What do you want to find out?

How does the Recalculating function work?

- The odometer readings must increment over time, so a later recorded odometer position must be greater than an odometer recorded at a past (ie. earlier) date.

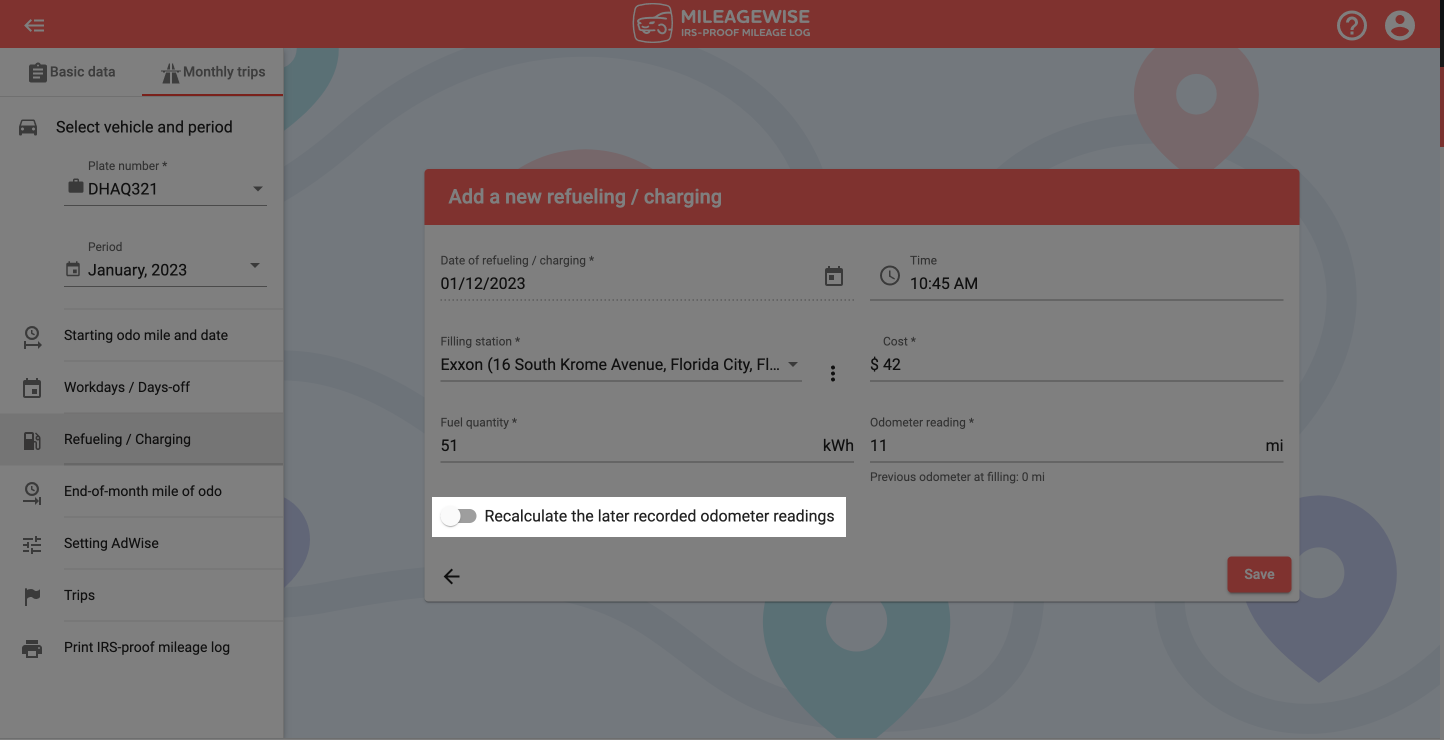

- If you are currently working on retrospectively reconstructing your mileage logs and you are trying to record an odometer for a past date (e.g. 01/02/2017), the Add a new refueling / charging screen menu will display the option to “Recalculate the later recorded readings”.

- The option to recalculate odo readings is only available on the Web Dashboard, but not in the mobile app.

- When the function is switched on, it will increase the number of the later recorded odometer position by the difference between the odometer data that is being recorded at the given refueling and the previously recorded odometer reading.

Example:

January 1, 2020, Starting odometer reading: 1000 mi

January 31, 2020, End-of-the-month odometer reading: 2000 mi

February 15, 2020, Odometer reading at refueling: 2500 mi

If we retrospectively record a refueling with a 1500 mi odometer reading for January 15, 2020 and turn on the “Recalculate the later recorded odometer readings” option, the odometer readings will change as follows:

January 1, 2020, Starting odometer reading: 1000 mi

January 15, 2020, Odometer reading at refueling: 1500 mi

January 31, 2020, End-of-the-month odometer reading: 2500 mi

February 15, 2020, Odometer reading at refueling: 3000 mi

- If the function is not switched on, the odometer position of the refueling inserted after the previously recorded odometers will not change the already recorded odometer readings.

Based on the data in the example above, if you do not turn on the “Recalculate the later recorded odometer readings” option, then after inserting the refueling, the odometer readings are as follows:

January 1, 2020, Starting odometer reading: 1000 mi

January 15, 2020, Odometer reading at refueling: 1500 mi

January 31, 2020, End-of-the-month odometer reading: 2000 mi

February 15, 2020, Odometer reading at refueling: 2500 mi

When should I use the “Recalculate the later recorded odometer readings” function?

- Use this function if you do not record your vehicle’s actual odometer data or only annually (when refueling, you use the mileage calculated by the program) and you want to insert a refueling retrospectively to an earlier date because, for example, you just found a refueling receipt.

- Under no circumstances should you use the function if you regularly record your odometer records after refuelings and at the end of the month, because in this case, these actual odometer readings would also change.