Try MileageWise for free for 14 days. No credit card required!

Dashboard

We’ll show you how to claim mileage on your tax return. We’ll cover everything from how do you track mileage for taxes to keeping records and filling out forms. Our tips are for both experienced business owners and first-timers. We aim to make mileage deductions easy to understand and help you maximize your tax return.

So, get ready to learn about mileage deductions! By the end of this guide, you’ll know how to claim mileage on your taxes. You’ll also know how to use this tax break to your advantage.

Understanding Mileage Deduction Eligibility

To claim a mileage deduction on your taxes, you need to know the rules for different types of mileage. The IRS lets you deduct for business, medical, moving, and charitable mileage. Each has its own set of criteria.

Business Mileage

Business mileage is the most common deduction. It covers trips from your office to a worksite or second business location. It also includes business-related errands.

If you’re self-employed, you can deduct the miles you drive for business. For example, if you use your vehicle 75% for business, you can deduct that much of your auto expenses. The 2024 IRS standard mileage rate for business driving is $0.67 per mile.

Medical and Moving Mileage

Medical mileage is for trips to and from medical appointments. If your medical expenses are over 7.5% of your adjusted gross income (AGI), you can deduct them. This includes travel and parking costs.

Moving mileage is for active-duty military members who must move due to a permanent change of station.

Charitable Mileage

Charitable mileage is for work with qualifying charities. Expenses like parking and tolls for volunteer work are considered charitable donations. They can be included as an itemized deduction at 14 cents per mile.

Remember, fines for traffic tickets are never deductible, even if they were during work hours. Also, if you own rental property, you can deduct mileage for maintenance or check-ups.

Table of Contents

Choosing Between Standard Mileage Rate and Actual Expense Method

When you claim mileage on your taxes, you can choose between two methods. The standard mileage rate or the actual expense method. Your choice depends on your driving habits, vehicle costs, and how you like to keep records. Let’s look at when each method might be better.

When to Choose the Standard Mileage Rate Method?

The standard mileage rate is often easier. For 2024, the IRS sets it at 67 cents per mile. So, if you drove 5,000 miles for work in 2024, you could deduct $3,350. This rate covers many costs, like:

- Gas

- Maintenance and repairs

- Depreciation

- Insurance premiums

This method is great for those who drive a lot for work. For example, an Uber driver who drove 30,000 miles in 2024 could deduct $20,100. Plus, you can switch to the actual expense method later if it’s better.

When to Choose the Actual Expense Method?

Under the actual expense method, you must track all actual expenses incurred while operating your vehicle for business purposes. You’ll need to keep records of:

- Lease payments

- Gas

- Insurance

- Oil changes and maintenance

- Depreciation

For example, if your vehicle costs $9,500 and you use it for business 50% of the time, you can deduct $4,750. This method is good if you have high vehicle costs or don’t drive much for work. But, it needs more detailed records and math.

Remember, if you pick the actual expense method in the first year, you must keep using it for the vehicle’s life. The standard mileage rate lets you switch methods later.

Maintaining Accurate Mileage Records

To claim a mileage deduction on your taxes, it’s crucial to keep accurate records. You can track your business, medical, moving, and charitable miles in two ways. You can use a mileage tracking app or keep a manual mileage log.

Mileage Tracking Apps

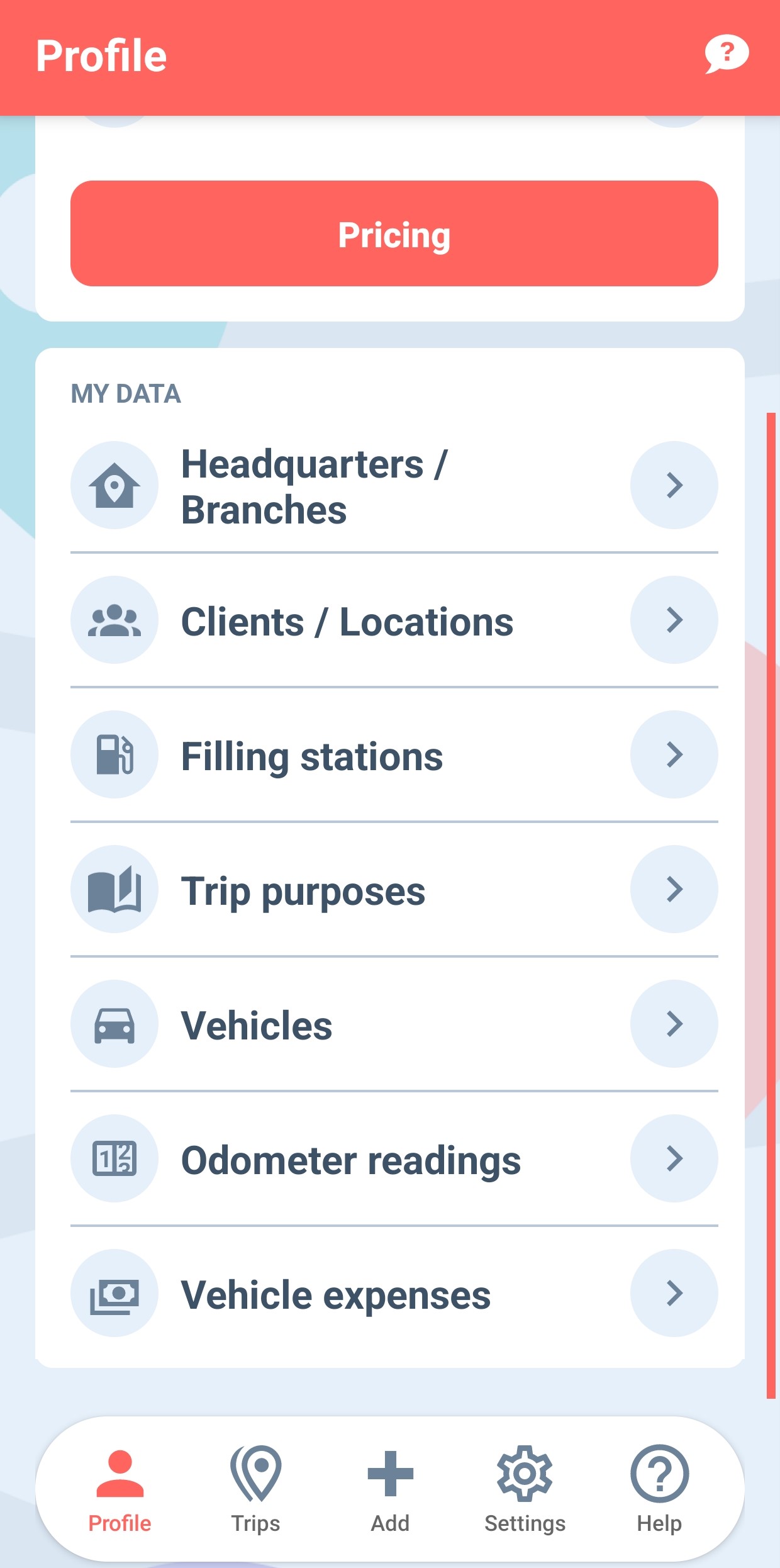

Mileage tracking apps like MileIQ, TripLog, and MileageWise make tracking easy. They use GPS to automatically track your drives. You can then classify each trip as business, personal, or other.

MileageWise is the best mileage tracking app because you don’t even have to bother by classification because after a proper initial setup it categorizes your trips automatically.

When trying to choose the best mileage tracking app, look for automatic tracking and easy trip classification. Also, make sure it can generate IRS-compliant reports. Some apps even connect with your calendar and track other vehicle expenses.

Manual Mileage Logs

If you like a traditional method, use a manual mileage log. Start by recording your odometer readings at the start and end of each year. For each trip, note the date, purpose, start and end locations, and total miles.

- Date of the trip

- Purpose of the trip

- Starting and ending locations

- Total miles driven

Here’s an example of a manual mileage log entry:

| Date | Purpose | Start Location | End Location | Miles Driven |

|---|---|---|---|---|

| 04/15/2024 | Client Meeting | Office | Client’s Office | 42 |

Keep your mileage records and supporting documents for at least three years after filing. This includes your mileage logs, odometer readings, and any vehicle expense receipts.

Calculating Your Mileage Deduction

To figure out your mileage deduction, you can pick the standard mileage rate or the actual expense method. The standard mileage rate is easy. Just multiply your business miles by the IRS rate, which is 67 cents per mile in 2024. This is up from 65.5 cents in 2023.

For instance, if you drove 30,000 miles for work in 2023, you could claim $19,650 for the year. Remember, the IRS has different rates for medical/moving and charitable mileage. In 2024, these rates are 21 cents and 14 cents per mile, respectively.

Or, you can use the actual expense method. This involves adding up all your vehicle costs. These include gas, oil, repairs, tires, insurance, and more. Then, multiply this total by your business use percentage.

To find your business use percentage, divide your business miles by your total miles driven.

Here’s an example calculation for the actual expense method:

| Total Car Expenses | $6,850 |

|---|---|

| Business Miles | 20,000 |

| Total Miles Driven | 60,000 |

| Business Use Percentage | 33.33% |

| Mileage Deduction | $2,260.50 |

It doesn’t matter which method you choose. Keeping accurate records is key to support your mileage deduction claim. Using a mileage tracking app can make this easier. It also helps ensure you’re ready for an IRS audit.

Filling Out the Necessary Tax Forms

To claim your mileage deduction, you need to fill out the right tax forms. This depends on your job status and the type of mileage you’re claiming. It’s important to report your mileage correctly and provide all the needed information. This way, you can get the deductions you deserve.

Form 2106 for Employees

If you’re an employee and your employer didn’t pay for your work-related mileage, use Form 2106. This form is for reporting unreimbursed employee expenses, like vehicle costs. But, remember that since 2018, most employees can’t claim unreimbursed mileage as a tax deduction anymore.

Eligibility: only certain categories of employees can use Form 2106 to claim unreimbursed expenses. These include:

- Armed Forces reservists

- Qualified performing artists

- Fee-based state and local government officials

- Employees with impairment-related work expenses

Schedule C for Self-Employed and Business Owners

Self-employed people and business owners should use Schedule C. This form is for reporting business-related mileage and expenses. You’ll need to give details about your vehicle’s business use percentage and work miles. The 2023 standard mileage rate is $0.655 per mile, and it’s $0.67 per mile for 2024.

Schedule A (Form 1040) For Charitable or Medical Mileage

If you drove for charity or medical reasons, claim these miles on Schedule A (Form 1040). The rates for these purposes are different from business mileage:

- Charitable mileage: 14 cents per mile

- Medical and moving mileage: 21 cents per mile

When filling out these forms, make sure to give accurate information. Keep detailed records of your mileage to back up your deductions. If you’re unsure, talk to a tax professional for help.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Keeping Supporting Documentation

When you claim mileage on your taxes, it’s key to have supporting documents. These include mileage logs, receipts, invoices, and any other records that prove your vehicle expenses. The IRS might ask for these during an audit, so keep them organized and ready for at least three years after you file.

Mileage logs should have all the details of each business trip. This includes the date, purpose, starting and ending points, and total miles. Using a mileage tracking app can help you keep accurate records. It makes it easier to tell personal from business miles, which is important for your deduction.

Also, save receipts and invoices for any vehicle costs, like gas, maintenance, repairs, and insurance. These help if you use the actual expense method instead of the standard mileage rate. Make sure your mileage records match these documents for accuracy.

Here’s a table outlining the key information to include in your mileage log:

| Date | Purpose | Starting Point | Destination | Total Miles |

|---|---|---|---|---|

| 01/15/2024 | Client Meeting | Office | Client’s Office | 42 |

| 01/18/2024 | Conference | Home | Conference Center | 87 |

| 01/22/2024 | Supply Run | Office | Office Supply Store | 12 |

Keeping detailed and organized records helps you prepare for an IRS audit. It lets you confidently claim your mileage deduction. Always keep these records for at least three years after filing. Using digital tools can make keeping records easier.

In MileageWise you can keep all car related expense documents in one place for easy access in tax season.

Common Mistakes to Avoid When Claiming Mileage on Your Taxes

When you claim mileage on your taxes, knowing common mistakes is key. These errors can lead to trouble with the IRS. By avoiding these pitfalls, you can make sure your deductions are right and follow the rules.

More than 90% Business Mileage on a Car Used For Both Business and Personal Purposes

Many people claim most of their car miles as business use, even if they use it for personal things too. To get it right, keep track of both business and personal miles. Then, figure out how much of your car expenses you can deduct.

MileageWise makes it really easy to keep track of your business to personal mile ratio and adjust it if needed while still being 100% IRS compliant.

Using Incorrect Mileage Rates

The IRS updates mileage rates every year. For 2024, the rates are:

- 67 cents per mile for business use

- 21 cents per mile for medical or moving

- 14 cents per mile for charity

Using old rates can lead to wrong deductions and IRS penalties. Always check the latest rates before you calculate your deductions. MileageWise always uses the right mileage rates even if you do retrospective logs for 2023,2022 or 2021.

Insufficient Documentation

Having good records is vital for mileage deductions. The IRS might ask for proof of your claims. So, keep detailed logs with:

- Dates of travel

- Business destinations

- Purpose of each trip

- Starting and ending odometer readings

- Total miles driven for business

Not having enough proof is a common mistake. It can make your deductions look shaky. Think about using the MileageWise mileage app to track your trips and make reports for the IRS.

How to Claim Mileage on Your Taxes

Claiming mileage on your taxes can save you a lot of money. But, you must follow the IRS rules carefully. By tracking your miles, choosing the right deduction, and keeping good records, you can get the most from your tax deduction.

- Check your method of calculation so choose either the actual expense or standard mileage method. Pick the one that saves you more money.

- Gather your mileage records:

For the standard mileage record just print our the mileage log from your MileageWise app.For the Actual Expenses Method, keep receipts and documentation for all vehicle-related expenses incurred throughout the year.

- Calcutale your mileage claim and file the proper mileage logs for the IRS.

Keeping accurate records is very important. Use a log or a mileage app to track your trips.

When tax time comes, use your chosen method to figure out your deduction. Self-employed people use Schedule C, while employees might use Form 2106. Remember to keep your records for at least three years.

By following these steps and getting tax advice when needed, you can confidently claim mileage on your taxes. Remember, keeping accurate records and following IRS rules are key to avoiding mistakes and making your tax filing smooth.

Maximizing Your Mileage Deduction

To get the most out of your mileage deduction, track all eligible trips. This includes short errands that might seem small. Over time, these miles can really add up, boosting your deduction.

Track All Eligible Trips and Personal Miles

Be careful to track both business and personal miles. The IRS lets you deduct the business part of your vehicle costs. So, keeping accurate records of your total mileage is key. Tracking personal miles as well adds more credibility to your claim and sends a clear signal to the IRS that you are keeping business and personal use separate.

Consider Using a Mileage Tracking App

For easier tracking of eligible trips, think about using a mileage tracking app. These apps make tracking simple and help you keep accurate records for taxes. Some top apps include:

The Most Convenient Mileage Tracker App For Tax Purposes

MileageWise is a top choice for an IRS-compliant mileage tracker app. It tracks your trips automatically and creates detailed reports for taxes. With MileageWise, you can:

- Automatically track your trips using GPS

- Classify trips as business, personal, or other categories

- Generate IRS-compliant mileage logs

- Integrate with your favorite accounting software

Using a mileage tracking app like MileageWise saves time. It helps you maximize your mileage deduction and ensures your records are accurate and IRS-compliant.

The Importance of Accurate Mileage Claims

When you file your taxes, it’s vital to report your mileage accurately. This helps avoid IRS audits and big penalties. Only claim miles for business, medical, moving, or charity. Claiming personal trips as business can lead to serious trouble.

To keep your claims accurate and safe, keep detailed records. Use a mile tracker app or GPS for easy tracking. These tools help sort trips by purpose, like work or charity.

Keep records of dates, places, and reasons for your trips. This proves your tax deductions to the IRS. Good record-keeping lowers the risk of mistakes. Check your records often to stay ready for audits.

Know the risks of wrong mileage claims:

- A taxpayer made up business visits for an IRS audit.

- They didn’t provide proof of business trips and had duplicate entries.

- A Missouri woman was sentenced to prison for fake travel claims and must pay restitution.

Stay informed about the IRS mileage rates:

| Purpose | 2024 Mileage Rate |

|---|---|

| Business | 67 cents per mile |

| Medical | 22 cents per mile |

| Charitable | 14 cents per mile |

| Moving | 22 cents per mile |

Focus on accurate mileage claims and keep good records. This way, you can claim what you’re allowed to without fear of audits or penalties. Being honest makes tax time easier and less stressful.

Seeking Professional Tax Advice

Claiming a mileage deduction is easy for most people. But, some situations make it better to get help from a tax expert. The rules for mileage deductions can be tricky, especially if your tax situation is different or you’re not sure about what you need to keep track of.

MileageWise has a Tax Preparation service you can use that completely takes care of all mileage related tax claim for your even if you have little or no mileage logs. Call us if you are in need of such help.

A tax pro can explain the details of mileage deductions. They can make sure you get the most you can and help if you’re audited by the IRS. They can also tell you if using the standard mileage rate or actual expenses is better for you.

When to Consult a Tax Professional

Think about getting a tax pro in these cases:

- You have a complex tax situation, like owning many businesses or vehicles used for both work and personal use.

- You’re not sure if you qualify for mileage deductions or what expenses count.

- You need help with keeping records or organizing your mileage logs and documents.

- You’re facing an IRS audit and need audit assistance to get through it and protect your rights.

A tax professional can also keep you updated on tax law changes. For example, the IRS changes the standard mileage rate every year. In 2024, it’s 67 cents per mile, up from 65.5 cents in 2023.

| Year | Standard Mileage Rate (per mile) |

|---|---|

| 2023 | $0.655 |

| 2024 | $0.670 |

With complex tax situations, getting professional tax advice can give you peace of mind. A good tax advisor can look at your situation, suggest the best way to deduct, and make sure you follow all tax laws.

Conclusion

Claiming mileage on your taxes can save you a lot of money. This is especially true if you use your vehicle for work, medical needs, moving, or charity. To get the most out of this deduction, you need to know the rules and how to keep good records or use a mileage app.

It’s important to understand who can claim mileage and how to do it. You can use the standard mileage rate or the actual expense method. Keeping detailed records of your trips is key to following IRS rules and avoiding tax audits.

Using a mileage tracking app like MileageWise can make keeping records easier instead of using excel templates. MileageWise helps classify trips, calculate distances, and pair vehicles with clients. It also has a feature to check for errors in your logs.

With MileageWise, your data is safe and easy to access on different devices. They also offer a service to help with your tax deductions. This can help you save even more money.

By using the IRS standard mileage rate, you can save a lot. For example, if you’re in the 24% tax bracket, you could save $13.44 for a 100-mile trip. If you’re unsure, getting tax advice can help you make the most of this deduction.

With the right information and tools, claiming mileage on your taxes can be easy. It can also save you a lot of money for your business or personal use.

FAQ

What types of mileage can I claim on my taxes?

You can claim business, medical, moving, and charitable mileage. Each type has its own rules and what you need to show.

What's the difference between the standard mileage rate and actual expense methods?

The standard mileage rate is 67 cents per mile for business in 2024. It’s simpler. The actual expense method lets you deduct more, like depreciation and gas. It’s more detailed but might be worth it for some.

How do I keep accurate mileage records for tax purposes?

Use apps like MileIQ or MileageWise for easy tracking. Or keep a manual log with trip details. Remember to record odometer readings and keep all receipts.

Which tax forms do I need to fill out to claim my mileage deduction?

Employees use Form 2106 for vehicle expenses. Self-employed use Schedule C. For charitable and medical, use Schedule A (Form 1040).

What supporting documentation do I need to keep for my mileage deduction?

Keep logs, receipts, and invoices for three years after filing. Detailed records help defend your deduction if audited.

What are some common mistakes to avoid when claiming a mileage deduction?

Don’t claim all personal miles as business. Use the right mileage rates and keep accurate records. False claims can lead to big problems with the IRS.

How can I maximize my mileage deduction?

Track all trips, even short ones. Use apps like MileageWise for easy tracking. This way, you won’t miss out on any miles.

When should I seek professional tax advice for my mileage deduction?

Get a tax pro if your situation is complex or you’re unsure about anything. They can help you follow the rules and claim the most you can.

Norbert Szabo

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |