Tracking your business mileage is crucial for maximizing tax deductions and getting accurate reimbursement. Without a reliable system in place, keeping track of every mile driven can be a daunting task. That’s where a business mileage tracker comes in handy. It not only simplifies record-keeping but also ensures you capture every eligible mile for tax purposes.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

What is a Business Mileage Tracker?

A business mileage tracker is a tool or app that helps you record the distance you drive for business purposes. It allows you to easily differentiate between personal and business trips. This provides you with a detailed mileage log that is ready for the IRS when tax season comes around. The main purpose here is to maintain an accurate log of your work-related travels.

Benefits of Using a Business Mileage Tracker

Accuracy and Convenience

One of the biggest advantages of using a business mileage tracker is accuracy. With features like GPS tracking and automatic mileage tracking, the app records all relevant data for your business trips. This data can then be used for expense tracking, calculating tax deductions, and staying IRS-compliant.

Time-Saving Benefits

Another great benefit is how much time you save. Instead of manually entering every trip into a mileage tracker spreadsheet, a mile tracker app can do it all automatically. Simply install the app, and let it do the work for you. Meanwhile, it eliminates the hassle of remembering every mile you drove for work.

Top Features to Look for in a Business Mileage Tracker

Automatic Mileage Tracking

Automatic mileage tracking is a must-have feature that ensures every mile is captured without you needing to remember to log it. This feature is especially important for those who have multiple business trips in a day and need an easy way to keep track of their mileage.

Integration with Expense Tracking Tools

A good mileage tracker should easily integrate with your expense management tools. Furthermore, it should help you streamline your financial records. This integration makes it easier to track all your expenses in one place, ensuring accuracy and efficiency.

Calculate Mileage Reimbursement

Another key feature is the ability to calculate mileage reimbursement. This feature makes it easy to determine how much you are owed for your business travel. Also, it provides a detailed mileage log for taxes, ensuring compliance with IRS regulations.

Need a Mileage Tracker Solution for your Business?

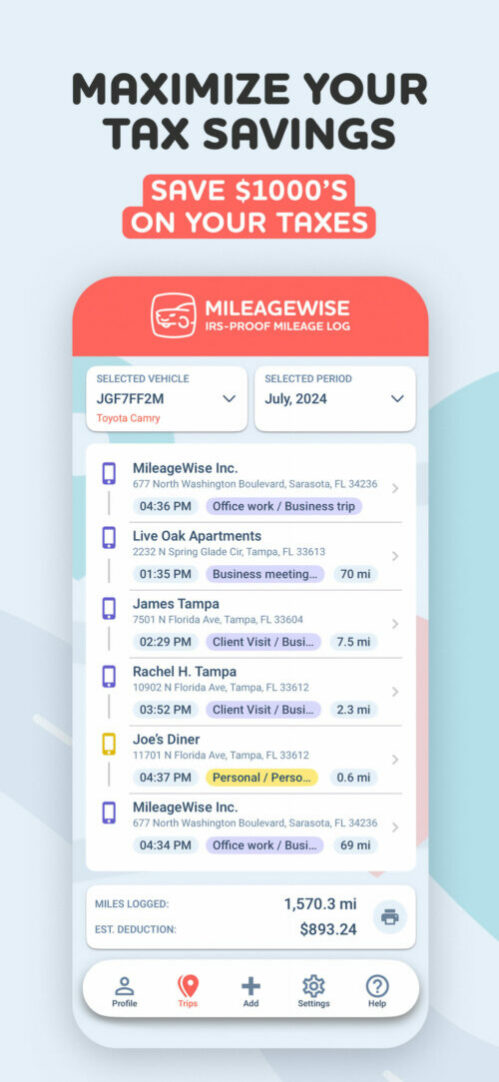

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Best Business Mileage Tracker Apps in 2024

There are several excellent options for work mileage trackers available in 2024. The best mielage tracker apps come with features like GPS tracking, automatic logging, and the ability to track mileage for both business and taxes.

Everlance

Everlance is designed with freelancers, gig workers, and small business owners in mind. It offers robust tracking and reporting features. The free version allows up to 30 automatically detected trips per month and unlimited manual trip logging. On the other hand, the premium plan includes unlimited automatic trip detection, bank and credit card integration, and advanced reporting features.

Best For: Freelancers and small business owners looking for a combined mileage and expense tracker.

TripLog

TripLog caters to both individual users and businesses. It offers customizable features to meet diverse needs. The free version provides up to 40 manually logged trips per month. However, the paid plans include unlimited automatic mileage tracking, fuel and expense tracking, and integration with accounting software.

Best For: Small businesses and frequent drivers requiring detailed expense and fuel tracking.

MileIQ

MileIQ is a simple yet powerful app designed for professionals with straightforward mileage tracking needs. The free version allows up to 40 trips per month. Meanwhile, the paid version offers unlimited trip tracking, automatic drive detection, and easy trip classification.

Best For: Professionals with simple mileage tracking needs.

Driversnote

Driversnote focuses on creating mileage logs that are compliant with tax authorities. The free version includes up to 20 manually tracked trips per month. The premium version offers unlimited trip tracking, advanced reporting options, and integrations for seamless tax preparation.

Best For: Tax-focused users needing detailed mileage logs.

MileageWise

MileageWise stands out with its AI Mileage Log Generator, making it ideal for reconstructing past mileage logs. The app offers a 14-day free trial with premium features. All plans provide personalized automatic trip detection, IRS-compliant reporting, and an AI-driven retrospective logging feature.

Best For: Users needing an IRS-proof mileage tracking solution with advanced features.

How to Calculate Mileage for Reimbursement

Calculating mileage for reimbursement is simple. Here’s a step-by-step guide:

-

Review your mileage log to ensure all business trips are captured correctly.

-

Apply the standard mileage rate to calculate your reimbursement. The current rate is determined annually by the IRS.

-

Multiply the number of business miles with the standard mileage rate.

Use this tool to calculate your mileage deduction:

Business Mileage Tracker vs. Mileage Tracker Spreadsheet

When it comes to keeping a mileage log, you have two main options: a mileage tracker app or a mileage tracker spreadsheet. While spreadsheets are a more manual method, they can be useful for those who prefer a hands-on approach. However, a mile tracker app offers significant benefits. This includes GPS integration, automatic mileage tracking, and easier reporting for tax deductions.

Tips for Maximizing Your Business Mileage Deductions

To make the most of your mileage deductions, using a business mileage tracker is essential. By keeping an accurate mileage log, you can ensure you are getting the most out of your tax deductions and avoiding any issues with the IRS. Be sure to use a reliable app like MileageWise to capture every mile, and double-check your records to avoid common mistakes.

MileageWise: Your Go-To Business Mileage Tracker

MileageWise takes mileage tracking to the next level with advanced, user-friendly features. These are designed to save time, maximize deductions, and eliminate the stress of manual logging. Here’s why MileageWise stands out from other mileage tracking apps:

Battery-Friendly Automatic Tracking

Many mileage tracking apps rely on continuously running GPS, which can drain your phone’s battery quickly. MileageWise uses smart tracking technology that records stops and calculates miles traveled without constant GPS usage. This approach:

-

Minimizes battery usage: Keeps your phone charged longer.

-

Protects your privacy: Tracks only essential trip data.

-

Boosts efficiency: Ensures seamless and accurate mileage logging without interruptions.

Whether you’re a gig worker or a business owner, MileageWise’s battery-friendly design is ideal for everyday driving needs.

Customizable Experience Tailored to Your Needs

MileageWise offers extensive customization options to suit individual preferences and business requirements. You can:

-

Adjust settings: Personalize the app based on your driving habits and needs.

-

Create custom categories: Include specific trip purposes or business activities in your logs.

-

Enjoy flexibility: Perfect for self-employed professionals, real estate agents, or Uber drivers.

This tailored approach ensures a user experience that feels both efficient and personalized.

Ad-Free Interface

Unlike many apps cluttered with ads, MileageWise provides a completely ad-free experience. This means:

-

No interruptions: Avoid distractions from pop-ups or ads.

-

A smoother user interface: Focus solely on tracking your mileage.

Say goodbye to distractions and focus on efficient, accurate mileage logging.

Built-in IRS Auditor: Your Compliance Guardian

One of MileageWise’s most powerful features is its IRS Auditor, an intelligent tool that:

-

Checks for errors: Identifies duplicate trips, inconsistent odometer readings, or missing entries.

-

Suggests corrections: Provides recommendations to resolve discrepancies.

-

Ensures IRS compliance: Prepares mileage logs to meet IRS standards, minimizing audit risks.

This tool acts as a virtual assistant, helping you create an IRS-proof mileage log to maximize tax savings.

AI Wizard for Reconstructing Past Trips

If you’ve missed logging a trip, MileageWise’s AI Wizard uses historical location data and driving patterns to:

-

Reconstruct forgotten trips: Accurately recreate missed journeys.

-

Complete your mileage log: Fill in gaps effortlessly for a comprehensive record.

-

Save time and reduce stress: Eliminate manual entry for past trips.

This feature is a game-changer for busy drivers, ensuring accurate records even if trips are forgotten in real time.

Conclusion

Using an app to keep track of business mileage is key to maximizing your tax deductions, staying compliant with IRS requirements, and ensuring you get reimbursed for every mile driven for work. Choose a reliable mile tracker app, such as MileageWise. Save time, simplify your expense tracking, and ultimately keep more money in your pocket.

If you’re ready to simplify your mileage tracking and maximize your savings, try MileageWise today. With automatic mileage tracking and easy expense tracking, it’s the perfect solution for your business needs.

Try it for free for 14 days. No credit card required!

Dashboard

FAQ

What is a business mileage tracker?

A business mileage tracker is an app or tool that helps record the miles you drive for work purposes. It differentiates between personal and business trips, creating an accurate mileage log for tax deductions and reimbursements.

Why should I use a mileage tracker app instead of a spreadsheet?

Mileage tracker apps offer features like GPS integration, automatic mileage logging, and seamless reporting. These features save time and reduce errors compared to manual entry in spreadsheets.

What features should I look for in a mileage tracker?

Key features include automatic mileage tracking, integration with expense tools, mileage reimbursement calculation, and compliance with IRS standards.

How do I calculate mileage reimbursement?

Multiply your total business miles by the current IRS mileage rate to determine your reimbursement.Use a mileage deduction calculator.

How does MileageWise differ from other mileage trackers?

MileageWise offers battery-friendly tracking, a customizable user experience, an ad-free interface, an IRS Auditor for compliance, and an AI Wizard to reconstruct past trips.