In the program, the menu layout is designed to guide the user.

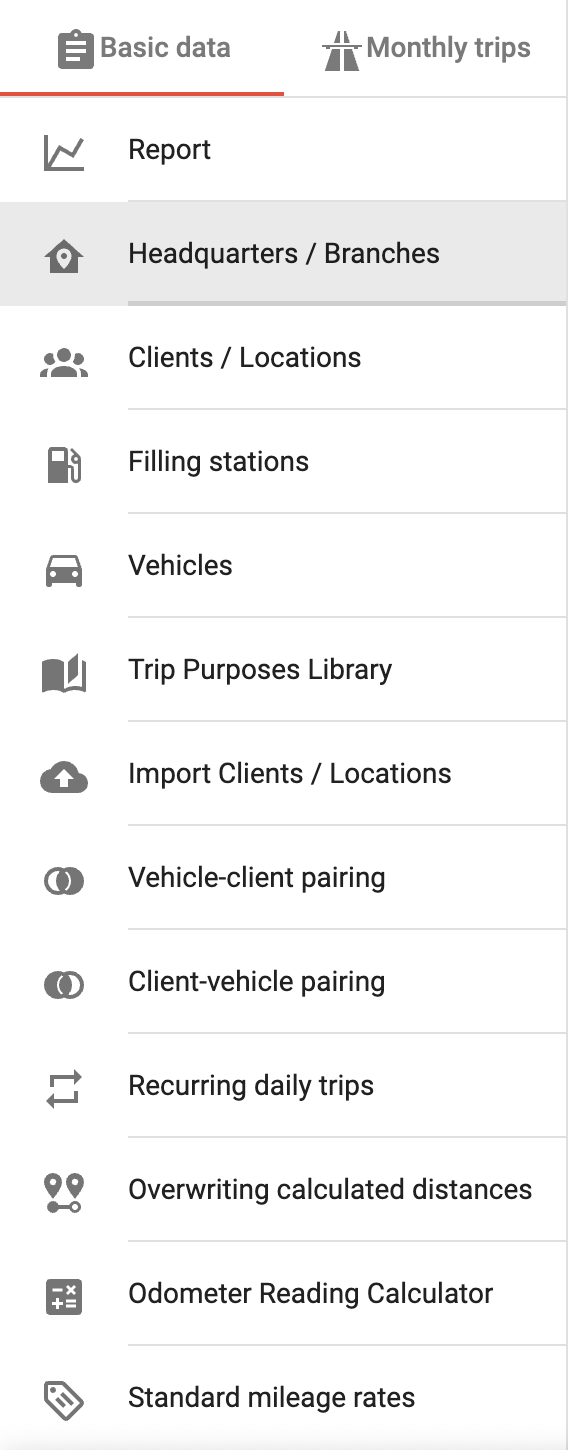

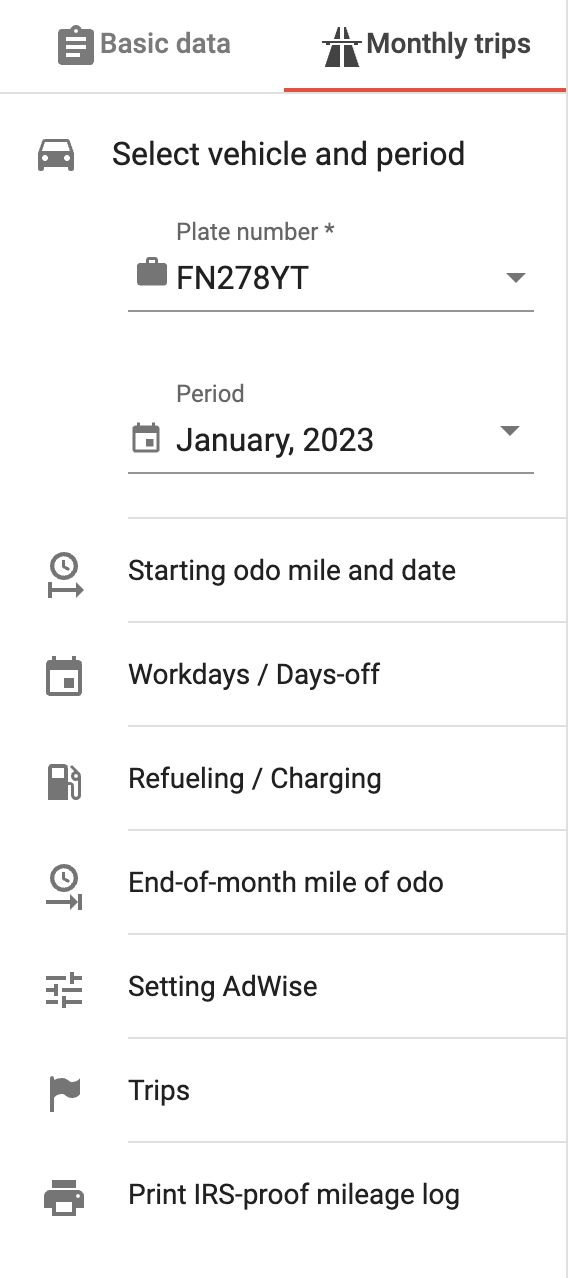

You should go from top to bottom in the Basic data and Monthly trips tabs.

We advise you to enter the Basic data first, including the recurring daily trips.

After that, on the Monthly trips tab, enter the Starting odometer reading (if necessary), then your workdays and days off, and then refuelings / chargings.

Proceed with entering the fixed trips (i.e. record trips connected to the data of parking, speeding tickets, car-related bills, etc.) and then enter the end-of-month odometer reading.

If necessary, set your preferred parameters in the AI Wizard function settings, and following that, in the Trips tab, you can put the finishing touches on your mileage log.

If the entered and deductible distances match the IRS-proof mileage log is ready to be generated.

It’s important to know, that any entered monthly data can be edited or supplemented at any time, you can’t go wrong with MileageWise.

This mileage tracker app goes beyond the basics! Automatically track your trips and customize your settings to match your needs. Designed to be battery-friendly, data-efficient, and fully ad-free — all while respecting your privacy. No upselling, no distractions — just the features you need.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

April 29, 2025 Are you a freelancer or independent contractor? Do you get paid with a 1099 form? Then you need a 1099 tax calculator!

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

Last Updated: April 7, 2025 If you use the internet for work, you might be able to claim a deduction on your tax return. But

Last Updated: March 3, 2025 If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax-deductible? The short answer is yes,

© 2025 MileageWise – originally established in 2001