Whether you’re self-employed, a business owner, or simply looking to maximize your tax savings, understanding the mileage rates is a key step. These IRS-set rates are not just numbers. They’re your opportunity to save money while staying compliant with tax regulations.

We’ll break down the mileage rates of the last few years, update the fresh ones and explore how they apply to business, medical, and charitable travel. You’ll also learn how to choose the right deduction method, keep accurate records, and even uncover strategies for making the most of your mileage tax deductions.

Ready to drive your tax savings to the next level? Read on!

Table of Contents

Try MileageWise for free for 14 days. No credit card required!

Dashboard

IRS Standard Mileage Rates

The standard mileage rate is the default cost per mile to drive established by the Internal Revenue Service (IRS). It is for taxpayers who claim a tax deduction on an IRS form for the cost of using a vehicle for business expenses, charitable or medical purposes, and even moving expenses. This federal mileage rate varies depending on the type of expense and is adjusted annually by the IRS. Furthermore, it makes it easier to figure out car expenses for tax deductions because it includes all variable costs of operating and expenses related to business.

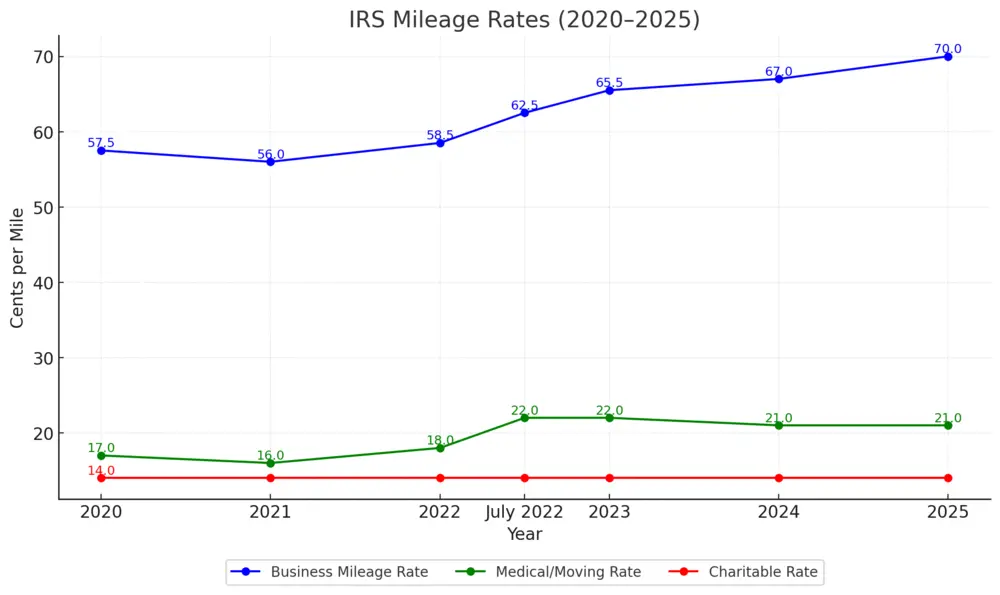

The 2025 Mileage Rates Have Been Announced

Here are the new rates:

- Business mileage rate: 70 cents per mile. Used for work-related travel.

- Medical and military moving rate: 21 cents per mile. For trips related to medical care or military relocations that meet specific IRS guidelines for tax deductions.

- Charitable rate: 14 cents per mile. Designed for volunteers supporting nonprofit organizations.

Mileage Rates for 2024

To deduct your miles for last year, the mileage rates of 2024 will apply. You have until April 2025 to file for mileage reimbursement.

- Business Mileage Rate: 67 cents per mile for work-related travel.

- Medical and Military Moving Rate: 21 cents per mile for trips related to medical care or qualifying military relocations under IRS guidelines.

- Charitable Rate: 14 cents per mile for volunteers supporting nonprofit organizations.

How the IRS Sets Mileage Rates

Standard mileage deduction rates are based on cost data and analysis that Motus compiles and sends out to the IRS. Motus uses data from the whole country and measures gas/oil prices, service costs, automobile insurance premiums, travel expenses, depreciation, and other costs included in operating and maintaining a car.

The standard mileage rate for automobile business purposes is based on both fixed and variable costs of using a vehicle, while medical and moving rates are only based on the variable costs of car driving.

How the IRS Determines the Federal Mileage Rate

The IRS looks at several things when setting the average rate:

- Fuel prices and how cars use fuel

- How much the car loses value over time

- Insurance costs

- Maintenance expenses

- Tire wear

| Cost Category | Percentage of Rate |

|---|---|

| Fuel | 30% |

| Depreciation | 25% |

| Insurance | 15% |

| Maintenance | 20% |

| Tires | 10% |

For charity purposes, the standard mileage rate is based on the minimum value established by federal law. It is meant to compensate taxpayers for expenses they usually pay out of their pocket and are not reimbursed for by anyone else but the IRS.

What does the IRS Standard Mileage Rate cover?

- The same tariffs apply to all passenger cars, including cars, vans, pickups, and panel vans.

- The mileage rates cover variable costs for vehicle operations such as gasoline, oil, tires, maintenance, and repairs, and fixed costs for vehicle operations such as insurance, registration, depreciation, and leasing.

- The mileage rates do not cover the cost of parking and tolls and they do not vary by geography, it’s the same amount throughout the U.S.

- Taxpayers cannot deduct mileage for the private usage of the vehicle

Types of Mileage Rates

Business Miles

Chad delivers groceries as a Spark delivery driver for Walmart, for which he uses his own car daily. Our freelancer, Chad drives from home to Walmart and visits several clients a day from there. He can deduct 67 cents for every business mile he drove in 2024 between Walmart and a client, and also between clients. However, he is not able to deduct the costs of commuting between his home and Walmart. Chad uses an automatic mileage tracker app, which is available for both iOS and Android phones, and creates a mileage log in just 7 minutes every month. Chad is a wise man, be like Chad. 🙂

Start Your Journey of IRS-Proof Logging

Charity Miles

Rose does volunteer work for Hunger Fight Inc. in Jacksonville, Florida. She drives to different places in the area to collect charity and run other types of errands for the organization, which is qualified to provide her with a charitable deduction for the miles she drives. This amount is 14 cents per mile.

How Many Charitable Miles Can You Deduct for the Year 2024?

In general, charitable gifts can be deducted up to 60% of your AGI (Adjusted Gross Income) using the charitable mileage rate, but you may be limited to 20%, 30%, or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come with a lower limit, for instance).

The specifics can be found in IRS Publication 526.

Miles for Medical Purposes

Marshall broke his jaw and has been paying hospital and doctor visits ever since. He can deduct the visits that are not covered in his health plan provided by his employer. The medical mileage rates are limited to his AGI. This means that medical expenses are deductible only if they exceed 7.5% of his AGI.

So, if his annual income is $50,000, he can claim a medical deduction only if his medical expenses exceed $3,750. According to the current mileage tax deduction rules, he cannot claim any deductions up to $3,750. Medical expenses include costs of treatments affecting the structure or function of the body, alleviation, diagnosis, and the treatment or prevention of diseases.

Moving expenses

Since the 2017 TCJA (Tax Cut and Jobs Act), only active-duty military members using their privately owned vehicle (POV) can deduct moving expenses. If you are on active duty, you can claim a moving deduction from your taxable income on your Form 3903 and include it as an attachment to your Form 1040. The relocation must be the result of a military order and must be a permanent change os station (PCS), or you must be a member of a protected area, that is servicing more than 100 miles from your home. In these cases, you can deduct unreimbursed moving expenses for you, your spouse, and your dependents.

Who Can Claim the Standard Mileage Rate?

The standard mileage rate is for many people. Self-employed folks use it for vehicle expenses on their taxes.

They list these on Form 1040, Schedule C.

Workers who drive for work might also qualify. Many employers pay based on the IRS rate. If not, you can claim it as an itemized deduction.

| Category | Eligibility | Form Used |

|---|---|---|

| Self-employed | Yes | Form 1040, Schedule C |

| Employees (reimbursed) | No (but may receive tax-free reimbursement) | N/A |

| Employees (unreimbursed) | Limited | Form 1040, Schedule A |

| Volunteers | Yes (for charitable driving) | Form 1040, Schedule A |

Volunteers driving for charity can also get a mileage deduction. But, it’s at a lower rate. Keep good records of your miles for your claims.

But, there are some rules. You can’t use the standard rate for five or more business vehicles at once. Always check the IRS or talk to a tax expert to make sure you can claim these deductions.

MileageWise for Retrospective Mileage Deduction

MileageWise helps you recover your past trips and offers you two unique features to back up your claim retrospectively:

Google Timeline Import

As an industry-first solution, MileageWise’s dedicated recovery feature lets you take advantage of the Google Maps records Google has saved for you. However, due to Google’s recent update, this feature is hindered at the moment. Our developers are working on a solution for our software to integrate the exported files.

Until then, we have several alternatives to offer:

AI Wizard

Take charge of your mileage tracking with AI-powered program, a powerful DIY tool designed for ultimate control. Accessible via our intuitive web dashboard, this cutting-edge solution helps you rebuild mileage logs with precision and ease. Whether you’re addressing missed trips or incomplete records, the AI Wizard equips you to create an IRS-compliant log effortlessly.

Mileage Log Tax Preparation Service

Prefer to leave the mileage tracking to the pros? Our Mileage Log Tax Preparation Service is here to simplify your life. Let our experts handle the details, crafting a precise, IRS-compliant mileage log on your behalf. With this service, you can focus on running your business while we manage the number-crunching and log creation for you.

How to calculate a mileage deduction

There are two ways to calculate mileage for taxes: you can choose the standard mileage rate or the actual expense method.

Standard Mileage Rate

The standard mileage rate is a simple way to deduct miles. It is based on the miles traveled, not the actual cost of maintaining your car. To use the standard mileage rate for a vehicle, you have to choose this method in the first year of using your car in your business. Then, you can choose to deduct based on the standard mileage rate or the actual cost for subsequent years.

If you choose a standard mileage rate for the vehicle you are leasing, you must adhere to this method throughout the entire lease period. If you choose the standard mileage rate method, you will need to track your miles to calculate the corporate year-end deduction. For that, an automatic mileage tracker app is strongly recommended, as you can save yourself plenty of hours when automatically logging your 1000+ trips/month compared to tracking your miles on paper or an Excel sheet.

Use This Calculator To See How Much You Could Save

Actual Expense Method

The actual expense method is for those who’d like to deduct the actual costs of operating an automobile for business instead of their mileage. These deductible costs of operating include gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation (or lease payments). These are attributable to the portion of the total miles driven that are business miles.

If you choose this method in the first year of using a vehicle, you won’t be able to switch to the standard mileage rate as long as you drive that car for business.

Whether you’re an employee or an entrepreneur, having high costs of driving a vehicle or owning a very expensive vehicle usually means you can deduct more if you can prove the actual expenses with appropriate receipts.

What You Need To Track With The Actual Expense Method?

Itemized vehicle expenses mean tracking all your car expenses to calculate the deductible costs. This includes:

- Gas and oil

- Maintenance and repairs

- Vehicle insurance

- Registration fees

- Depreciation

Itemizing can give you bigger deductions, especially if you drive a lot or have an expensive car. But, it requires keeping detailed records.

| Factor | Standard Mileage Rate | Itemized Expenses |

|---|---|---|

| Record-keeping | Mileage log only | All receipts and mileage log |

| Best for | Low-cost, high-mileage vehicles | Expensive, low-mileage vehicles |

| Depreciation | Included in rate | Calculated separately |

| Flexibility | Less flexible | More flexible |

Think about your car’s age, cost, and how much you use it. New, expensive cars often get more from itemizing because of depreciation. Older, efficient cars might do better with the standard rate.

Remember, once you use the standard mileage rate for a leased vehicle, you must use it for the whole lease. Choose wisely to get the most deductions under current tax laws.

Current IRS Standard Mileage Rates for Electric Cars

While the IRS provides a standard mileage rate, when your are looking specifically for electric car mileage reimbursement rates it currently doesn’t distinguish between electric and gas-powered vehicles. Businesses and employees using electric cars should know the different costs involved in reimbursement. They need to make sure they get fair compensation based on their vehicle’s real expenses.

Calculating Your Mileage Deduction Using the 2024 Rate

Figuring out your mileage deduction can be tricky, but it’s worth the effort. Let’s break down the process and explore some helpful tools for accurate tax deduction calculation.

Step-by-Step Guide to Calculation

To calculate your mileage deduction:

- Track your business miles driven

- Multiply total miles by the 2024 rate

- Add up parking fees and tolls

- Sum these amounts for your total deduction

Keep detailed records of your trips, including dates, destinations, and purposes because this information is used to calculate the deductible miles.

Common Mistakes to Avoid

When claiming mileage deductions, steer clear of these errors:

- Mixing personal and business miles

- Forgetting to log start and end odometer readings

- Not keeping receipts for parking and tolls

- Using outdated mileage rates

- Mixing business miles with medical or moving

By avoiding these pitfalls and using reliable tracking methods, you’ll maximize your deduction while staying compliant with IRS rules.

Many businesses have been suffering because of the increased gas prices and other goods. The increase of the Standard Mileage Rate in 2024 can mean a bit of a relief to many and also a good reason to make sure that you create a 100% IRS-Proof Mileage Log, that meets every expectation.

Recordkeeping Requirements for Mileage Deductions

Keeping accurate records is key when claiming mileage deductions. The IRS has strict rules to make sure taxpayers report their vehicle use correctly. By keeping a detailed mileage log, you protect yourself from IRS audits and get the most from your deductions.

Essential Information to Document

Your mileage log should have important details for each trip. Write down the date, destination, purpose, and total miles. For business trips, mention the client or customer you visited. This detail helps your records pass IRS checks.

If you are interested an example here is a mileage log sample.

IRS-Approved Recordkeeping Methods

The IRS allows different ways to track your mileage. You can use a logbook, spreadsheet, or mobile app. Many prefer apps that log trips and calculate deductions automatically. The most important thing is to be consistent.

| Recordkeeping Method | Pros | Cons |

|---|---|---|

| Physical Logbook | Simple, no technology required | Manual entry, prone to errors |

| Spreadsheet | Easy to organize, calculate totals | Requires discipline to update regularly |

| Mobile App | Automatic tracking, GPS accuracy | May drain phone battery, privacy concerns |

Duration for Keeping Mileage Records

The IRS wants you to keep mileage records for at least three years after filing your tax return. These records are crucial if you’re audited. It’s smart to keep them longer, especially for business use.

By following these guidelines, you’ll be ready for any IRS questions. You’ll also make sure you’re getting the mileage deduction you deserve.

Mileage Cost Per Mile

Dependig you your mileage cost either the AEM or the SMR gets you more deduction. To figure our what your actual mileage cost is use our cost per mileage calculator.

The Link Between Mileage Cost and Tax Deductions: Maximizing Your Savings

Understanding the intricate connection between mileage cost and tax deductions is crucial for anyone looking to maximize their financial savings, whether you’re a sole proprietor or managing a fleet of vehicles for your business. The IRS cost per mile offers a standard deduction rate for business-related travel, reflecting not just the fuel expenditure but also the average cost of wear and tear per mile. This deduction is pivotal for accurately reporting organizational costs and ensuring that every mile driven for business purposes contributes to lower taxable income.

Key Insights:

- Utilizing the IRS cost per mile guideline helps streamline the deduction process, offering a straightforward method to account for vehicle cost per mile.

- Properly documented mileage costs can significantly reduce your taxable income by including not only the direct expenses of operating a vehicle but also the amortization of organizational costs related to vehicle use.

- Understanding the current cost per mile and how it impacts your tax obligations can lead to more effective budgeting and financial planning, ensuring that businesses and individuals alike are leveraging tax laws to their fullest advantage.

By aligning your mileage tracking practices with tax deduction strategies, you can transform the cost to drive per mile into a powerful tool for financial optimization.

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

FAQ

What does the government pay for mileage?

The IRS allows reimbursements for individuals using a personal vehicle for business, medical, charitable, or moving purposes for military personnel. For 2024, the standard mileage rates are 67 cents per mile for business, 21 cents for medical and moving, and 14 cents for charity. In 2025, the new business mileage rate is 70 cents per mile.

What counts as a business mile?

A business mile includes any mile driven for business-related activities, excluding commuting between home and your regular workplace. Miles driven from your office to client meetings, between job sites, or to a business event all count as business miles.

Does the IRS mileage rate include gas?

Yes, the IRS mileage rate includes the cost of gas along with other vehicle expenses like maintenance and insurance. This rate simplifies the deduction process, allowing you to calculate your expenses based on the miles driven rather than tracking each cost separately.

Are car registration fees deductible from my taxes?

Car registration fees are not generally deductible from your taxes on a federal level as part of the standard mileage deduction. However, if the fee is based on the vehicle’s value, it may be deductible as a personal property tax.

How do I calculate the travel fee for a trip?

To calculate the travel fee for a trip using the IRS standard mileage rate, multiply the total miles driven for the trip by the applicable mileage rate (67 cents for business in 2024 and 70 cents per mile for 2025). For example, if you drove 100 miles for business purposes in 2024, your travel fee would be $67.

How do I calculate annual mileage?

To calculate annual mileage for tax deductions, follow these steps:

Record Start and End Odometer Readings: At the beginning and end of the year, note the odometer readings of the vehicle used for business purposes.

Track Business Miles: Throughout the year, keep a detailed log of all miles driven for business purposes. This log should include the date of each trip, the purpose, and the miles driven.

Subtract to Find Annual Business Mileage: Subtract the starting odometer reading from the ending odometer reading to get the total miles driven for the year. Then use your detailed log to determine what portion of these miles were for business.