Effortlessly track your trips with our Phone Charge Monitoring feature. Once activated, your trips are recorded automatically without needing to press a single button.

Who is this feature for?

This feature is ideal if you regularly charge your phone in your vehicle or if your car doesn’t have a built-in Bluetooth device. The Mileage Tracker App will detect when you charge your phone in the car and log your visit when you unplug your phone upon arrival.

Requirements:

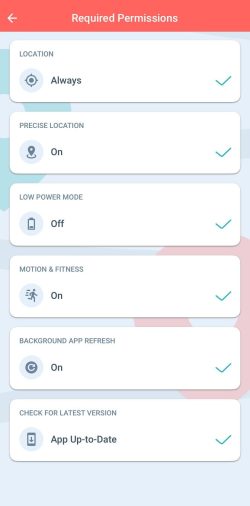

Check that all required permissions are enabled for automatic recording to work properly:

Battery and Power Saving:

We only use GPS and data to record your arrival, making this feature efficient in terms of battery and power usage.

How to Activate Phone Charge Monitoring:

Go to the Recording Options menu in the MileageWise Mileage Tracker App.

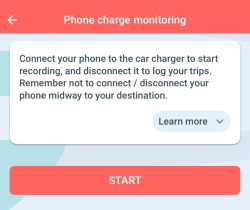

Select Phone Charge Monitoring to learn more about the advantages and disadvantages of this option.

Decide if it’s right for you.

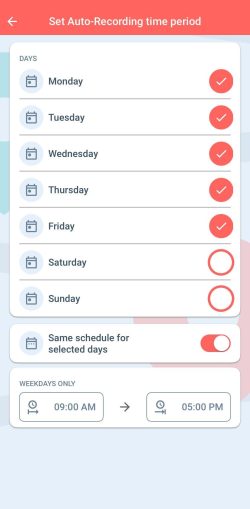

Set an Automatic Recording Time Period to specify when the app should track your trips.

5. Click the START button to activate the feature.

How It Works:

Once activated, when you connect your phone to the charger in your vehicle, the app will notify you. From then on, the app will automatically record your trips when you unplug your phone or turn off the ignition, and “walking” mode is recognized.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

Are you confused about taxes from your 1099 income? A 1099 calculator helps freelancers, rideshare drivers, and other self-employed workers easily figure out taxes. Let’s see how

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

© 2025 MileageWise – originally established in 2001