Calculate how much money you can get back with IRS-Proof mileage logs:

FRAGMENTED MILEAGE LOGS?

If you work for multiple rideshare platforms like Uber or Lyft, you’ll often end up with fragmented mileage logs. If you can’t account for all the miles you drove for business, you could miss out on valuable tax deductions! On top of that, an incomplete mileage log may not meet IRS requirements.

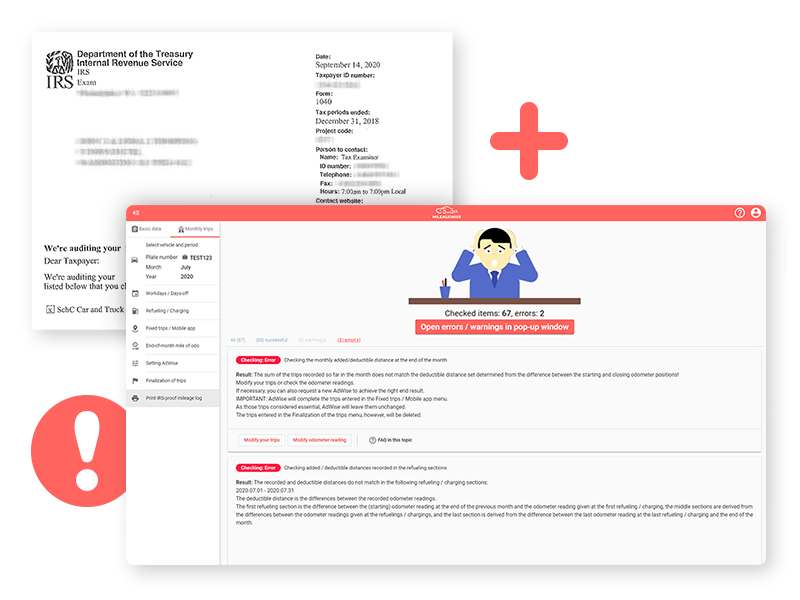

A FINE FROM THE IRS IS NO JOKE!

The IRS can request all of your business records, including gas receipts, proof of business expenses, and odometer readings from mechanics or safety inspections. So your mileage logs need to be bulletproof to avoid hefty fines from the IRS in case of an audit— guessing your trips isn’t an option.

MILEAGEWISE TO THE RESCUE

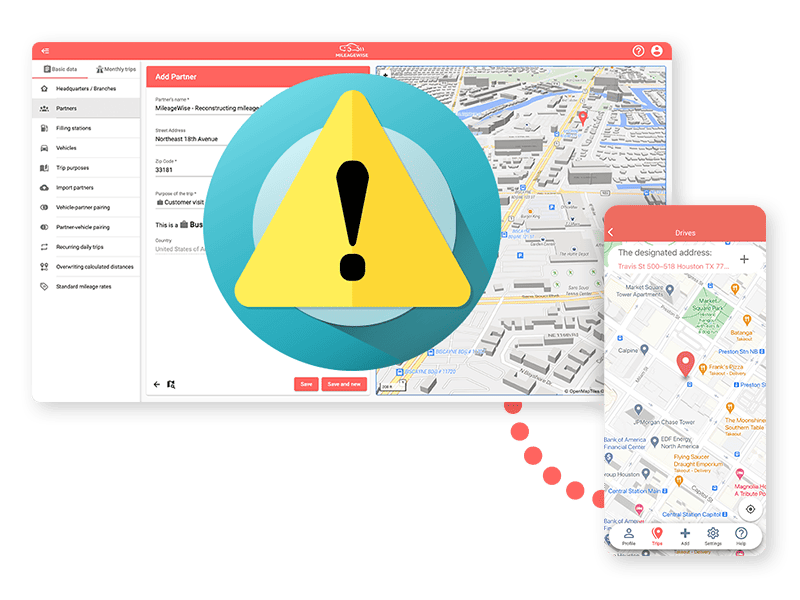

You can track your mileage with the MileageWise app at the same time as the other apps you use. Or, if you already have mileage logs, you can import them into the web dashboard.

Once your trips are imported, our AI Wizard will automatically recommend trips to fill any gaps in your log.

MAX OUT YOUR TAX DEDUCTIONS!

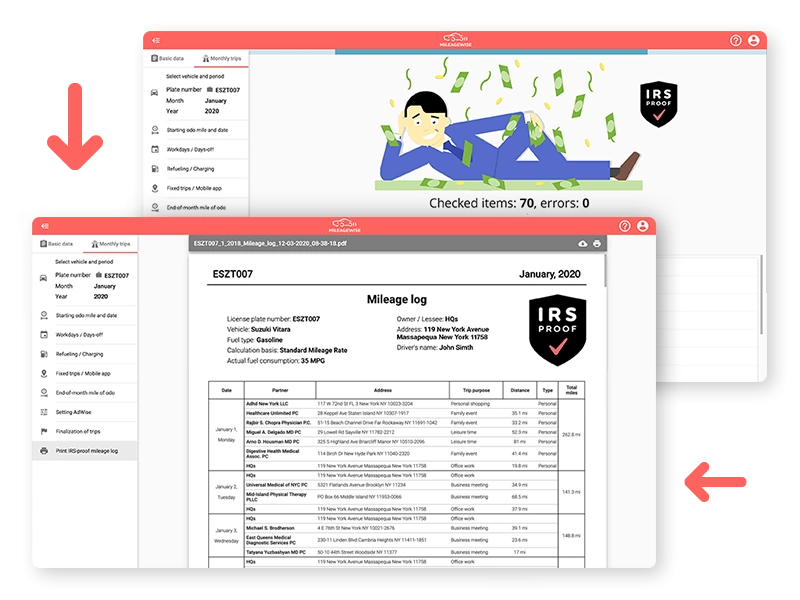

As you create your log, the built-in IRS auditor checks and corrects 70 potential red flags to make sure your final mileage log is flawless and IRS-proof.

Take advantage of our 14-day free trial and try all of our unique features. By protecting yourself from the costly consequences of inaccurate logs, you’ll see why MileageWise is one of the most affordable solutions on the market.