Note: Adding a refueling / charging is only necessary when using the Actual Expense Method. In the case of using the Standard Mileage Rate, you only need to log your arrival at the gas / charging station (the trip itself), as you would with any other client / location.

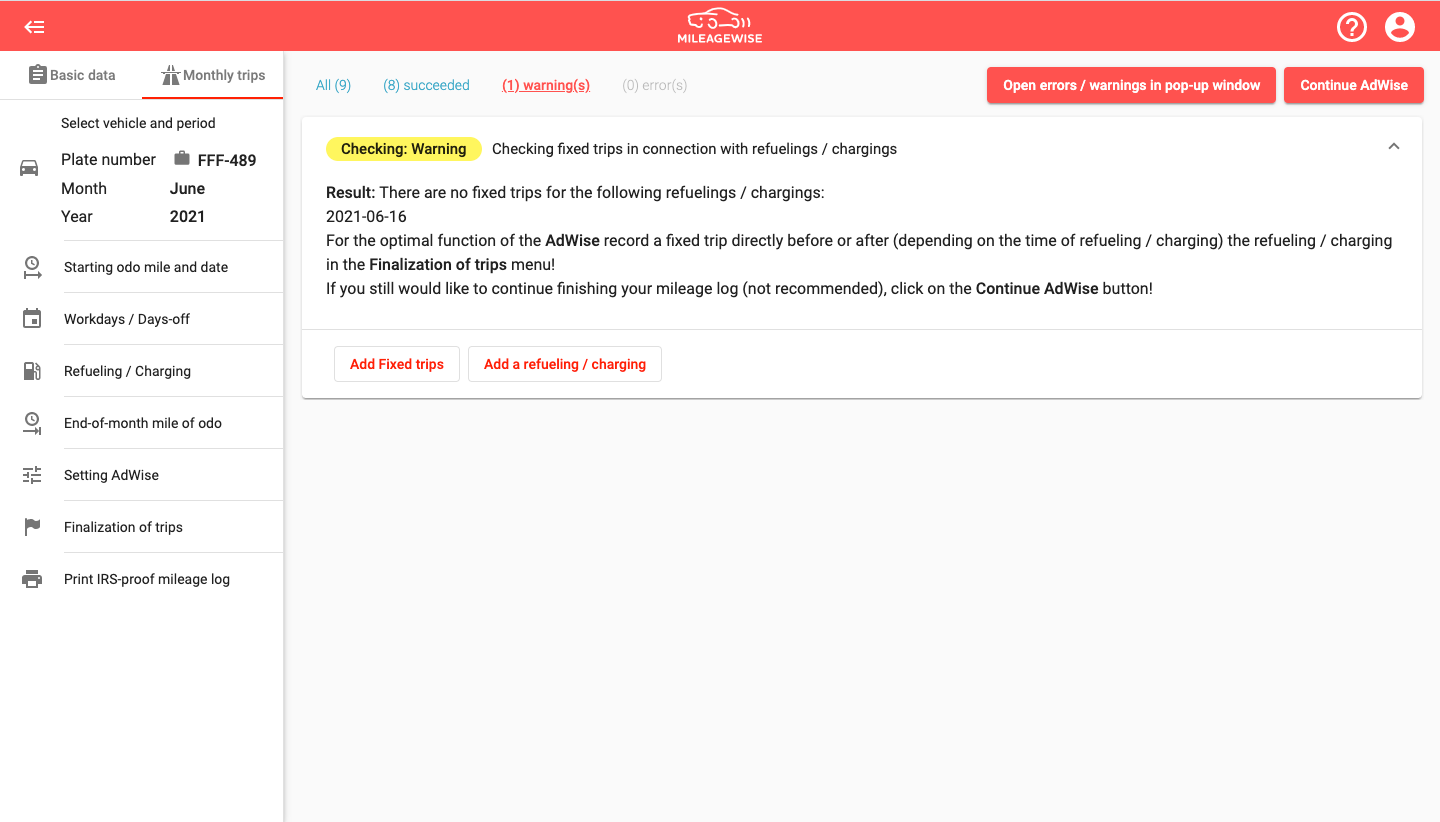

When using the AI Wizard feature, MileageWise runs a check following the parameters set by the user.

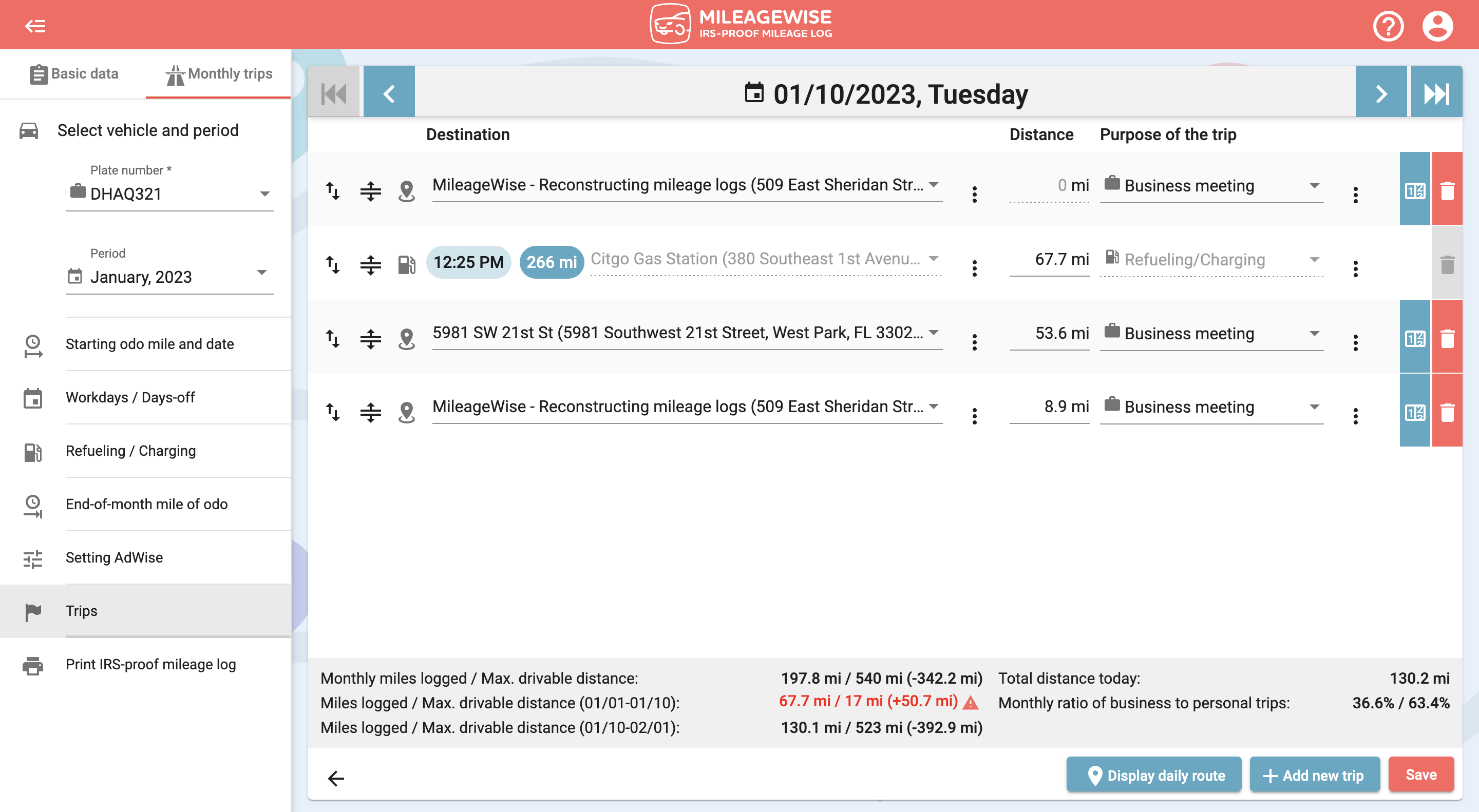

To create a more accurate mileage log, it is recommended that at least one Fixed trip (Recurring daily trips, trips tracked with the mobile app, and trips recorded in the Fixed trips / Mobile app menu) be recorded on the day of the refueling / charging.

If you receive the above warning after starting the AI Wizard feature, it is recommended to add at least one Fixed trip to the day of the refueling / charging in the Trips menu! Click the Add Trips button below the warning to go to the Trips menu.

This is just a warning. You can continue without correcting the error by clicking Continue AI Wizard.