The Overwriting calculated distances feature allows you to specify the distance the program calculates between two specific clients (instead of the distances calculated by the program).

To overwrite the distances calculated by the program go to the My data menu and select the Overwriting calculated distances menu point.

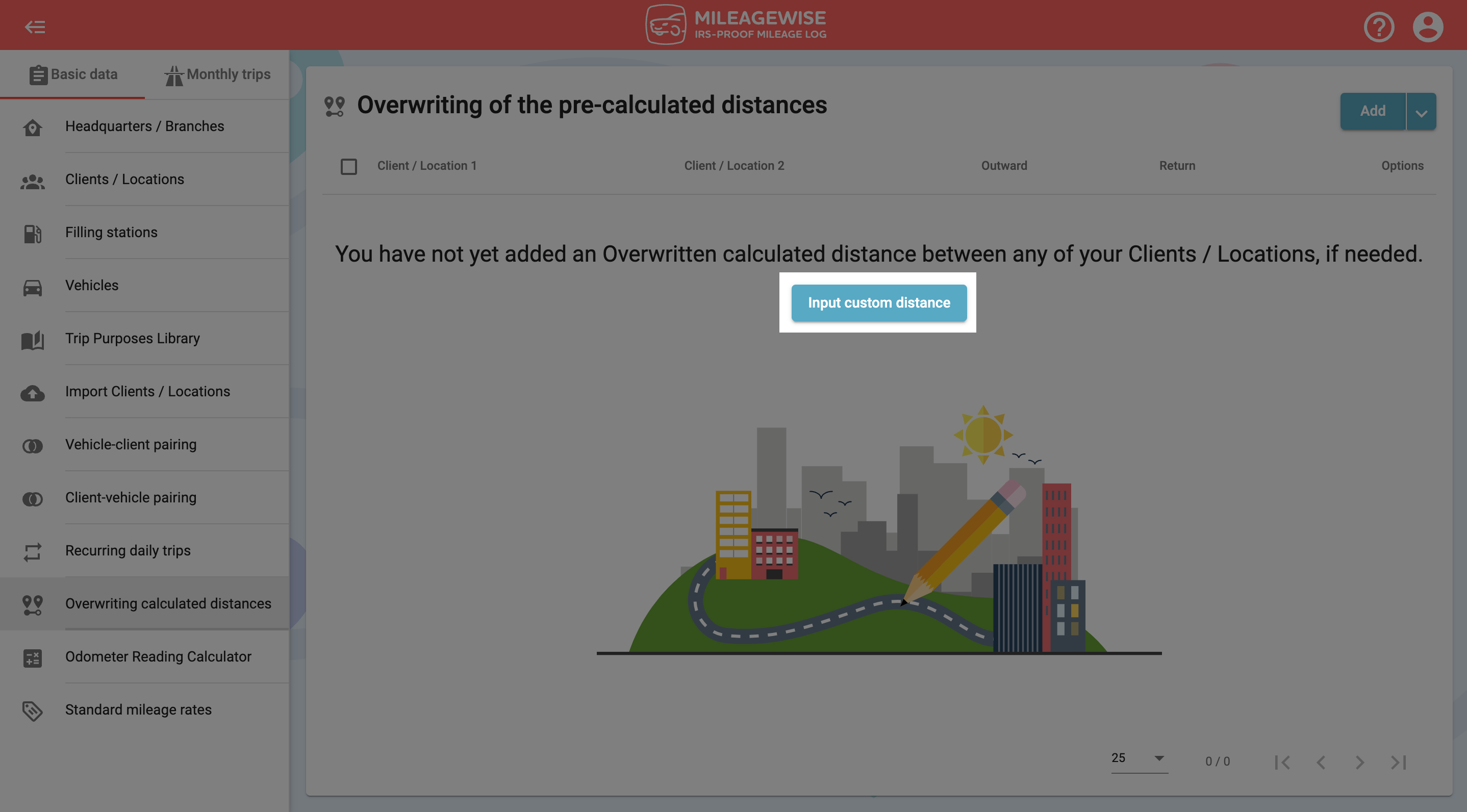

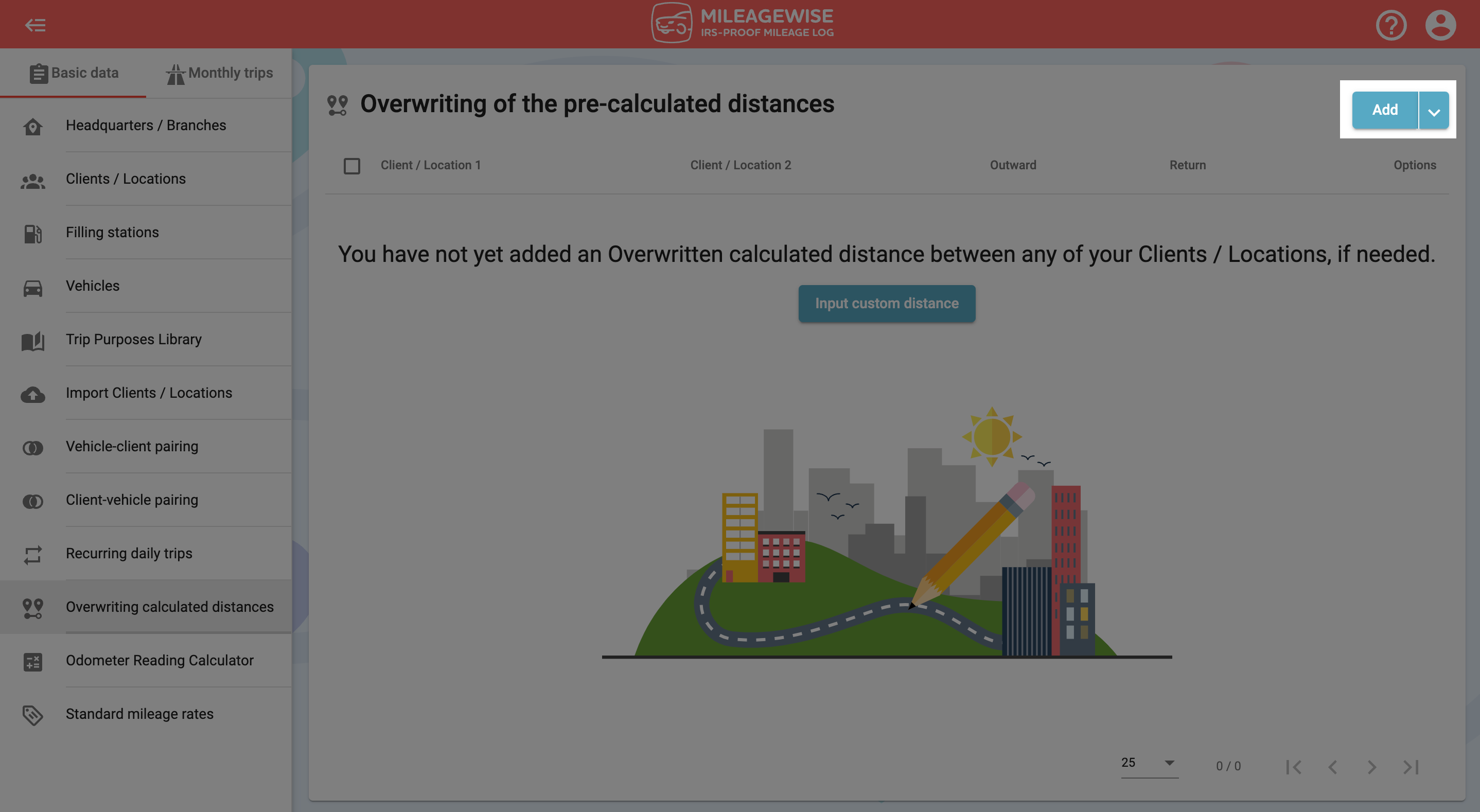

To record data, click on the text in the middle of the interface. Or select Add in the upper right menu.

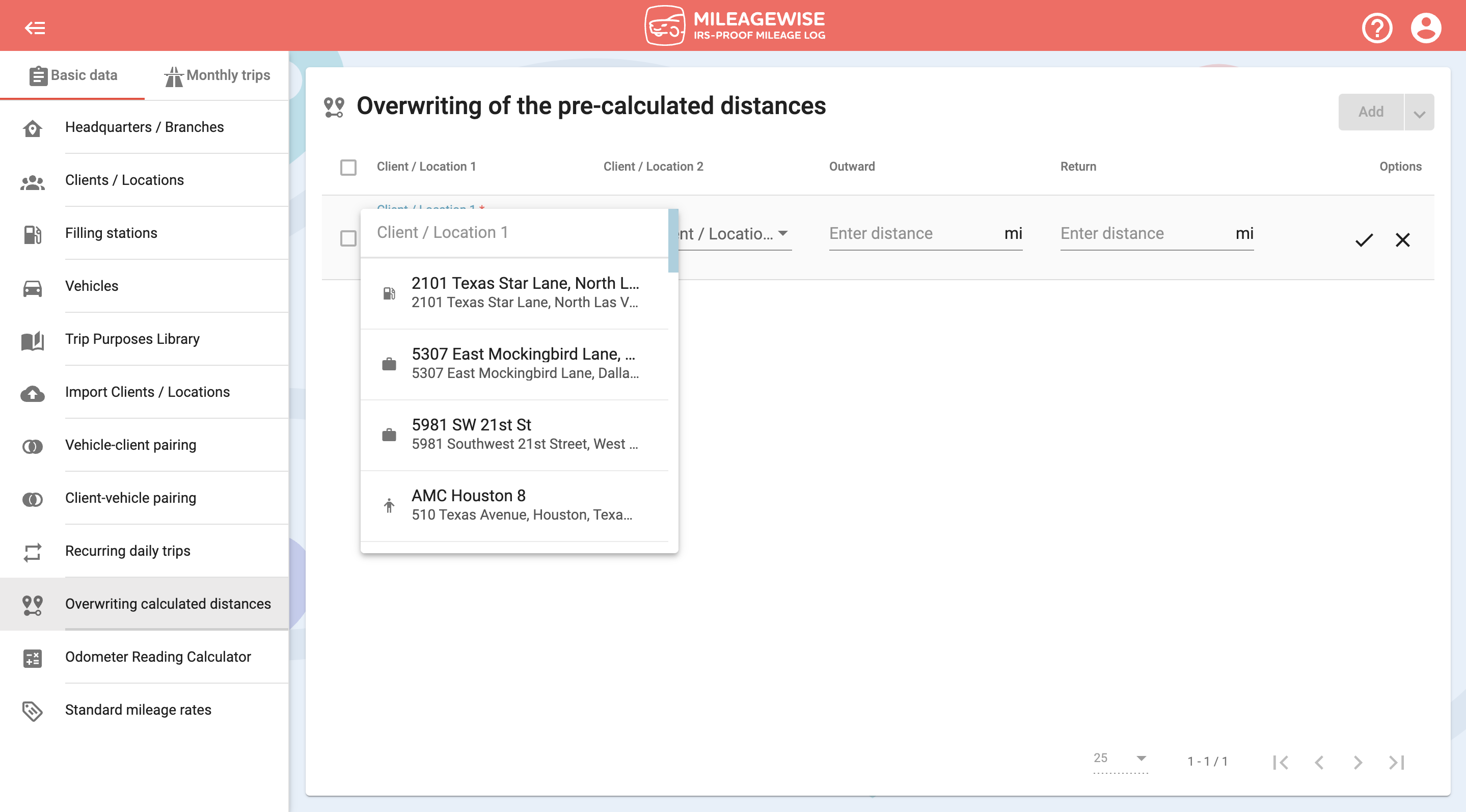

Select the first client from the drop-down list or use the search option. The list shows you the clients in each category (active-passive-inactive clients, headquarters, branches, and Filling stations).

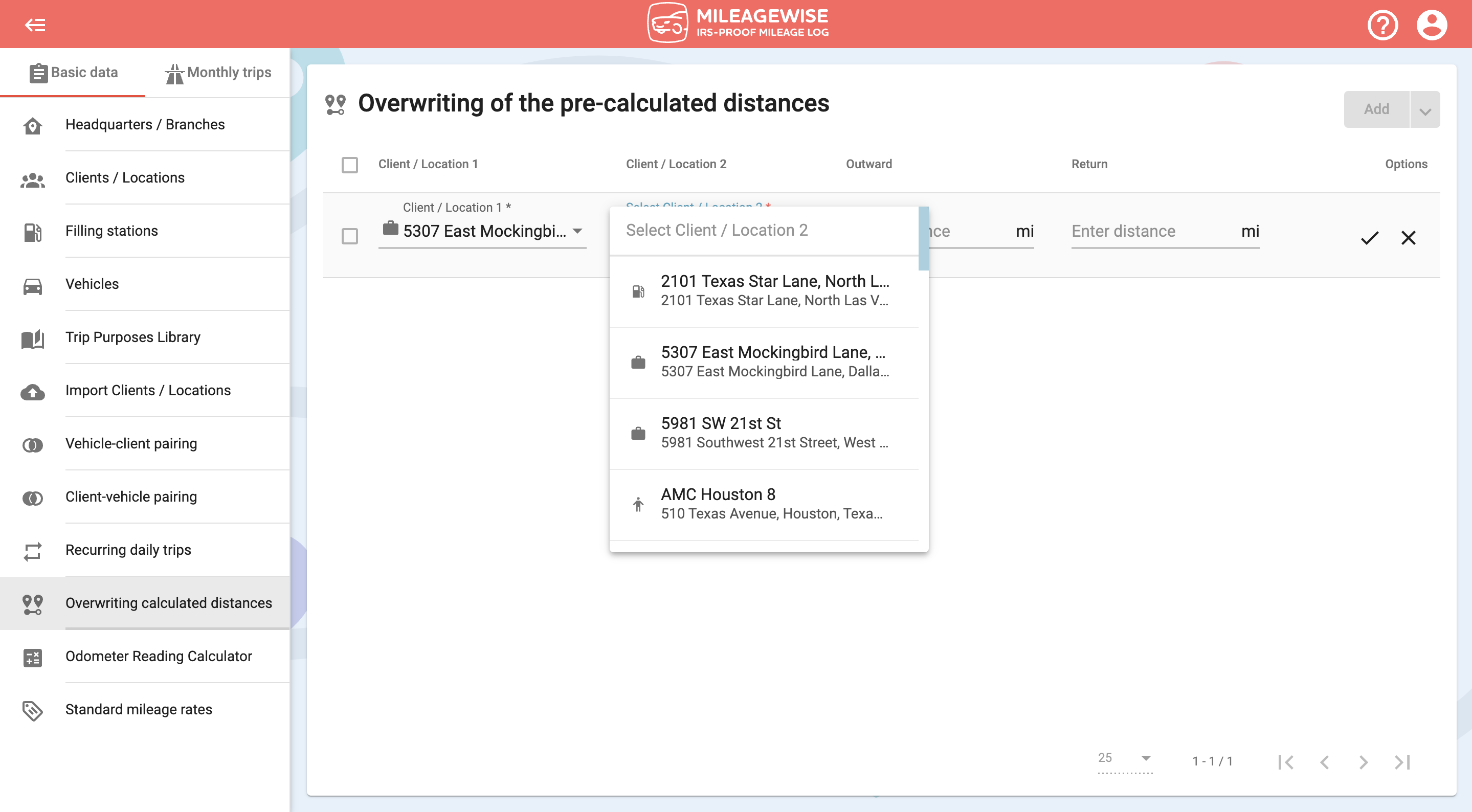

Next, select the client you have arrived at. Since you can also specify the outward and return distances, the order in which you add the clients does not matter.

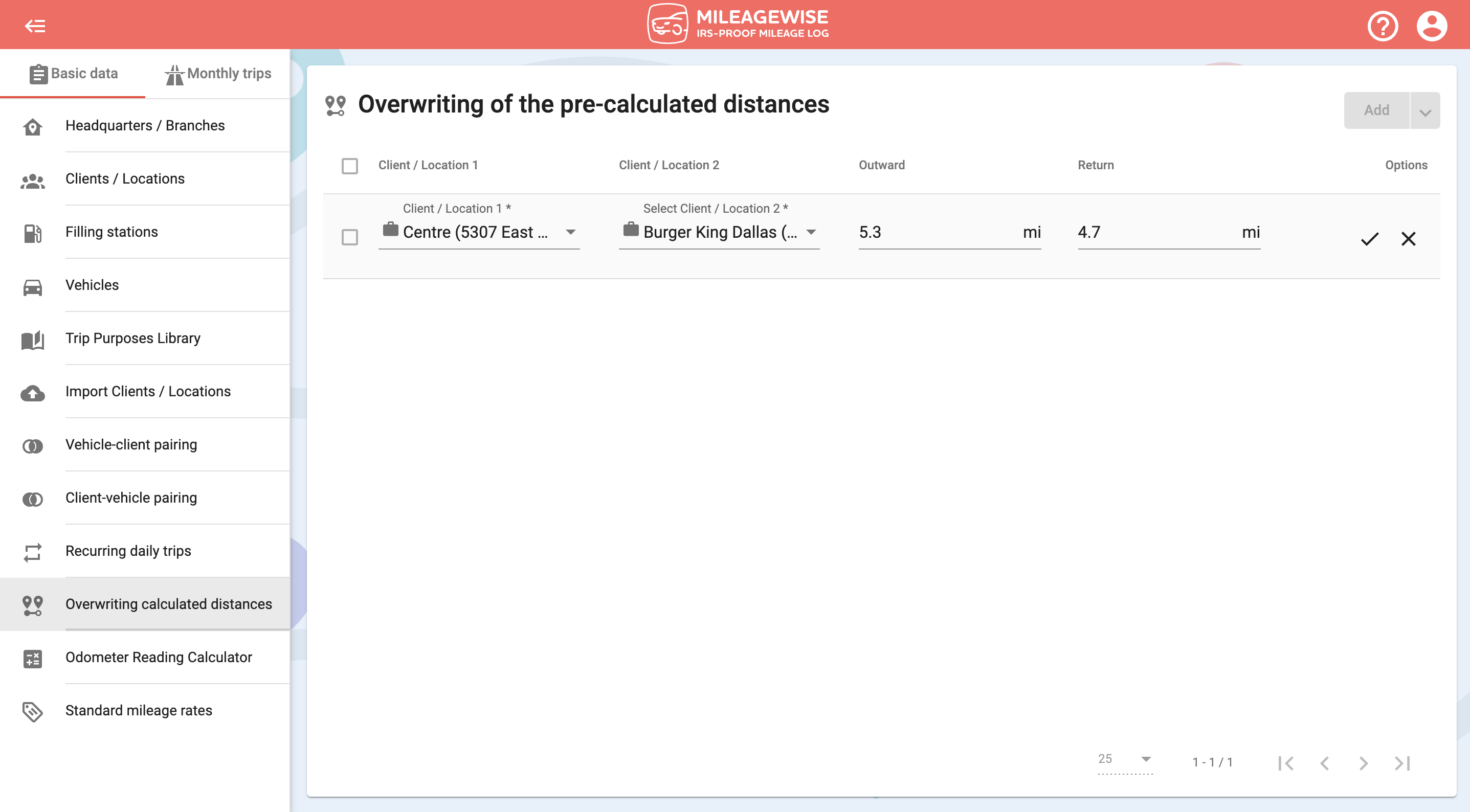

After selecting the clients, the distances are calculated by the program and are automatically filled in, which you can then overwrite.

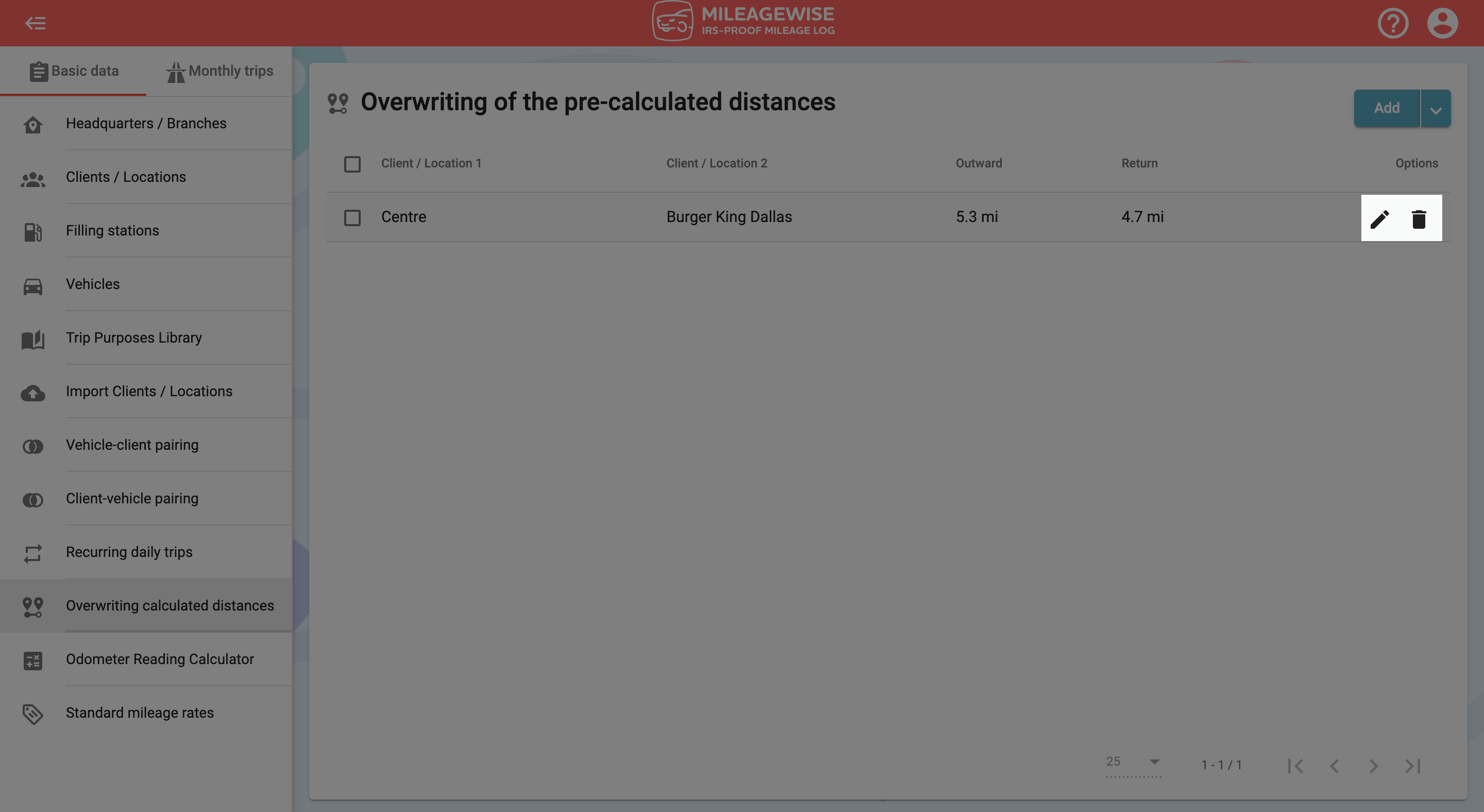

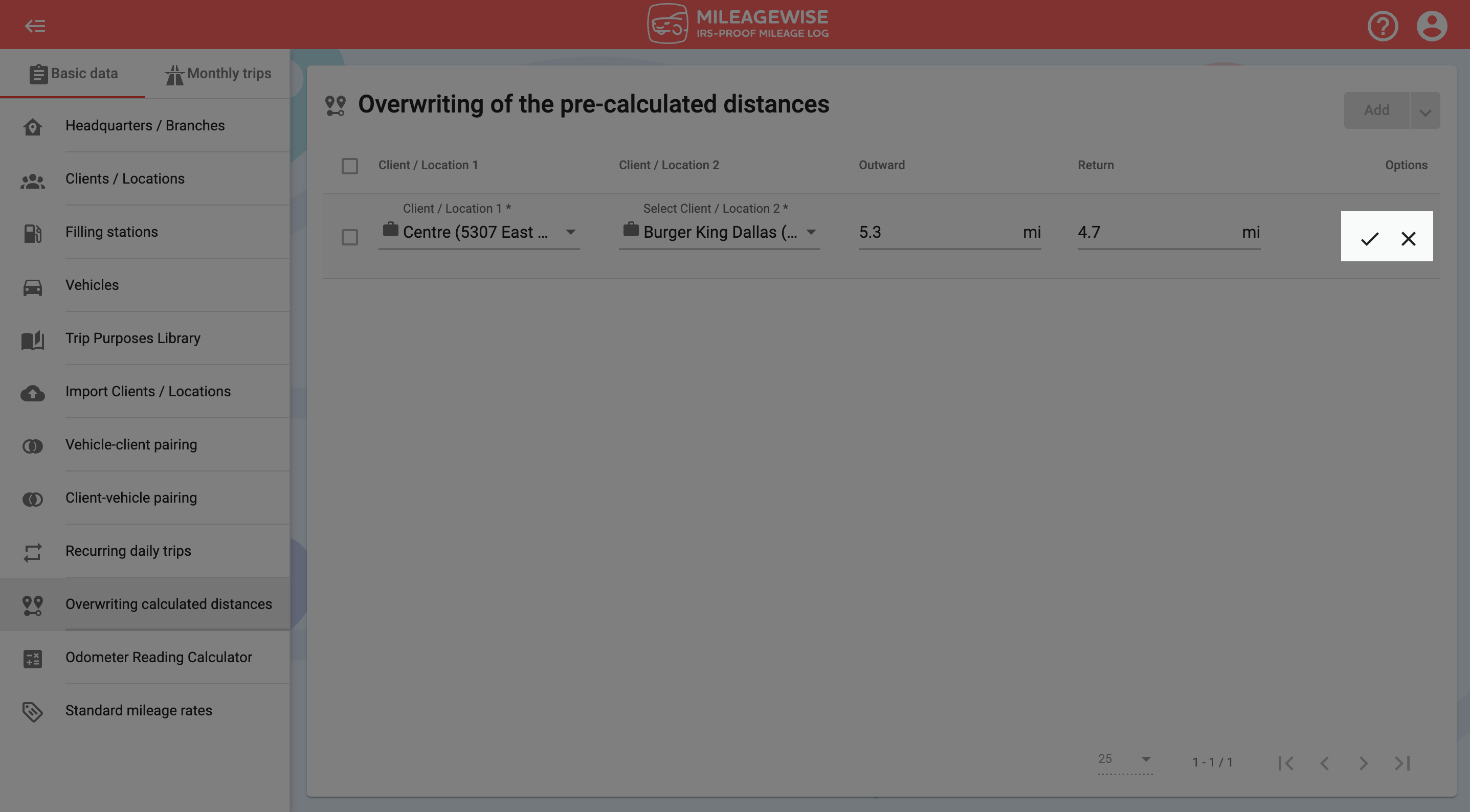

If you want to edit the setting, click the ![]() icon at the end of the line in the list of data, if you want to delete it, click the

icon at the end of the line in the list of data, if you want to delete it, click the ![]() icon.

icon.