Last updated: February 17, 2025

If you use your personal vehicle for business purposes, the IRS allows you to deduct a portion of the expenses incurred as a tax write-off. To claim these deductions, you must keep a detailed record of all business-related miles driven, known as a mileage log. Keeping an accurate small business mileage log ensures you can maximize your deductions while complying with IRS mileage log requirements.

In this article, we will guide you through the IRS mileage tracking requirements, explain the importance of maintaining mileage documentation, and answer common questions on the topic. Whether you’re self-employed, an employee, or an employer managing company cars, this guide will help you keep your mileage records IRS-compliant and optimized for tax deductions.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

Do I need to keep a Small Business mileage log?

Keeping a mileage log is essential for various situations. Especially, if you aim to claim mileage deductions on your taxes or need to track travel expenses for business purposes.

For self-employed individuals, maintaining a detailed mileage record is crucial as it helps substantiate claims for business mileage deductions, reducing taxable income and ensuring compliance with IRS regulations.

Furthermore, employees who use their privately owned vehicles for work-related travel should also keep a mileage log to seek reimbursement from their employers and to claim deductions for unreimbursed travel expenses.

Moreover, employers who provide company cars to employees must track mileage to distinguish between business and personal use of the vehicle. This differentiation is important for tax reporting and for calculating the taxable benefit received by the employee. Accurate mileage reports help employers monitor vehicle usage, maintain transparency, calculate mileage deductions, and ensure compliance with company policies and IRS mileage log requirements.

IRS Mileage Log Requirements

- The year-start & year-end odometer readings of your car

- The mileage for each business trip (e.g. 18.6 miles)

- The date, the starting & ending locations, and the purpose of each business trip

- The total mileage you drove during the year for business, commuting, and personal purposes other than commuting

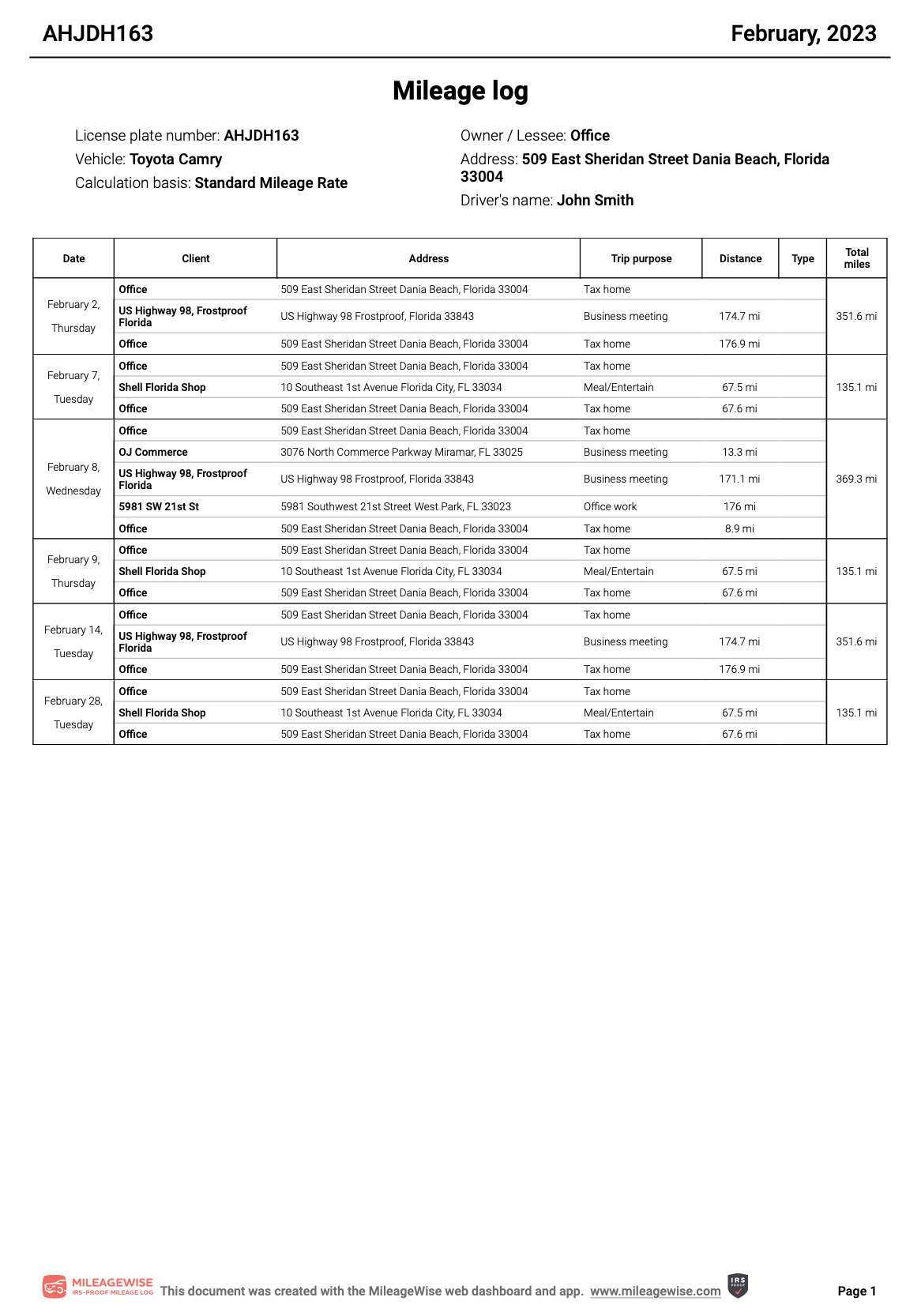

Here is an example of a monthly mileage log:

PRO TIP: MileageWise automatically takes care of all IRS mileage log requirements mentioned above. Its built-in IRS auditor function checks & corrects 70 potential IRS red flags in your mileage log (including these) before generating your mileage log.

The built-in IRS auditor and tracking of your personal trips are 2 of the methods by which MileageWise guarantees that your mileage log is 100% IRS-Proof.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

What mileage log formats are accepted by the IRS?

The IRS accepts two forms of mileage log formats: paper logs and digital logs.

Paper mileage log

A paper log is a simple, written record of your business miles driven. It should include the date, the purpose of the trip, and the total miles driven for each business trip.

Digital (electronic) mileage log

We can say that this type of mileage log has become the “standard mileage log form” due to technological development. Digital logs must have the same information as paper logs.

These logs can be in the form of a spreadsheet (like Google Sheets / Excel) or a piece of mileage logging software. The latter is definitely the quickest and easiest way to log your miles in 2025 as your trips can be logged fully automatically via a mileage tracker app.

PRO TIP: Going with a digital mileage log, it is advised that you keep a mileage log backup by Google in case of any technical difficulties. Regardless of the mileage log format you choose, the most essential thing is that your mileage log is accurate, complete, and contains all the necessary information required by the IRS.

Small Business IRS Mileage Log requirements: Your Odometer records

The IRS does not require to record your odometer for each trip in a mileage documentation. However, recording your odometer on the first day of each month does help increase the accuracy of your log and make it easier to verify your deductions in case of an audit. The important thing is to have a complete and accurate record of your business miles driven, including all required data.

You must keep your mileage records for the entire tax year, from January 1 to December 31.

PRO TIP: Do you want to backtrack your odometer reading for a past date? Use MileageWise’s Odometer Calculator.

Standard Mileage Rates & The Actual Expense Method

The IRS standard mileage rate for business use of a personal vehicle changes every year to follow changing prices related to vehicles. In this case, you deduct the mileage rate from every mile you have driven for business.

For the actual expenses method, you can only deduct the portion of the expenses incurred for business use. To calculate this percentage, divide the total business miles driven by the total miles driven during the year. To support business or gig worker mileage deductions with the actual expense method calculation, you should keep all invoices, receipts, and a mileage log of all business miles driven.

How long should I keep my mileage records?

It’s recommended to keep your IRS compliant mileage records for at least three years, as this is the typical statute of limitations for tax purposes in the United States.

However, some tax authorities may audit tax returns filed up to six years prior to the current date, so it’s a good idea to keep your records for at least that long, just to be safe.

Do I have to include personal miles in the same mileage log as business miles?

Trips for personal reasons (such as commuting or personal shopping) are not deductible but are strongly recommended to be included in your mileage log.

Although the IRS doesn’t require personal trips in your mileage log, it’s strongly recommended that you include them because it will provide clarity for both yourself and the IRS, since you need to separate your total business mileage, total personal mileage, and total commuting mileage for the year.

Also, logging your personal trips boosts the proficiency of MileageWise’s built-in IRS auditor function, which you need for an IRS-approved result.

NOTE: If you have a home office, the miles driven from your home to other work-related locations are deductible. In that case, make sure to deduct all of those trips as they fall in the business trip category.

What happens if I don’t have accurate records to support my mileage deductions?

In this case, the IRS may disallow your deductions, or worse, you may receive an enormous IRS fine.

If you’re getting audited, there’s no time for hesitation, but no need to panic either: MileageWise’s Mileage Log Tax Preparation Service will fix your mileage log, whether it’s only about filling a few gaps in your mileage log or recreating it from scratch for an entire year.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Facing trip gaps? Effortless log recovery and backtracking with MileageWise

One of the most stressful aspects of mileage tracking is dealing with lost data or incomplete logs. MileageWise alleviates this anxiety by offering innovative tools that can backtrack and fill in missing information.

If you’ve forgotten to log a trip, the software’s AI Wizard Mileage Log Generator can reconstruct the journey based on your habits and past records, ensuring that your mileage log remains whole and defensible. Also, its Google Maps Timeline Export to Mileage Log feature can turn your previously recorded drives into a proper, IRS-Proof log!

Enhanced Audit Protection with MileageWise

MileageWise’s commitment to compliance doesn’t end with just ensuring that your logs meet the IRS’s standards. The solution’s advanced features provide a robust shield against audits by offering detailed documentation and real-time tracking that aligns with IRS mileage log requirements. With MileageWise, you’re not only keeping record your trips; you’re also making sure that your data that stands up to scrutiny.

Can I track multiple cars with MileageWise?

For those managing multiple vehicles for business use, MileageWise’s system allows for seamless switching and tracking across different cars. This means that you can maintain separate logs for each vehicle in your team, ensuring that the mileage for each is accurately recorded and reported without any mix-ups or errors. Furthermore, your privacy is protected with our mileage tracker app.

MileageWise as a Tax Planning Tool

Beyond mere tracking, MileageWise can serve as an integral component of your tax planning strategy. By analyzing your mileage data, it can provide insights into your deductible expenses and help you make informed decisions that could lead to significant tax savings throughout the year.

The user experience with MileageWise is intuitively designed, making it accessible for individuals who are not tech-savvy. The platform’s interface is straightforward, guiding you through each step of the process, from inputting your first trip to finalizing your yearly report. This user-friendly approach removes the intimidation factor from tax compliance and makes it a manageable task for anyone.

In conclusion, MileageWise is not just about compliance; it’s about convenience, confidence, and control over your mileage deductions. Its suite of features transforms the cumbersome task of log-keeping into a streamlined process, ensuring that your focus remains on your business, not on your mileage log.

FAQs

Do I need a mileage log to comply with the IRS regulations?

Yes, if you use your personal vehicle for business purposes and wish to claim deductions, you must keep a detailed mileage log to comply with IRS regulations and substantiate your claims. If you are an employee and use your own car for work, consult your method of vehicle expense reimbursement with your manager.

How do I log miles for taxes?

To log miles for taxes make sure to include all required data such as starting and end-of-year odometer readings, dates, distances, starting and ending points and purposes of trips. Track consistently and review your logs regularly, whether using a paper or digital format.

The IRS did not accept my mileage log. How do I prepare a mileage log for IRS audit?

If the IRS did not accept your mileage log, collect all business travel data you have and use a reliable mileage log recovery tool like MileageWise to recreate or correct your log. Contact MileageWise’s Tax Preparation Service for professional help.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |