Companies that reimburse employees for driving their personal cars for work have several options. One of the most effective and IRS-compliant options is an FAVR vehicle reimbursement program.

But what exactly is FAVR, and how does it work? In this guide, we’ll explain the basics, walk you through how to calculate an FAVR allowance, cover IRS FAVR guidelines, and compare FAVR to other car reimbursement programs like mileage rate reimbursement.

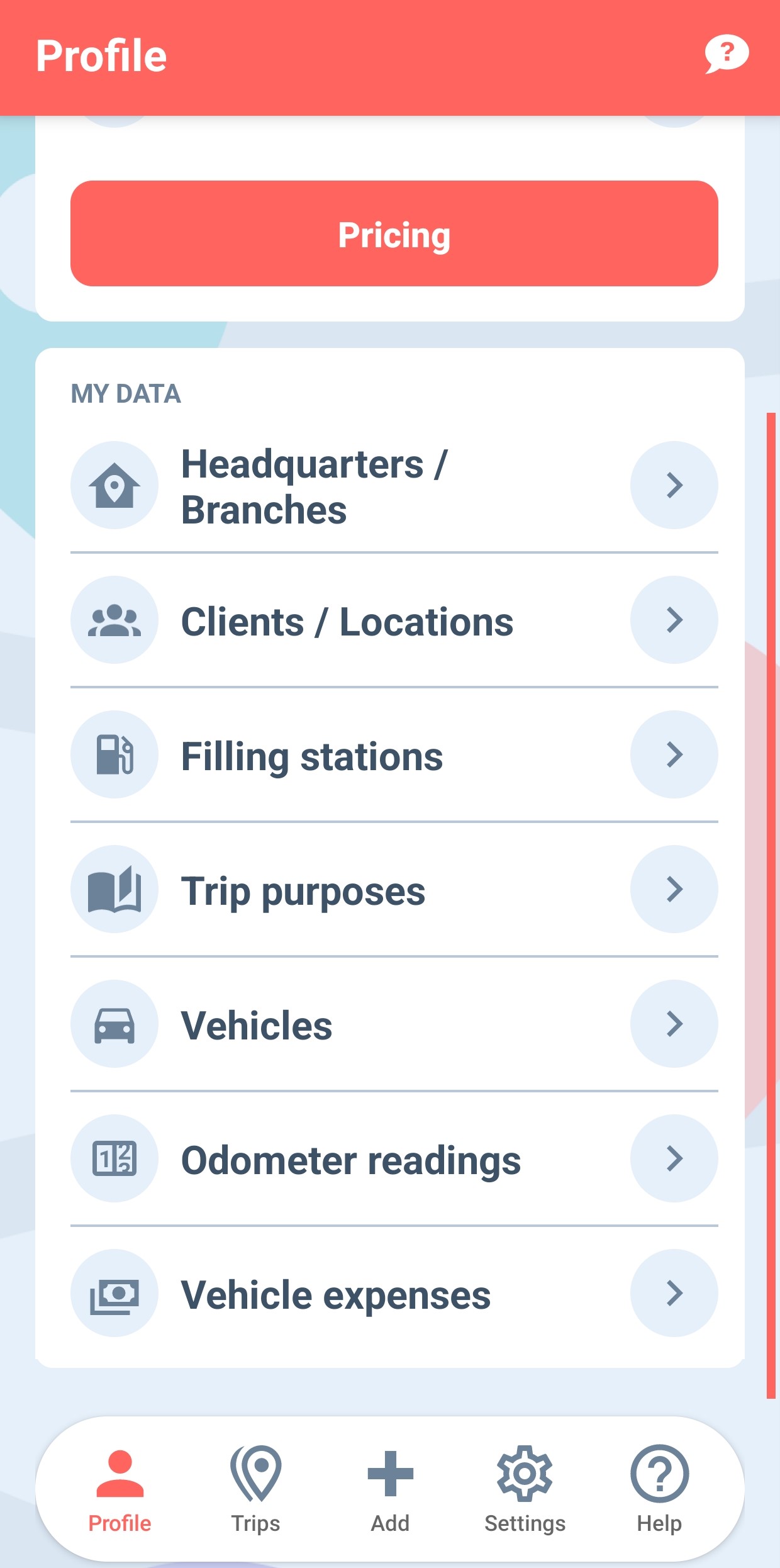

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

What is FAVR?

Understanding Fixed and Variable Rate Reimbursement

FAVR stands for Fixed and Variable Rate. It’s a type of vehicle reimbursement program that businesses use to fairly and accurately pay employees who drive their personal vehicles for work.

Unlike flat car allowances, which give everyone the same amount, FAVR programs adjust the reimbursement based on factors like location, vehicle type, and actual driving costs. This makes FAVR more precise and more compliant with IRS FAVR guidelines.

How FAVR Works

The company reimburses drivers for two types of costs:

- Fixed costs, like insurance, registration, and depreciation.

- Variable costs, like gas, maintenance, and oil changes.

Because these expenses change based on where employees drive and how much they drive, FAVR programs offer a customized, fair, and tax-compliant approach.

IRS FAVR Guidelines and Compliance

Key Rules for FAVR Programs

If a company wants its FAVR reimbursement program to meet IRS guidelines and remain untaxed, it needs to follow several rules. These include:

- Vehicle Age: The model year of the vehicle cannot differ from the current calendar year by more than the number of years in the company’s chosen retention period. This means that if a company has a retention period of, for example, 4 years, the vehicle’s model year can be up to 4 years older than the current year.

- Setting Rate and Amount: The company needs to create a mileage reimbursement policy that calculates each driver’s allowance based on real, up-to-date costs for owning and operating a vehicle in their location, like local gas prices, insurance rates, and maintenance costs. The IRS requires companies to use reliable, third-party data sources (not just guesses or averages) to make sure the reimbursement amounts are fair and accurate.

IRS FAVR Vehicle Age Compliance

Vehicle age matters because older cars have different depreciation rates and maintenance costs. By limiting the vehicle’s age, IRS FAVR guidelines ensure companies use accurate cost data that reflects typical business vehicles.

How to Calculate an FAVR Allowance

What Goes Into an FAVR Calculation?

Calculating an FAVR car allowance means adding up both fixed and variable costs. Each employee’s allowance looks a little different, depending on:

- Location (gas prices, insurance rates, and taxes vary)

- Vehicle type (a sedan costs less than a large SUV)

- Business miles driven (higher miles mean higher variable costs)

Using an FAVR Car Allowance Calculator

Many companies use an FAVR car allowance calculator to simplify the math. These tools pull in IRS data, local cost factors, and company policies to calculate fair, accurate, and compliant allowances.

Whether you calculate manually or use a calculator, the FAVR reimbursement program must stay within IRS FAVR guidelines to remain tax-free.

FAVR vs. Other Car Reimbursement Programs

Comparing FAVR to Mileage Rate Reimbursement

FAVR isn’t the only option for reimbursing employee mileage. Many businesses provide a mileage reimbursement by the IRS (or lower) rate, which gives employees a set amount (in cents per mile) for every business mile driven.

Here’s how FAVR compares to the mileage rate method:

Factor | FAVR Program | Mileage Rate |

Personalization | Customized to each driver’s costs | Same rate for everyone |

IRS Compliance | Tax-free if compliant | Tax-free if compliant |

Accuracy | Higher (reflects local costs) | Moderate (national average in case of IRS rate) |

FAVR vs. Flat Car Allowances

Some companies also offer a flat car allowance, which is a set monthly payment. While simple, these allowances are often taxable and may overpay or underpay drivers. In contrast, FAVR programs match payments to actual costs, making them more fair and cost-effective.

What About Motus FAVR Programs?

Popular Providers and FAVR Options

Many companies use third-party services to manage their FAVR plan. One well-known provider is Motus, which offers FAVR reimbursement programs alongside other mileage and fleet management tools.

While Motus is popular, some companies prefer managing their own FAVR car allowance process, especially if they already have mileage tracking software in place. This can save money and offer more flexibility.

Mileage Rate Explained

What is the Mileage Rate?

The mileage rate is the IRS-approved rate businesses can use to reimburse employees for driving personal vehicles for work. It covers both fixed and variable costs at a single, per-mile rate.

While not as tailored as an FAVR plan, the mileage rate is easy to apply and works well for companies with simpler reimbursement needs.

Final Thoughts on FAVR Programs

An FAVR vehicle reimbursement program offers one of the most accurate, fair, and IRS-compliant ways to reimburse employees for business driving. By combining fixed and variable rate payments, FAVR programs account for both predictable costs and costs that change with mileage and location. Whether you use an FAVR car allowance calculator or work with a provider like Motus, understanding FAVR guidelines and IRS compliance rules helps you build a better, more cost-effective vehicle reimbursement program.

Track Mileage Accurately with MileageWise

If your business is considering an FAVR reimbursement program, accurate mileage tracking is essential. That’s where MileageWise comes in. With its automatic mileage tracker app, built-in IRS compliance checks, team management tools, and easy reporting, MileageWise helps businesses and employees log every business mile correctly.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |

FAQ

What is an FAVR program?

An FAVR program is a vehicle reimbursement method that combines fixed and variable rate payments to cover employee driving expenses. It’s more accurate than flat allowances and can be IRS-compliant if set up correctly.

How do you calculate an FAVR car allowance?

To calculate an FAVR car allowance, companies add up fixed costs like insurance and depreciation, plus variable costs like fuel and maintenance. Many businesses use an FAVR car allowance calculator to simplify the process.

How does FAVR compare to the IRS mileage rate?

The IRS mileage rate gives a flat amount per mile, while FAVR programs personalize reimbursement based on real costs. FAVR reimbursement tends to be more accurate but requires more record-keeping.

Is FAVR better than a car allowance?

A FAVR car allowance is usually more accurate and tax-free if compliant. Flat car allowances are easier but often taxable and less fair to employees.

Rebeka Barefield

Similar Blog Posts

FAVR Vehicle Reimbursement Explained

Companies that reimburse employees for driving their personal cars for work have several options. One of the most effective and IRS-compliant options is an FAVR vehicle reimbursement program. But what exactly is FAVR, and how does it work? In this guide, we’ll explain the basics, walk you through how to

How to Create an Effective Mileage Reimbursement Policy

A well-defined mileage reimbursement policy is essential for any business that relies on employees using their personal vehicles for work purposes. Whether employees are visiting clients, attending conferences, or running errands for the company, reimbursing them fairly for business mileage is both an ethical and financial priority. A clear policy

Your Ultimate Mileage Reimbursement Guide 2024

Understanding mileage reimbursement is crucial for anyone using their car for work. It’s a simple way to reduce your tax liability and get compensated for business driving. You should make sure you’re getting the most out of your benefits while following tax rules. This guide will explain everything you need

Your Complete Mileage Deduction Guide

Are you a self-employed individual or an employee with business-related travel expenses? If so, claiming a mileage deduction can significantly reduce your tax liability. In this guide, we’ll explore everything you need to know about mileage deductions, from eligibility criteria to calculation methods and record-keeping requirements. Looking for a comprehensive

California Mileage Reimbursement 2024: Laws, Methods, and Tools

Last updated: October 21, 2024 Navigating the highways of California’s business landscape requires more than just a roadmap. It demands a thorough understanding of local mileage reimbursement laws. It doesn’t matter if you’re an employer or self-employed. Strap in and prepare for a journey through the legal landscapes and practicalities

Navigating the IRS Rule for Mileage Reimbursement

July 10, 2023 Well, hello there, business owners, entrepreneurs, gig workers, and freelancers! Have you ever looked at your vehicle and thought, “Boy, if only I could squeeze some more financial juice out of this jalopy”? Today’s your lucky day. We’re diving headfirst into the roller coaster that is the