Home » AI Mileage Log Generator Software

WHEN THE CLOCK IS TICKING...

Need to generate a mileage log for a past mileage deduction because the IRS is knocking on the door? Scrambling to get it done with little or no data to work with? Were you relying on your Google Timeline data only to find that it’s gone or useless?

Creating IRS-proof mileage logs can feel overwhelming, especially when you’re racing against the clock. Our AI Mileage Log Generator can help you!

THE DEVIL IS IN THE DETAILS

Traditional mileage tracker apps, other software, Excel files, Google Sheets, or templates won’t help you fix mileage logs from a prior year.

Submitting incomplete mileage logs can raise red flags with the IRS. Gaps or inconsistencies may lead to a hefty fine. That’s where the AI Mileage Log Generator makes a real difference.

Generate GAP-FREE MILEAGE LOGS

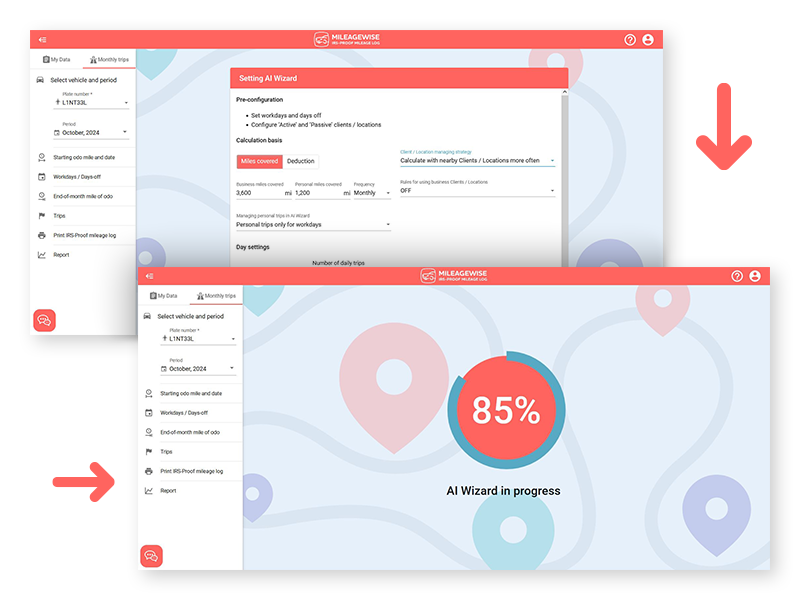

The AI Mileage Log Generator suggests missing trips to fill in any gaps caused by manual trip recording or incomplete imports. Set it up in just a few seconds, and it will auto-populate trips into your mileage log based on previously visited locations and client addresses.

Your mileage log - Just as you like it

MileageWise offers flexible tools to create personalized mileage logs. Whether you need recurring trips, limits on daily client visits or mileage, or a log that backs up a specific deduction amount, our AI-powered Mileage Log Generator can handle it all!

Download your IRS-compliant log in Excel (XLS), CSV, or PDF, and maximize your deductions with ease!

“DOES THE IRS APPROVE OF IT?”

The AI Mileage Log Generator’s built-in IRS auditor checks and corrects 70 possible red flags in your mileage log before finalizing it, ensuring your mileage report is 100% IRS-proof!

According to Publication 463, retrospectively recorded documentation is also valid.