Introduction

If you drive a car for business, you could be eligible to claim the expenses on your federal income tax return. Therefore, whether you’re a mobile financial planner who travels to clients all over the place or a DoorDash driver who delivers meals, you may write off the miles you rack up while operating a vehicle for work.

In this article, we’ve collected essential information and guidance on how to track mileage for taxes.

Let’s start with the basics:

How does IRS mileage deduction work?

Small business owners and the self-employed are able to deduct business-related vehicle expenses. Instead of using a Schedule A form for itemized deductions, these individuals can claim mileage on their Schedule C tax form. Note that only a proportionate portion of costs based on business use may be written off by employees who use a car for both personal and work travel.

There are 2 ways to calculate these expenses: either using the federal standard mileage rate set by the IRS every year, or the actual expense method.

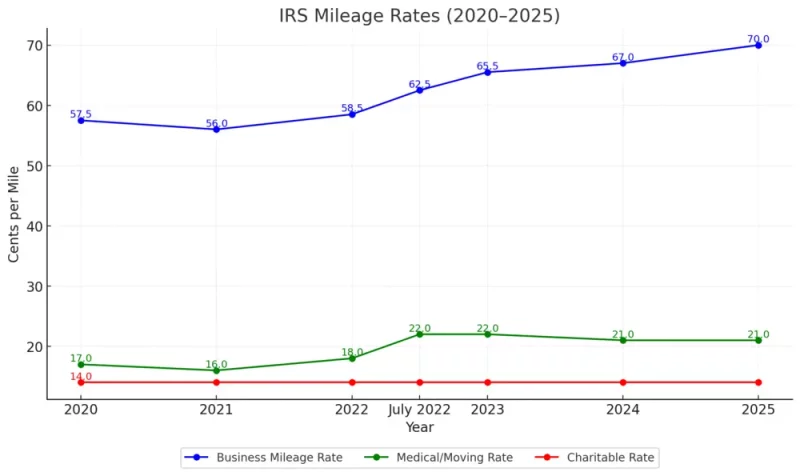

When does the IRS mileage rate change?

Every December the IRS announces the federal mileage rate for the following year. There have been some exceptions when the mileage rate was changed mid-year due to volatile global economic circumstances and gas prices. For instance, the IRS mileage rate was increased for H2 2022 (62.5 cents/mile for business) compared to H1 2022 (58.5 cents/mile for business).

How is the IRS mileage rate determined?

The standard mileage rate for business usage, according to the IRS, is based on a yearly analysis of the fixed and variable expenses of operating a car. Both fixed and variable mileage costs are included in these prices.

Almost anything a car owner can think of will have an impact on their pocketbook is taken into account by these fixed and variable charges. Each year, the IRS makes a judgment based on a variety of criteria, including the price of gasoline, the cost of maintenance, the price of oil changes, the cost of insurance, and simple depreciation.

The standard mileage rate does not include parking fees or tolls. These expenses are still deductible but need to be calculated separately.

The standard mileage rate for 2025

The 2025 federal IRS mileage rates are:

- 67 cents per mile for business purposes

- 21 cents per mile for medical and moving purposes (the latter is only for active military members)

- 14 cents per mile for charity purposes (this rate has been the same since 2011)

How to stay compliant with IRS mileage deductions

Depending on your circumstances, you may need to follow certain IRS mileage log rules in order to maintain accurate mileage records. The IRS definitely has guidelines that apply to self-employed people, independent contractors, and business owners.

If you’re an employee and you’re tracking your trips for mileage reimbursement, it’s possible that your company also has specific requirements for mileage reporting.

IRS requirements for tracking mileage

The IRS’s rules are very simple when it comes to maintaining appropriate records.

They consist of:

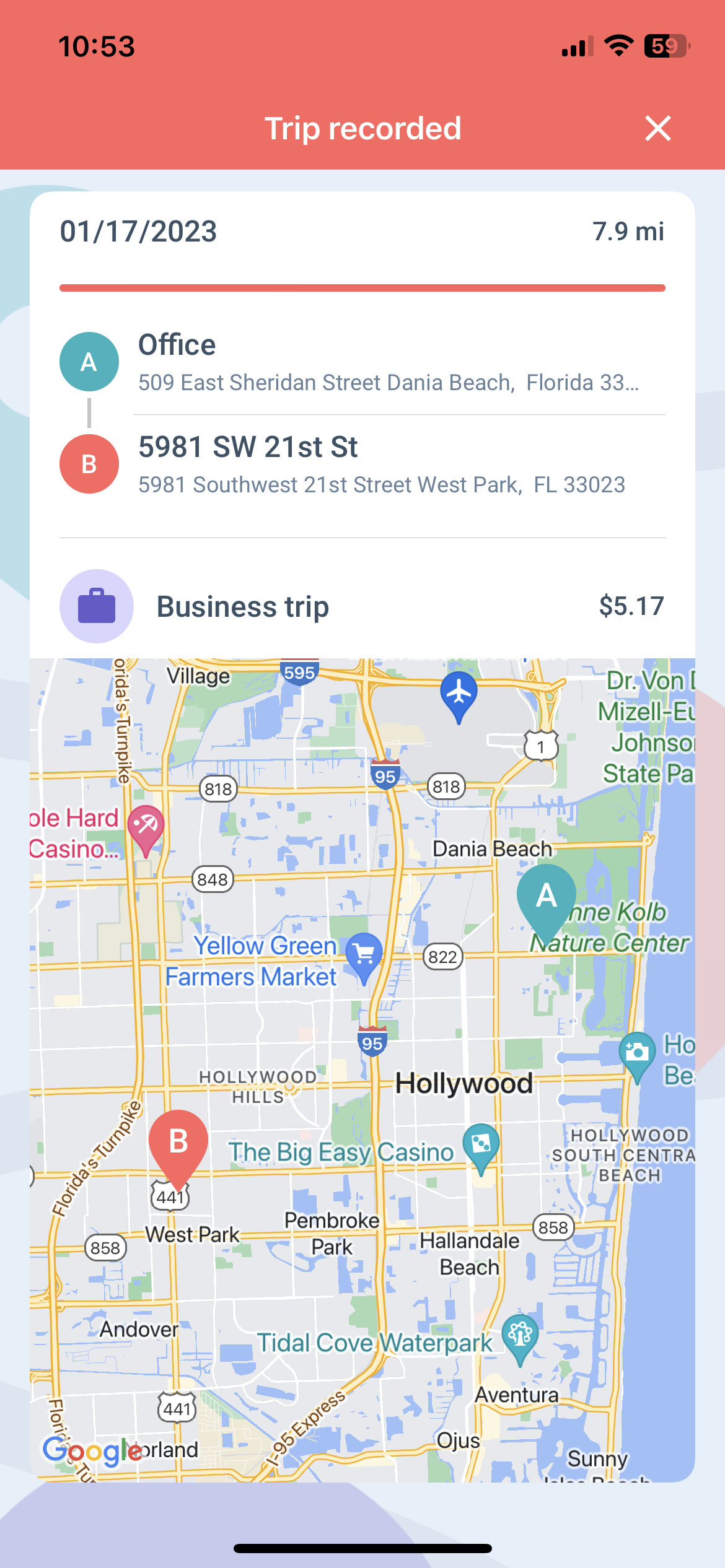

- The date, the purpose, and the starting & ending locations of each trip

- The year-starting & year-ending odometer readings

- The sum of all year mileage: business + commuting + personal (other than commuting)

TIP 1: Although the IRS doesn’t require personal trips in your mileage log, it’s strongly recommended that you include them because it will provide clarity for both yourself and the IRS since you need to separate your total business mileage, total personal mileage, and total commuting mileage for the year.

Also, logging your personal trips boosts the proficiency of MileageWise’s built-in IRS auditor function, which you need for an IRS-Proof result.

TIP 2: Record your activities as soon as you can, don’t put it off until later that night or the next day. The best practice is to have an automatic mileage tracker app like MileageWise that does that for you in the background.

What business expenses are deductible for IRS mileage?

If you solely use your automobile for work, you may deduct the whole cost of purchase and operation. If the automobile is used for both business and personal trips, you can only deduct the expense of the business usage. The standard mileage rate or the actual expense approach can be used to calculate the amount of your deductible automotive expenses.

If you’re not sure which one to choose, start with the standard mileage rate because you can switch to the actual expense method anytime. Still, if you choose the actual expense method in the first year of the operation of that particular car, you’re not able to switch to the standard mileage rate as long as you drive that car for business.

The Standard Mileage Rate

The standard mileage rate should be considered a package that contains gas, oil changes, parking fees, tire replacements, purchasing new batteries, and other required supplies as variable expenditures. Taxes, insurance, licenses, and registration fees are a few examples of fixed costs. These are all supposed to be covered by the IRS’s standard mileage rate.

The Actual Expense Method

Choosing this technique, you need to keep & collect all of your business-related receipts that you’d like to deduct. Then you’ll be able to deduct these items from the proportion of your business trips compared to your personal trip with your car. If you use a particular car only for business purposes, you’ll be able to deduct all of your business-related car expenses.

This method is typically more profitable for really expensive cars or if you drive an extremely high amount of miles.

IRS guideline for mileage reimbursement

The compensation employees receive for using their personal car for work-related activities is known as mileage reimbursement. All expenses related to owning and operating a personal car throughout the required mileage are supposed to be covered by the reimbursement.

There are 3 types of mileage reimbursement:

- car allowance (a monthly lump sum)

- a negotiated cent-per-mile rate (taxable above the federal IRS mileage rate)

- FAVR (stands for Fixed And Variable Rates, it’s the combination of the two above)

Some businesses choose to set a preset monthly sum as compensation when workers often drive their own automobiles for work-related purposes.

Mileage reimbursement typically works on a per-mile basis and pays for all the costs associated with owning and operating a car for work.

The combination of the two is called FAVR: it includes a fixed lump sum every month to cover the fixed costs of the operation of the vehicle, plus a cent-per-mile rate (which is in this case much lower than the federal mileage rate). The FAVR is the most innovative among the 3 methods.

Is IRS mileage reimbursement taxable?

Only if the mileage rate that the employer and employee agreed upon exceeds the IRS mileage rate. In this case, the part above the federal rate is taxable – this means that employers rarely set the mileage reimbursement rate higher than the IRS federal mileage rate.

How to keep records of your business mileage deductions

You must maintain accurate records demonstrating the number of miles you drove, the location, and the business reason in order to claim mileage reimbursements. Using a timely log is the most effective approach to accomplish this.

As I’ve mentioned above, every business trip requires four pieces of information: the date, the beginning and end of the journey, and the excursion’s purpose…and of course the odometer reading, but it’s enough if you log it monthly (the year-starting and the year-ending odometer is the bare minimum in the eyes of the IRS).

There are 3 major methods for keeping track of mileage:

- manually on a paper mileage logbook

- electronically, on a mileage log template on Excel or a mileage log template on Google Sheets

- a mileage app

Tips for claiming mileage deductions

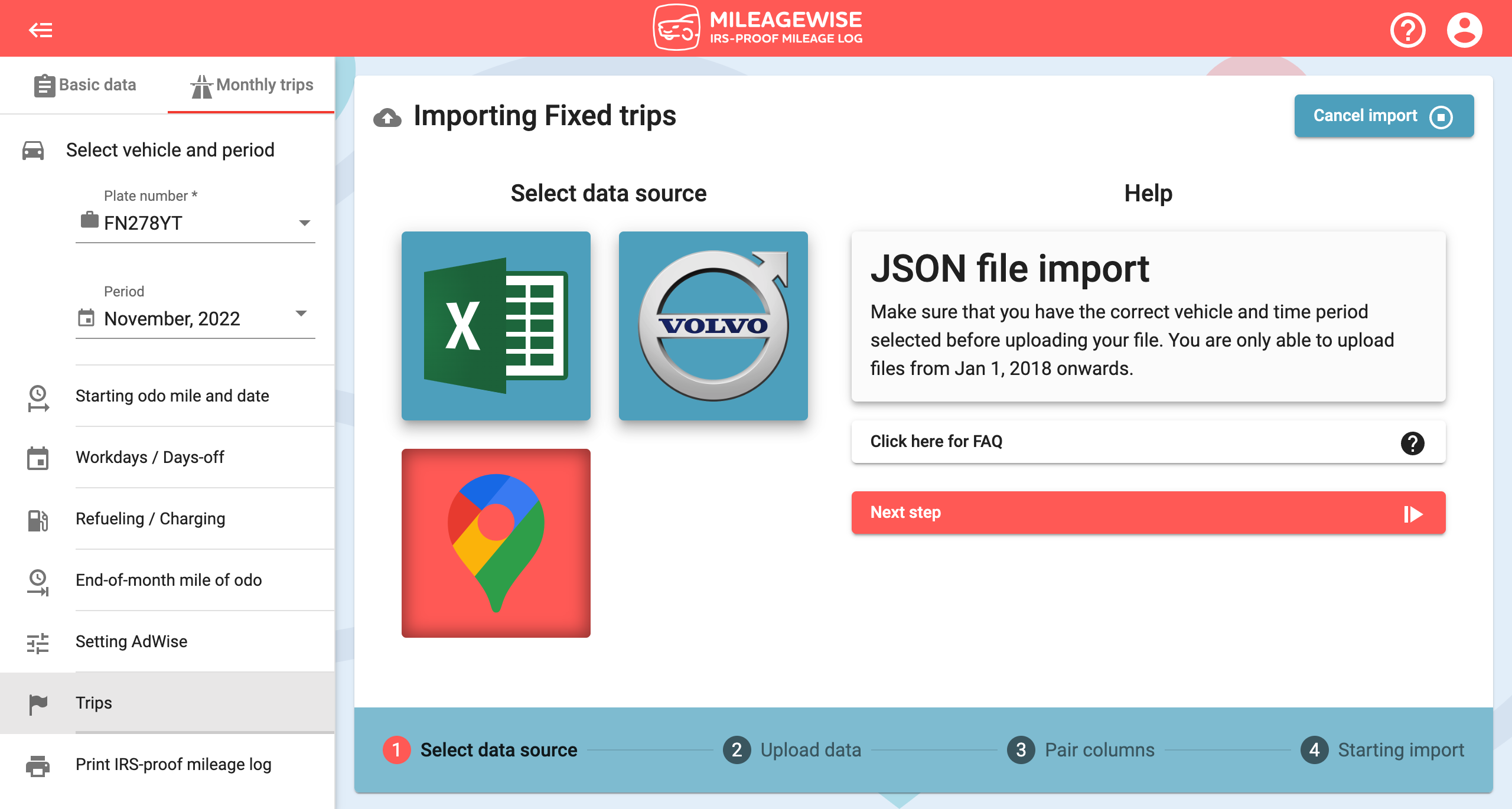

- We strongly recommend that you keep track of your miles with a mileage tracker app like MileageWise, in which you can choose from 3+1 automatic drive detection modes. When you’re done with your trips for the month, sit in front of the computer, open MileageWise’s Web Dashboard platform in your favorite browser, finalize and then print your IRS-Proof mileage log in only 7 minutes.

- When it comes to rates, if this is your first year of business with a particular vehicle, try the standard mileage rate because you’ll be able to switch to the expenses method – not if you start with AEM.

- Parking fees & tolls are not included in the standard mileage rate, so make sure to deduct those expenses, too – separately.

- If you’re a rideshare driver, your “empty” miles (that are not with a passenger) are also deductible if they’re related to business – don’t miss out on this opportunity.

- Gather your documents – parking fees & tolls if you use the standard mileage rate or every single piece of receipt if you use the actual expenses method.

- If you don’t have a sufficient mileage log for previous years but had Location History turned on in your Google account, you’re able to convert those Google-recorded trips into an IRS-Proof mileage log.

- Try MileageWise for 14 days for completely free – no credit card needed.

Where does mileage go on the tax returns?

Schedule C, Part ll, Line 9 is where you should enter your car expenditures if you are a business owner or self-employed.

Common mistakes made with mileage deductions

- Tracking your miles on paper or in a spreadsheet: This one’s so overlooked. We know that it’s free, but come on...you’re wasting so much more than $6/month by manually tracking your miles, never mind the fines that may come with flaws that any human might do. Seriously, people need to forget about this method.

- Lack of a home office: You cannot claim an automobile tax deduction for travel from your house to work, according to one of the many restrictions. These deductions would be permitted, though, if you had a home office that counts as your primary place of business.

- Claiming only business-related usage: The majority of individuals do make this error. If you don’t have your mileage records in order but continue to say that you commute only for work-related reasons. The IRS will immediately take note of this and may possibly initiate an audit. Be wise & create your mileage log with MileageWise so that your mileage log will remain 100% IRS-Proof. Our built-in IRS auditor function checks & corrects 70 potential red flags in your mileage log before letting you generate your document – just like an IRS auditor would do, the main difference is that this one’s working for you. 🙂

Frequently asked questions about mileage deductions

Are estimates acceptable? I don’t know the exact numbers, I drove approx. 15,000 miles last year.

No, you are not permitted to justify your mileage deduction with anticipated business miles.

What if I don’t frequently use my car for work?

You can still deduct normal mileage or real expenditures based on the proportion of time you spend driving for work even if you only use it 50% of the time or less.

If you use your automobile for business 50 percent or less of the time or less, specific conditions for depreciation apply:

- Section 179 deductions and extra depreciation allowances are not permitted.

- Depreciation must be calculated over a five-year period using the straight-line technique.

What if I lease a vehicle for my company?

If you drive a leased car, you may still calculate your deductible driving costs using either the standard mileage rate or the actual expense method. If you use the latter, you can deduct the part of the lease payments that are for the use of the car in your business.

In order to calculate depreciation and the value of the leased car, there are certainly difficult, unique requirements (like “inclusionary amounts“). Before attempting to deduct the expenditures associated with this car from your business tax return, consult IRS Publication 463 and speak with a tax expert.

Historical IRS mileage rates

Conclusions

There are many factors to keep in mind when looking to deduct your car-related business expenses.

First, choose the method of calculation, then your way of mileage tracking, while making sure to exploit every single opportunity for deductions.

Don’t forget: using MileageWise you can deduct $1,000s/year/car.

Too busy to assemble your own mileage log? We’ll take care of it with our Mileage Log Tax Preparation Service 🙂