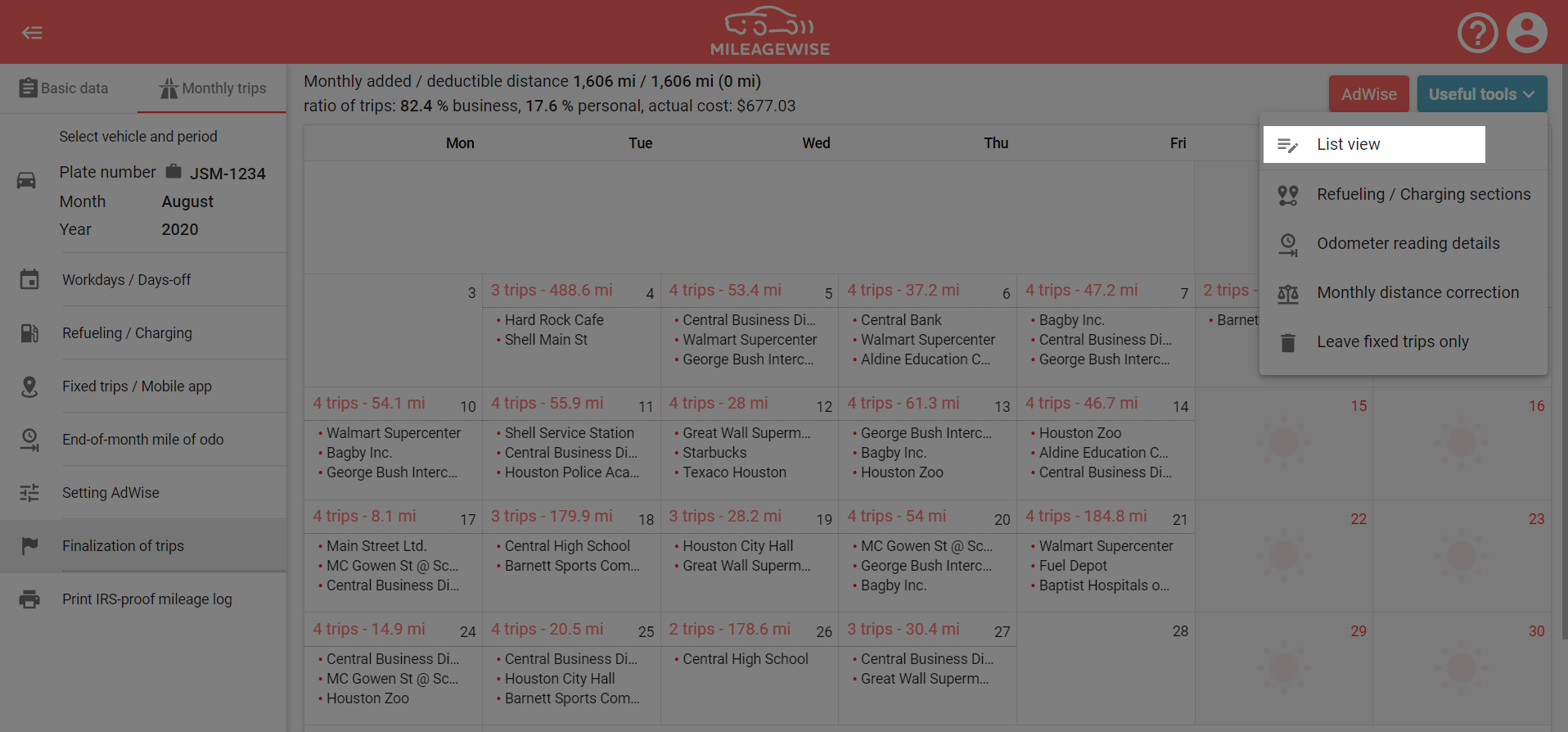

MileageWise’s Web Dashboard: Retrospective Mileage Log Made Easy

Sep 20, 2023 Struggled with missing or faulty mileage logs? Overlooked IRS requirements? Or simply procrastinate till tax season? We’ve all been there. To simplify your logging woes, we’re thrilled to unveil our latest tutorial video: “An Introduction to MileageWise’s Web Dashboard: Retrospective Mileage Logging Made Effortless.” Here’s what you can expect: Retrieve and fill gaps in past mileage logs to ensure IRS compliance. Import Google Maps Timeline records and turn them into IRS-proof mileage logs. Learn how our users claim $ 1,000s in tax deductions based on business mileage