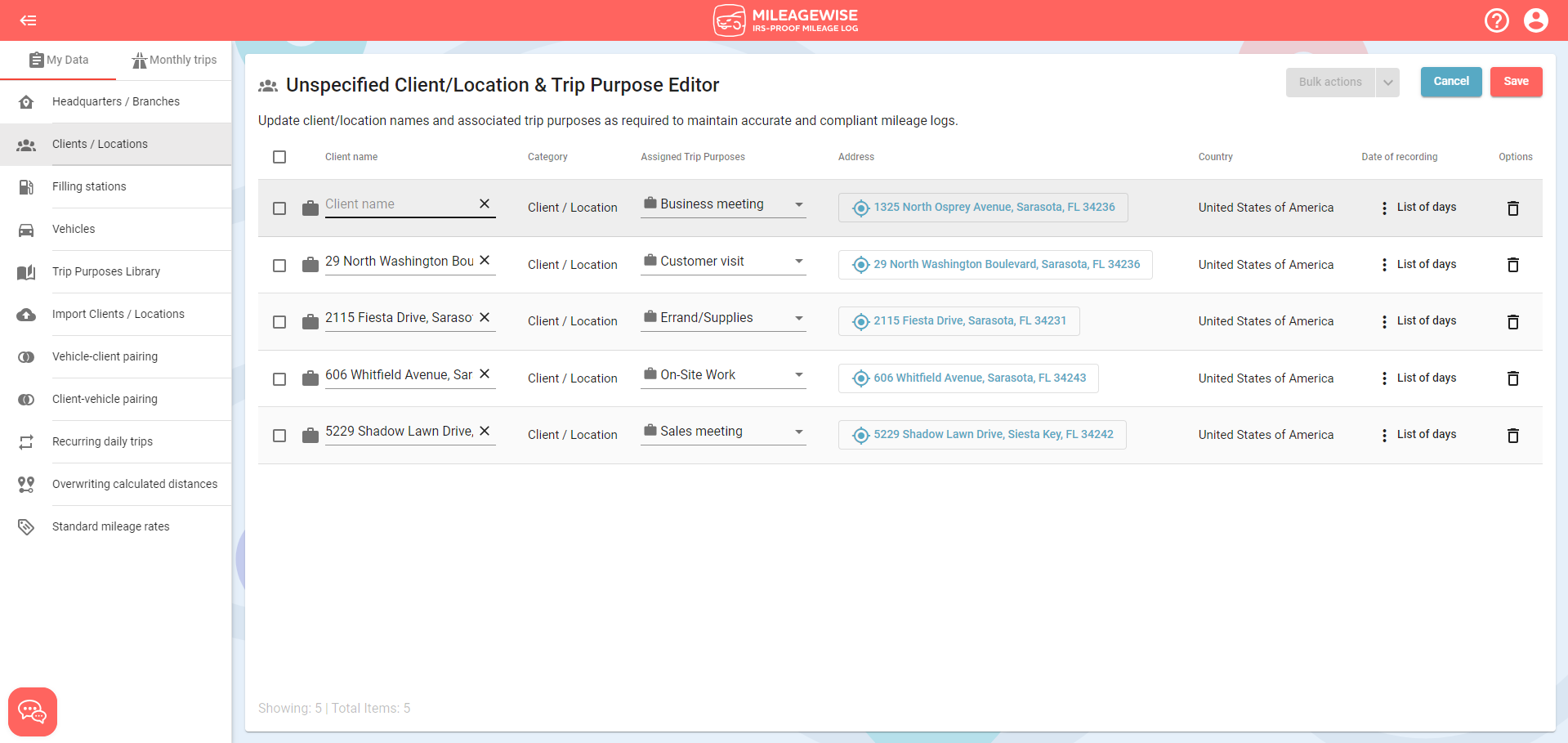

The Manage Unspecified Clients/Locations feature allows you to easily rename any unnamed clients or locations, ensuring that your mileage logs are complete and IRS-compliant.

Unnamed clients or locations can be created if you have enabled automatic trip logging in the MileageWise mobile app. When a stop is logged that doesn’t match any existing clients or locations in your list, the trip is saved as an anonymous visit, with only the address details attached. Before finalizing your mileage log, you need to rename these unnamed entries.

This tool is especially helpful if you realize that a client’s category or trip purpose (e.g., business vs. personal) is incorrect. This is crucial for keeping an accurate business-to-personal ratio, which is vital for tax deductions. Fixing these issues last minute before printing would be difficult, but this tool simplifies the process.

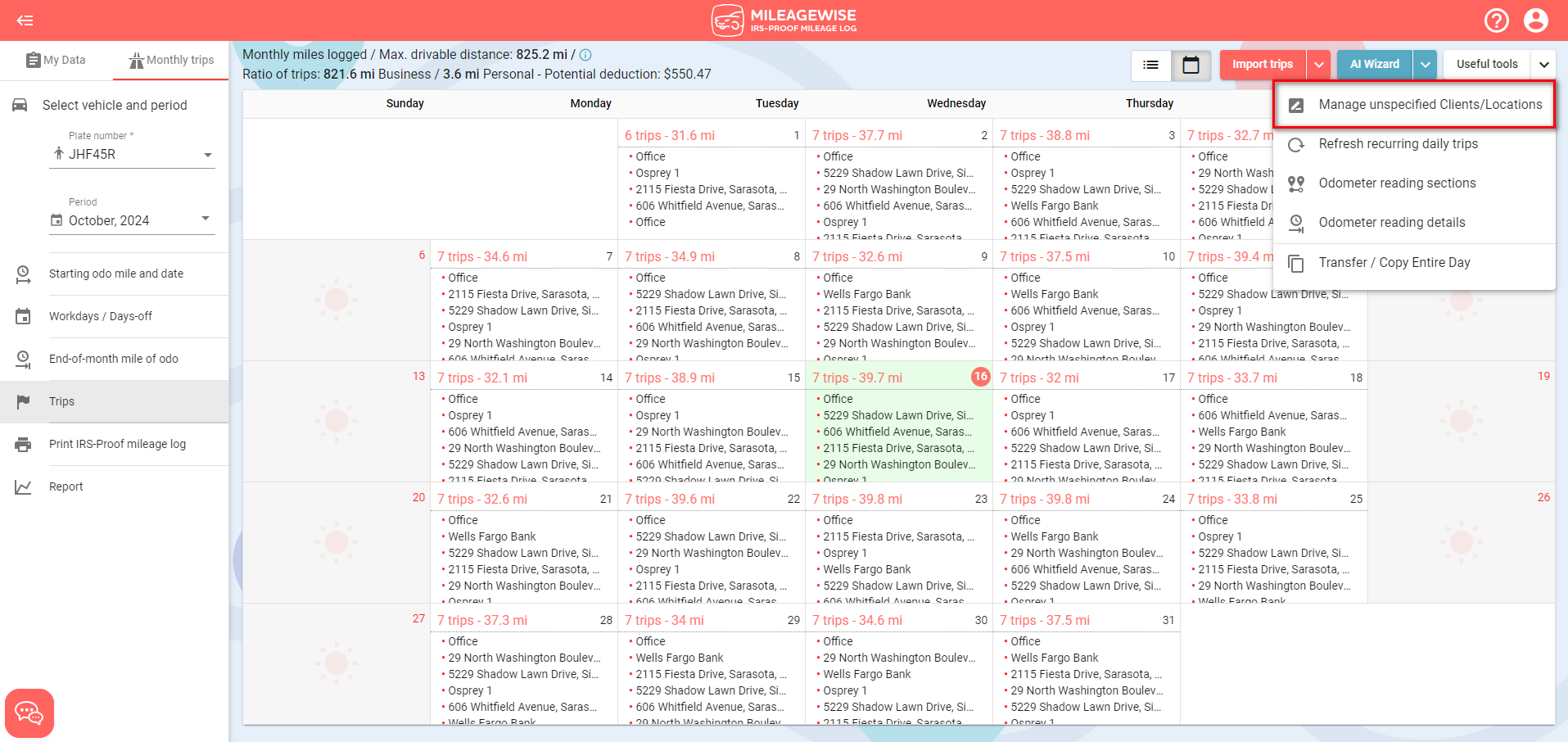

Steps to Manage Unspecified Clients/Locations:

Navigate to the Trips Menu

2. Rename the Clients/Locations

3. Save Your Changes

4. Ensuring Accurate Records

Bonus Tip:

If you realize after logging your trips that a certain client or location has an incorrect category or trip purpose (such as being marked as “personal” instead of “business”), you can use this tool to quickly update it without needing to go through each individual trip.

By following these steps, you can ensure your mileage logs are compliant, properly categorized, and ready for IRS review.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

Are you confused about taxes from your 1099 income? A 1099 calculator helps freelancers, rideshare drivers, and other self-employed workers easily figure out taxes. Let’s see how

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

© 2025 MileageWise – originally established in 2001