Every year, millions of taxpayers unknowingly pay more than they owe. Are you one of them? Overpaying taxes happens when you miss out on deductions, fail to track expenses, or overlook key tax breaks. One of the biggest mistakes people make is not tracking their mileage properly—which means leaving hundreds or even thousands of dollars on the table.

If you drive for work, tracking mileage is a simple way to reduce your taxable income and keep more money in your pocket. But many people forget to log their miles, use outdated methods, or don’t even realize they qualify for a deduction. Let’s break down how you could be overpaying taxes and the easiest way to stop it.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

How Overpaying Taxes Costs You More Than You Think

Tax overpayment isn’t just an occasional mistake. It’s a widespread issue that affects 1099 earners (self-employed individuals, gig workers, and small business owners) the most. The IRS estimates that millions of taxpayers don’t claim deductions they qualify for, either because they aren’t aware of them or because they lack the records to back up their claims.

For example, the IRS standard mileage rate for 2025 is 70 cents per mile. That means if you drive 10,000 business miles in a year, you could deduct $7,000 from your taxable income. Without proper records, though, this deduction might be lost.

Common Reasons People Overpay Taxes

- Forgetting to track business expenses

- Not keeping accurate mileage records

- Assuming small deductions don’t add up

- Using outdated methods like spreadsheets or paper logs

- Failing to separate personal and business trips properly

If you don’t track your miles, you’re giving away money to the IRS. But there’s an easy fix.

Mileage Tracking: The Secret to Reducing Your Tax Bill

Mileage deductions are one of the most overlooked tax breaks, especially among freelancers, independent contractors, and small business owners. Whether you drive for Uber, Lyft, or DoorDash, or visit clients regularly, mileage is a real business expense, just like office supplies or equipment.

Who Qualifies for a Mileage Deduction?

If you use your personal vehicle for business-related travel, you may qualify. This includes:

- Rideshare and delivery drivers

- Contractors and field service workers

- Sales representatives and consultants

- Medical professionals making home visits

- Real estate agents meeting and escorting clients

The key is accurate record-keeping. The IRS requires a detailed mileage log showing:

- The starting and ending odometer readings of the year

- The date of each trip

- Starting and ending locations

- Purpose of the trip (business/charity/medical/moving/personal)

- Total miles driven

Without this, your deduction could be rejected in an audit. That’s where the right tool makes all the difference.

How to Stop Overpaying Taxes with Automatic Mileage Tracking

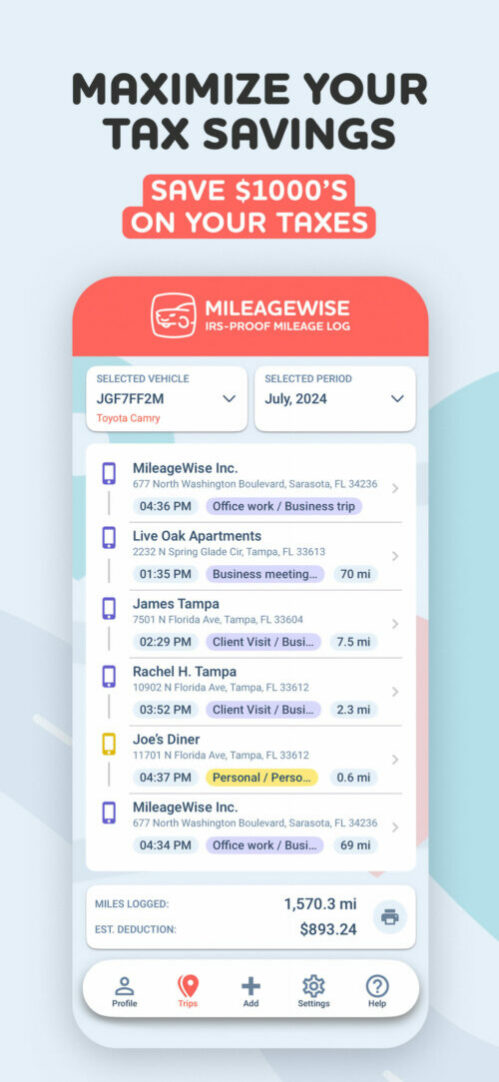

Tracking miles manually is time-consuming and easy to forget. That’s why many business owners and gig workers use MileageWise, a mileage-tracking app designed to automate the process and ensure every mile is logged correctly.

Why MileageWise?

- Automatic tracking – Never miss a mile again

- AI-powered log reconstruction – Forgot to track a trip? The app fills in missing mileage

- 100% IRS-compliant – No risk of losing deductions in case of an audit

- No ads, no upsells – Unlike other mileage trackers, MileageWise keeps things simple and distraction-free

Imagine getting a bigger tax refund just by tracking your miles correctly. With an easy-to-use app, you can stop overpaying taxes and maximize your savings.

Start Tracking & Stop Overpaying Taxes Today

If you drive for work and aren’t tracking your mileage, you’re paying too much in taxes. With the IRS mileage rate at 70 cents per mile, every mile you log can put more money back in your pocket.

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

FAQ

How do I know if I’m overpaying taxes?

You may be overpaying taxes if you’re missing deductions, not tracking expenses, or failing to claim business mileage. Many taxpayers unknowingly leave money on the table by not keeping accurate records.

Who qualifies for a mileage deduction?

Self-employed individuals, gig workers, and business owners who use their personal vehicles for work-related travel can claim a mileage deduction. This includes rideshare drivers, real estate agents, freelancers, and contractors.

How much can I save by tracking mileage?

The IRS standard mileage rate for 2025 is 70 cents per mile. If you drive 7,500 business miles per year, you could deduct $5,250 from your taxable income, potentially saving thousands in taxes.

What happens if I don’t track my mileage?

Without a mileage log, you risk losing your deduction or facing IRS penalties during an audit. The IRS requires detailed records for mileage claims.

What’s the easiest way to track mileage and stop overpaying taxes?

Using a mileage tracking app like MileageWise automates the process, ensuring every mile is logged accurately. The app provides IRS-compliant records, saving you time and maximizing deductions.

Rebeka Barefield

Similar Blog Posts

Overpaying Taxes? Here’s How to Stop Losing Money

Every year, millions of taxpayers unknowingly pay more than they owe. Are you one of them? Overpaying taxes happens when you miss out on deductions,

Should I File My Small Business Taxes Separate from Personal?

As a small business owner, you might wonder, “Should I file my business taxes separately from my personal taxes?” This decision can have significant implications

Understanding US Marginal Tax Rates 2025

Did you know your next dollar could be taxed at a completely different rate? Knowing about US marginal tax rates is key to saving money.

1099 Tax Deductions List For 2025

Filing taxes can be tough, even for those who get a 1099 form. In 2024, knowing the 1099 tax deductions list is key to saving on taxes. This

How to Reduce 1099 Taxes?

Many freelancers, independent contractors, and small business owners receive income reported on a 1099 form. While this offers flexibility and autonomy, it also comes with

How Much is 1099 Tax in California?

If you work as a freelancer or independent contractor in California, knowing your 1099 tax is key. The tax process can seem complex. But, this