Last updated on March 18, 2025

Facing a tax audit can be stressful, but audit protection offers a safety net by providing expert assistance if the IRS reviews your return. Whether you’re self-employed, a business owner, or just want peace of mind, the right audit defense service can save you time, money, and frustration. But is it worth the cost? In this guide, we’ll break down how audit protection plans work, who needs them, and how to reduce your IRS audit risk—so you can file your taxes with confidence.

The IRS Audit: Triggers To Avoid

The IRS audits millions of tax returns each year, and mileage deductions are one of the most common areas of scrutiny. If your mileage log isn’t IRS-Proof, you could be denied your deductions, assessed penalties, or even have your tax return audited.

Understanding Audit Triggers: Navigating the What and Why of Audits

Navigating the maze of audit triggers can often feel like decoding a complex puzzle. Yet, understanding these triggers is your first line of defense in the proactive world of audit preparation. Let’s break down the common reasons you might find yourself under the magnifying glass and how to navigate these waters with confidence.

Common Audit Triggers

Discrepancies in Tax Returns: Like mismatched puzzle pieces, numbers that don’t add up between your filings and your actual financial statements are a red flag to auditors. This could include income not matching the figures reported by employers or banks.

Large Deductions Relative to Income: Claiming significantly high deductions or credits in comparison to your income level might raise eyebrows. It’s like telling a fish story; the bigger the claim, the more scrutiny it invites.

Random Selection: Sometimes, you’re just the lucky winner of the audit lottery. Random selection is a tool used by tax authorities to ensure fairness in the audit process.

Repeated Losses on a Business: Continually reporting a loss on a business venture can signal to auditors that it’s a hobby rather than a legitimate business, especially if these losses are used to offset other income.

High Cash Transactions: Businesses that deal predominantly in cash (restaurants, salons, etc.) are on the radar for obvious reasons—cash is harder to trace, and thus, there’s a higher risk of underreported income.

Q: What should I do if I discover a discrepancy in my tax return?

A: Don’t wait for an audit notice to act. Amend your return as soon as possible. This shows good faith and may mitigate penalties.

Q: How can I prove my deductions are legitimate?

A: Keep detailed records of all deductions claimed, including receipts, invoices, and logs, especially for donations, business expenses, and travel.

Q: Is there a way to reduce my chances of being randomly selected for an audit?

A: While you can’t influence random selection, ensuring your returns are accurate and complete can make the process smoother if you are selected.

Q: Can my business claim a loss every year?

A: While startups often operate at a loss initially, claiming losses year after year might require you to prove your business motive and strategy to turn a profit.

Q: How do I handle cash transactions to avoid audit triggers?

A: Implement a robust accounting system to document all cash transactions meticulously. Regular bank deposits and receipts can bolster your credibility.

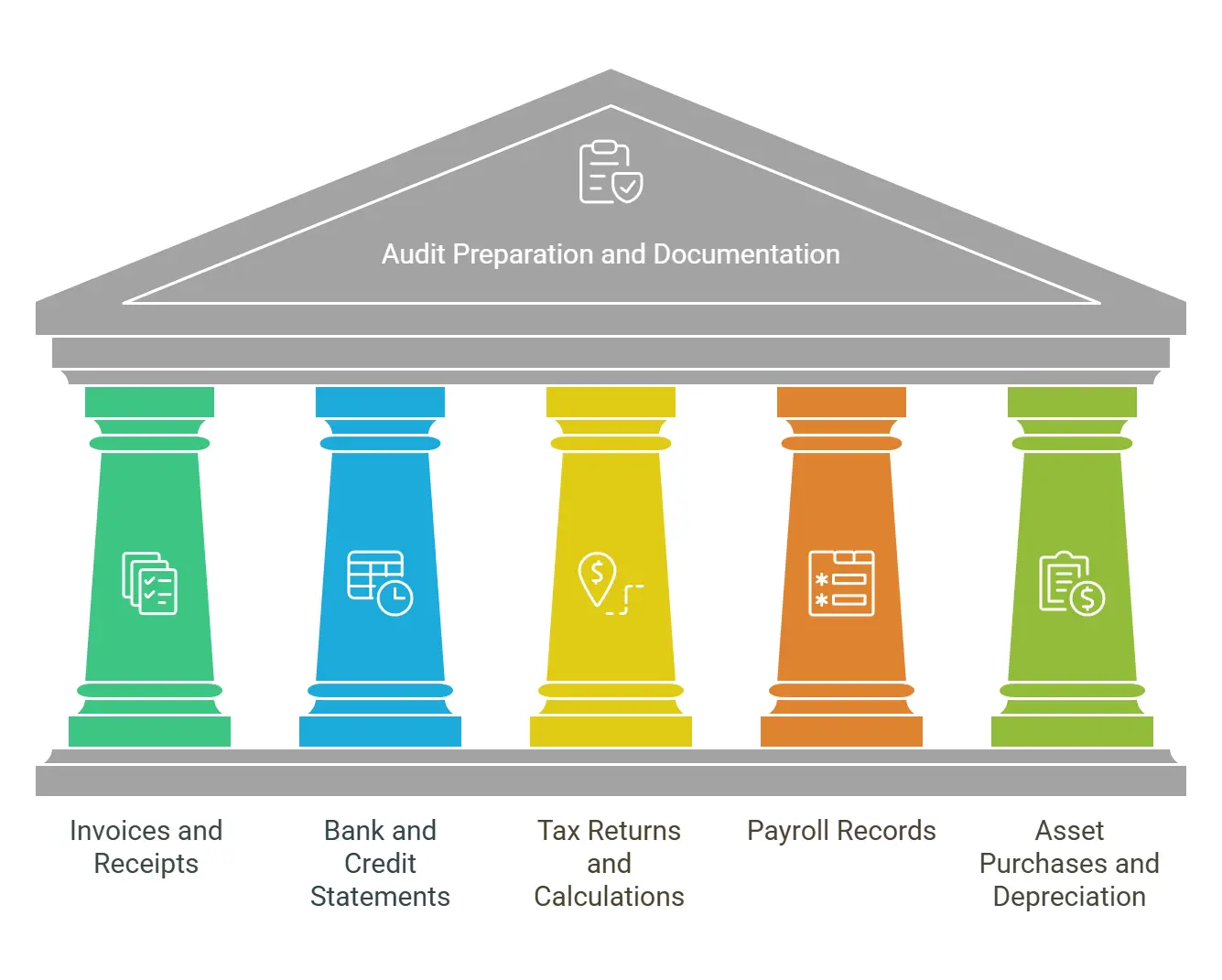

Preparation and Documentation: Your Audit Armor

The right preparation and documentation can make it or break it so let’s gear up and explore how you can fortify your defenses with meticulous record-keeping and organized documents.

Essential Records to Keep

Invoices and Receipts: The bread and butter of your financial records. These documents are the foundation of your expenses and income, providing the proof behind every transaction.

Bank and Credit Card Statements: These are your financial timeline, offering a month-by-month snapshot of your business activities. They should align with your invoices, receipts, and ledger entries.

Tax Returns and Calculations: Past tax returns are the maps of your financial journey, while the calculations show the route you took. They are critical for comparing year-on-year data and understanding tax positions.

Payroll Records: For businesses with employees, maintaining detailed payroll records is non-negotiable. These documents support your tax withholdings and payments to employees.

Asset Purchases and Depreciation Schedules: Big-ticket items and their depreciation impact your financial and tax situation significantly. Keeping track of these helps in accurately reporting asset values and depreciation deductions.

FAQs to Equip You Further

Q: How long should I keep my financial records?

A: The rule of thumb is to keep records for at least seven years. Tax authorities can audit your returns for up to six years back, depending on the situation, so it’s wise to err on the side of caution.

Q: What’s the best way to organize my financial documents?

A: Digital organization is key. Use cloud storage and accounting software to categorize and store documents. Ensure everything is labeled clearly and backed up in multiple locations.

Q: How can digital tools help with audit preparation?

A: Digital tools automate the tracking of income and expenses, or business miles traveled and they generate reports, and ensure accuracy. They can also flag discrepancies early, reducing the chances of audit triggers.

Q: What if I’m missing some documents?

A: Act proactively to retrieve missing documents from banks or vendors. If certain documents are irretrievable, consult a tax professional for advice on alternative evidence that may satisfy audit requirements.

Q: How should I present my documents if audited?

A: Organize your documents according to the auditor’s request, usually by year and type of document. Creating summaries and providing clear, direct access to requested information can streamline the audit process.

What About Your Mileage Log? Is It IRS-Proof?

The IRS has strict requirements when it comes to mileage deductions, and without proper documentation, and a tax person at hand, you could find yourself in hot water.

That’s where MileageWise comes to the rescue. We understand the anxiety that tax audits can cause, and we’re here to offer you peace of mind with our Audit Defense Protection plan.

What is MileageWise’s Audit Defense?

Our prepaid Mileage Log Audit Defense service is designed to provide you with comprehensive coverage for your mileage log. For only $49.99 per year per vehicle, you can safeguard yourself against the uncertainty of IRS audits. If you’re audited, the IRS will likely ask you to provide evidence to support your mileage deductions.

But what exactly does this service entail?

1. Professional Tax Services

MileageWise is more than just a mileage tracking app; we offer professional tax services that ensure your mileage log is audit-proof. Our team of experts understands the complexities of IRS regulations and can provide you with the guidance and assistance you need when it matters most.

2. IRS Audit Protection Plan

With our IRS audit protection services plan, you can rest easy knowing that in the event of an unexpected IRS audit, your mileage log is not only prepared but also protected. We’ll be by your side, helping you navigate the audit process, and ensuring your deductions stand up to scrutiny.

3. Prepaid Peace of Mind

For just $49.99 per year per vehicle, you get prepaid peace of mind. No unexpected fees or surprises. We believe that being proactive about your tax situation is essential, and our prepaid option ensures that you’re always covered.

4. Is Audit Defense Worth It?

You might be wondering if audit defense protection is worth the investment. The answer is a resounding YES! The cost of an IRS audit and a possible penalty can be substantial, both in terms of time and money. With MileageWise’s Audit Defense Protection, you’ll have expert support without breaking the bank.

5. Protect Your Hard-Earned Money

At MileageWise, we understand the value of your hard-earned money. Our audit defense protection is designed to help you protect your finances and ensure you’re not paying more in taxes than you should be. With our assistance, you can maximize your deductions and keep more money in your pocket.

If you contrast the prepaid service with MileageWise’s Mileage Log Tax Preparation Service, the saving is substantial! MileageWise makes it easy and affordable to get an IRS-Proof mileage log. Simply sign up for the service and MileageWise will do the rest.

How does MileageWise Mileage Log Audit Defense work?

If you’re audited by the IRS, MileageWise will help you defend your mileage deductions. MileageWise’s experts will work with you to gather the necessary documentation and prepare for your audit.

Google Timeline Import: Your Secret Weapon

If there are obvious trip gaps in your log, our experts will turn your Google Maps records into an IRS-Proof mileage log. This feature is exclusive to MileageWise and can offer you an excellent way to cover missed trips retrospectively. This will be included in your prepaid plan.

Go Ahead, Secure Your Peace of Mind

In the world of taxes, having a reliable partner is essential. MileageWise’s Audit Defense Protection service is your best ally when it comes to tax audit help and safeguarding your financial well-being. Don’t leave your mileage log to chance—invest in the peace of mind that comes with our audit protection plan.

Are you ready to protect your finances and ensure your tax audit protection plan is in place? Take advantage of MileageWise’s Audit Defense Protection for just $49.99 per year per vehicle and let our experienced team of tax experts guide you through any tax audit with confidence. Your financial security is worth it.