IRS Red flags IN YOUR MILEAGE LOGS?

Do the trips in your mileage logs follow IRS requirements? The IRS can request all of your business records, including gas receipts, expense reports, odometer readings from mechanics or safety inspections, traffic camera data, tolls, and parking fees.

When you file for a mileage deduction, numbers based on a “homemade” mileage log won’t fly under the radar and it certainly won’t hold up in an audit.

EXCEL IS NOT ENOUGH ANYMORE

If the IRS audits your mileage deduction, they may request additional records to verify your claim. If you rush to put together a mileage log at the last minute, even a beginner auditor will easily spot unrealistic odometer readings or inconsistent mileage totals. Handing in mileage logs with red flags can result in rejected mileage logs and an enormous fine.

DON’T MISS OUT ON CLAIMING $1,000S

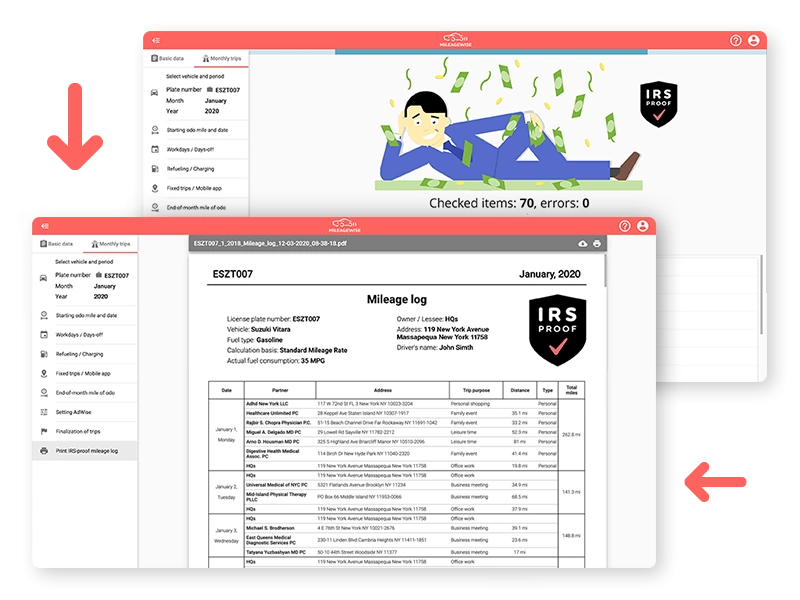

Manually add or edit your data in the MileageWise Web Dashboard, or import it from sources like Google Maps Timeline. Before finalizing your mileage log, MileageWise automatically checks and corrects 70 potential red flags to ensure your mileage report is 100% IRS-proof.

“ARE MILEAGEWISE LOGS IRS-PROOF?”

We’ve put 20+ years of expertise and data from more than 30,000 vehicles into MileageWise to create the fastest, most stress-free mileage logging experience. Our software ensures that every mileage log is state-of-the-art and IRS-proof!