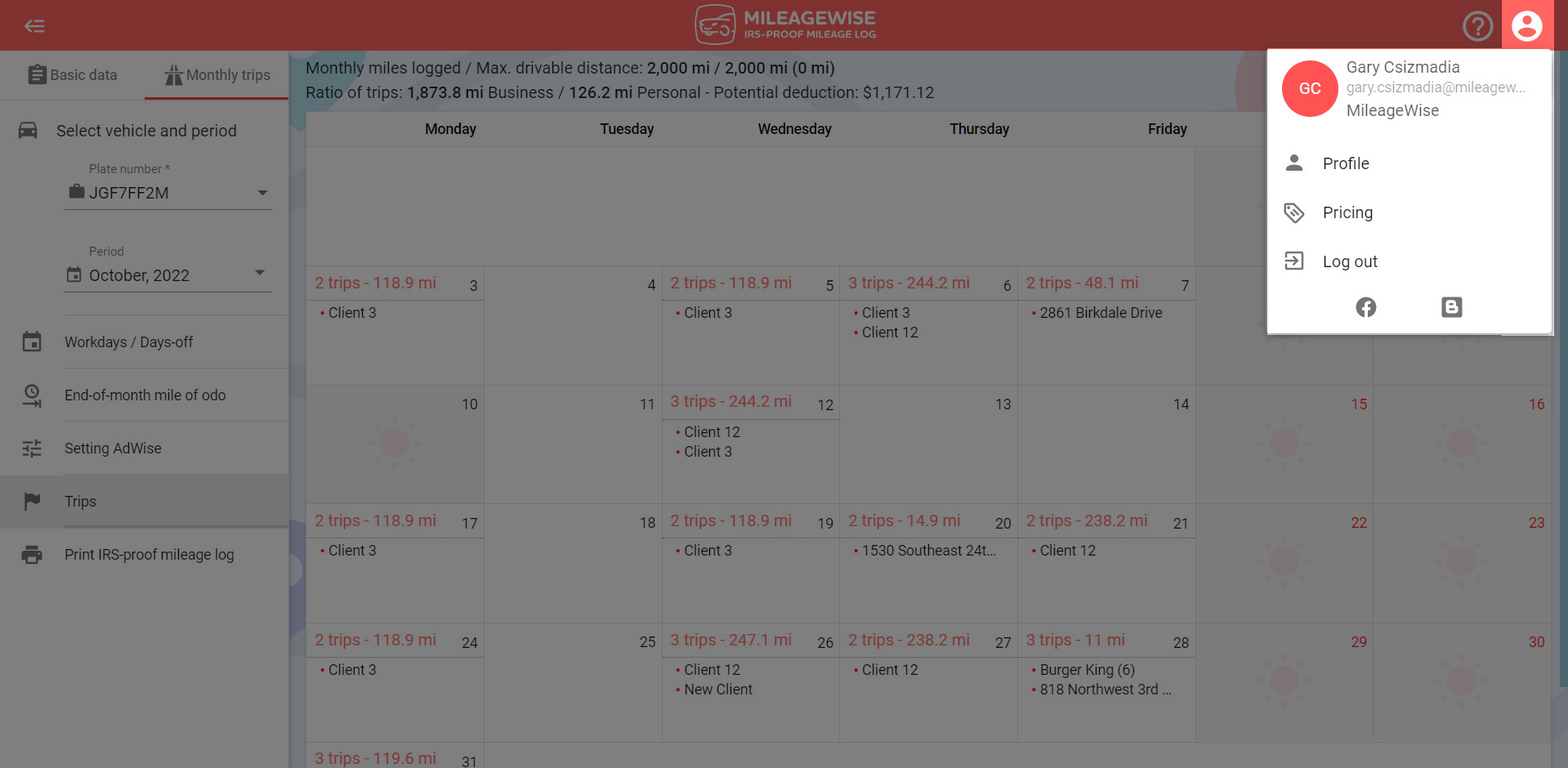

At the top right corner click on the Profile menu point.

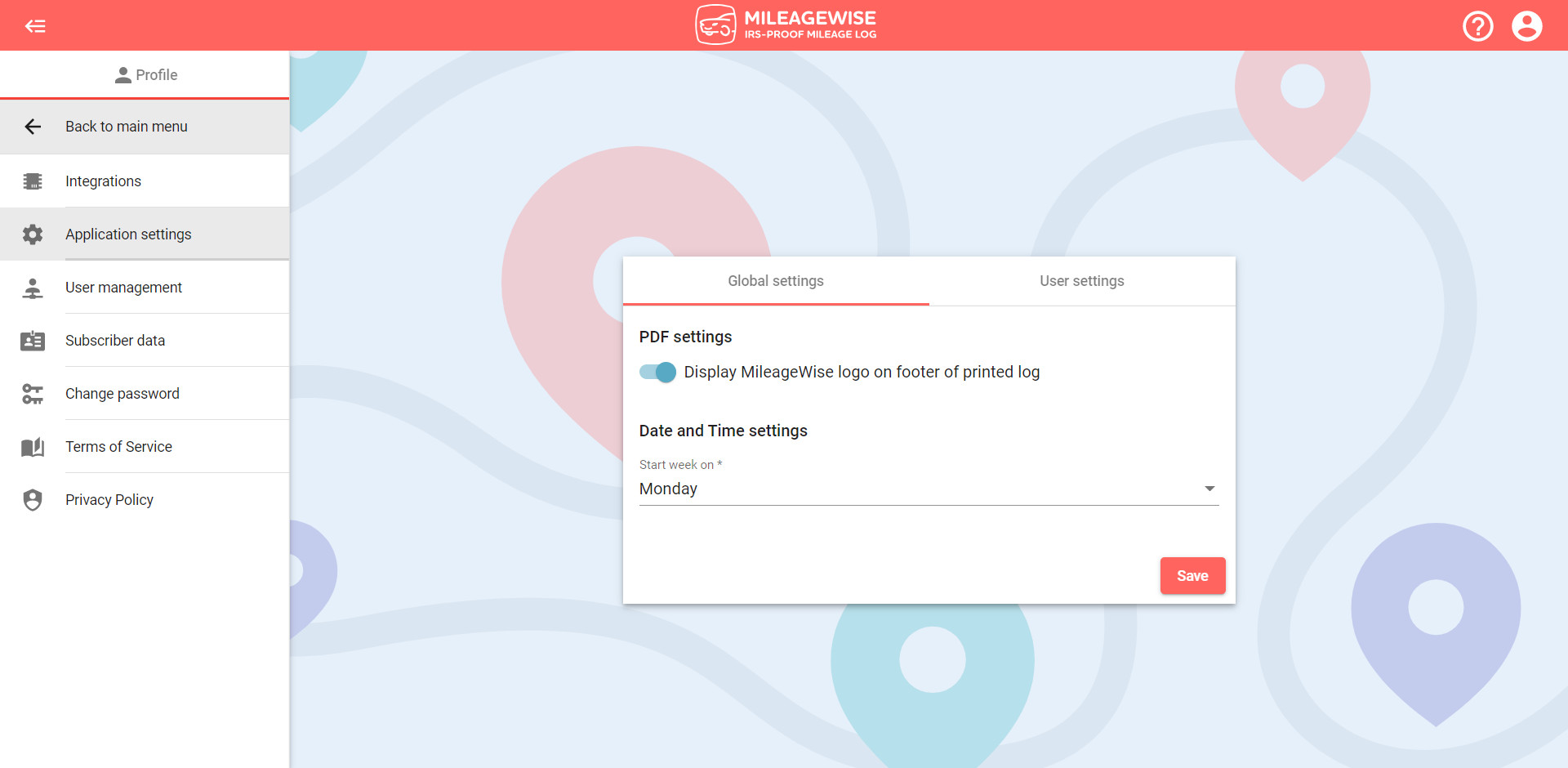

From the left-hand menu, select the Application settings option.

Here you are able to set individual elements of the Web Dashboard that will further customize the platform for you and your mileage logs. You can choose between Global settings and User settings.

In Global settings, if you make any changes they will apply to all users in the account.

Within the Global settings section, you can decide whether to display the MileageWise logo and other company-related information on the footer of your PDF mileage logs.

Displaying the PDF footer means that the MileageWise footer is visible on your generated final mileage log.

If you do not want the MileageWise footer to appear on your finished mileage log, you can turn off this feature by using the switch and then clicking on the Save button!

Under Date and Time settings you have the option to choose the starting day for the week in your calendar (Trips tab). The available options are; Saturday, Sunday, and Monday. Click Save when done.

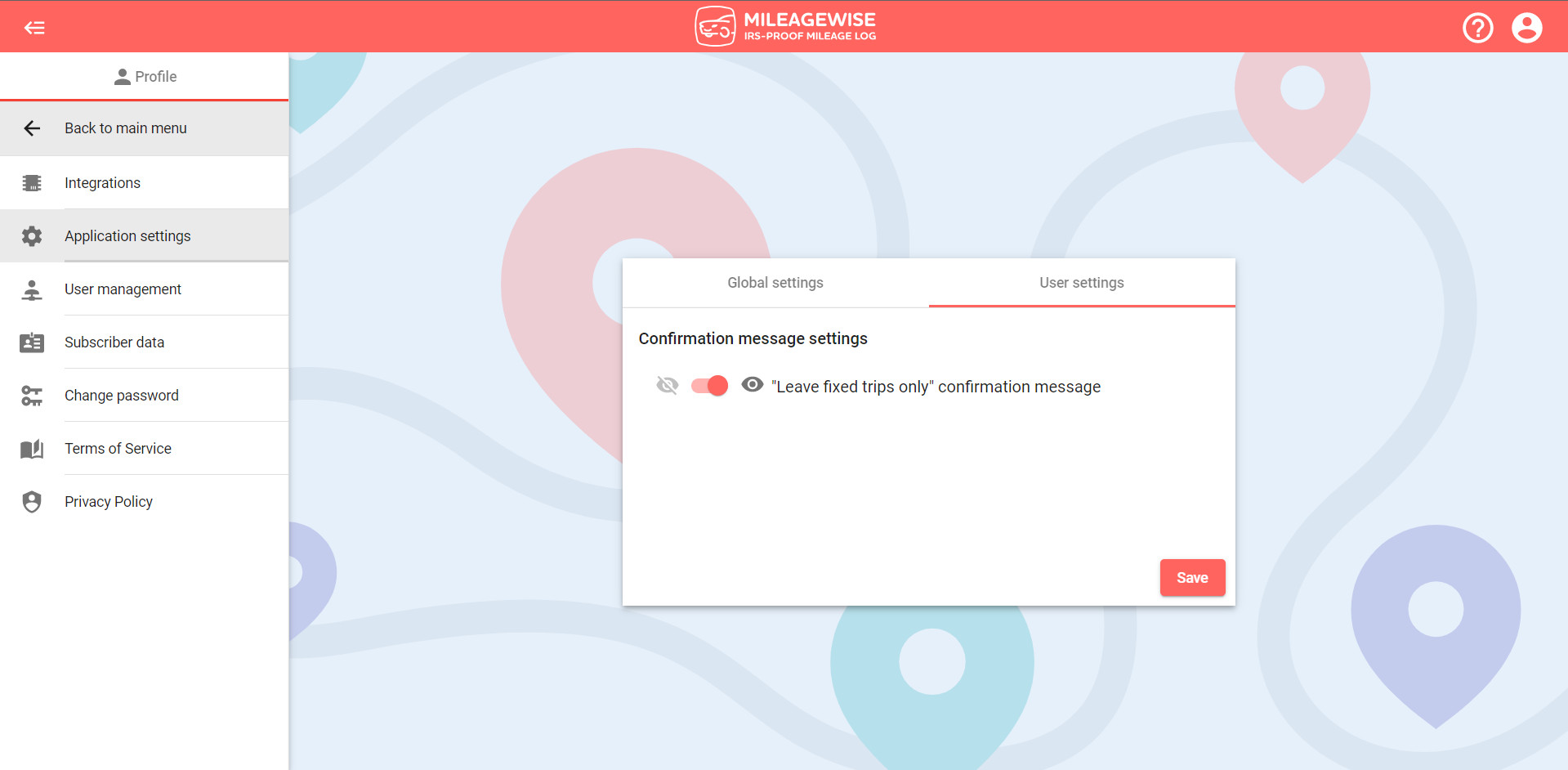

In User settings, if you make changes they will only apply to one specific user.

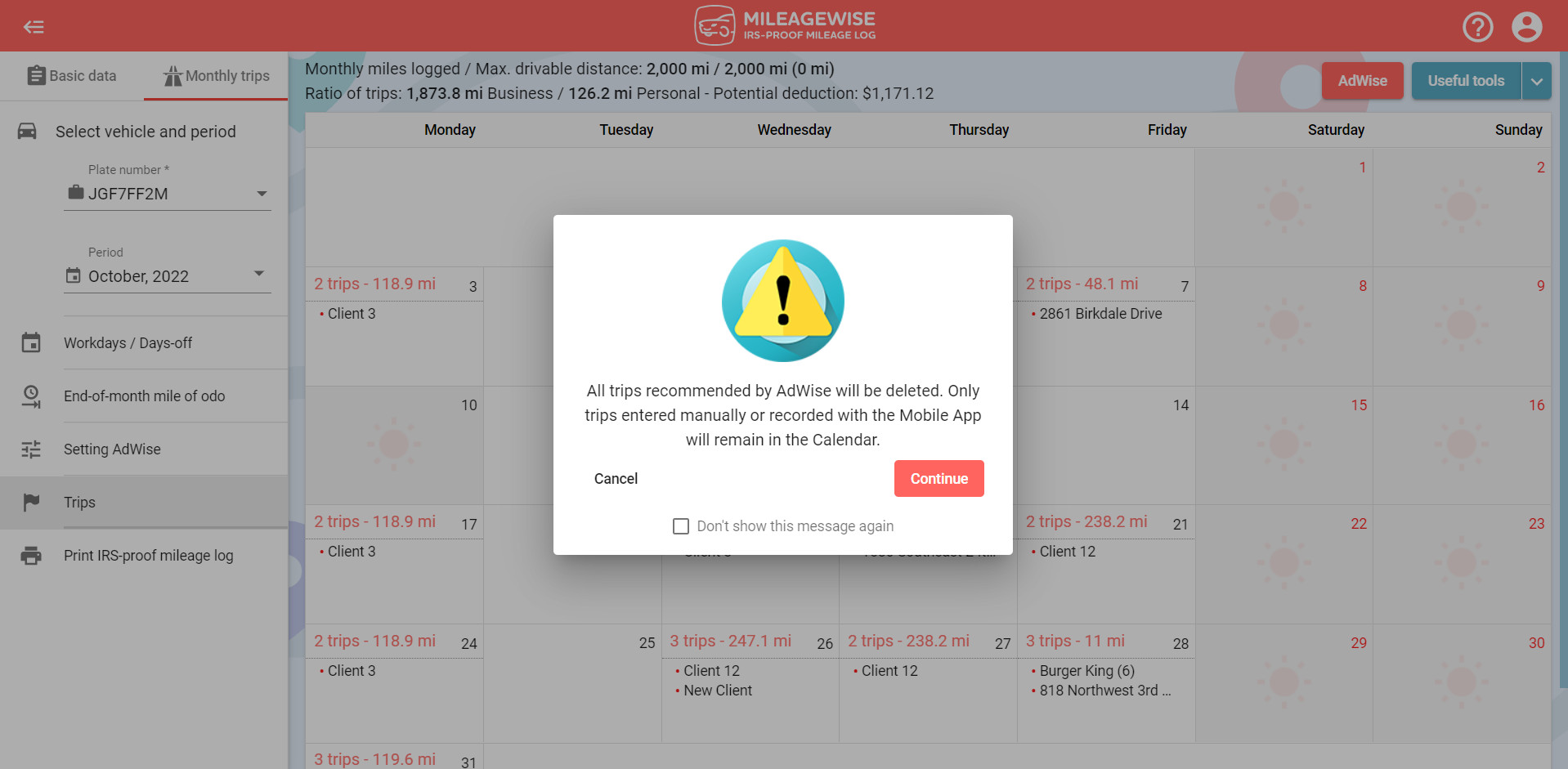

By default, all confirmation messages are displayed on the Web Dashboard in all internet browsers opened such as this message:

If you do not want the message to appear, you can turn off this feature by clicking on the switch in front of the “Leave fixed trips only” confirmation message text within the User settings and then clicking on the Save button or by ticking the box in the above message to not show the message again.

If you previously checked this option when the message was displayed, but still want this message to appear, set the switch in the Profile menu as described above.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

April 25, 2024 Unlock accurate 1099 tax estimates and boost savings by maximizing your mileage tax deductions. Get reliable, IRS-ready results with the right tools.

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

© 2025 MileageWise – originally established in 2001