In today’s fast-paced world, where every penny counts and efficiency is the name of the game, tracking your mileage can make a significant difference, especially for professionals on the go and businesses with fleets. But why exactly is mileage tracking so crucial, and what benefits does it bring to the table? What is the best app to track mileage? And what makes an app the best mileage tracking app out there?

Let’s dive in and explore the answers to these questions, and perhaps, in the process, transform the way you view your daily commutes and business trips.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

Why Using the Best Mileage Tracker App Matters For Any Business

- Tax Deductions and Reimbursements: One of the most compelling reasons to keep a meticulous record of your mileage is the potential for tax deductions and reimbursements. Whether you’re self-employed or working for a company, the miles you drive for business purposes can translate into significant savings when tax season rolls around.

- Budgeting and Financial Planning: Understanding how much you’re spending on travel can help you budget more effectively. By tracking your mileage, you can gain insights into your spending patterns, helping you make informed decisions about where you can cut costs.

- Operational Efficiency: Mileage tracking for business isn’t just about financial benefits. It’s also about optimizing operations. Knowing the ins and outs of your fleet’s movements can help streamline routes, reduce fuel consumption, and enhance overall productivity.

Benefits of Using a Mileage Tracking App

- Automatic Tracking: Say goodbye to manual logs. Mileage recording apps automate the process, ensuring accuracy and saving you time.

- Comprehensive Reports: With the touch of a button, generate detailed reports and logs for personal use, business analysis, or tax purposes.

- Easy Access to Historical Data: Need to look up a trip from six months ago? Mileage tracker apps store your history, making it easy to retrieve past records.

- Peace of Mind: Rest assured knowing your mileage is being tracked accurately, freeing you up to focus on what you do best.

Best Mileage Tracker App

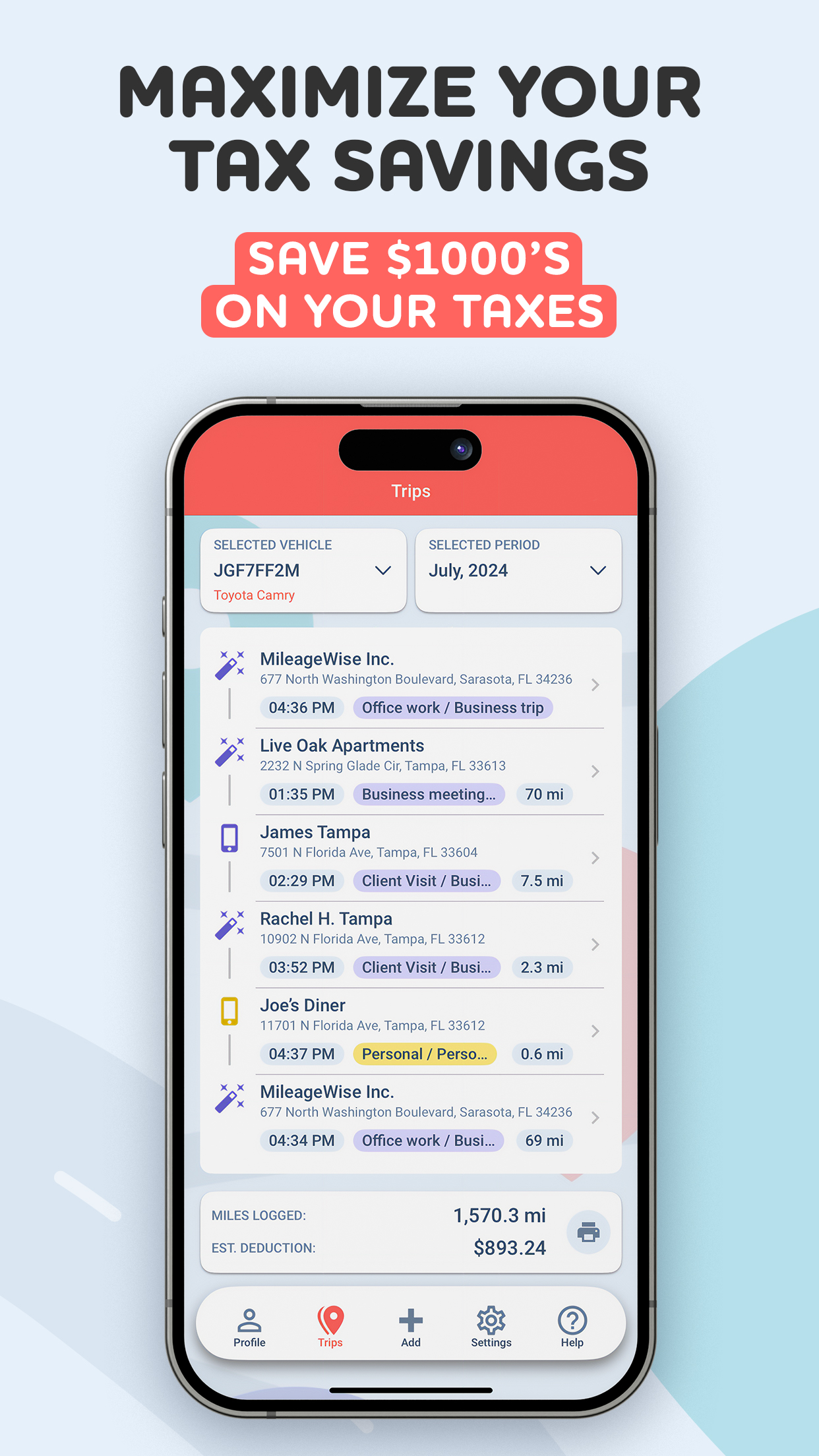

Automatic Tracking: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

FAQs

- Q: Do I really need a mileage tracker app?

- A: If you’re looking to streamline your tax deductions, improve financial planning, or enhance operational efficiency, then yes, a mileage tracker app can be a game-changer for you. If you don’t want to waste time with mileage log templates this is your best option.

- Q: Can I use mileage tracking for personal trips?

- A: Absolutely! While the primary focus might be on business mileage, tracking personal trips can also offer insights into your spending and help with budgeting.

- Q: What if I forget to start the tracker?

- A: Many apps feature automatic trip detection, ensuring every mile is accounted for, even if you forget to start the tracker manually.

- Q: Are mileage tracker apps complicated to use?

- A: Not at all! Most apps are designed with user-friendliness in mind, offering intuitive interfaces and easy navigation.

Mileage tracking, once perceived as a tedious task, has been revolutionized by the advent of mileage tracker apps, turning it into a seamless and almost effortless part of your routine. Whether you’re a freelancer looking to maximize deductions or aiming to boost operational efficiency, the importance of tracking your mileage cannot be overstated. With the right app, you can unlock a world of benefits, from financial savings to enhanced productivity, all while enjoying the journey along the way.

Features That Define The Best Mileage Tracker App

When it comes to selecting the best mileage tracker app, not all are created equal. The key to finding your ideal companion on the road lies in understanding which features will serve your needs best. Whether you’re a bustling small business owner, a freelance dynamo, or someone who simply loves to be on top of their travel expenses, knowing what to look for can turn a good app into a great one. Let’s navigate through the essential features that can make your mileage tracking effortless and effective.

Essential Features That Make a Difference

- Automatic Mileage Tracking: The cornerstone of the best mileage tracker app is its ability to automatically track your mileage without the need for manual input. Look for apps that use your phone’s GPS to detect when you’re driving and automatically log each trip.

- Accurate Expense Reporting: A feature that compiles comprehensive reports of your mileage for tax deductions or reimbursements can save you hours during tax season. These reports should be easily exportable and IRS-compliant.

- Customizable Categories: The best apps allow you to categorize trips as business or personal and even tag them with custom labels for more detailed tracking and reporting.

- Integration with Other Apps: Seamless integration with accounting or expense tracking software can streamline your workflow and reduce manual data entry.

- Cloud Storage and Backup: Ensure your data is never lost with cloud storage capabilities. This feature allows you to access your mileage logs from any device, anywhere.

FAQs

- Q: How accurate are GPS-based mileage tracker apps?

- A: GPS technology has come a long way, and most mileage tracker apps offer a high level of accuracy, ensuring that every mile is counted correctly.

- Q: Will a mileage tracker app drain my phone’s battery?

- A: While it’s true that GPS can consume more battery, many apps are designed to minimize battery usage. Plus, the benefits often outweigh the need for a little extra charging.

- Q: Can I manually add trips if I forget my phone?

- A: Yes, the best mileage tracker apps allow for manual trip entries, ensuring you’re always able to keep your logs accurate and up-to-date.

- Q: Are there mileage tracker apps that are free to use? What is the best free mileage app?

- A: There are several free apps available that offer basic tracking features. However, for more advanced features, a paid subscription might be necessary.

- Q: What is the best mileage tracker app for small businesses?

- A: The best mileage tracker app for small businesses depends on their specific needs, such as IRS compliance, expense tracking, and integration with accounting software

By prioritizing these essential features, you’re not just choosing an app; you’re investing in a tool that can significantly impact your financial health and operational efficiency by helping you maximize tax deductions or streamline your business operations.

Let’s See How Much Tax You Can Deduct Using The Standard Mileage Rate

Maximizing Your Tax Deductions with Mileage Tracker Apps

Navigating the world of tax deductions can often feel like exploring a labyrinthine maze. Fortunately, mileage tracker apps can be your guide, shining a light on the path to maximizing deductions and ensuring you don’t leave money on the road. Understanding how to leverage these apps effectively can transform a daunting task into a rewarding journey. Let’s embark on a trip to discover how you can use mileage tracker apps to fuel your tax savings.

Key Strategies for Maximizing Deductions

1. Diligent Tracking: The foundation of maximizing your tax deductions lies in the consistent and accurate logging of every mile. With a mileage tracker app, you can automate this process, capturing every business trip without fail.

2. Understanding Tax Laws: Knowledge is power, especially when it comes to tax deductions. Familiarize yourself with the IRS guidelines for mileage deductions to ensure your logs meet the necessary criteria.

3. Regular Reporting: Make it a habit to review and export your mileage reports regularly. This not only keeps you organized but also prepares you for tax season well in advance, reducing last-minute scrambles.

4. Categorize Trips: Use your mileage tracker app to categorize trips accurately. Distinguishing between business, personal, charity, and medical trips can help you claim the maximum deductions allowed.

5. Keep Detailed Records: Besides mileage, keep records of tolls, parking fees, and other travel-related expenses. Many apps allow you to log these additional expenses, providing a comprehensive financial overview.

FAQs

- Q: How much can I really save with mileage deductions?

- A: The amount varies depending on the number of business miles driven and the current IRS mileage rate. However, diligent tracking can lead to significant savings (in the thousands per annum).

- Q: What is the IRS mileage rate?

- A: The IRS sets a standard mileage rate each year, which is a deductible amount per mile for business, medical, moving, and charitable driving. It’s crucial to check the latest rate on the IRS website, but if you rely on an advanced mileage tracker app, it’ll automatically adjust to the latest rates.

- Q: Can I claim mileage for trips to and from work?

- A: Generally, commuting miles are not deductible. However, trips between workplaces or to meet clients are considered business mileage.

- Q: How long should I keep my mileage logs?

- A: The IRS recommends keeping your records for at least three years from the date you file your income tax return.

By harnessing the power of mileage tracker apps, you can ensure that every business mile driven translates into tax deductions, effectively turning your vehicle into a tool for financial optimization. Remember, the key to maximizing your deductions is not just about logging every mile; it’s about staying informed, organized, and proactive in your approach. With the right app and strategy, you can navigate the complexities of tax deductions with confidence, ensuring that you’re always on the road to financial efficiency.

So What Is The Best Mileage Tracker App?

While we are going to provide a thorough feature comparison of various leading mileage tracker apps below, it’s worth mentioning the main features MileageWise offers you in this regards.

In comparing MileageWise with other leading mileage tracking apps, several key differences emerge, focusing on features, pricing, and intended user base.

MileageWise stands out for its unique offerings that cater specifically to ensuring IRS compliance and ease of use without the need for additional hardware for Bluetooth tracking. It offers features like automatic classification of trips, integration with other software for expense tracking, and the capability to backtrack forgotten mileage via Google Timeline or using AI, making it highly suitable for those who prioritize IRS-Proof records and the convenience of importing data from other platforms.

In terms of pricing, MileageWise offers a variety of plans starting from $9.99 per vehicle per month, with options for monthly, annual, and lifetime plans. Its structure is designed to cater to both individual and enterprise needs, offering features like trip classification, built-in IRS auditor features, and IRS-Proof mileage log creation. In addition, it can also help you if you need to solve tax preparation or auditing issues involving your mileage log.

Wrapping It Up

When considering what constitutes the best mileage tracker app, it’s important to evaluate them based on features like accuracy, ease of use, reporting capabilities, IRS compliance, and overall user satisfaction.

We trust that the points we shared will help you decide on the most suitable mileage tracker app for your needs. Make sure to check out our comprehensive guide to the features in various leading apps below.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

FAQ

Looking for a mileage app suggestions?

MileageWise offers an AI-powered mileage log generator, which can help you reconstruct past trips and fill in gaps in your mileage log. It also has a built-in IRS auditor that checks your mileage log for contradictions and ensures that it is IRS-compliant. The AI Wizard can help recover past trips, ensuring that no deductible miles are missed

Best mileage log creator? What mileage tracker app would an experienced driver recommend?

Best app to track mileage automatically?

MileageWise is one of the top mileage tracking apps for automatic tracking. It uses advanced GPS technology and smart features to accurately log trips, even if you forget to start the app manually. The app also has a built-in AI that helps reconstruct past mileage logs, ensuring IRS compliance and offering unique features like the AdWise Wizard. With MileageWise, you can track mileage effortlessly, manage expenses, and maximize deductions, making it ideal for self-employed individuals and businesses alike.

What is the best way to track routes and mileage?

The best way to track routes and mileage is by using a dedicated and reliable mileage tracking app like MileageWise. It provides automatic GPS tracking, so trips are recorded in real-time without manual input. MileageWise’s AdWise Wizard feature also allows users to fill in gaps for untracked trips, ensuring complete and accurate records. This combination of automation and manual flexibility is ideal for IRS-compliant mileage logs, maximizing tax deductions, and offering detailed route insights for personal or business use.

I have an Android, any suggestions on the best app to use to keep everything recorded for tax purposes?

MileageWise is a top choice for Android users. It’s tracking system logs every mile you drive, so you will never miss a trip again, and it helps you stay organized to generate irs-compliant mileage reports for tax preparation. If you upload all of your receipts it can be used for automatic expense tracking. With IRS-compliant reports, it’s perfect for keeping your records easy and accurate. Just check it’s ratings and reviews.

Which is the best app for tracking all of your vehicle expenses?

MileageWise is a great app for tracking all your vehicle expenses. It keeps records of your fuel costs, maintenance, and mileage in one place. Perfect for mileage and expense tracking making tax time a breeze and helping you to start saving time and money! Awailable both on ios and android.

What is a good mobile app for tracking car mileage for expense reports or taxes?

When it comes to tracking car mileage for expense reports or taxes, the MileageWise app stands out as a top choice. This 1 app for automatic mileage tracking simplifies the process of tracking miles driven for business purposes. Whether you’re tracking business expenses or calculating mileage reimbursement, Everlance allows you to classify trips with just a swipe. You can easily set work hours and the app automatically tracks your mileage, saving time and money today.

For those who prefer a different expense tracker option, MileIQ is another trusted mileage tracker on the app store for businesses of all sizes. With its innovative tracking capabilities, users can start tracking their drives for work effortlessly. Simply swipe right for business miles to log trips, making it easier than ever to track your business expenses. Both apps have never been easier to use and are trusted by millions, ensuring you have the best tracking solution for your needs.

What are the top 5 app that track mileage?

When looking for the top 5 mileage apps, users often seek ways to track mileage efficiently. The Everlance app stands out as it is designed to help users make mileage tracking seamless while also allowing for logging with MileIQ. These apps cater to both business and personal needs, enabling users to classify trips as business or work or personal with ease.

Another popular choice is a comprehensive mileage tracker and expense app that simplifies tracking work expenses. Users can easily manage their records and ensure accurate reporting. With these tools, you can simply use this app to monitor your 1 mileage and optimize your tax deductions.

Is there a tracking app that works well for husband/wife business?

For couples running a business together, tracking mileage can be a daunting task. Fortunately, there are apps specifically designed for this purpose. One such app is Mileagewise, which is designed to simplify the process of logging miles. With its user-friendly interface, it works seamlessly on an iPhone, allowing both partners to easily record their business trips.

What makes MileageWise particularly appealing is its ability to automatically track mileage using GPS technology. This means that couples can focus on their work without worrying about manual entries.

Ultimately, MileageWise serves as an invaluable tool for husband-and-wife teams, ensuring accurate mileage tracking and maximizing deductions come tax season.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |