Odometers – What You Need to Know

How to tell how many miles a car has?

Check the car’s odometer, usually found on the dashboard, to see the total miles traveled.

What does odometer mean? What does an odometer measure?

An odometer is an instrument used to measure the distance traveled by a vehicle, typically in miles or kilometers.

What does “odometer rolled over” mean?

“Odometer rolled over” refers to the odometer reaching its maximum reading and starting over from zero, common in older vehicles. This means the odometer starts counting from zero, so it is necessary to add past mileage to know all past mileage.

Can you change a car’s mileage?

It is possible to change car mileage, but doing so is illegal and unethical unless correcting a known error.

Keep Track of you Odometer Readings and More

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-powered Mileage Log Generator: This tool helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Table of Contents

Calculate your Past Odometer Readings

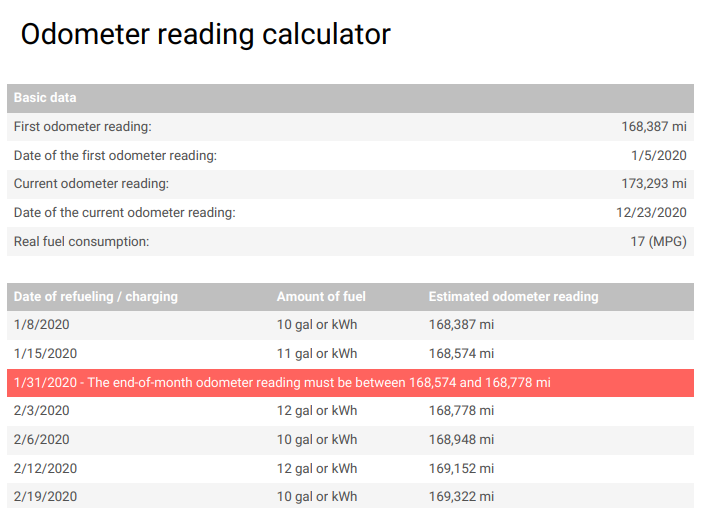

If the IRS audits you for mileage, you’ll have to know your past odometer readings for the IRS to accept your mileage log.

To create a retrospective mileage log, use the odometer reading calculator to calculate how much the odometer reading could be at certain refuelings/chargings and at the end of the month.

Before you get started, you’ll need some information:

- The starting odometer reading of your vehicle,

- The current odometer reading of your vehicle,

- Approximate fuel consumption of your vehicle,

- The date of your refuelings/chargings,

- Amount of fuel refueled per refueling/charging.

Without this information, you will not be able to calculate accurate odometer readings at certain refuelings/chargings. Without accurate odometer readings, your mileage logs will be inaccurate, so we recommend that you take the time to gather the data as soon as possible.

TIP: You can find information about the odometer readings recorded during a service visit or vehicle inspection by checking your vehicle’s history if you know its VIN (Vehicle Identification Number). Check your VIN for more info.

The finished document will look like this:

Click on the image to see the full document.

10 and 20-year Rules for Odometer Disclosures

As of January 2021, for vehicles beginning with the Model Year 2011 odometer disclosures are required for every transfer of ownership for the first 20 years. The model Year 2010 and older vehicles are exempt from this rule, continuing to be subject to the previous 10-year odometer disclosure rule.

Fuel Mileage Calculator

Fuel economy in automobiles can be calculated in either US or metric units by using a Gas Mileage Calculator. Calculate your vehicle’s fuel efficiency in mpg-US (miles per gallon), mpg Imp (miles per Imperial gallon), km/l (kilometers per liter), or l/100km (liters per 100 kilometers).

Fuel economy/efficiency ratings are converted and displayed for all units, including mpg US, mpg Imp, km/l, and l/100km.

TIP: Do you have to change from a decimal odometer to a binary odometer or vice versa? Set a value and see the binary, octal, decimal, hexadecimal, and custom base versions of your odometer reading.

Odometer Reading Guide: How to Read an Old Odometer (Step-by-Step)

- Find the dashboard odometer: The speedometer panel has a rectangle-shaped glass.

- Check the arrangement: To calculate your distance, count the odometer digits. Some versions also show a tenth of a distance unit. This normally appears in a different-colored wheel.

- Read the displayed number from left to right.

- Add the current number to the rollover: Old odometers roll back to zero after a certain limit, reducing their accuracy. Note and add these readings to gain a better idea of the vehicle’s trip distance.

- How does an odometer work? How to read a transmission-shaft-connected gear-driven wheel drives odometers? As the shaft rotates at the same pace as the wheels, the mechanism can estimate your car’s distance by multiplying the number of spins by the tire’s circumference.

Odometer calculator by brand and Model

You can find an odometer calculator with a thorough breakdown of vehicle categories, brands, models, and even memory types, where you can easily find your own vehicle to calculate the odometer for distances traveled. You can even upload your own dashboard file.

How Can a Tire Size Calculator help?

The tire size calculator compares the diameter, breadth, sidewall, circumference, and rotations per mile of two tires. Then, as an added benefit, it displays samples of your speedometer reading with the first tire and the real speed you’re moving if the second tire is installed. When looking for tires that are a different size than standard, this tire calculator comes in handy.

Using MileageWise to create a mileage log, you’ll be able to reconstruct your past mileage. With the help of our AI-powered Mileage Log Generator that fills the gaps in your incomplete logs, you can create a backtracked, IRS-compliant mileage log.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

FAQs about Mileage Tracking for Taxes

Is it better to track mileage or gas on taxes?

Tracking mileage is often better because the IRS standard mileage rate typically covers gas, maintenance, and other vehicle expenses, making it simpler.

Can I switch from actual to standard mileage?

If you opt for the standard mileage rate during the first year a vehicle is in use, you have the option to alternate between using the standard mileage and actual expenses methods each year. However, if you start with the actual expenses method in the first year, you must continue using this method for as long as you use that vehicle for business.

What counts as mileage for taxes?

Mileage for business, medical, moving (if eligible), and charitable purposes counts, but commuting to and from work generally does not.

What is considered medical mileage?

Medical mileage refers to the distance traveled for medical care which can be deductible from taxes if it meets certain IRS criteria.

How do I track mileage for taxes?

Use a mileage tracking app, a mileage logbook, or a spreadsheet to record the date, purpose, start/stop locations, and miles driven.

Why is the Odometer Reading Important?

Determining Car Value

The mileage recorded by your odometer is a significant factor in determining your car’s resale value. Generally, the more miles a car has traveled, the lower its resale value will be. Buyers often associate high mileage with more wear and tear, leading to potential future repairs.

Legal Responsibilities

When selling a vehicle, it’s legally required to disclose the accurate mileage. Any discrepancies between the actual mileage and the number displayed on the odometer can even lead to accusations of fraud.

Car Insurance

Your odometer reading can affect your car insurance premiums. Some insurance companies offer discounts for low-mileage vehicles since they are statistically less likely to be involved in accidents.

Fuel Efficiency Monitoring

Monitoring your car’s fuel efficiency is easier when you keep track of your odometer readings. By noting the mileage at each fill-up, you can calculate how many miles you’re getting per gallon. Furthermore, this also helps you spot any issues with your car’s engine or fuel system early on, if you have unusullay large fuel consumption.

Mileage Deduction for Taxes

If you use your car for business or are self-employed, keeping precise records of your mileage is vital for claiming deductions. However, documenting only your odometer readings is not adequate for mileage deduction

Tip: Consider using a mileage tracking app to record your miles consistently. These tools help ensure you’re not leaving money on the table when it’s time to file your taxes.

Manually keeping a mileage log isn’t just time-consuming; it also leaves you prone to around 70 potential red flags when using Excel-based mileage log templates—errors you can avoid entirely by using our MileageWise dashboard

Similar Blog Posts

Calculator for Mileage Reimbursement 2024 & 2025

Mileage reimbursement compensates employees or self-employed individuals for car expenses. These include costs like gas, maintenance, and depreciation. It is calculated based on the IRS standard

Mileage Calculator and Your Cost Per Mile: Know Your Numbers

Calculating your fuel price has never been easier. With a mileage calculator, you can quickly figure out how much you’re spending per mile on fuel,

Free Mileage Reimbursement Calculator for 2024 & 2025

If you’re someone who frequently travels for work, or manages employees who travel for work, then a mileage reimbursement calculator can come in handy. Not

Smart Mileage Calculator for Vehicle Users 2024

Last updated on: June 26, 2024 MileageWise has a smart solution to calculate the Mileage of vehicles, making the process easier. The Internal Revenue Service’s