ensuring that every Shipt delivery is accounted for, regardless of your schedule or occasional forgetfulness.

By importing data from Google Timeline, you won’t miss any journeys recorded by Google, resulting in more comprehensive logs and fewer unrecorded trips.

This feature alone places MileageWise to be one of the best mileage tracker apps when it comes of saving $1000’s on deductions.

Effortlessly Track Expenses with Detailed Reports in Freshbooks for Increased Earnings

Don’t overlook MileageWise’s comprehensive 100% IRS-compliant mileage log reports that can be seamlessly integrated with Freshbooks.

With a transparent view of your spending, you can track deductions and boost your earnings while saying goodbye to unexpected expenses that eat into your income.

MileageWise has your back, allowing you to deliver groceries or household essentials with a smile.

Compile, Review, and Print IRS-Compliant Logs in Minutes

When it’s time to prepare your logs for tax deductions, you can easily assemble your monthly mileage logs within the MileageWise dashboard and print them in IRS-compliant format in just minutes!

MileageWise: A Must-Have App for Every Shipt Driver

Why let mileage tracking weigh on your mind when MileageWise is just a tap away? Sign up today and tap into its financial benefits. So, the next time someone asks about your Shipt earnings and mileage records, proudly show them your MileageWise app. Let’s simplify tax time and increase your take-home pay!

FAQs

How does MileageWise ensure that my mileage logs are IRS-compliant?

MileageWise is designed to meet IRS standards for mileage tracking, offering features like automatic trip recording and detailed monthly logs. The app records each trip based on IRS requirements, including the date, time, mileage, and purpose of the trip. Additionally, with the Web Dashboard, you can review and print your logs in a format that is ready for tax auditing, ensuring that you’re always prepared and compliant.

What are the benefits of using the automatic trip recording feature in MileageWise?

The automatic trip recording options in MileageWise, including vehicle movement monitoring, Bluetooth monitoring, and Plug’N’Go monitoring, provide a hands-free way to ensure all trips are logged accurately. This feature saves you time and ensures you never miss a deductible mile. You can customize settings to record trips only during work hours, making it easier to separate business and personal mileage.

Can MileageWise help me if I forget to record some of my Shipt deliveries?

Absolutely! MileageWise includes a retrospective logging feature called AI Wizard. This tool uses AI to analyze your typical driving patterns and suggests realistic trips for any untracked miles. It ensures that your mileage log is complete and accurate, even if you’ve forgotten to record some trips. This feature is particularly valuable for maintaining IRS compliance and maximizing your tax deductions.

How does MileageWise protect my privacy while using the app?

MileageWise prioritizes your privacy by not engaging in constant GPS tracking. The app uses point-to-point connections to map your route during automated trip recordings. This method conserves battery and data usage while complying with privacy laws. Additionally, the calculation of trip distances is handled on MileageWise’s secure server, ensuring your data is processed safely and discreetly.

Does MileageWise assist in tracking and reporting vehicle-related expenses?

MileageWise allows you to not only track miles but also monitor and report other vehicle-related expenses. The app provides detailed reports that can be integrated with accounting software like Freshbooks. This integration helps you keep a transparent record of all expenditures, ensuring that you can claim all eligible deductions and ultimately increase your earnings by reducing unexpected costs.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |