Last updated: Feb 14, 2024

Commuting in the United States is an integral part of daily life for millions of Americans. Whether it involves navigating urban traffic, relying on public transportation, or even telecommuting, the way Americans get to work and back home has a significant impact on their daily routines, quality of life, and the environment.

One question that often arises in connection with commuting is whether commuting to work is deductible. Let’s explore the bigger picture in this blog post.

Is Commuting To Work Tax Deductible?

In the United States, you generally cannot claim mileage or commuting expenses as tax deductions. Commuting is considered a personal expense, and the Internal Revenue Service (IRS) does not allow deductions for commuting to and from your regular place of work.

However, there are some exceptions where you may be able to claim mileage or transportation expenses:

- Business-related travel: If you are traveling for business purposes, such as visiting a client’s office, attending a business meeting or conference at a different location, or making deliveries as part of your job, you can typically deduct the mileage or transportation expenses associated with that business travel. This is often referred to as “business mileage” and is subject to certain IRS mileage log requirements.

- Self-employed individuals: If you are self-employed and use your vehicle for business purposes, you can usually deduct the business-related mileage expenses. This includes driving to meet clients, traveling to job sites, or any other business-related travel.

- Moving expenses: In some cases, you may be able to deduct moving expenses if you relocate for a new job that is a significant distance from your old home. However, there are strict IRS rules and criteria for claiming moving expense deductions.

- Special circumstances: There may be certain situations or programs (e.g., employer-sponsored transportation benefits or state-specific programs) that allow for commuting-related tax benefits or deductions. These can vary by location and employer.

It’s important to consult with a tax professional or use tax software to ensure you are following the correct rules and guidelines when it comes to claiming any mileage or transportation expenses on your taxes. Attempting to claim commuting expenses that do not qualify can result in penalties or audits by the IRS.

Commuting And Mileage: Diving Deeper

After an important general introduction, let’s now dive deeper into the topic of commuting and mileage.

Navigating the intricate world of mileage deduction and commuting can be a tad overwhelming, but fear not! We’re here to break it down for you, answering your FAQs and providing a list of tools and terms that can help you manage your commuting miles efficiently.

FAQs:

1. What are commuting miles?

- Commuting miles refer to the distance you travel between your home and your regular workplace. These are typically not deductible for tax purposes.

2. Can I claim mileage for commuting to and from work?

- In most cases, no. Commuting miles driven between your home and work are considered personal and are not eligible for mileage claims.

3. What’s the IRS standard mileage rate, and how does it relate to commuting miles?

- The IRS sets standard mileage rates for business purposes every year, but commuting miles are not considered business miles. Business miles are those driven for work-related activities other than commuting.

4. Is there a difference between business miles and commuting miles for self-employed individuals?

- Yes, there is. Business miles are miles driven for work-related purposes like client meetings, deliveries, or travel to a second job location. Commuting miles, on the other hand, are the miles you drive to and from your regular workplace.

5. How can I track my vehicle miles effectively?

- Several apps and tools can help you keep track of your miles, such as MileageWise, MileIQ, Stride, Mile Keeper, Mile Recorder, or Get Mileage. These apps make mileage logging a breeze, however, not all mileage trackers were created equal:-)

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

6. What is CompanyMileage.com, and how can I use it to log my commuting miles?

- CompanyMileage.com offers mileage tracking solutions. If your company uses it, you can log in and record your business miles. However, it’s essential to note that this platform typically focuses on business-related mileage, not commuting miles.

Tools and Terms:

Here’s a list of tools and terms that can assist you in managing your commuting miles:

- CompanyMileage.com Login: Log in to your CompanyMileage account if your company uses this platform for mileage tracking.

- My Mileage: An app that helps you keep track of your mileage for various purposes, including work-related travel.

- Mile Keeper: A mileage tracking app that helps you record your miles accurately.

- To Mileage: Another app designed to help you log and manage your mileage efficiently.

- Mile Recorder: Keep a record of your mileage using this user-friendly app.

- Get Mileage: Calculate and record your mileage effortlessly with this tool.

- IRS Standard Mileage Rates: The rates set by the IRS for deductible business mileage expenses. See above.

- Business Miles vs. Commuting Miles: Understanding the distinction between these two types of mileage is crucial for tax purposes.

- Mileage Stipend: Some employers provide a stipend for commuting expenses, but it’s usually considered taxable income.

- Keep Track of Mileage: Using apps and tools like MileageWise, you can easily keep tabs on your mileage and ensure accurate records.

Remember, while you can’t typically claim deductions for commuting miles, keeping precise records of your business-related mileage can help you maximize your eligible tax deductions. Let’s explore how MileageWise can help you in this regard.

Understanding Tax Home and Commuting for Self-Employed Individuals

Tax home, in the context of self-employed individuals and home office workers, can be a bit of a puzzle. Your tax home is typically considered the location where you primarily conduct your business activities. This definition has implications for commuting expenses and tax deductions. Below, we’ll unravel the intricacies of tax home and commuting for self-employed individuals.

FAQs:

1. What is a tax home, and why is it important for self-employed individuals?

- Your tax home is your primary place of business, and it’s crucial for determining what commuting expenses you can deduct on your taxes. Understanding this concept helps you navigate the complex world of tax deductions.

2. Can I deduct commuting expenses as a self-employed person who works from home?

- Generally, commuting expenses between your home and your home office are not tax-deductible. However, there are exceptions, such as if you have multiple work locations or meet clients at various locations.

3. What are the rules for deducting mileage when my home is my primary place of business?

- If your home office is your principal place of business, you may be able to deduct mileage for business-related trips, like meeting clients or visiting job sites. However, daily commuting from home to your primary place of business is usually considered a non-deductible personal expense.

4. Can I claim the home office deduction if I have a home-based business?

- Yes, you can claim the home office deduction if you use a portion of your home exclusively for business purposes. This deduction covers expenses related to your home office, such as a portion of your rent or mortgage, utilities, and home maintenance.

5. How do I keep track of deductible mileage as a self-employed individual with a home office?

- To keep track of deductible mileage, use a mileage tracking app like MileageWise. Categorize your trips as business-related and ensure you have detailed records to support your deductions.

Tips for Self-Employed Commuters:

- Maintain Accurate Records: Keep detailed records of all your mileage, including dates, destinations, and purposes of the trips. This documentation will be essential when claiming deductions.

- Understand Your Tax Home: Know where your primary place of business is and the rules governing commuting expenses to and from your tax home.

- Differentiate Business from Personal: Ensure you can distinguish between trips that are purely personal commuting and those that are business-related.

- Consult a Tax Professional: Tax laws can be complex, and individual circumstances vary. Consider consulting with a tax professional to maximize your deductions and ensure compliance with tax regulations.

MileageWise: Your Commuting Miles Tracker

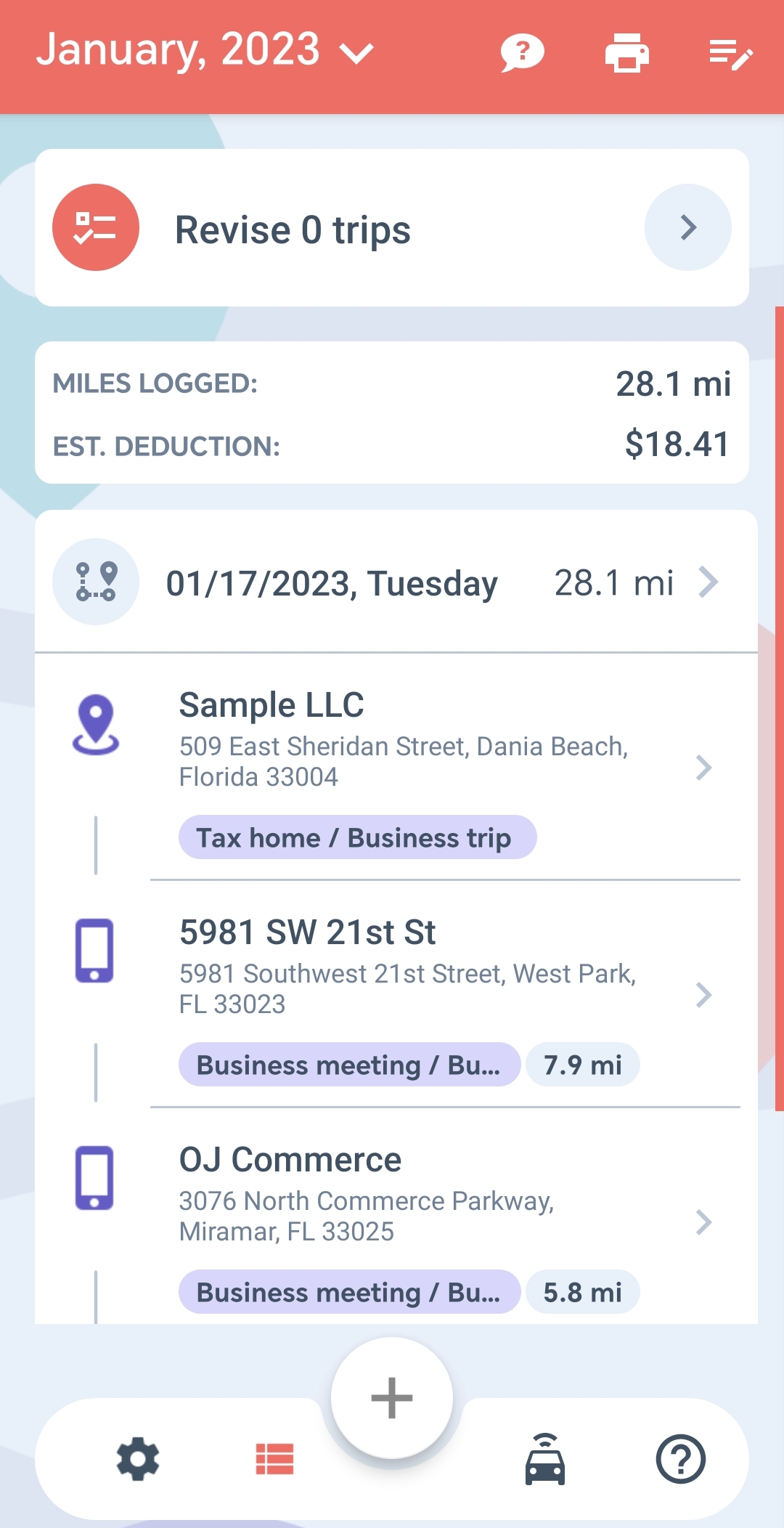

MileageWise is a mileage tracking app that can be particularly helpful for individuals looking to track their commuting miles. Here’s how MileageWise can assist those wanting to monitor their commuting miles:

- Automated Mileage Tracking: MileageWise offers automatic mileage tracking using GPS technology. Once you set it up, the app can passively record your trips, making it convenient for daily commuters. You don’t need to remember to manually enter your miles.

- Accurate Mileage Logs: MileageWise provides precise mileage logs, ensuring that your commuting miles are accurately recorded. This accuracy is crucial, especially if you plan to claim mileage deductions for tax purposes.

- Categorization and Purpose: The app allows you to categorize your trips, distinguishing between personal, business, and commuting miles. This feature is particularly useful for those who need to separate their commuting miles from deductible business miles.

- Customizable Reports: MileageWise enables you to generate customized mileage reports. You can easily extract data related to your commuting miles for record-keeping or tax purposes.

- IRS Compliance: The app is designed to meet IRS requirements for mileage tracking, which is essential if you plan to claim mileage deductions on your tax return. This compliance ensures that your commuting miles are documented correctly, in a fully IRS-Proof way.

- User-Friendly Interface: MileageWise features an intuitive and user-friendly interface, making it accessible for individuals who may not be tech-savvy. You can quickly start tracking your commuting miles with ease.

- Data Security: MileageWise prioritizes data security and privacy, ensuring that your mileage information is stored securely and remains confidential.

- Regular Updates: The app typically receives updates to improve its functionality and adapt to changing tax regulations, ensuring that it remains a reliable tool for tracking commuting miles.

By using MileageWise to track your commuting miles, you can simplify the process of documenting your daily journeys, reduce the risk of errors, and ensure that you have accurate records for potential tax deductions or employer reimbursement. It offers a convenient and reliable solution for individuals seeking to monitor their commuting mileage efficiently.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!