You can use your MileageWise account with multiple users. This is useful if you have more people using MileageWise at your company or if you would like to share your account with your colleagues or accountant. You can only invite a new user if you are the Administrator or Manager of the account, the one who created the account.

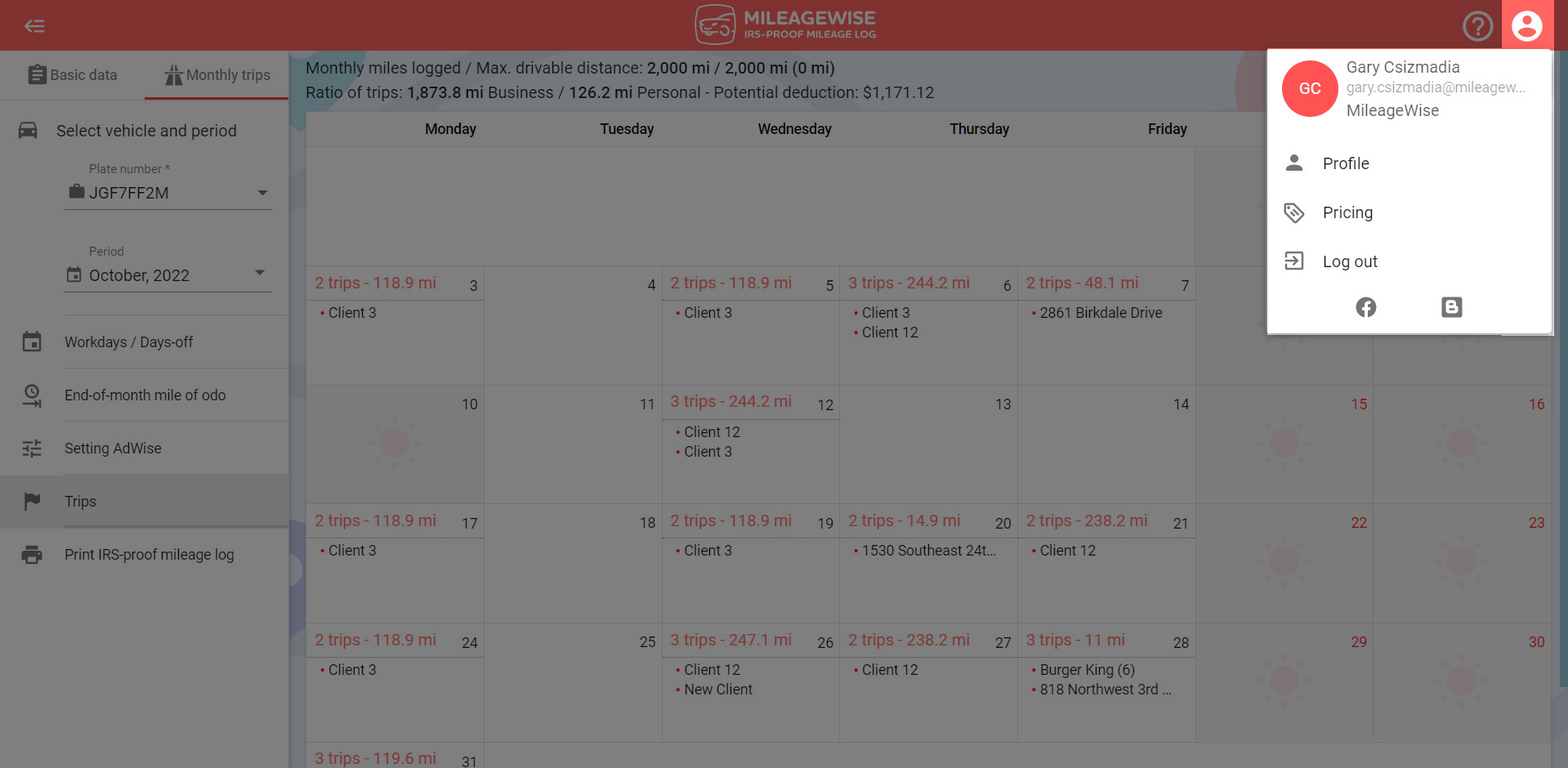

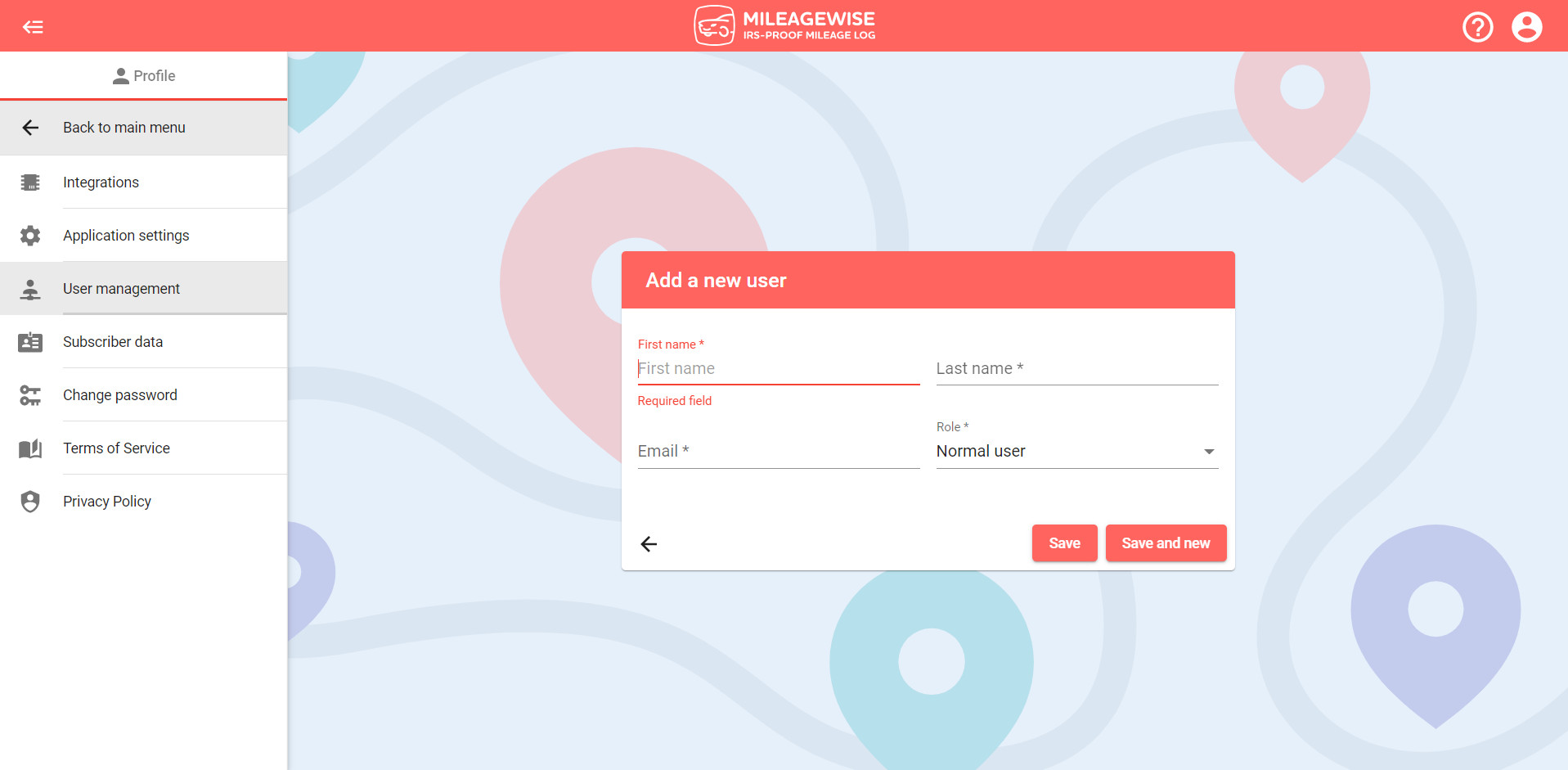

Click on Profile at the top right:

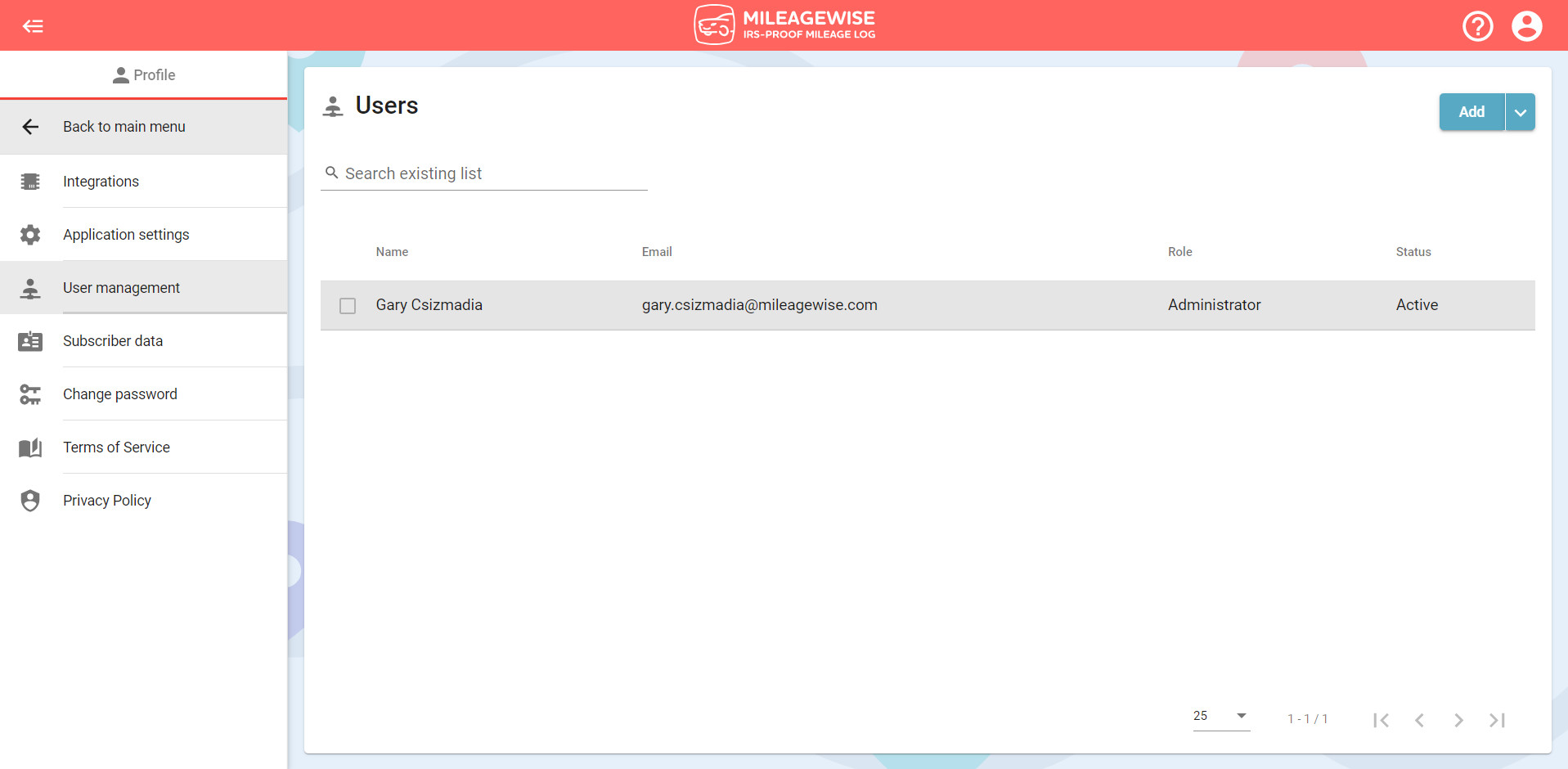

Under User management, you can add a new user to your account.

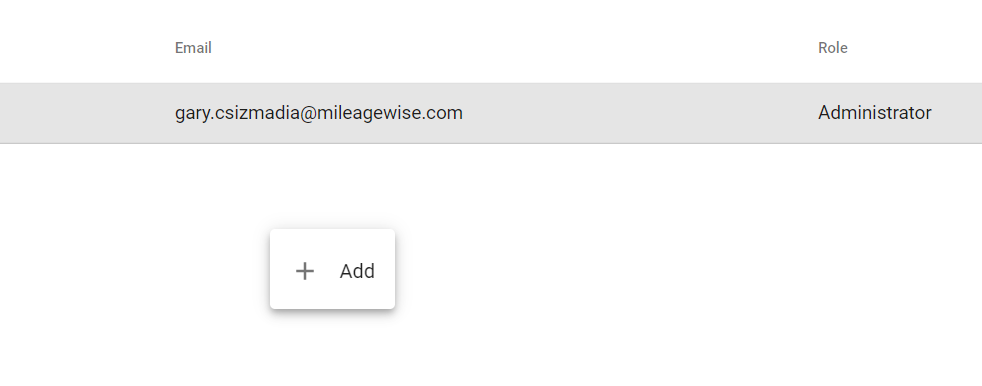

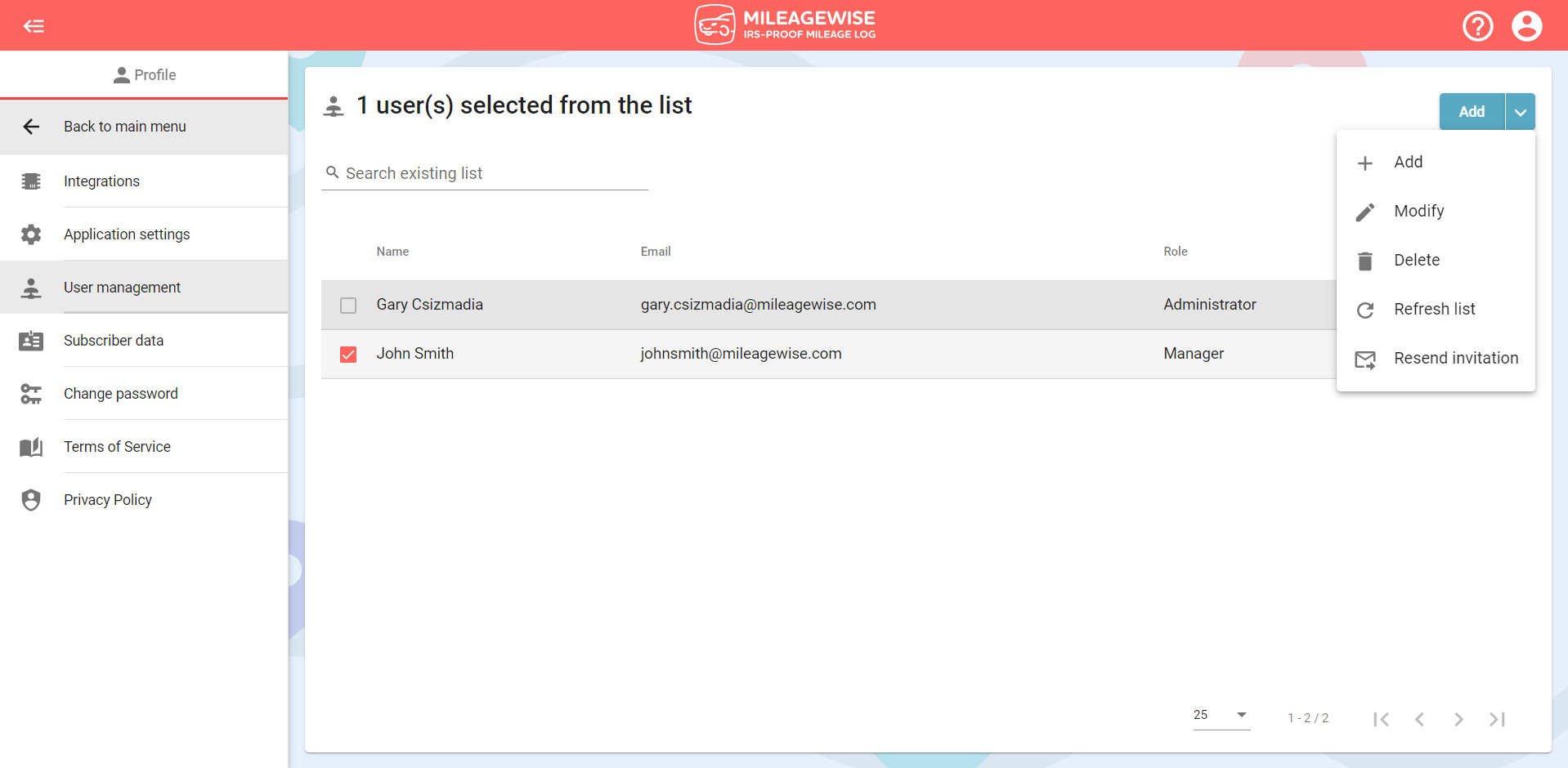

Right-click anywhere under the Users area and select the option Add.

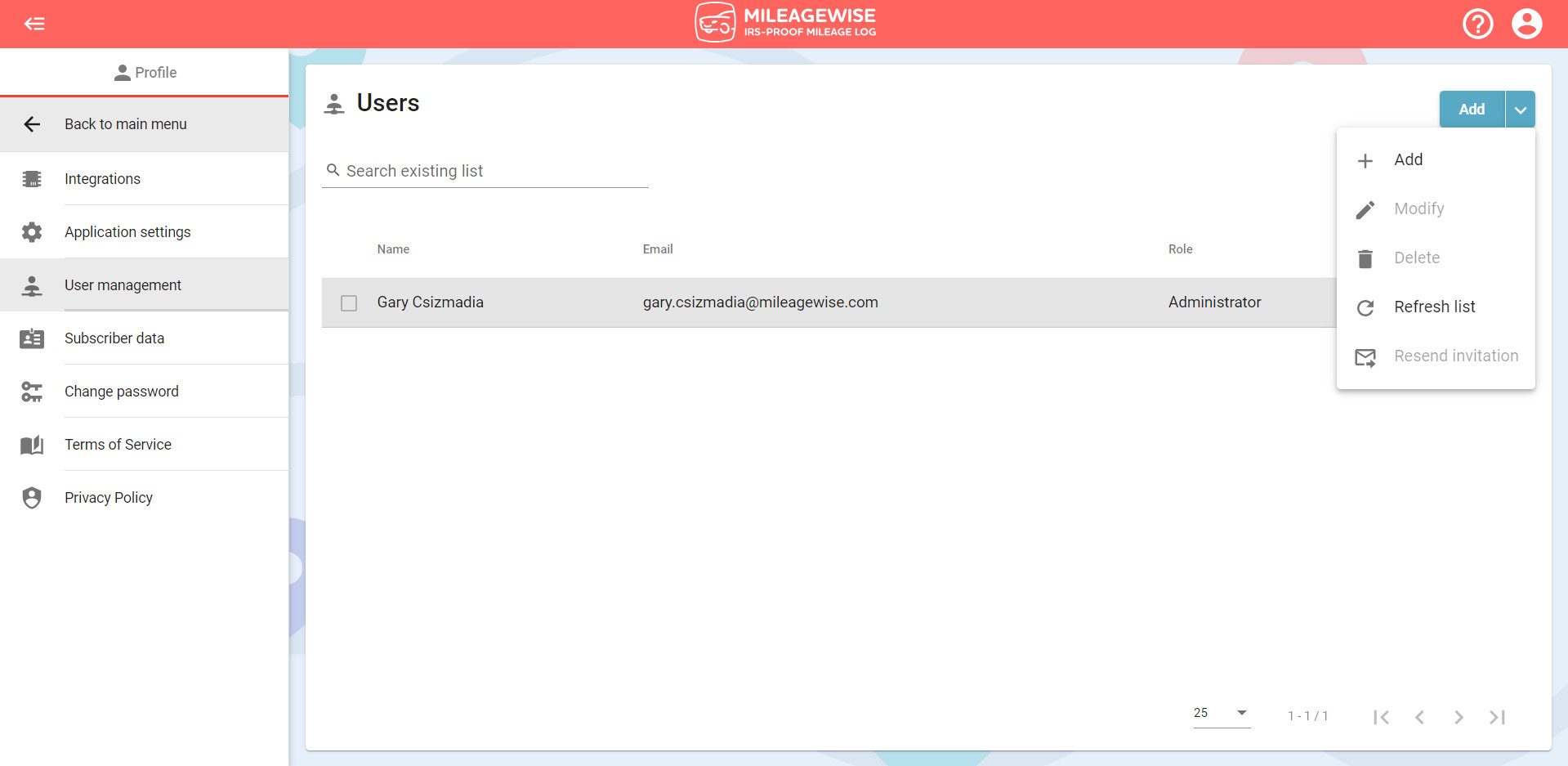

Or select Add from the top right menu.

Enter the name and email address of the user you want to invite.

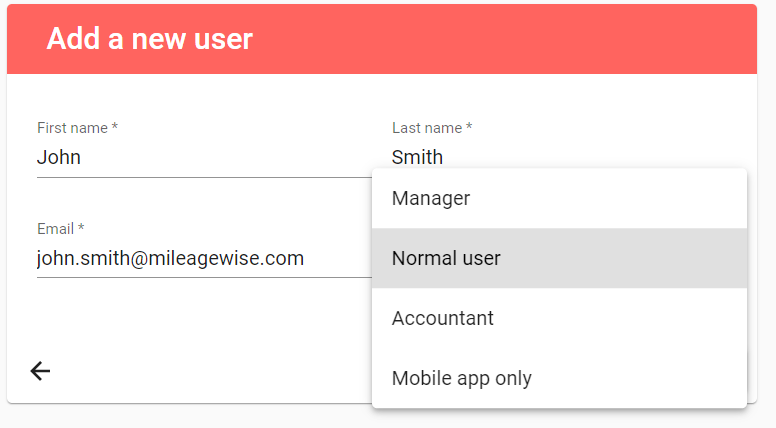

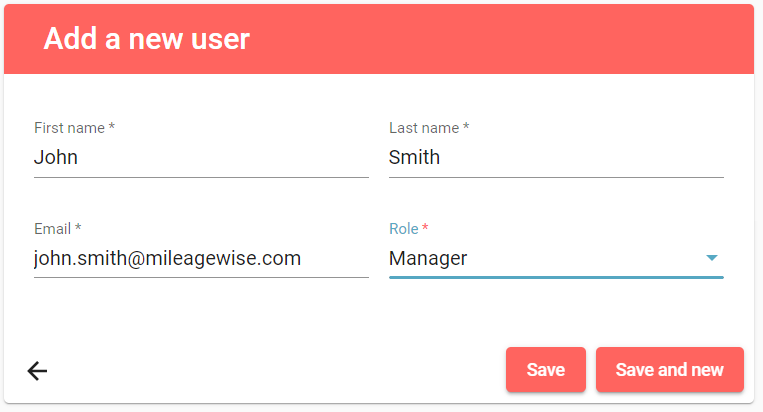

Then select the role of the new user. The Manager has the same authority as the Administrator – they can add, delete, and pair up vehicles with users. They can’t delete themselves or the Administrator. As Normal or Accountant users, they can access both the MileageWise Web Dashboard and Mileage Tracker App. If you want the user to access the account only through the mileage tracker app, select the Mobile app-only role.

After selecting the role, click Save.

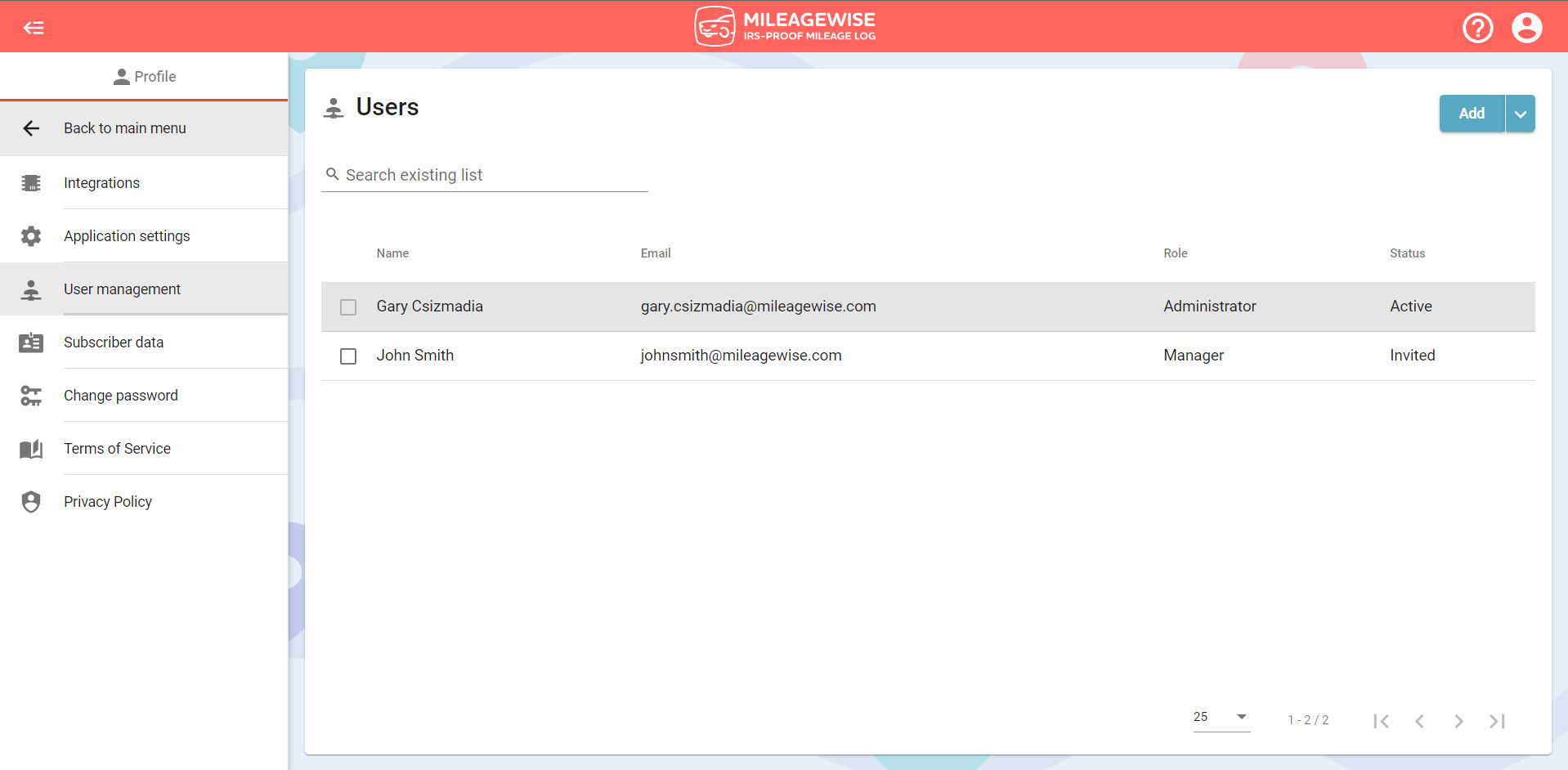

An invitation is sent to the user. Until the new user(s) activate their account by entering their password, you will see their status as “Invited”.

After the invitee confirms the registration with a password, the status changes to Active.

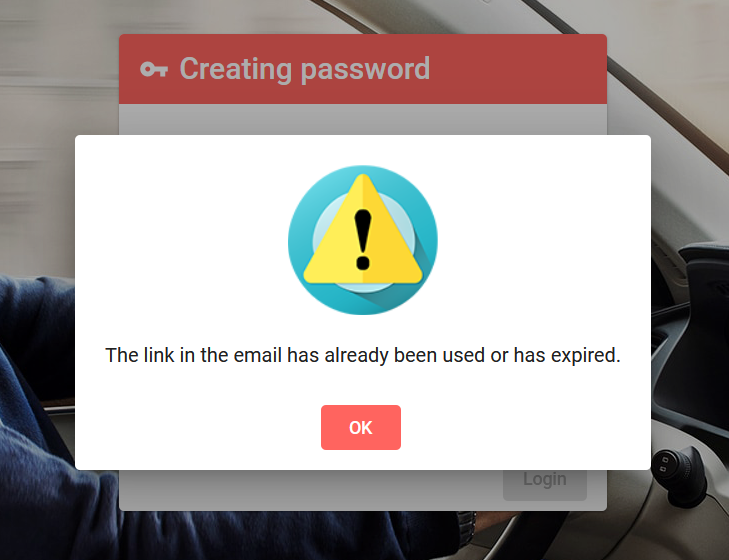

If the invitees receive the following error message, as an Administrator, you can invite them again.

You can resend the registration email to the user by selecting the Resend invitation option via the top right menu. This option is only available if the user is still in the “Invited” status.

IMPORTANT! After inviting the user, you need to set which vehicle(s) they will have access to. You can do this in the Vehicles menu. CLICK HERE for more information!