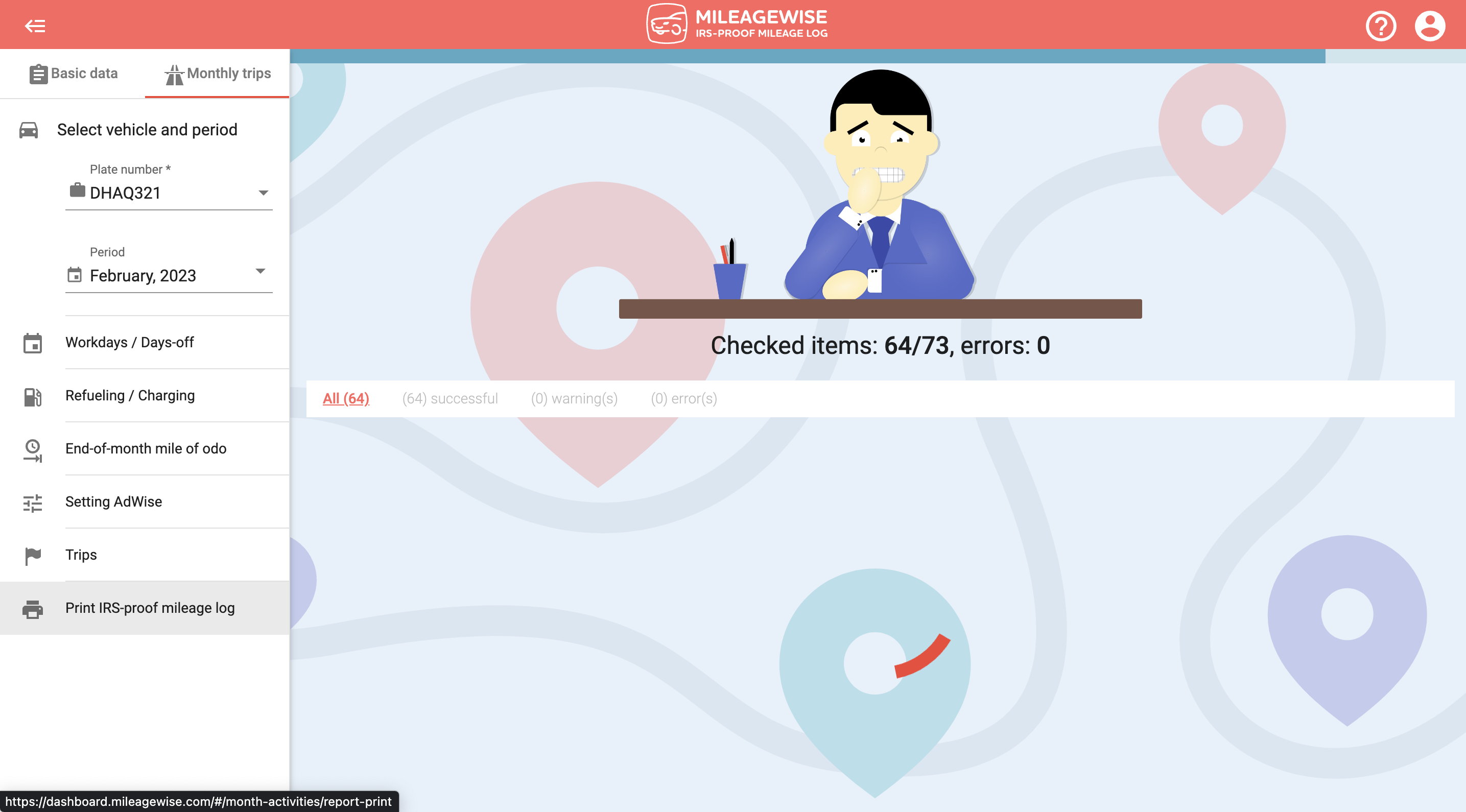

After you have recorded each visit, click on the “Print IRS-proof mileage log” button. Then the program will run a check to see if all the data is entered correctly and if there are any potential red flags that might trigger an IRS audit. This process is fully automated, so you don’t have to worry if you don’t know how to create a mileage log.

When running the checks, the system automatically performs distance corrections.

If all is well, your mileage log will be prepared in accordance with the legal regulations!

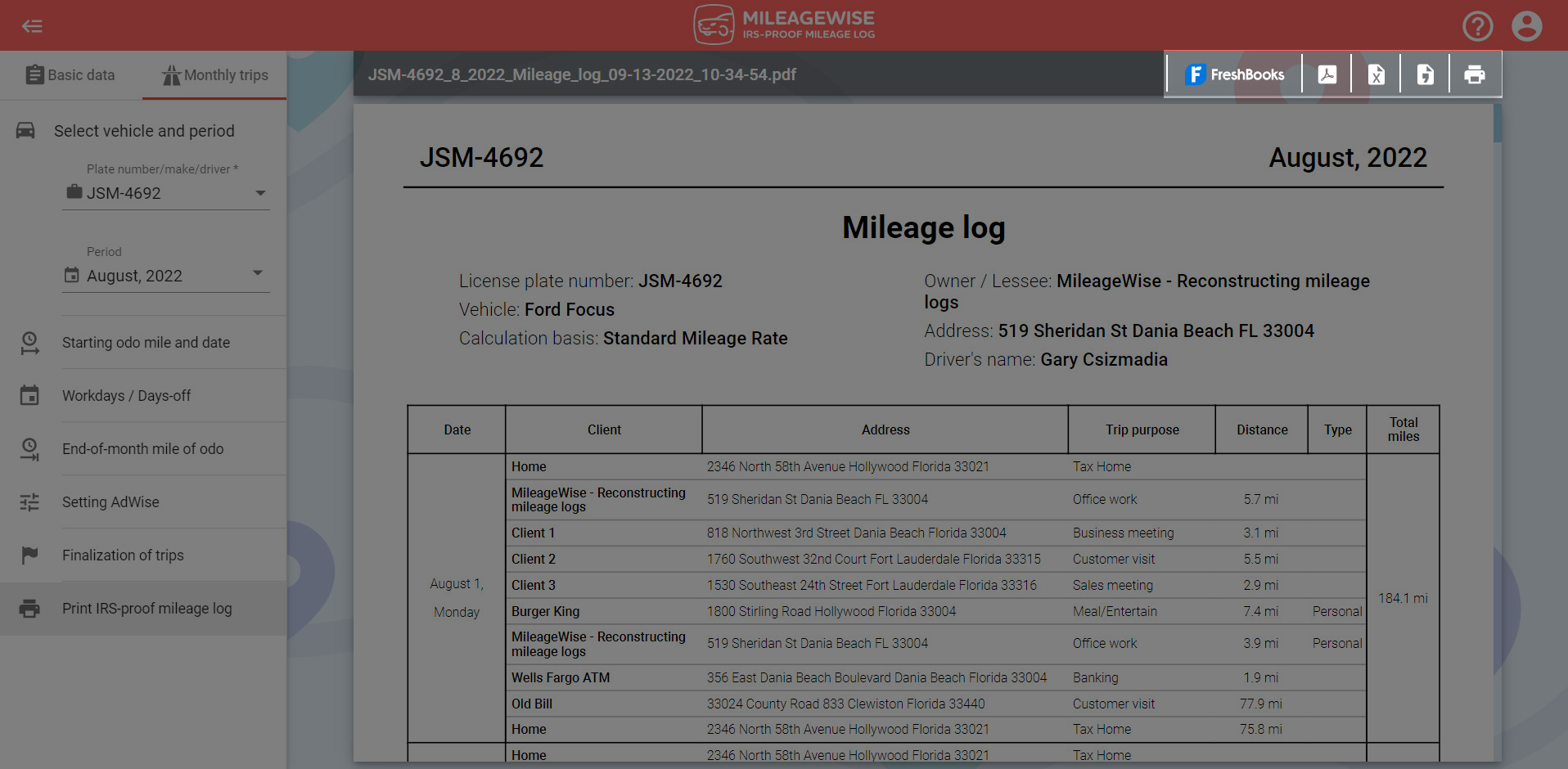

You can download your electronic mileage log directly from the top right of the page. You can save the document as a PDF, Excel, or CSV file. You also have the option to upload your document directly to your Freshbooks account.

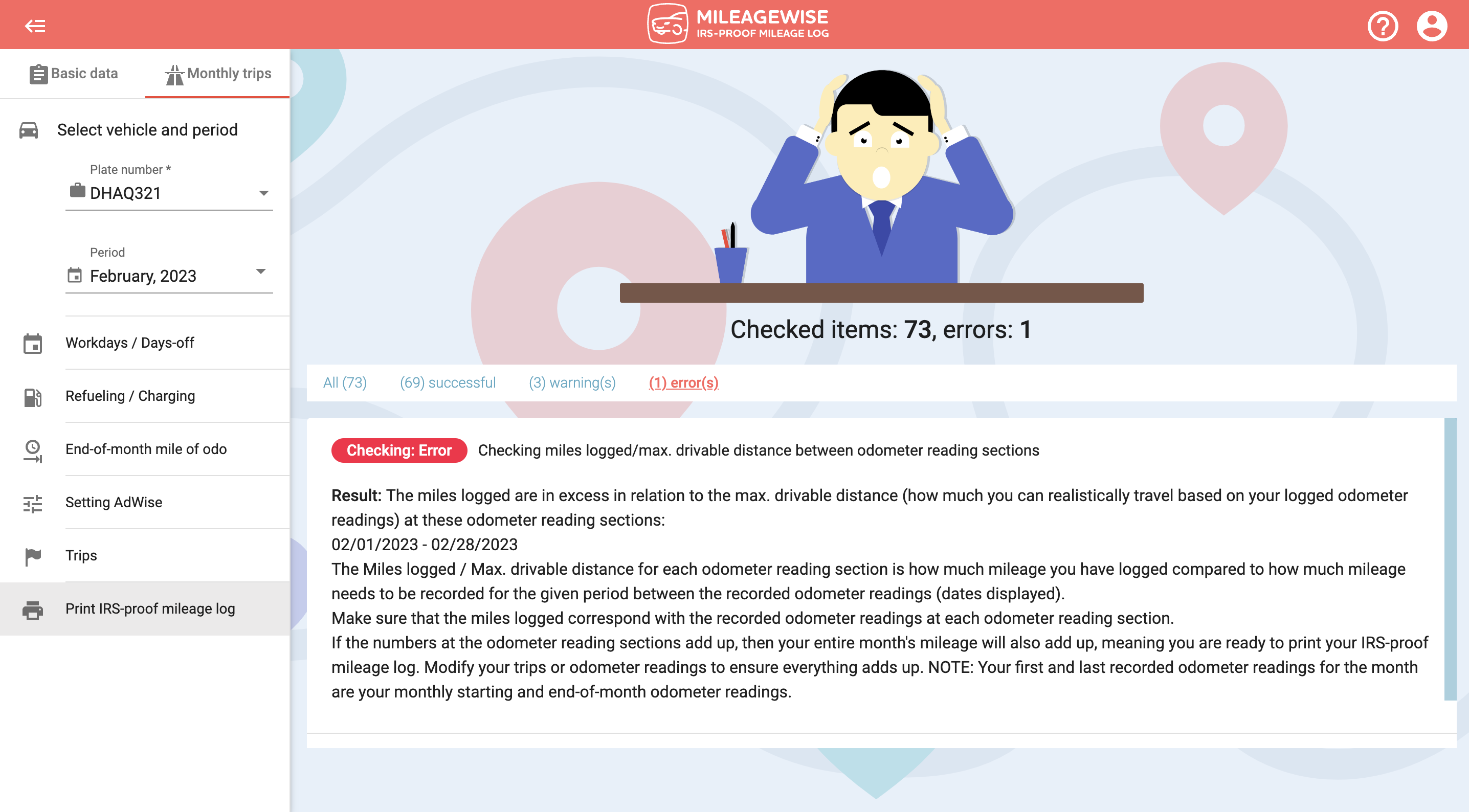

If the program finds an error during the checking process, it will let you know what the problem is and where to make the relevant changes. Click on the button at the bottom of the error message to navigate to the menu where you can fix the error.

For example, if your starting odometer reading is missing, you can click the Add odometer reading button at the bottom of the error message to go to the Starting odometer reading and date, where you can enter your odometer reading.

After correcting the errors, clicking on the Recheck button will jump you back to generating your simple mileage log, where the pre-check will run again.

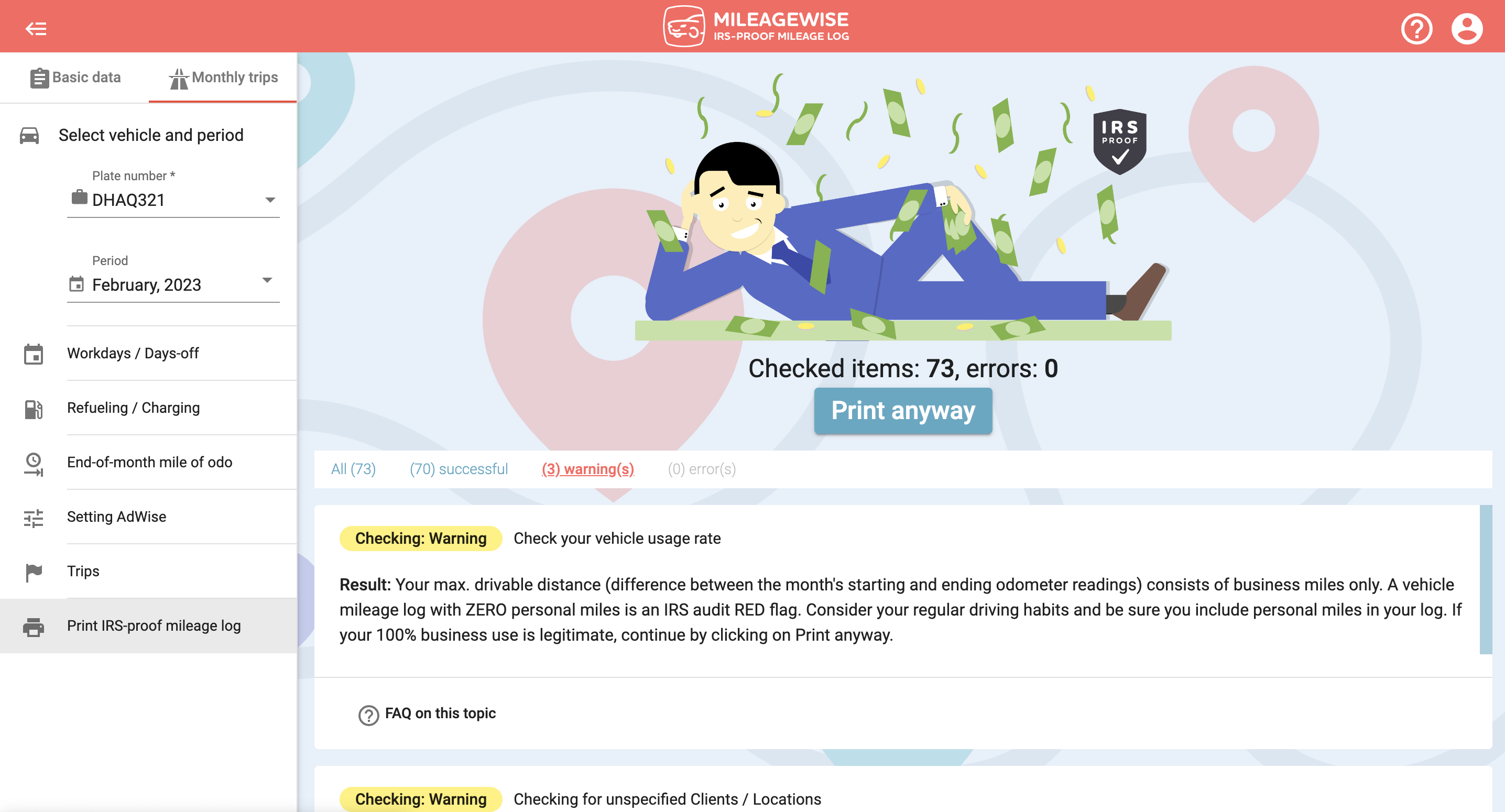

You can generate your IRS-compliant mileage log without correcting the warning(s) by clicking the Print anyway button.

Here are mileage log samples of MileageWise: