When reconstructing a mileage log, we recommend you proceed in chronological order.

This means that if, for example, the year 2018-2019 is missing, we recommend you start with January 2018 and make your way up to the present.

Following this order (past to present) is important because it is much to easier reconstruct your miles from the start than it is to try to track your miles back in time. An event that happened earlier always affects events that happen later on.

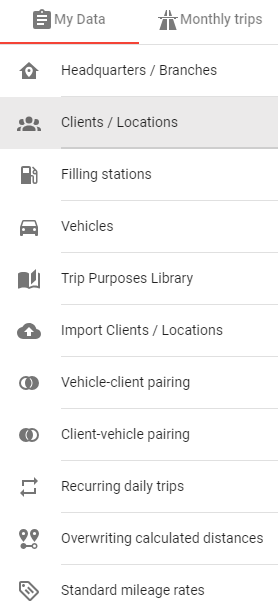

In the program, the menu layout is designed to guide the user.

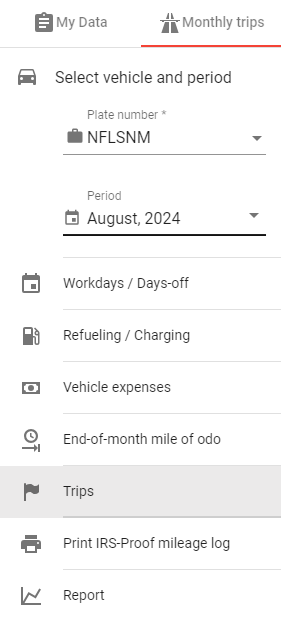

You should go from top to bottom in the My data and Monthly trips menus.

We advise you to start with the My data first.

After that, on the Monthly trips menu, enter the starting odometer reading (recommended), then just keep going downwards.

Proceed with entering the trips (i.e. all trips, including ones connected to parking, speeding tickets, car-related bills, etc.) and then enter the end-of-month odometer reading.

If necessary, set your preferred vehicle usage parameters in the AI Wizard function settings, then go back to the Trips tab to put the finishing touches on your mileage log.

If the miles logged match with the max. drivable distance, the IRS-proof mileage log is ready to be generated.

It’s important to know, that any entered monthly data can be edited or supplemented at any time, so you can’t go wrong with MileageWise.

With the help of the odometer reading calculator, you can calculate how much the odometer readings could have been at the end of each month.

It is important to note that the calculator is a helpful tool, it works with the data inputted, but it cannot take into account actual vehicle use and refueling / charging habits.

For example, if one’s refueling / charging habit is to empty the tank fully every time and to refuel to a full tank, the calculator will be able to calculate a realistic number. But even then, there may be a difference due to consumption, e.g. odometer readings can change depending on whether you drive in the city or on the highway.

If you are interested how a finished mileage log looks like here is a simple mileage log tamplate you can check out.

With our Google Maps Timeline integration for importing your Location History, the AI Wizard Mileage Log Generator for recovering past trips, and our Built-in IRS Auditor that spots 70 potential red flags, MileageWise makes sure your mileage logs are always 100% IRS-proof.

Are you confused about taxes from your 1099 income? A 1099 calculator helps freelancers, rideshare drivers, and other self-employed workers easily figure out taxes. Let’s see how

If you recently opened Google Maps and noticed your Timeline was deleted or partially missing, you’re not alone. In this post, we’ll break down what

If you use the internet for work, you might be able to claim a deduction on your tax return. But how much of your internet

If you regularly pay tolls for work-related travel, you may be wondering: Are tolls tax deductible? The short answer is yes, but only under specific

© 2025 MileageWise – originally established in 2001