Last updated: March 18, 2025

Facing a tax audit can be stressful, but audit defense ensures you have the right strategy to protect yourself. Whether you’re dealing with the IRS or a state tax agency, knowing how to respond, what documents to prepare, and when to seek professional help can make all the difference. This guide breaks down the different types of audits, common red flags that trigger them, and how tax defense services can help you navigate the process. Keep reading to learn how to defend your tax return, avoid costly penalties, and secure the best possible outcome.

In this post, we’ll uncover the biggest audit triggers, the financial risks of being unprepared, and, most importantly, how to protect yourself with a solid audit defense strategy.

A Guide to Audit Defense Services

When venturing into the labyrinth of tax filing, the concept of audit defense emerges as a concept of reassurance for many. Let’s dive into a sea of queries and enlightenment on this topic, highlighting the invaluable armor it can offer against the fear of tax audits.

What is audit defense?

In the realm of taxation, audit defense serves as your personal shield, offering guidance and support should the tax authorities scrutinize your tax return. This service can range from providing advice, and handling paperwork, to representing you in front of the tax agency.

Is audit defense worth it?

This question often dances on the lips of taxpayers. The value of audit defense becomes apparent when facing the complexity and potential stress of an audit. It’s like having a seasoned warrior by your side in a battle of numbers and legislation.

Considering the players out there, many wonder, “Is Turbo Tax audit defense worth it?” Given TurboTax’s comprehensive approach, combining software precision with expert human insight, the service aims to not only fortify your tax return against potential audits but also stand with you if one occurs.

Similarly, Tax Act audit defense offers its shield, promising protection and peace in turbulent times. It’s another ally in the quest for audit-proof tax filing, ensuring that you’re not walking the tightrope alone.

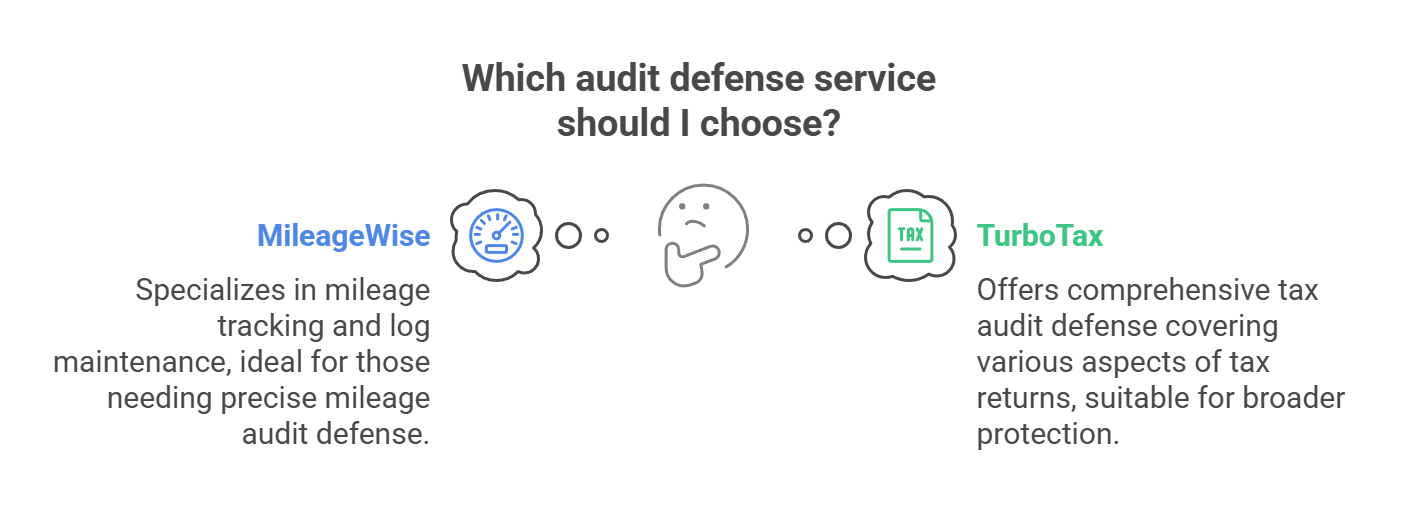

Audit Defense: Turbotax vs. MileageWise

But how does the MileageWise mileage tracker app stack up against TurboTax in terms of audit defense? Both platforms offer robust solutions, but they cater to different needs.

MileageWise specializes in mileage tracking and log maintenance, a crucial aspect for individuals and businesses claiming vehicle expenses. Their focus on expense and mileage tracker app functionality is tailored to safeguard and substantiate your mileage deductions as a proactive audit defense.

TurboTax, on the other hand, provides a broader tax audit defense service, encompassing various aspects of your tax return beyond just mileage. The choice between them might boil down to your specific needs—do you require comprehensive tax return protection or specialized mileage audit defense?

In essence, Turbo Tax audit defense in comparison to other services like MileageWise depends on your individual tax situation, your comfort level with potential audits, and the complexity of your tax returns.

Whether it’s the allure of comprehensive tax audit defense or the precision of an expense and mileage tracker app, the world of audit defense services offers a tailored solution to suit your needs.

When Can You Get an Audit from the IRS?

The IRS doesn’t audit taxpayers randomly; certain triggers can increase your audit risk. These include significant changes in income, large deductions relative to your income, and, of course, errors in your tax return. Staying informed about these triggers can help you prepare and potentially avoid the stress of an audit.

What Steps Do I Need to Take If I Receive the IRS Audit Notice?

Receiving an audit notice can be frightening, but taking immediate and informed audit defense steps can significantly ease the process. First, thoroughly review the IRS notice to understand the scope of the audit. Then, gather all necessary documentation, including income statements, receipts, and especially your mileage log if vehicle expenses are in question. Seeking professional help might be necessary at this point.

What Happens During the IRS Audit?

The IRS audit process involves a detailed examination of your tax return by the IRS to verify its accuracy. This process can take anywhere from a few months to over a year, depending on the complexity of the audit. It’s a time when the quality of your records, such as the IRS-proof mileage log, can make a significant difference in the outcome.

The Importance of an IRS-Proof Mileage Log for Audit Defense

Before we explore the real cost of ignoring IRS-Proof mileage logs, let’s clarify why maintaining such records is crucial in the first place. When you’re a small business owner or self-employed, keeping track of your mileage can make a significant difference in your tax liability. Here’s why:

Deductions: The IRS allows you to deduct certain business-related expenses, including mileage, as long as you can prove they were necessary and documented accurately.

Audit Protection: An IRS-Proof mileage log acts as a shield against audits. It provides concrete evidence of your claims and helps you avoid unnecessary scrutiny.

Financial Accuracy: Accurate mileage records help you track your expenses, plan your budget, and ensure you’re getting the deductions you’re entitled to.

Join 20K+ IRS-Proof users to save more

The Pitfalls of Ignoring IRS-Proof Mileage Logs

Now, let’s explore the potential pitfalls of not maintaining an IRS-Proof mileage log:

Underestimating Deductions: Without a proper record, you may underestimate the number of miles you’ve driven for business purposes. This can result in missed deductions, meaning you pay more in taxes than you should.

Increased Audit Risk: The IRS tends to scrutinize mileage deductions closely. Failing to provide adequate documentation can trigger an audit, leading to additional stress and expenses.

Penalties and Interest: If the IRS determines that your mileage deductions were inaccurate or fraudulent, you could face significant penalties and interest charges on the underpaid taxes.

What Does the IRS Consider an Acceptable Mileage Log?

Before we jump to real-life scenarios, it’s also good to clarify what type of data you need to present for your mileage deduction claim:

- State the year-start & year-end odometer readings of your car (we recommend monthly records to make the protocol easier to follow)

- State the mileage for each business trip (e.g. 18.6 miles)

- State the date, the starting & ending locations, and the purpose of each business trip

- State the total mileage you drove during the year for business, commuting, and personal purposes other than commuting

As you can see, without using an advanced mileage tracker app, like MileageWise, it’s quite a challenge to maintain a proper mileage log throughout the year.

Real-Life Scenarios: Understanding the Magnitude of Penalties

If you’re curious about the likelihood of your business being subject to an audit, it’s worth noting that in 2022, the IRS carried out 708,309 audits, leading to recommendations for an additional $30.2 billion in taxes.

Let’s consider a couple of real-life scenarios to illustrate the potential consequences of not having an IRS-Proof mileage log:

Scenario 1: The Forgetful Freelancer

Sarah is a freelance graphic designer who frequently travels to meet clients. She fails to maintain a mileage log because she’s always juggling multiple projects. She never reaches out to a tax consultant and when the IRS audits her, they disallow a significant portion of her mileage deductions, resulting in an additional tax liability of $5,000.

Scenario 2: The Negligent Business Owner

John owns a small construction company. He neglects to keep mileage records for his work trucks, assuming it’s not a big deal. He never seeks any tax return services, however, when the IRS investigates his business, they impose hefty penalties and interest charges, totaling $10,000.

The Solution: Mileage Log Audit Defense

To avoid finding yourself in situations like Sarah or John, it’s crucial to maintain an IRS-Proof mileage log and request tax assistance. But if you fear an audit is imminent, don’t panic. Our prepaid tax service called Mileage Log Audit Defense is here to help.

It’s basically an online tax preparation service to make sure your mileage log will stand up against IRS scrutiny. This is basically the same service we offer in our Mileage Log Tax Preparation Service but if you’ve already got the audit letter and had signed up for the audit defense service, you get the service for only $49.99, while if you use the tax preparation service, the price multiplies.

Our team of experts specializes in handling IRS audits related to mileage deductions. We’ll work tirelessly to review your records, gather necessary documentation, and create a 100% IRS-Proof mileage log for you.

We provide one-on-one online tax help as our goal is to minimize your tax liability and penalties, ensuring you receive the deductions you’re entitled to. After a brief online sign-up, we contact you via phone or email to understand the details of your case.

What Additional Benefits Can You Rely on with MileageWise’s Audit Defense Features?

1. Mileage Log Tax Preparation Service:

Understanding that not everyone has the time or expertise to manage their mileage logs, MileageWise’s Mileage Log Preparation Service steps in as a personal mileage log manager.

Outsourced Management: For those who prefer to outsource their mileage log management entirely, our Mileage Log Tax Preparation Service takes over. Entrust your logs to our team of experts who handle everything – from recording trips to ensuring compliance with tax regulations.

Accuracy Guaranteed: With professionals overseeing and fixing your mileage records, you can be assured of detailed and accurate logs, eliminating any worries of potential audit pitfalls.

Tailored to Your Needs: The Mileage Log Tax Preparation Service is adaptable, offering a bespoke experience based on individual requirements, be it frequency of updates or specific reporting needs.

2. Google Timeline Service:

For the modern traveler who relies heavily on Google Maps, the Google Timeline import feature is a game-changer.

Retrospective Trip Recovery: Ever missed logging a few trips? No worries. Our solution can recover trip gaps retrospectively using your Google Maps records. If you want, you can do it yourself too, but we are also glad to manage the entire process for you!

Comprehensive Details: The feature doesn’t just recover the basic details but offers comprehensive insights – starting and ending locations, stop durations, and routes taken. This level of detail ensures that your mileage log meets the stringent IRS requirements.

Privacy First: Understanding the sensitivity of location data, our platform ensures end-to-end encryption and strict privacy protocols. Your data is accessed solely for log recovery and never shared or used for other purposes.

NOTE, that Google has made updates to their Location History feature that could disable your yearly Retrospective Trip Recovery from Google Timeline!

Steps you should take to save your Google Timeline Data:

Turn auto delete OFF: Google will change the automatic deletion of the Timeline from 18 months to 3 months by default

Turn location history ON: Location History is turned off by default

Back up your Timeline in the Cloud: Instead of the Google Cloud, the Timeline will be stored on your device by default

Google will introduce these changes gradually on iOS and Android devices. You will receive a notification when your account receives the update.

Is your Google Timeline History missing?

No worries! If you lost data, reconstruct your trips with MileageWise’s very own AI Recommendation Wizard!

With our AI Wizard feature, you can recreate your past miles and fill in the gaps with ease while ensuring IRS compliance. Embrace the simplicity and accuracy of our solution and maximize your tax savings.

Stay on the Safe Side – and Save More

The real cost of ignoring IRS-Proof mileage logs is not one to take lightly. It can result in missed deductions, increased audit risk, and substantial financial penalties. By maintaining accurate records and seeking professional assistance if necessary, you can protect your finances and peace of mind. Don’t let forgetfulness or negligence lead to a tax nightmare – consider our Mileage Log Audit Defense service as your shield against IRS scrutiny.

MileageWise presents a cost-efficient remedy, priced at only $49.99 per year per vehicle, offering not just peace of mind but also an impressive 10x money-back guarantee.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |