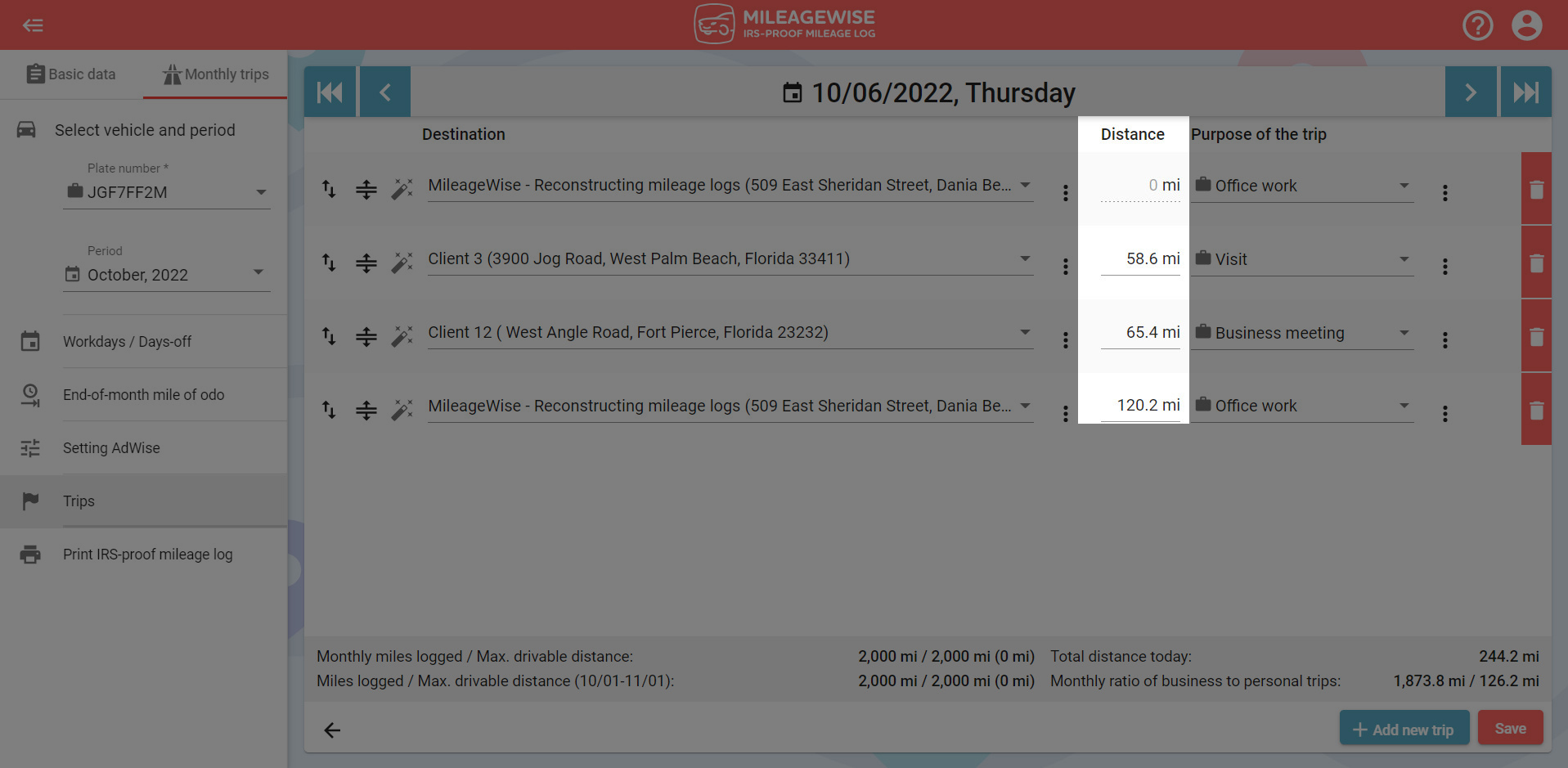

MileageWise will calculate the distances from client to client simultaneously. The system calculates optimum routes that are the most ideal for your mileage log in order to for it to be IRS-proof.

You can overwrite the distance for each trip by clicking on the distance column.

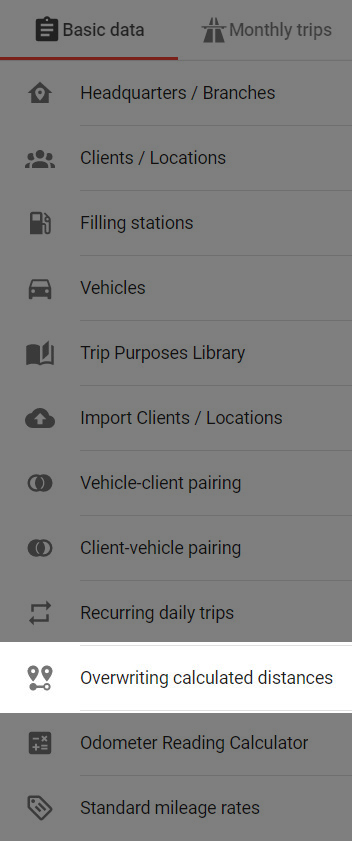

If you would like to permanently calculate with a different distance for a specific trip in the future, then you can set it with the ‘Overwriting calculated distances’ feature. You can specify the distance between two specific clients (instead of the program’s calculated distances). You can read more about this in this article.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

Are you confused about taxes from your 1099 income? A 1099 calculator helps freelancers, rideshare drivers, and other self-employed workers easily figure out taxes. Let’s see how

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

© 2025 MileageWise – originally established in 2001