IRS MILEAGE LOG REQUIREMENTS:

To meet IRS requirements, your mileage log must include:

- Total mileage for the year, broken down into business, commuting, and personal miles

- Odometer readings from the start and end of the year

- Dates of all business trips

- Client addresses you visited

- Purpose of each business trip

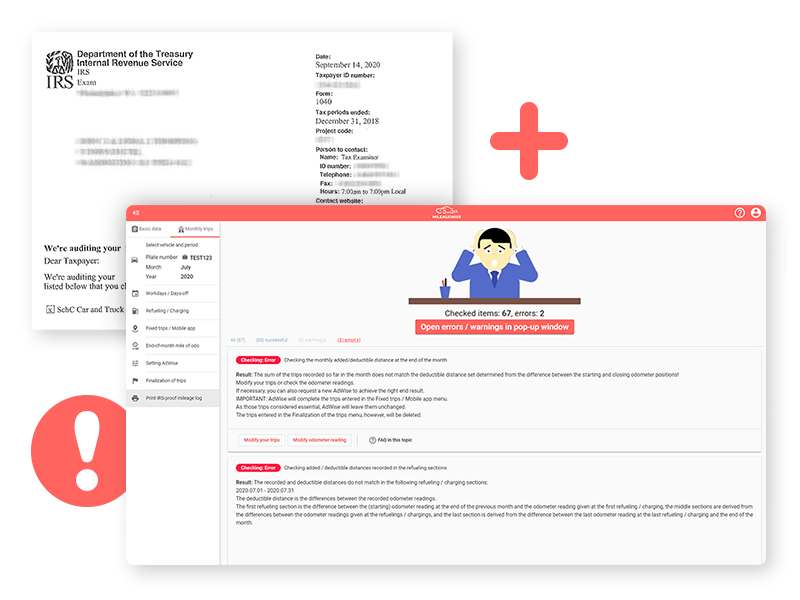

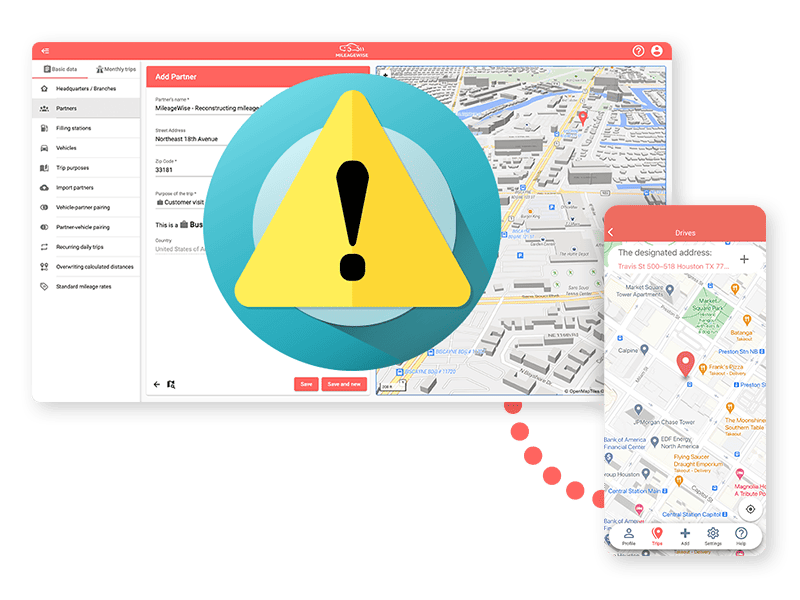

WATCH OUT FOR LANDMINES

Tracking your trips might sound simple, but in reality, the IRS can request all of your business records, including expense reports, odometer readings from your mechanic, traffic camera data, toll receipts, and more. If those documents don’t match your mileage logs, you could face a crushing fine from the IRS.

HOW TO TRACK YOUR MILEAGE?

Some people still track their mileage for taxes on paper. If that is what you prefer, we have a printable mileage log template for you.

However, traditional methods like Excel, Google Sheets, or basic templates won’t perform even the simplest checks, like making sure your odometer readings are realistic.

MILEAGE REIMBURSEMENT

If you (or your employees) drive a personal vehicle for business purposes, you may be eligible for a tax reimbursement on those miles. Use our company mileage reimbursement calculator to see how much you can save in a tax year.

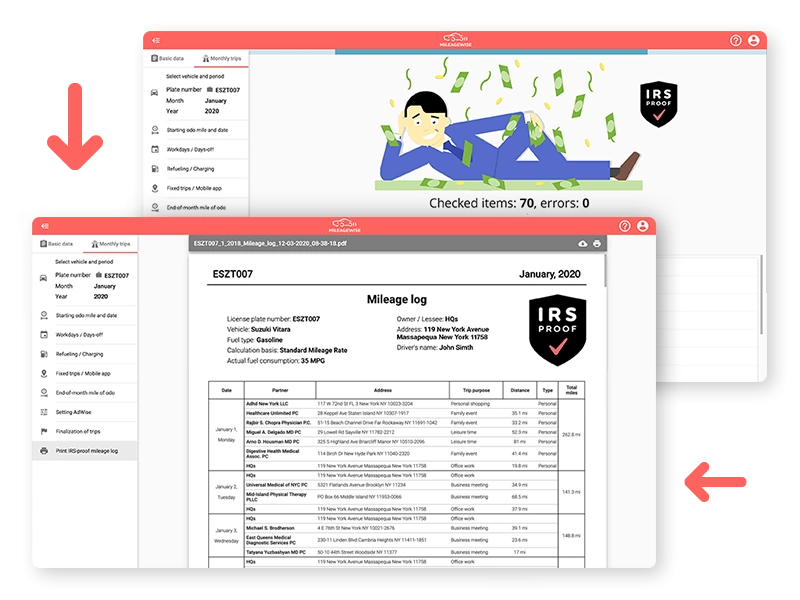

Whether you choose the standard mileage rate or the actual expense method, MileageWise ensures that your mileage logs meet every expectation.

GO WITH THE SMARTEST SOLUTION

Keeping a paper mileage log can take 3 to 5 hours every month. With MileageWise, you can do the same task in just 7 minutes per month.

You have options:

- Keep your log on paper and pay with your time.

- Use free or cheap software and risk receiving an IRS Fine.

- Use MileageWise and save more money and many hours each month.

- Outsource the task to our mileage log experts, and save your time, money and effort.

Don’t forget: Your MileageWise subscription is also deductible as a business expense.

BE WISE, CHOOSE MILEAGEWISE

MileageWise checks and corrects 70 potential red flags in your mileage logs before finalizing them, ensuring they are IRS-proof. It takes just 7 minutes to complete a full month of mileage logs, helping you claim $1,000s in deductible taxes a year.

MileageWise also offers an app for both iOS and Android phones so that you can record your trips on the go.