Last updated: November 22, 2024

Did you know that American taxpayers fell short of $1 billion in refunds because they didn’t file their tax returns for the year 2020? If you drive a car for a business purpose, there’s a good chance you are eligible for a mileage tax deduction on your federal income tax return, up to 3 years in retrospect.

This guide will help you understand how to log miles for taxes efficiently and maximize your 1099 deductions. We promise to provide clear, actionable tips to simplify mileage tracking and ensure you get the tax benefits you deserve.

Table of Contents

Why Track Mileage for Taxes?

Knowing how to how to track mileage for taxes accurately is crucial for reducing your tax burden. Freelancers, self-employed individuals, small business owners, and even some employees can benefit from mileage deductions. The IRS allows you to deduct a specific amount per mile driven for business purposes, which can add up significantly. Keeping a detailed mileage log can help you maximize these deductions and minimize the risk of an audit.

Business vs. Personal use: What’s Business Mileage?

It is essential to understand what qualifies as a deductible business mile and what does not. It is important to distinguish business miles and personal miles.

Business use purposes:

- Business meeting/conference

- Driving to a client

- Business lunch with a client

- Going to the post office, bank, or Home Depot for work supplies

- Medical purposes

- Running business-related errands

Personal use purposes:

- Commuting between home and the company’s headquarters

- Doing personal shopping

- Going to a family event

- Driving to the cinema/theatre

- Gym or other sports purposes

It’s vital to know that you need to track both purposes in your mileage report, so you get the ratio of personal and business trips.

Don’t run into trouble by claiming 100% business use of a vehicle at any cost. Using MileageWise’s AI-based AdWise Wizard feature, you can easily set the ratio of business and personal trips, so you get the best recommendations of forgotten trips retrospectively, auto-populated to fill in the gaps for your 100% IRS-Proof Mileage Log.

Take control of your mileage tracking for taxes and maximize your savings! Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

The Two Methods of Keeping Records for Mileage Reimbursement

There are two primary ways to claim mileage reimbursement on your taxes: the Standard Mileage Rate and the Actual Expense Method. Keep in mind that you cannot change the method in the same year.

Standard Mileage Deduction

This is the easier way, as you only need to track the number of miles driven in a year for business purposes, then you multiply it by IRS’s Standard Mileage Rate. Based on the average business miles claimed on taxes, it can add up to 12,000 per tax year. Be aware that by choosing this option, you won’t be able to deduct any specific operational expenses on the car (maintenance, fuel, insurance, etc.), but the IRS aims to cover all of these costs in the standard mileage rate.

Actual Expense Method

If you feel like you can’t get the most out of the standard mileage rate, you can still go with the Actual Expense Method. Although this way gives you the chance to deduct all your car-related business expenses depending on the ratio of your business miles, it takes more time to collect all of the receipts for your repairs, registration fees, refuelings, lease payments, garage rent, depreciation, licenses, insurance, tires, tolls, and parking fees. You must choose this option if you have 5 or more cars. Remember that if you choose this method, you also have to keep copies of all the relevant documentation, such as receipts or bills.

Both methods have advantages and disadvantages, and the right one depends on your specific situation. The Standard Mileage Rate is usually best for those who drive a lot of miles, whereas the Actual Expense Method may be preferable if you have significant vehicle-related expenses.

How to Track Mileage for Work

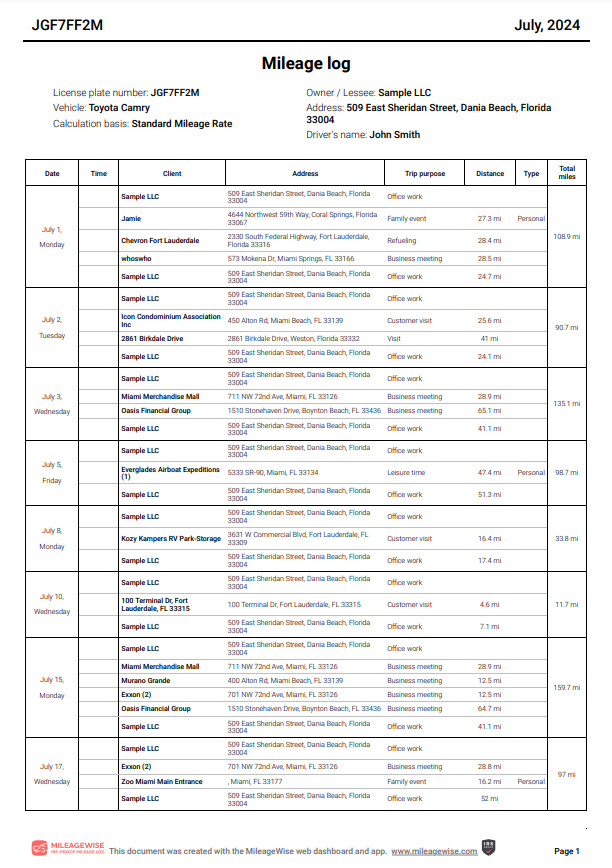

To comply with IRS requirements, your mileage log should include the following information:

- Date of each trip: Record the exact date when the trip took place.

- Purpose of the trip: Clearly state why the trip was taken (e.g., meeting with a client, buying supplies).

- Starting and ending points: Document both the starting location and the destination of each trip.

- Miles driven: Note the number of miles driven for each trip.

- Starting and ending odometer readings for the year: Record your vehicle’s odometer reading at the start and end of the year.

Common mistakes people make include failing to log trips consistently, missing key information, or providing vague descriptions of trip purposes. These errors could lead to audits or deduction rejections. These problems could be easily avoided using a free mileage tracker. Consistency and accuracy in your log are essential for ensuring your claims are accepted.

Here is an example:

How to Log Miles for Taxes?

Pen and paper vs. Mileage tracker app & web dashboard

There are several ways to keep track of your business miles: You can create a mileage log on paper, on Google / Excel Sheet, a printable Mileage Log Template or you can use a Mileage Tracker for taxes on your phone – sometimes accompanied by a Web Dashboard.

However, backtracking your business miles to reconstruct your mileage log on paper, especially retrospectively can be extremely difficult. There are countless fixed data and circumstances you have to keep in mind and put into your mileage log very precisely. It is a cheap solution, but at the end of the day, you will certainly ask yourself: Is it worth it?

Even mileage trackers with GPS technology are inexact sometimes because they can only track real-time driving, they cannot be used for reconstructing or creating logs retrospectively.

Calculating Your Reimbursement

Once you have a detailed mileage log, calculating your reimbursement is straightforward. Multiply the number of miles you drove for business by the IRS standard mileage rate. Keeping accurate and complete records will support your claim and help you get the maximum reimbursement without any issues. Double-check your entries and keep receipts if you choose to use the Actual Expense Method.

How to Deduct Miles from Taxes

Deducting miles from your taxes is easy when you have a proper mileage log. Here’s a step-by-step guide:

- Step 1: Total up all your business miles for the year.

- Step 2: Choose between the Standard Mileage Rate or Actual Expense Method.

- Step 3: Fill out the appropriate forms (e.g., Schedule C for self-employed individuals).

- Step 4: Include any supporting documents with your tax return to back up your claims.

- Step 5: Make sure you file before the deadline to avoid penalties. Following these steps can help you stay compliant with IRS requirements and avoid any surprises during tax season.

How to Recover Past Miles Retrospectively?

MileageWise’s the AI Wizard feature reconstruct your past trips according to past driving patterns and your preferences. Meanwhile, the Built-in IRS Auditor feature will check and correct 70 potential red flags in your logs to guarantee IRS-compliance.

Having your past mileage logs reconstructed, you can continue tracking your trips with MileageWise manually.

Can MileageWise also track Miles?

Absolutely. MileageWise’s Mileage Tracking App has Automatic Tracking based on Real-life drivers’ needs, experiences, and feedback. Furthermore, it has no unnecessary features, so your trips will be detected automatically without using up your Data and Battery.

On a tight deadline?

Outsource the task of keeping your mileage log to us!

FAQ

What is the Standard Mileage Rate?

The Standard Mileage Rate is a per-mile rate set by the IRS that you can use to calculate your mileage deduction. For 2024, the rate is 67 cents per mile. This method is simple and covers costs like fuel, maintenance, and insurance.

Who should track business miles?

Anyone who uses their car for work-related purposes should track their business miles. This includes freelancers, self-employed individuals, small business owners, and even employees who use their vehicles for work tasks.

What information is needed in a mileage log for taxes?

Your mileage log should include the date of each trip, purpose of the trip, starting and ending points, miles driven, and starting and ending odometer readings for the year. This helps ensure IRS compliance and accurate deductions.

Can I switch between the Standard Mileage Rate and Actual Expense Method?

You can switch methods, but not within the same year. Choose the method that gives you the highest deduction and stick with it for that tax year.

What are business miles vs. personal miles?

Business miles are any miles driven for work purposes, like client meetings or buying work supplies. Personal miles include commuting to your regular workplace, going to social events, or running personal errands. It’s important to distinguish between the two in your mileage log.

How do I deduct mileage from my taxes?

To deduct mileage, total your business miles for the year and multiply by the IRS Standard Mileage Rate. Then, fill out the appropriate tax forms (e.g., Schedule C) and attach any supporting documentation. Make sure to file before the tax deadline.

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |