May 3, 2024

Brace yourselves, fellow travelers! We’re about to take a scenic drive through the twists and turns of IRS mileage allowance. Yes indeed, those seemingly tiny miles can accumulate into a mountain of savings over the year. And with the current IRS mileage rate cruising at a smooth 67 cents per mile, there’s no better time than now to pull out that calculator and start tracking your business mileage.

Keeping Tabs on Those Miles – A Business Owner’s Best Friend

First things first: if you’re scratching your head about how to calculate IRS mileage allowance, let’s clear the fog. Just imagine each mile you drive for your business as a tiny nugget of gold. Now, imagine letting those golden nuggets slip through your fingers. Grim picture, huh? Whether you’re a small business owner, a bold entrepreneur, or a hard-grinding gig worker, every mile matters.

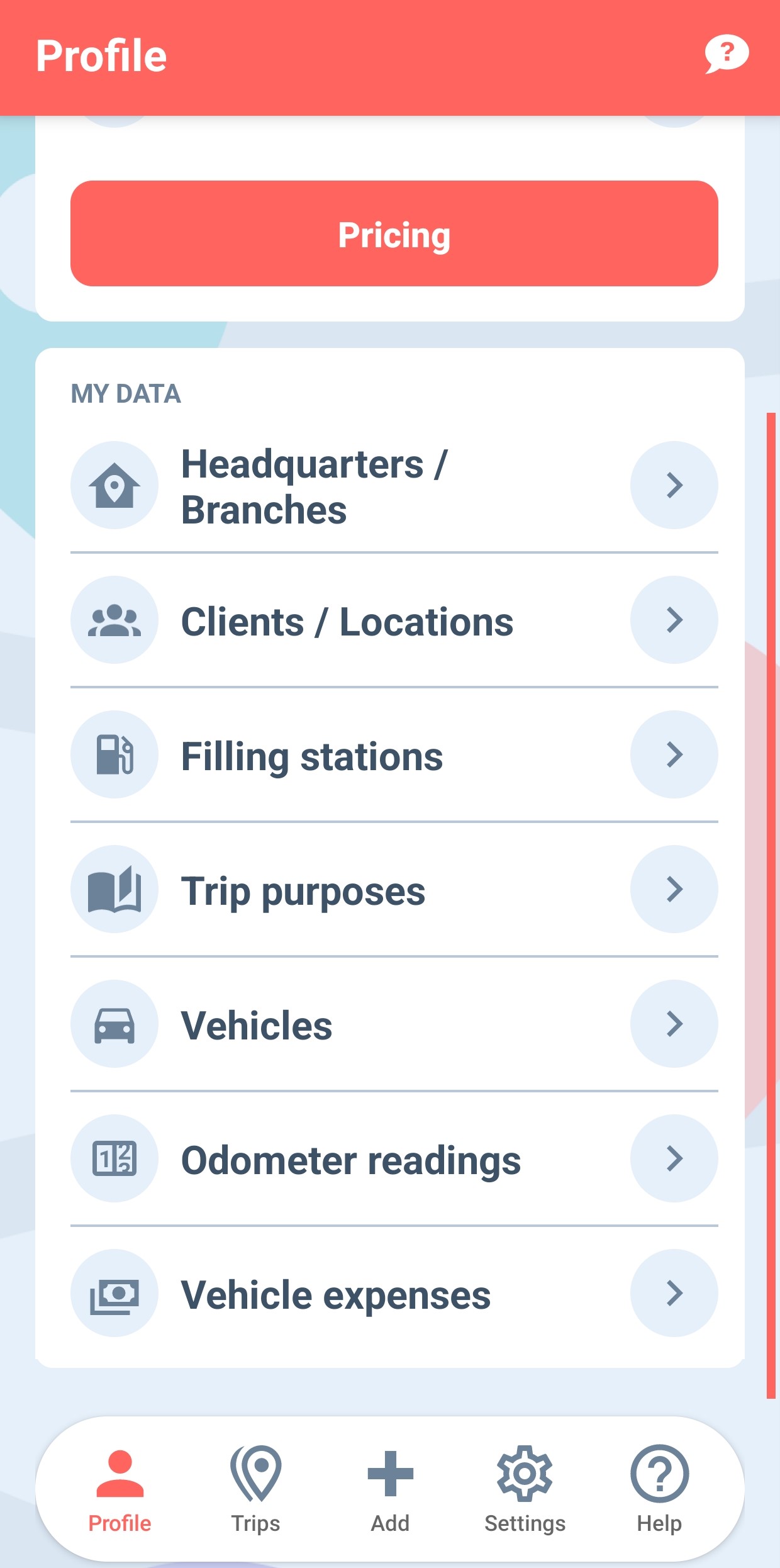

Every trip, be it to a client’s office, a supplier’s warehouse, or even a business lunch, translates into potential savings. So, it’s time to be as watchful as an eagle on the prowl. You need not lug around a box full of gas station receipts; nifty apps like MileageWise keep a meticulous record of your travels. Better yet, MileageWise can whip up a 100% IRS-Proof mileage log to add to your tax deduction arsenal.

Don’t Let Deductions Slip through Your Fingers – Documenting Your Mileage

Of course, it’s not enough to simply know the standard mileage rate IRS so generously offers. You’ve got to be able to show your work. IRS mileage log requirements can feel as prickly as a porcupine in a pillow fight, but they’re crucial. How else can you prove you’re not just joyriding on Uncle Sam’s dime? So, like a boy scout, be prepared. If the IRS comes a-knockin’, you better have your logs a-rockin’.

But where to document this mileage allowance, you ask? Simple. You’ll put these figures on Schedule C (Form 1040) line 9. It’s like your personal parking spot for all those miles you’ve clocked.

Is Your Mileage Rate up to Date? Stay Alert for Changes

Now, don’t go thinking the IRS mileage rate for 2024 is set in stone. The IRS mileage rate changes like the seasons, sometimes more frequently. Currently the rate is set at 67 cents/mile. However, It’s just like those cheeky weather forecasts; you never know when a windfall is around the corner. So, keep your ear to the ground and an eye on your inbox for any updates.

MileageWise to the Rescue – Your One-Stop Solution

Worried about all this tracking and documenting? Enter MileageWise, the superhero in this tale. With the finesse of a seasoned sommelier, MileageWise will help you keep track of every mile to claim and maximize your deduction. It’s like having your own personal tax assistant, but without the need for an extra cup of coffee at the morning meeting.

So, there you have it. The IRS mileage allowance might sound like a dry toast topic, but with a dash of knowledge, a sprinkle of diligence, and a healthy helping of MileageWise, it’s a recipe for some serious savings. So, rev your engines, entrepreneurs, and let’s hit the road to success!

Phew! That’s a wrap, folks. Time to turn off the engine, sit back, and let those mileage deductions roll in. Don’t forget, every mile counts, and with the right tracking, documenting, and claiming, the road to fiscal wisdom just got a whole lot smoother. So, keep on truckin’, you trailblazers!