In the List view, select Add from the right-click menu.

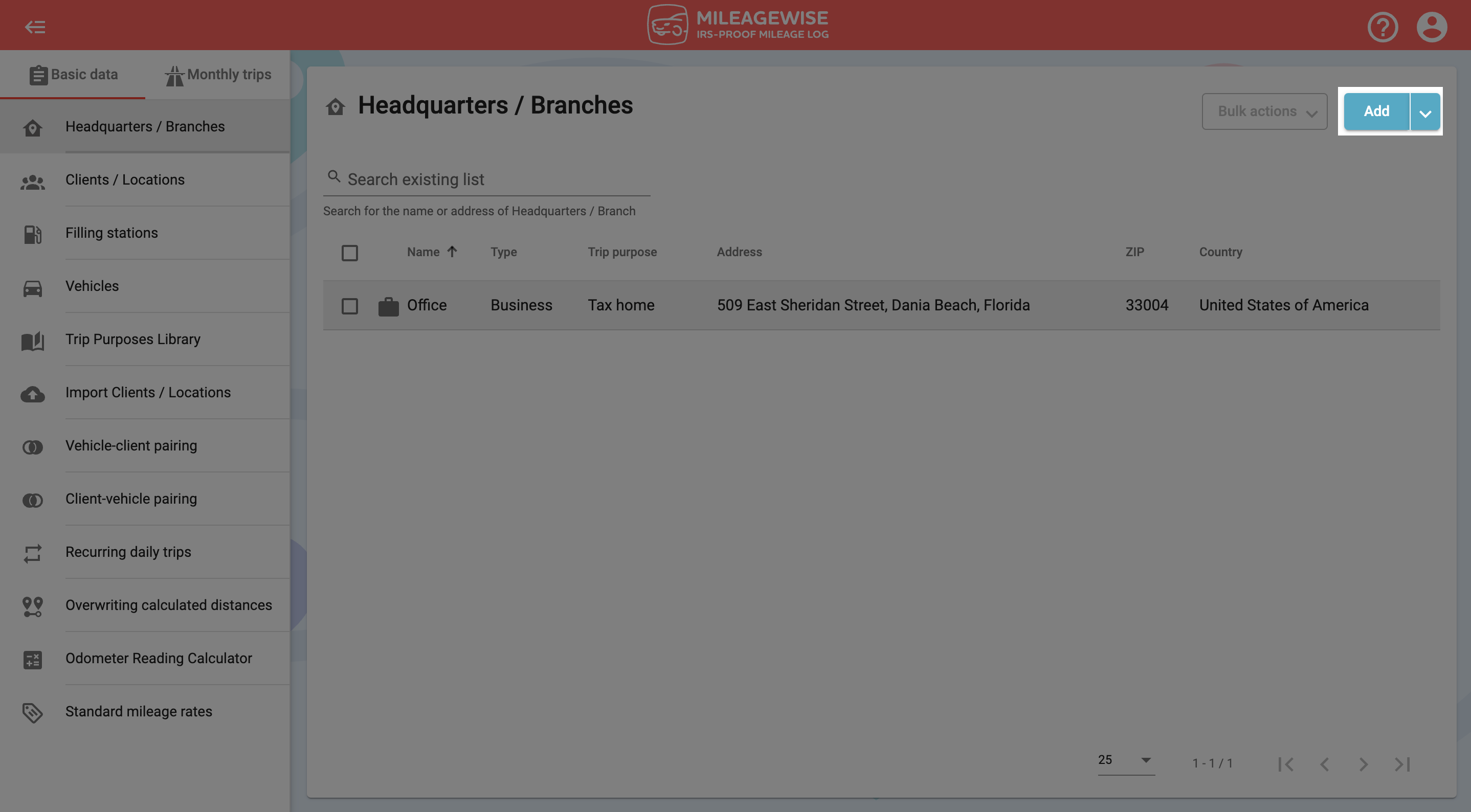

Or, click the menu at the top right and select Add:

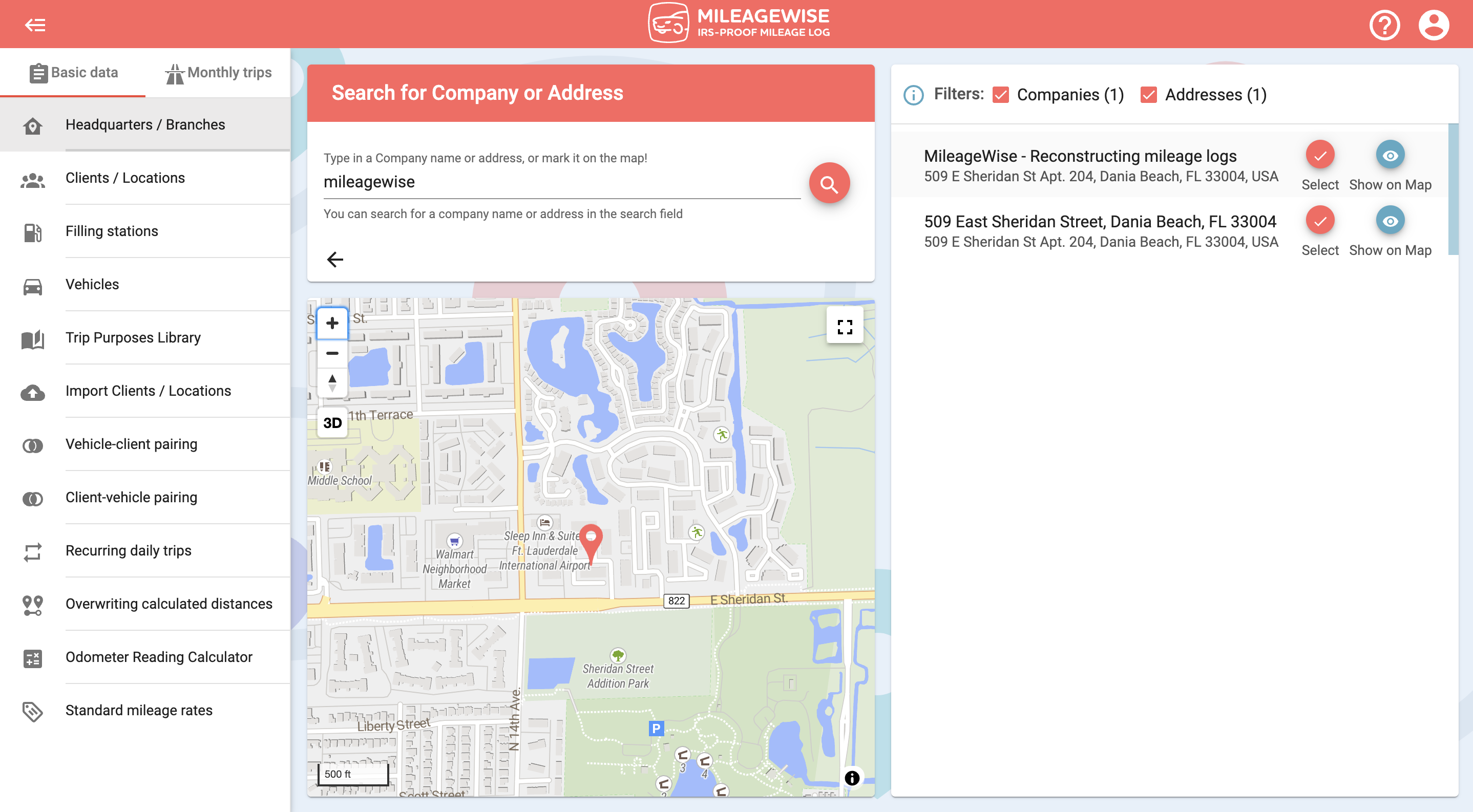

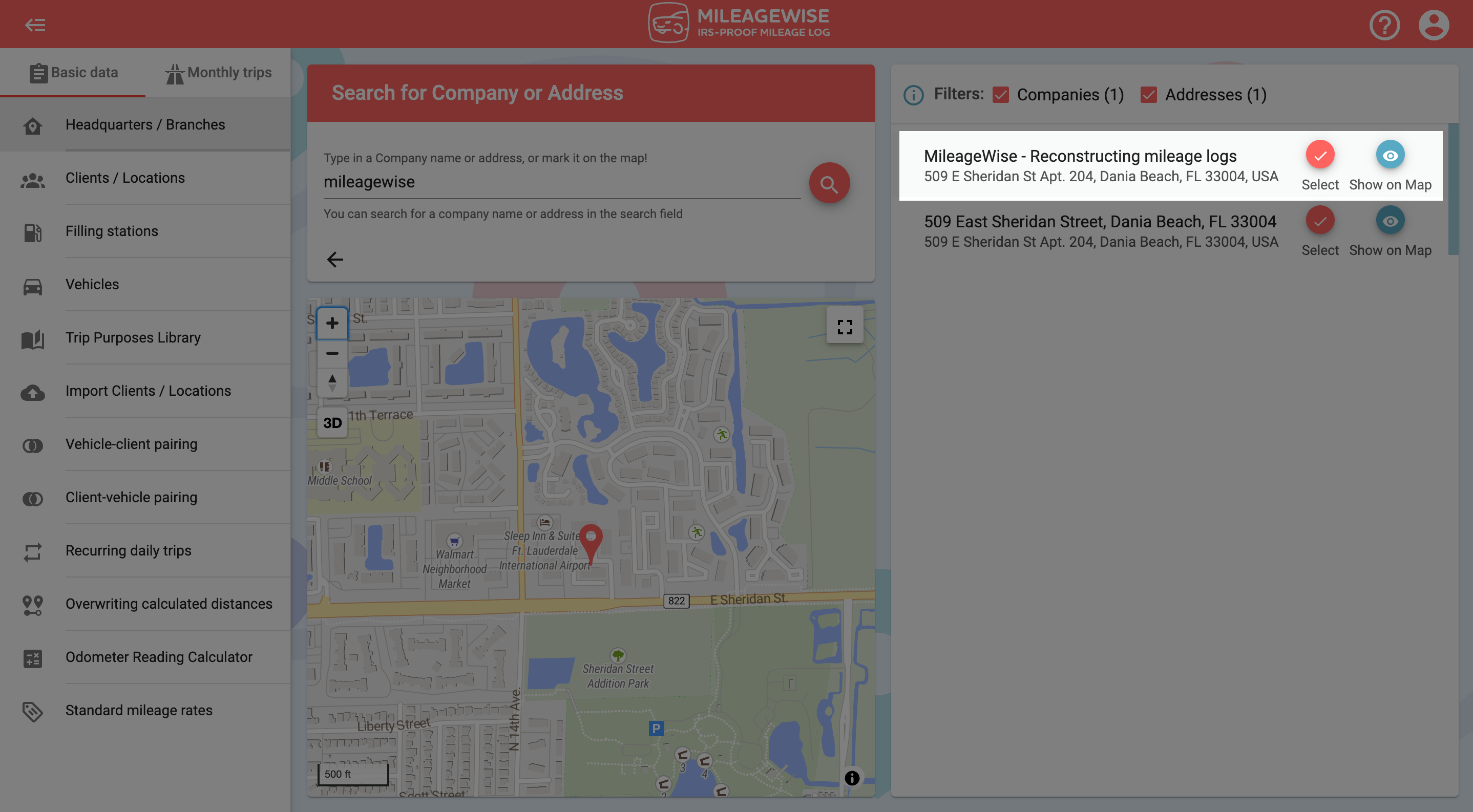

In the next window, type the name of the client in the search field. After that click on the magnifying glass icon or press Enter.

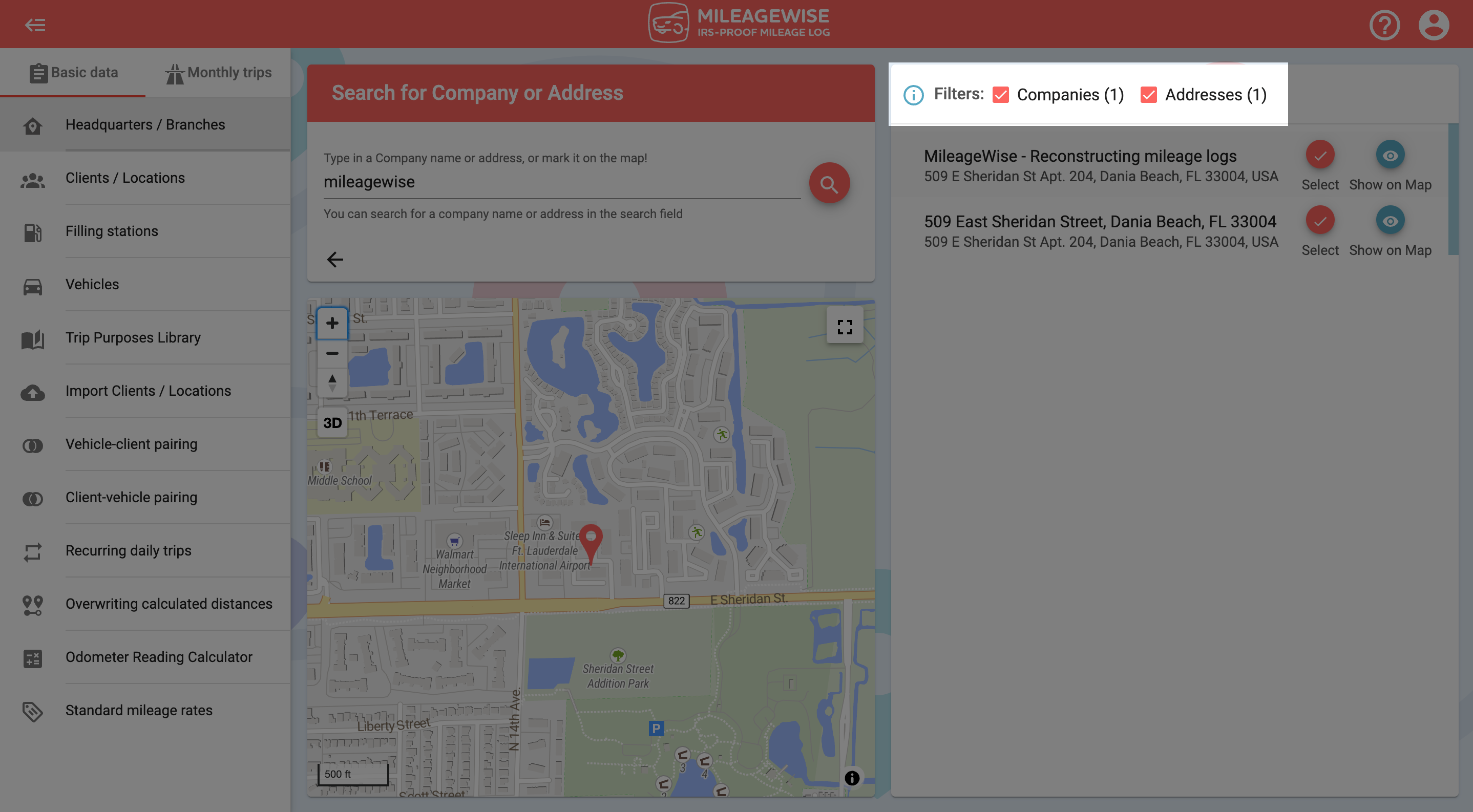

You can narrow your search results by turning off filters. You can see the client’s branches or choose to list the results by the address only.

You can see the address on the map by clicking on the

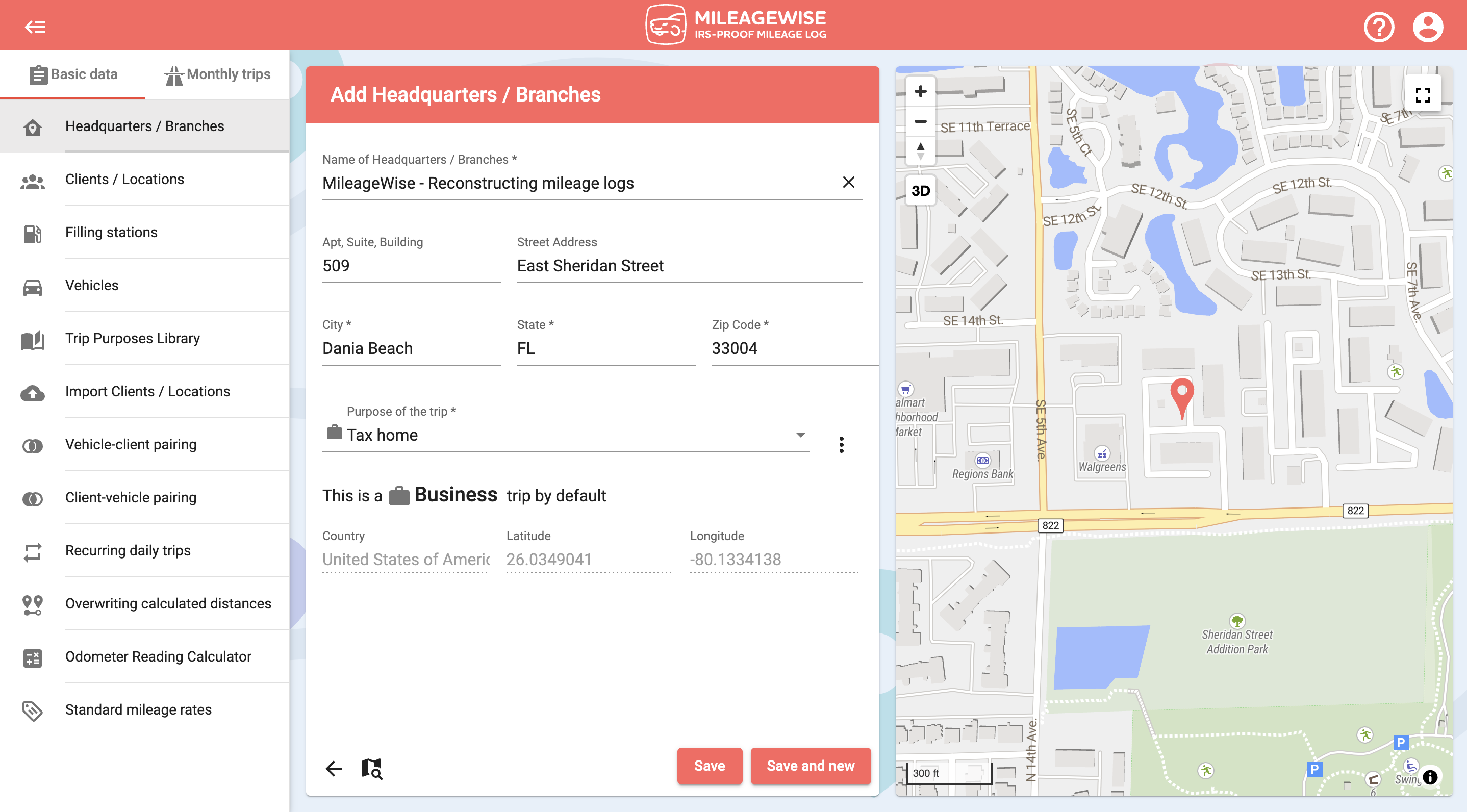

On the next page, the data will automatically be loaded in, all you have to do is click Save.

If you would like to add more headquarters or branches now, click Save and New and search for and record the next headquarters or branch as described above.

You can also search for a headquarters or branch by address and map.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

Are you one of the thousands of Instacart shoppers hustling to make deliveries across town and confused about Instacart 1099? Are you wondering about those pesky

© 2025 MileageWise – originally established in 2001