Understanding and managing quarterly taxes can be challenging for the self-employed, including freelancers, independent contractors (e.g. DoorDash drivers or Spark delivery drivers), and sole proprietors. This article will walk you through the most important aspects of self-employed quarterly taxes. It will offer a detailed look into calculating estimated tax payments, understanding due dates, avoiding penalties, and the importance of deductions. Additionally, we’ll introduce a revolutionary mileage log creator software that can significantly benefit self-employed individuals by maximizing their mileage tax deductions.

What Are Quarterly Taxes, and Who Are Required to Pay Them?

Quarterly tax payments (in other words estimated tax payments) are required for most freelancers, independent contractors, and sole proprietors. This applies particularly if their business or gig represents their primary income source. It is important to note that taxes aren’t withheld from their payment, so it is their responsibility to meet their tax obligations. People who are expected to owe more than $1000 on taxes from self-employed income and people with more than $400 self-employed or 1099 income are more than likely to be obligated to pay quarterly taxes.

In case you are expected to pay them, you have to pay an estimated amount of taxes four times a year instead of receiving one large bill in April. In doing so, you can better manage your finances and avoid underpayment penalties. They include federal and state income taxes and the self-employment tax.

When Are Quarterly Tax Payments Due?

The due dates for 2024 are as follows:

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

Mark these dates in your calendar so you don’t miss out on these deadlines.

What Happens If I Pay My Quarterly Taxes Late or Incorrectly?

Late or incorrect quarterly tax payments can lead to penalties, which are calculated based on the amount owed and the length of the delay. Fortunately, there are strategies to reduce these risks, including regular check-ins on your estimated earnings and adjustments to payments as needed.

How Do I Manage Quarterly Taxes Efficiently?

The most important aspect of managing quarterly taxes is understanding your expected annual income, subtracting deductible expenses, and applying the current self-employment tax rate.

Estimate your expected income

You can estimate your income by analyzing your expenses and income for the last three months or from the same periods of previous years. But, if you don’t have a steady set of data, tools like self-employed quarterly tax calculators or tax estimator software are available as well. These provide an estimate based on your income and business expense inputs.

Subtract your deductible income

Navigating deductions and credits is a key strategy for reducing your taxable income. Self-employed individuals can create deductions for home office expenses, supplies, professional services, and vehicle expenses. Moreover, understanding the available tax credits can further reduce your tax liability, making a significant difference in your overall tax-saving strategies.

Apply the self-employment tax rate

The IRS form 1040-ES will help you determine your quarterly tax debt.

How Do I Pay Quarterly Taxes as a 1099 earner?

For Independent Contractors

Expect to receive a Form 1099 from any client who has paid you $600 or more within the tax year. This form details your earned income, serving as a record for the IRS and as a starting point to calculate your estimated quarterly taxes.

For Freelancers

You might gather multiple 1099 forms from different sources, or sometimes none at all. Regardless, it’s crucial to account for all your self-employed earnings when figuring out your estimated tax payments.

Additional IRS Forms

Your business type dictates the forms you’ll need. Generally, sole proprietors, LLC members, S corp shareholders, and self-employed individuals will use Form 1040-ES for their quarterly estimated tax submissions.

What Payment Methods Are Available?

Online Payments

Online payment is a preferred method due to its quick, simple, and secure process. You can pay your quarterly estimated taxes to the IRS from a bank account without fees and even schedule payments ahead of time. Online methods are the fastest for same-day payment, in case you are in a rush. Just to be sure, check in with your bank about a same-day wire transfer, noting that fees may apply.

Mail Payments

Send a check or money order by mail for your quarterly taxes. Be sure to follow the IRS’s specific mailing instructions and use the correct address for your location, available on the IRS website.

Phone Payments

Dial 1-800-555-3453 to pay via the automated phone system. Have your taxpayer ID and a 4-digit PIN ready.

For detailed instructions or to choose the best payment method, visit the IRS website or consult a tax advisor.

We have mentioned that vehicle expenses are deductible, but did you know you can deduct a set amount for every mile driven?

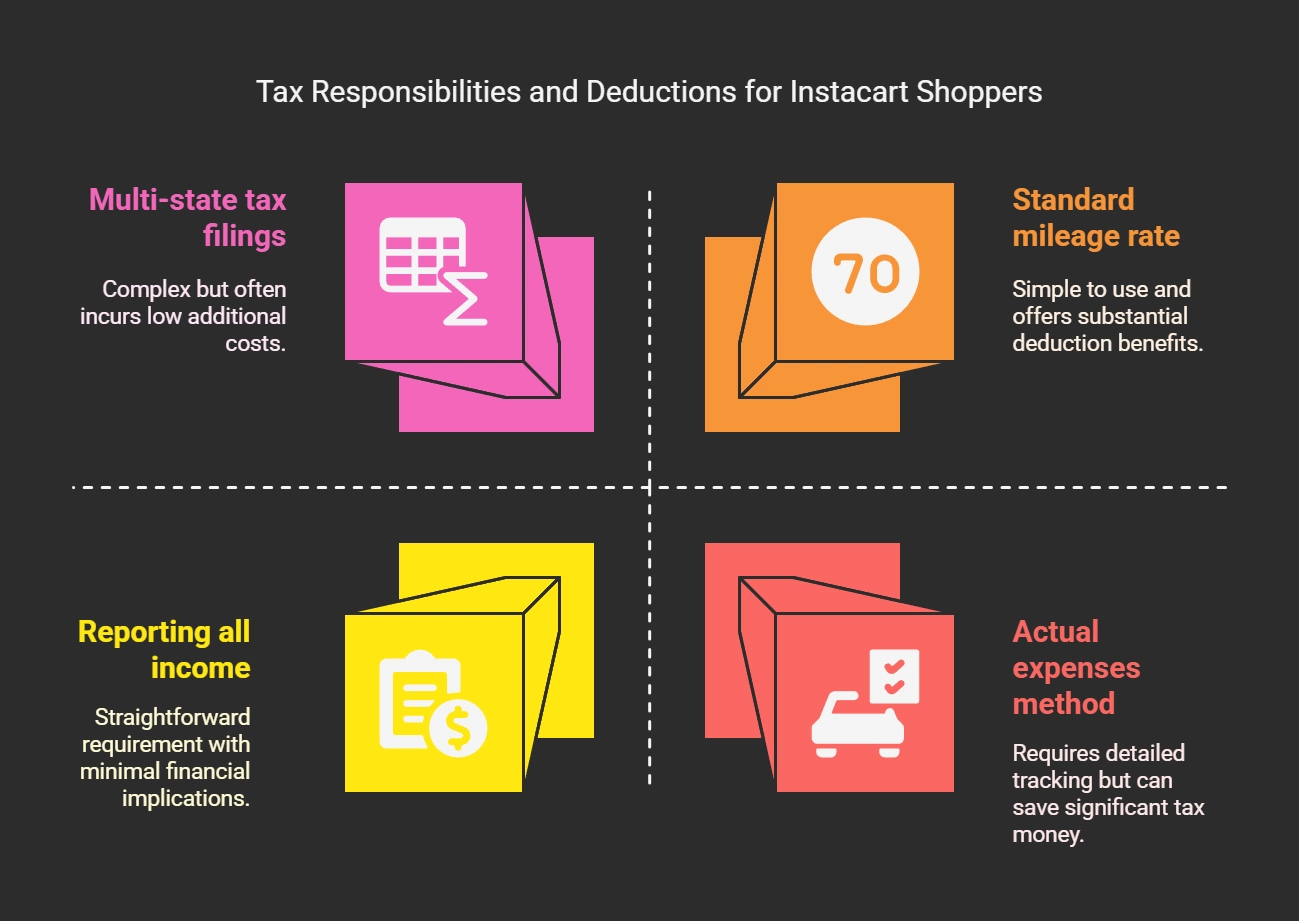

For self-employed individuals seeking tax deductions for travel, accurate documentation of either miles driven or specific travel expenses is crucial. There are two main methods to choose from: the standard mileage method and the actual expense method.

The standard mileage method lets taxpayers deduct a set amount per business mile driven, based on the IRS’s standard mileage rate. This rate is designed to cover all vehicle expenses, including fuel, repairs, maintenance, insurance, and depreciation.

On the other hand, the actual expense method requires you to itemize and deduct all vehicle expenses incurred for business travel.

Many prefer the standard mileage method for its simplicity and often, its potential to yield greater deductions. It simplifies the deduction process by eliminating the need to keep detailed records of every vehicle expense.

How Do I Maintain a Mileage Log?

Using a tax-purpose mileage tracker app is a smart strategy for accurately and efficiently tracking miles. These apps automate mileage tracking, moving away from manual logs and reducing errors that could lead to IRS scrutiny. Accurate mileage tracking not only ensures proper reimbursement but also streamlines expense management.

In essence, combining the standard mileage method with a reliable mileage tracker app is an effective approach for maximizing tax deductions.

MileageWise: Your IRS-Compliant Mileage Log Solution

One effective solution for maintaining an IRS-compliant mileage log is using MileageWise. Should the IRS require your mileage log during an audit, it will check for adherence to its standards. MileageWise offers precise, IRS-compliant data, whether you track daily or reconstruct mileage logs using its features.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

Why Choose MileageWise?

Effortless Mileage Tracking

MileageWise provides several user-friendly options for tracking. Its automatic tracking feature means you no longer need to manually record each trip.

IRS-Compliant Logs

MileageWise ensures your log meets IRS standards, using a built-in IRS Audotor to detect and correct any inconsistencies, offering peace of mind against audits.

Accessible Anywhere

Being cloud-based, you can access your logs from any device, offering flexibility for the self-employed constantly on the move.

Versatile Recording Modes

With options like vehicle movement tracking and manual input, MileageWise adapts to your preferred method of record-keeping.

An AI tool on your side

The AI Recommendation Wizard feature helps fill gaps in your log, ensuring accuracy and completeness.

FAQs

What are self-employed quarterly taxes?

Self-employed quarterly taxes, or estimated tax payments, are tax payments made four times a year by freelancers, independent contractors, and sole proprietors. These payments cover income taxes and self-employment taxes, helping manage cash flow and avoid underpayment penalties.

Who needs to pay quarterly taxes?

Individuals likely need to pay quarterly taxes if they owe more than $1,000 in taxes from self-employed income or have more than $400 in self-employed or 1099 income.

How do I calculate and pay my quarterly taxes?

Calculate your estimated tax payments by projecting your annual income, subtracting deductible expenses, and applying the self-employment tax rate. You can pay online, by mail, or over the phone using the IRS’s provided methods.

What are my options for tracking business mileage for tax deductions?

For tracking business mileage, you can choose between the standard mileage method and the actual expense method. A mileage tracker app like MileageWise can automate and simplify tracking, ensuring IRS compliance and maximizing deductions.

Why choose MileageWise for mileage tracking?

MileageWise offers effortless, IRS-compliant mileage tracking with features like automatic tracking, accessibility from any device, versatile recording modes, and an AI Recommendation Wizard. It ensures accuracy and completeness, providing peace of mind against audit

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |