Last updated: June 14, 2024

Using a car for business generates a significant amount of expenses for those who drive their vehicle to create revenue, leaving many wondering how to deduct mileage on taxes.

The Internal Revenue Service (IRS) offers 2 ways to calculate how much you can deduct from those expenditures each tax year – these are the standard mileage rate and the actual expenses method. Each has its pros and cons, and figuring out which one is more beneficial for your business income depends on several factors, which we’ve set out to explain in this article.

What is the standard mileage rate?

This is the more simple one of the 2 options mentioned above. Using this method of calculation, you don’t need to track all of your individual expenses or keep every single receipt during your trips. Basically, all you have to do is keep track of your mileage throughout the year.

TIP: Take a photo of your odometer on January 1 before your first trip of the year, so you can always see where it stood at the very beginning of the tax year.

In order to use the standard mileage rate, you must choose this option in the very first year of using that particular vehicle for business purposes. Also, if you decide to go with the standard mileage rate, you must keep a mileage log.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

What does a mileage log have to include?

- The dates of your trips

- The starting and ending odometer readings for each year – to avoid complications, we strongly recommend that you capture it on the 1st of each month

- The purpose of each trip (e.g. business meeting, shopping for supplies, personal shopping)

- The starting and ending times of your trips

If you don’t want the hassle of manually logging your drives on paper or in an Excel mileage log template, use a mileage tracker app like MileageWise, which automatically tracks and classifies these trips for you.

The calculation of the standard mileage rate

Another huge advantage of using a mileage tracker application is that you’ll see how many business miles you’ve done during the year, which makes the calculation plain and simple. Let’s say, you did 15,000 business miles and 10,000 personal miles in 2024.

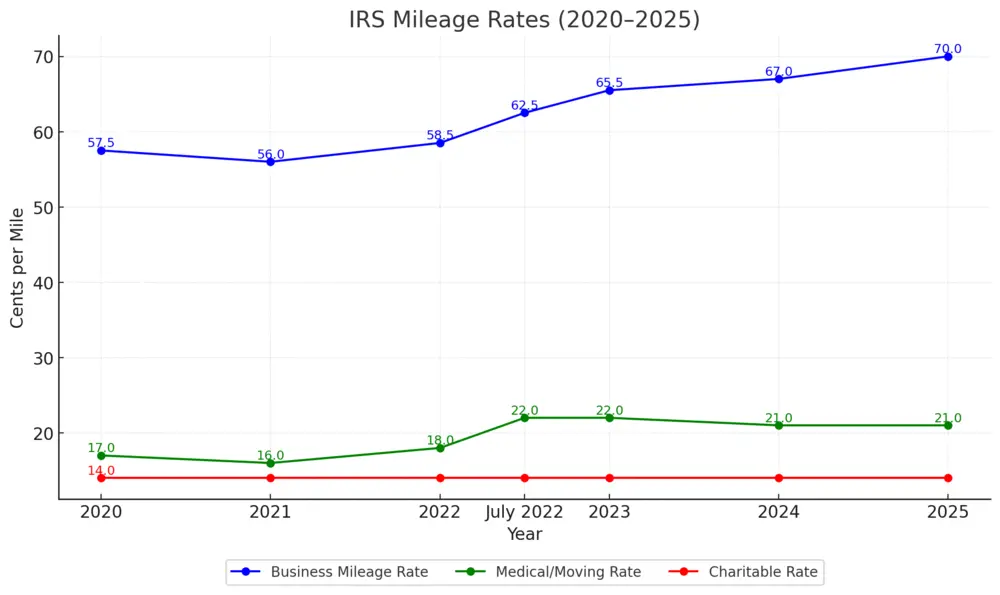

In this case, you have to multiple the 15,000 miles with the current IRS standard mileage rate, which is 67 cents for 2024.

15,000 miles x 0.67 dollars = $10,050 mileage tax deduction for the tax year 2024

What expenses can I deduct when using the standard mileage rate?

When you use the standard mileage rate, all your expenses are included in the federal mileage rate (67 cents for 2024). Therefore, you can only deduct these specific amounts (like repairs and refuelings) by using the actual expense method.

Is that option worth it? Let’s find out:

How does the actual expenses method work?

The actual expense method demands you to keep track of all your documentation, including your receipts that show exactly how much money you spent on each item during the operation of your vehicle. When this sum is added up, you need to multiply it by the percentage of your business use of the vehicle.

Let’s say that your business use is 70% and your personal use is 30% for 2024. Your business car-related expenses were $12,000 in total, so that is the sum you need to multiply by the 70 percent.

$12,000 x 0.70 = $8,400 in business expenses

What expenses are included in the actual expenses?

- Gasoline

- Auto insurance

- Lease payments

- Car depreciation (see a depreciation table for details)

- Maintenance (such as car service, brake pad replacements, oil changes)

- Licensing & registration fees (not deductible in every state)

- New tire purchases

It’s worthy of note that parking fees and tolls are not included in the lists of the actual expenses or in the standard mileage rate “package”, but they’re still deductible.

Which approach is better for tax deductions?

Generally, the more expensive your car is and the higher your car-related expenses are, the better option would be to go with the actual expenses method. Drivers with “regular” automobiles and spending habits tend to choose the standard mileage rate.

How to write off a car for business

If your business purchases a car, you’re able to write off its expenses with the depreciation deduction, using the actual expenses method. Keep in mind that you’re only able to deduct the business-use portion of the car, so if you used your car for 70% for business, you’ll only be able to deduct 70% of that particular car’s depreciation. The amount of a car’s depreciation depends on a lot of things, see a depreciation calculator for a more detailed answer.

Let’s see 2 examples with gig workers, although this is true for small business owners, self-employed people, and independent contractors as well.

Example #1: Part-time DoorDash driver

A DoorDash partner-driver drove a total of 8,000 miles in 2024, and 4,000 of those miles were for business.

The driver’s actual expenses included:

- $800 gas

- $1,200 insurance

- $5,600 lease payments

- $350 repairs

- $80 oil

- $400 car washes

These costs total $8,430. The actual expenses deduction is $4,215 ($8,430 x 0.5 = $4,215) since the driver utilized the vehicle for business purposes 50% of the time.

Using the same statistics, the driver multiplies the business mileage (4,000 miles) by the standard mileage rate (67 cents per mile in 2024), yielding a standard mileage deduction of $2,680.

In this case, the actual expenses approach allows the DoorDash driver-partner to deduct $1,535 more vehicle tax deduction than the standard mileage method.

Example #2: Full-time DoorDash driver-partner

A DoorDash partner-driver drove 36,000 miles in 2021, and 23,400 of those miles were for business. The driver’s actual expenses include:

- $3,800 gas

- $2,970 depreciation

- $1,330 insurance

- $1,050 repairs

- $160 oil

- $440 tires

- $700 car washes

These expenses total $10,450. Since the DoorDash driver-partner used the vehicle for business 65% of the time, the actual expenses deduction is $6,792 ($10,450 x 0.65 = $6,792).

Using the standard method with these same numbers, the driver would multiply the number of miles driven for business (23,400) by the standard mileage rate (67 cents per mile in 2024), which comes out to $15,678.

In this example, the DoorDash driver-partner is able to deduct $8,886 more by using the standard mileage method than by using the actual expenses method.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & track your miles for free for 14 days. No credit card required!

When can I not use the standard mileage rate?

You cannot choose the standard mileage rate if you use 5 or more cars at the same time (as in fleet operations) or if you want to deduct all business-related expenses during your business operation.

Can I Switch From Actual Expenses to Standard Mileage?

If you choose the standard mileage rate in the first year of the operation of a particular vehicle, you are able to switch from actual expenses to standard mileage and back from year to year.

However, if you go with the actual expenses method in the first year, you’re not allowed to change from that as long as you drive that vehicle for business purposes.

If you don’t own a luxurious car with extremely high costs, we recommend going with the standard mileage rate in the first year as that option gives you freedom and choice to calculate your deductions every year and determine which method you’ll want to use in the following year.

How to track miles for business

If you wish to save many hours a week from logging your mileage manually, it’s definitely worth having a mileage tracker app that does that automatically for you.

MileageWise’s mileage tracker app has 3 types of automatic tracking modes, along with a manual trip recording option. After having your miles recorded for the month on your phone, it takes only 7 minutes to edit & finalize your monthly trips.

Before generating your mileage log, MileageWise’s built-in IRS auditor checks and corrects 70 potential IRS red flags in your mileage log to make sure that it is 100% IRS-compliant.

After registering, you have 14 days to try MileageWise’s features and track your miles for free!