Last updated: October 24, 2023

A bit of a Hurdlr history

Hurdlr, the company behind the well-known automatic business expense & mileage tracker, was co-founded by Raj Bhaskar and Anup Desai. Raj Bhaskar has a background in creating solutions for real estate and financial management, which likely influenced the development of Hurdlr’s feature set geared towards automating and streamlining accounting tasks.

So what is Hurdlr for?

The company aims to simplify financial and tax management for freelancers, independent contractors, small business owners, and even enterprises. The latter can use the Hurdlr app as a value-added part of their service to help customers, members or contractors manage business finances and grow their profit more easily. The solutions, in general, have been designed to integrate with bank accounts, credit cards, and popular platforms like Uber, Airbnb, and Lyft, making it easier for users who engage in gig work or run small businesses to track their income, expenses, and tax obligations automatically.

The Hurdlr mileage tracker app has gone through several updates to refine its features and user experience over the years, so let’s see what it has to offer users at its present incarnation, especially in terms of IRS-proof mileage tracking, which is a crucial ingredient of the overall picture encompassing business expanse tracking and tax estimation.

Getting Started

Right from the beginning, Hurdlr prepares your account for the interrelated scenarios of mileage, income, and expense tracking so that you can claim the highest possible deduction amount.

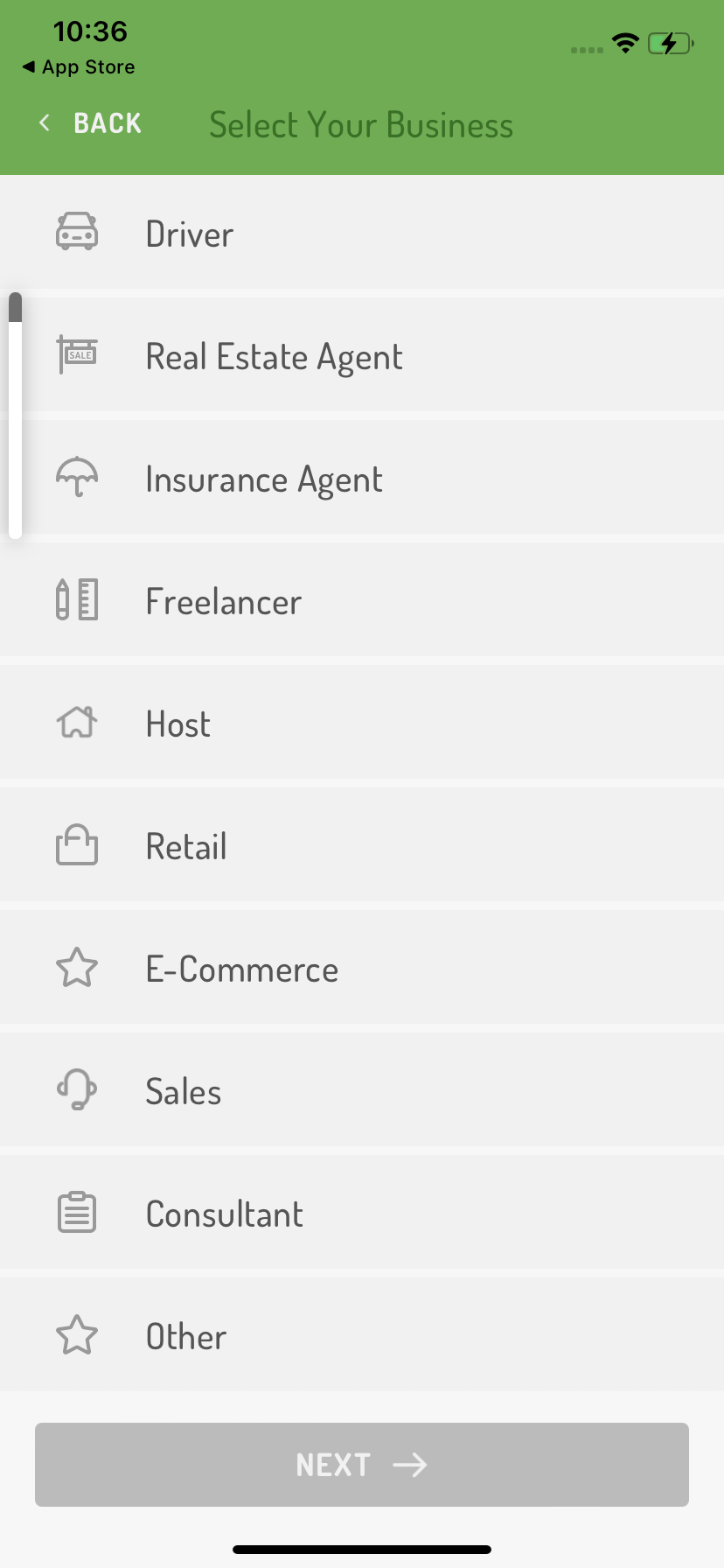

On the first screen, you can select the business profile you want to track. As you can see, Hurldr caters specifically to drivers, small business owners, sales reps, and so on. For the sake of the testing, I’ve selected the Driver option:

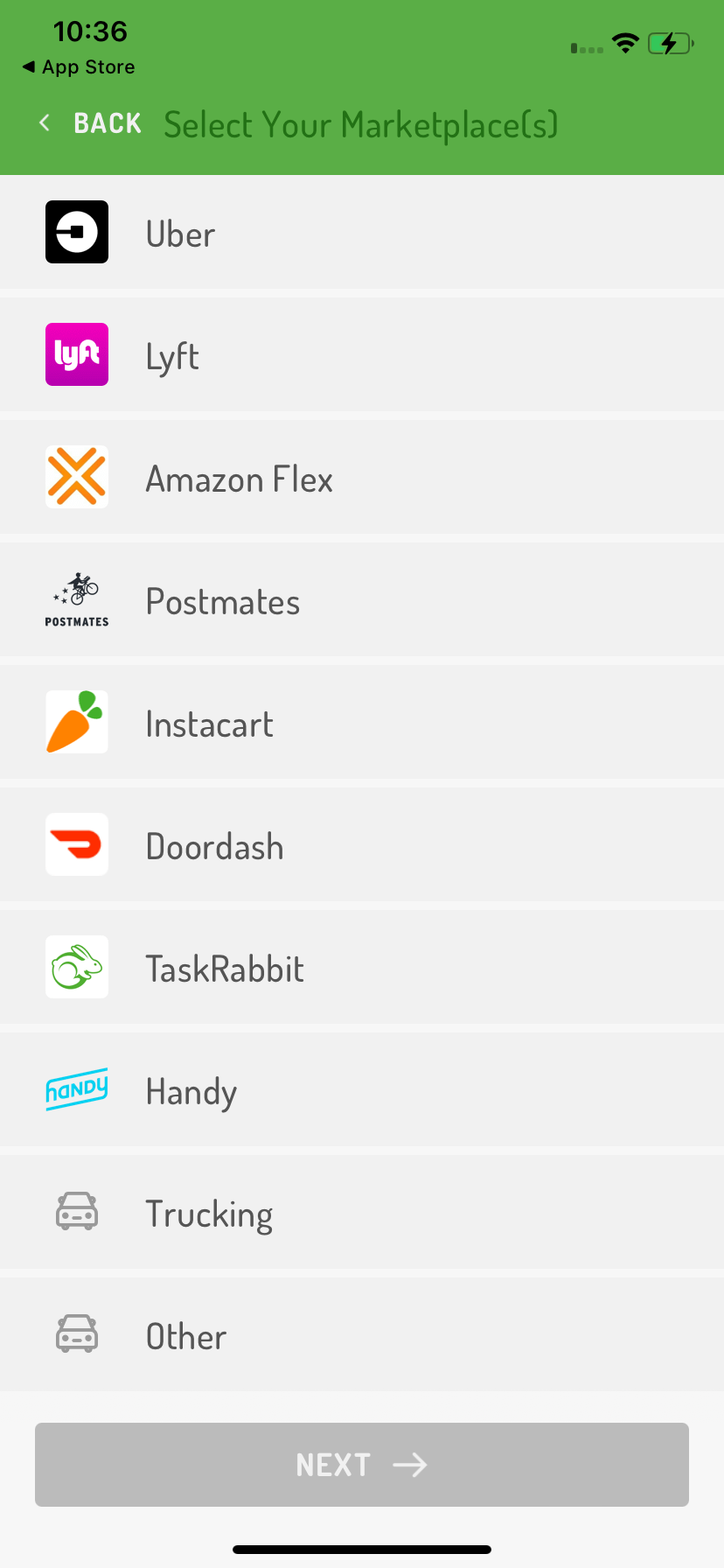

In the resulting screen, the idea of accurately targeted tracking is taken a step further. Here you can even select the company you do delivery driving for. Let’s say you drive for Uber, so if you select that option, now Hurdlr will help you take care of your Uber driver taxes:

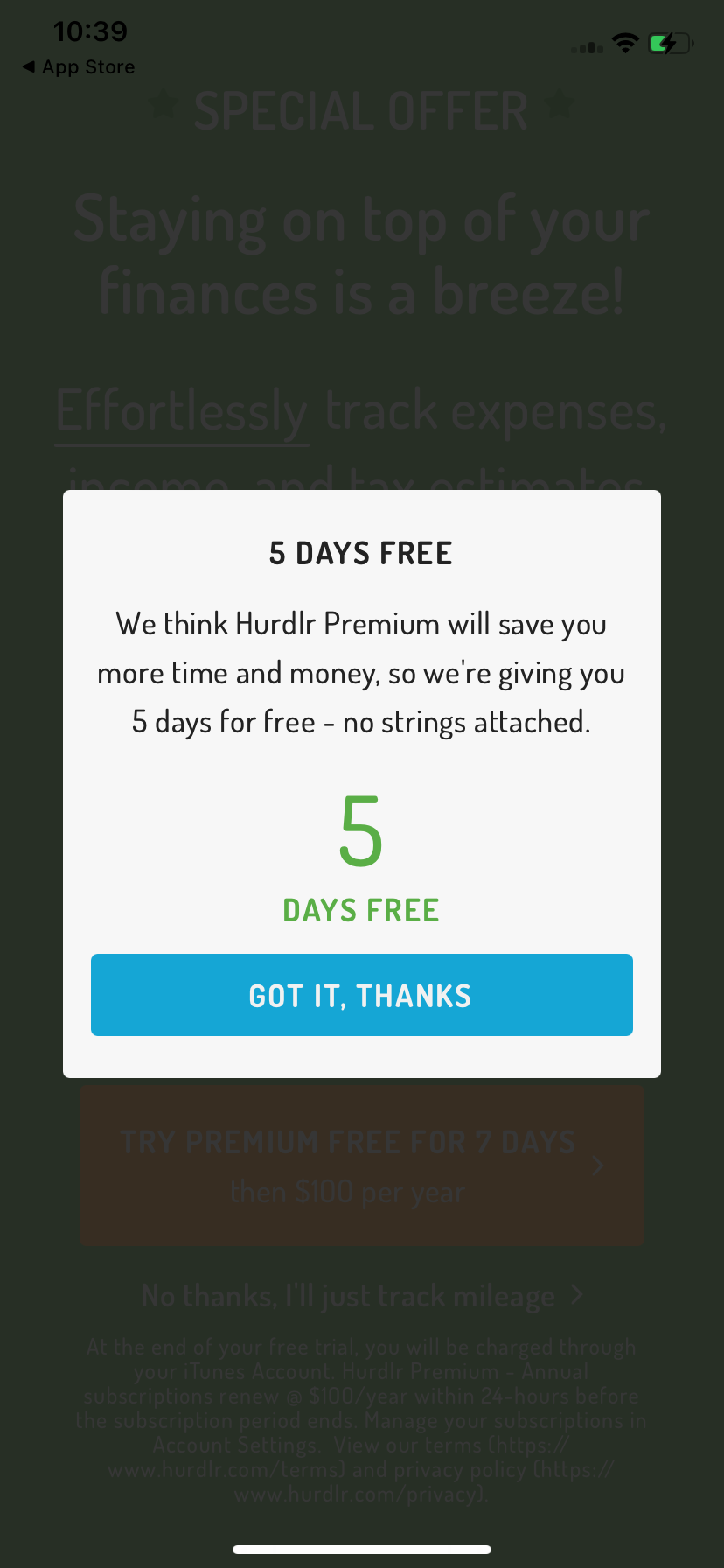

Once your setup is done, you get 5 days of tracking for free:

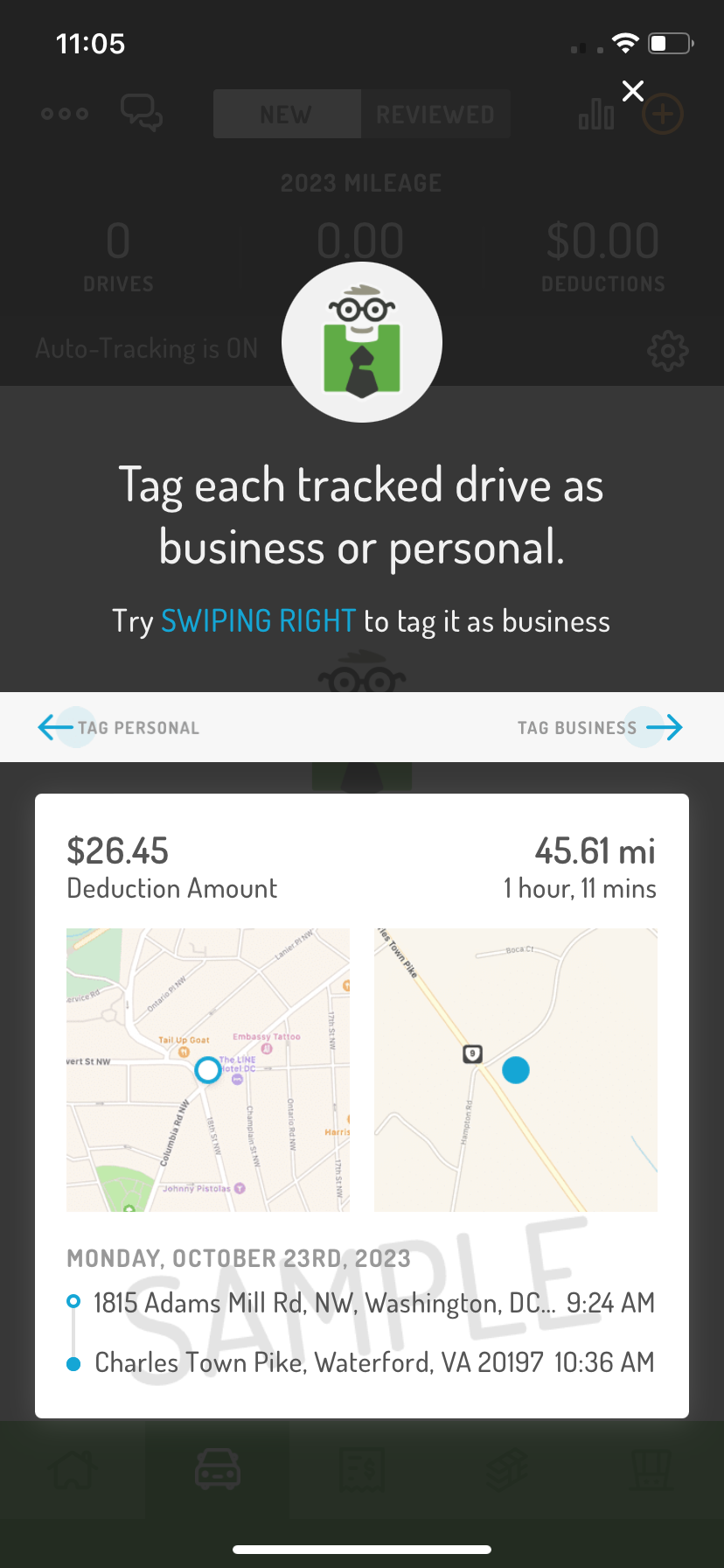

Now the app is ready to start tracking your mileage automatically. Once a trip is done, you can decide its purpose by a simple swipe:

The Full Spectrum of Tracking

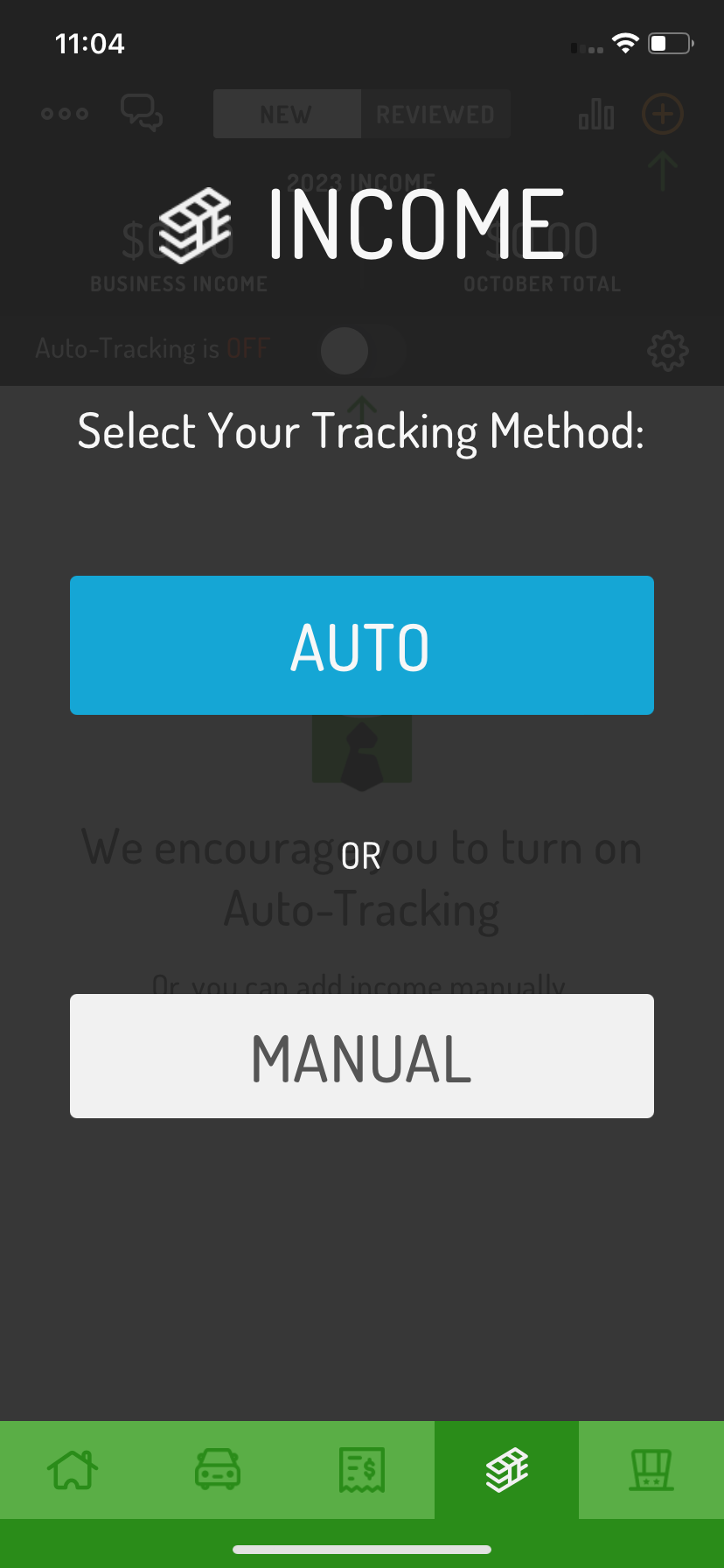

As mentioned in the intro, Hurdlr’s forte is in offering comprehensive tracking not only for your mileage but income and expenses too so that you get a full picture of how much you could potentially deduct and save. During the setup, you can also decide how other areas, like income and expenses, should be tracked:

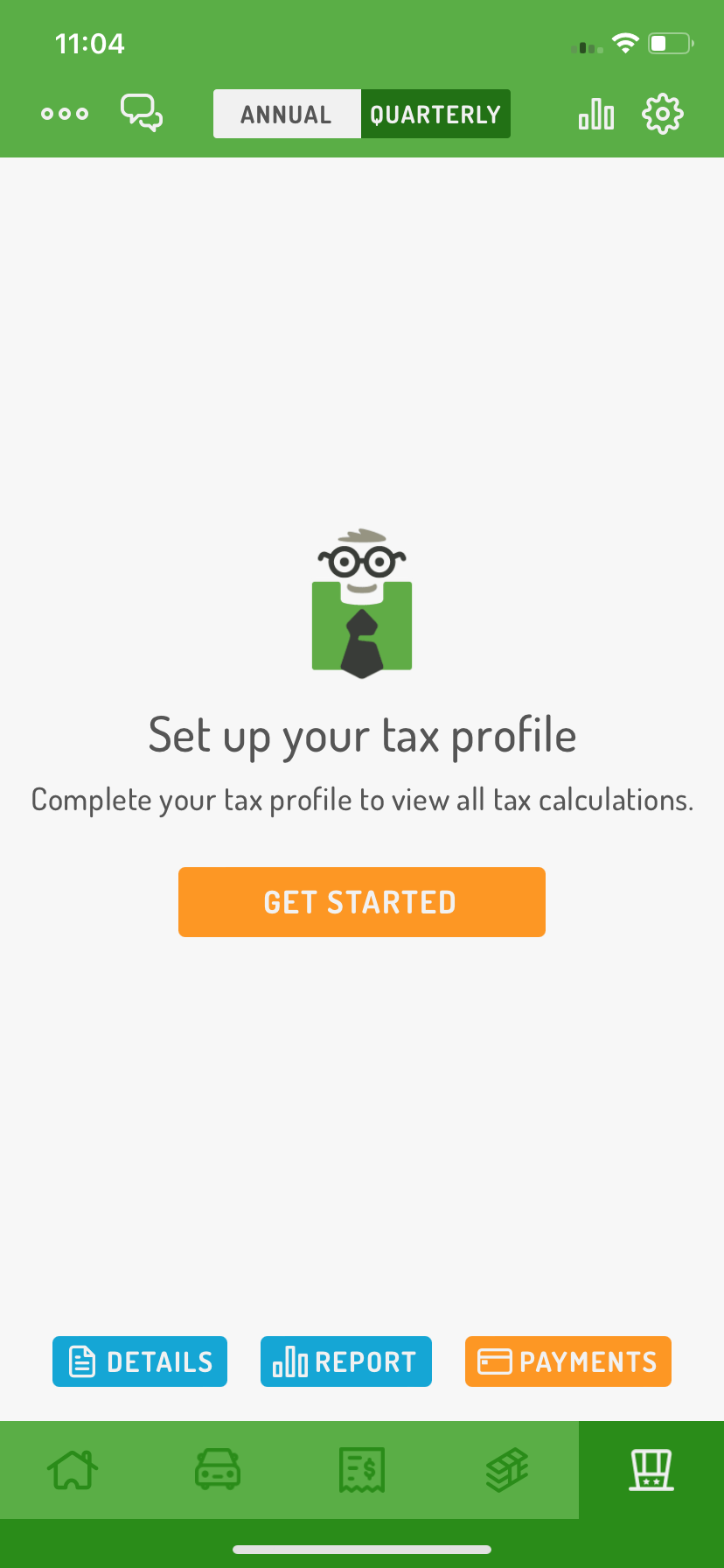

You can also set your tax profile to be able to view everything in one place:

Pros and Cons of using Hurdlr – The Good

In general, its user-friendly interface, automation capabilities, and real-time tax estimates are particularly beneficial for freelancers and small business owners who may not have the time or expertise to manage their finances manually. So let’s start with the pros in detail:

Automatic Tracking:

Hurdlr excels in automating the tracking of expenses and mileage, removing the need for manual entries for each expense. This is a huge time-saver and minimizes the risk of errors or omissions.

Auto-tagging Repeat Drives

If you often find yourself driving the same routes for business purposes, Hurdlr offers an auto-tagging feature. This function remembers your frequent trips and automatically categorizes them for you, making the logging process even more straightforward.

Easily separate business and personal trips

Hurdlr provides a simple and quick method for categorizing your trips as either business or personal. This feature often involves using arrows or swipes in the app, making it effortless to separate business miles from personal miles, which is essential for tax purposes.

TIP: Nice try, but how about MileageWises’s uber-convenient, AI-powered trip auto-classification feature that makes sure your business trips and personal trips never get mixed up again?

Real-time Tax Estimates:

Hurdlr provides a real-time view of your tax obligations based on your income and expenses, which is incredibly useful for planning and budgeting.

Integration:

The app can integrate seamlessly with other platforms you might use for your business like Uber, Lyft, Airbnb, PayPal, and Stripe thus capturing your financial data, including mileage information, from multiple sources in one place.

User-Friendly Interface:

The user interface is clean and intuitive, making it easy even for users who aren’t tech-savvy.

Export and Reporting:

The app allows for easy export of your financial data, which is useful for sharing information with your accountant or for your records.

Let’s take a look at the Cons now:

Subscription Model:

The premium version, which you can try for free for 5 days, starts at $10/mo. – Hurdlr’s pricing might be considered a bit pricey for small business owners or freelancers who are just starting. Limitations in the free version include no access to the fully automatic mileage tracker feature – it means that you need to manually start and stop tracking for each trip, which could be okay for people who track a round-trip a week, but not for those who track daily.

Limited assistance in IRS compliance:

While the Hurdlr website does describe at length the importance of keeping proper logs to prepare for an IRS audit, the mileage tracker solution doesn’t necessarily offer any tangible help in this regard, sort of leaving it up to the user to smarten up in the subject matter and then decide how seriously they’ll take the relevant requirements.

But should we just accept that that’s the best a mileage tracker app can do for the user? What about trip gaps? What about the need for retrospective logs or the ability to import Google Timeline logs to cover trips that never got properly taken care of? No mention of these in the Hurdlr book.

MileageWise, however, offers users a great deal of help in this regard, going as far as checking and correcting 70 possible IRS red flags in their records before letting the user generate the final log. It is literally like having an IRS-auditor in the user’s pocket.

Moreover, MileageWise’s AI Wizard suggests plausible trips based on your driving patterns, helping to complete any gaps in your mileage log for a result that’s compliant with IRS requirements.

Wrapping it up

While, ultimately, Hurdlr is a 2-in-1 automatic business expense & mileage tracker, its mileage tracker solution falls short of explicitly helping its customers achieve IRS-proof logs, which not only serve as the backbone of the tax deduction for business mileage but are also an integral part of the bigger picture. If your mileage log deduction stands on weak legs, your overall business expense tracking and, consequently, your overall tax deduction opportunity will also suffer. As a verdict, Hurdlr could do with a feature like MileageWise’s above-mentioned AI Wizard.

Plus, if you make the move to MileageWise, you don’t need to worry about losing the opportunity to do expense tracking and mileage tracking in one go. You can already avail of the vehicle expense tracker in the MileageWise web dashboard and the great news is that the same feature will also be available in the mobile app soon!

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card is required!

See Why The Wise Choose MileageWise

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |