Welcome to the world of mileage tracking – a crucial aspect for anyone seeking to optimize their tax deductions. Whether you’re a freelancer, a small business owner, or an employee with work-related travel, understanding how to accurately log your miles for IRS purposes is essential. This comprehensive guide is your roadmap to navigating the complexities of IRS mileage logs. Topics we are going to cover:

- Crafting an IRS-Compliant Mileage Log: Key Details to Include

Offering practical advice on how to keep a meticulous and IRS-compliant mileage log, including tips on recording and organizing data. We explain and highlight crucial data using a real-life IRS-compliant mileage log sample. - Understanding the IRS Mileage Rate: How It’s Calculated and Updated

This section explains how the IRS determines the mileage rate, including factors that influence annual updates. - Eligibility Criteria: Who Can Claim Mileage Deductions?

Detailing who qualifies for mileage deductions, including specific examples of professions and scenarios where mileage logging is applicable. - Common Mistakes to Avoid in Mileage Logging and Reporting

Highlighting frequent errors that taxpayers make when logging or reporting mileage, and how to avoid these pitfalls. - Leveraging Technology: Best Apps and Tools for Mileage Tracking

Reviewing modern tools and apps that can assist in accurate and efficient mileage tracking, aligning with IRS requirements. - MileageWise: Your IRS-Proof Mileage Creator

Let’s explore how MileageWise can be your ultimate ally in mileage logging, serving as your IRS-approved mileage tracker app.

Crafting an IRS-Compliant Mileage Log: Key Details to Include

When it comes to IRS-compliant mileage records, when you track mileage for taxes, accuracy and detail are paramount. An IRS-compliant log is more than just a record of distances; it’s a comprehensive document that showcases the purpose and necessity of each trip. Let’s break down the essential elements your mileage documentation should include to meet IRS standards.

Critical Elements of an IRS Mileage Log:

A well-maintained mileage document should include the following key components:

- Date of Travel: Record the date for each journey. This helps establish the timeline and frequency of your travels.

- Trip Purpose: Clearly state the reason for each trip. The IRS specifically looks for the business purpose, which could include meetings, client visits, supply pickups, etc.

- Starting Point and Destination: Detail where each trip began and ended. If you have regular destinations (like an office or client site), you can use shorthand after the first full entry.

- Odometer Readings: Include both the starting and ending odometer readings for each trip. This gives a clear indication of the distance traveled.

- Total Miles: Calculate and record the total miles driven for each trip. This is critical for your deduction calculations.

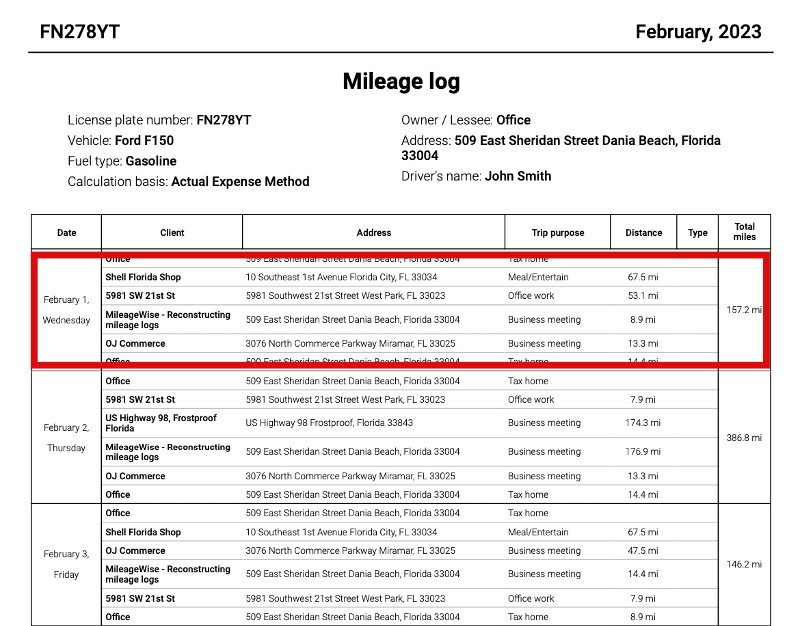

Let’s take a look at a real-life example of an IRS-Proof mileage log sample. You can use it as a free IRS mileage log template.

The snippet below shows all the above mentioned details, except for the odometer and the summary data, which we’ll show on the next images:

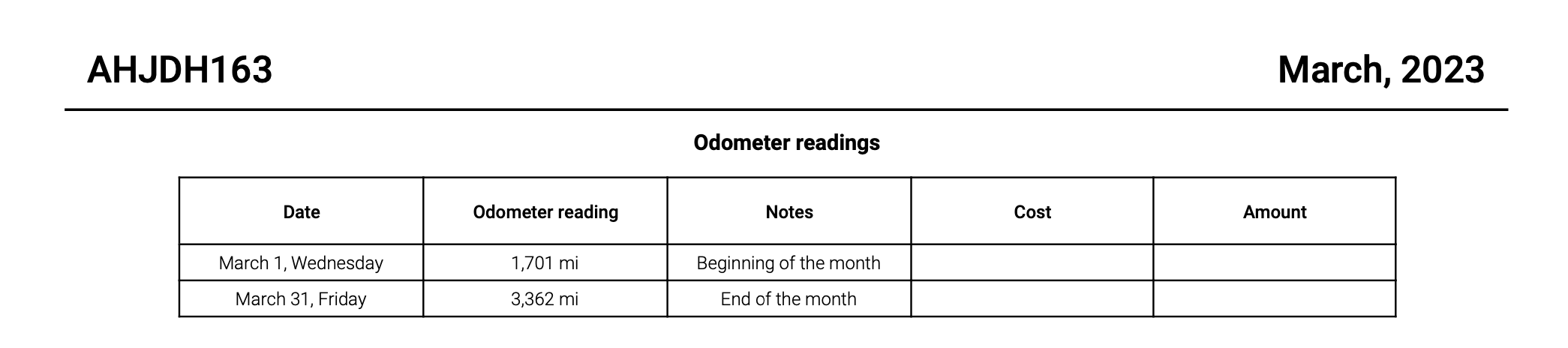

Now the odometer part:

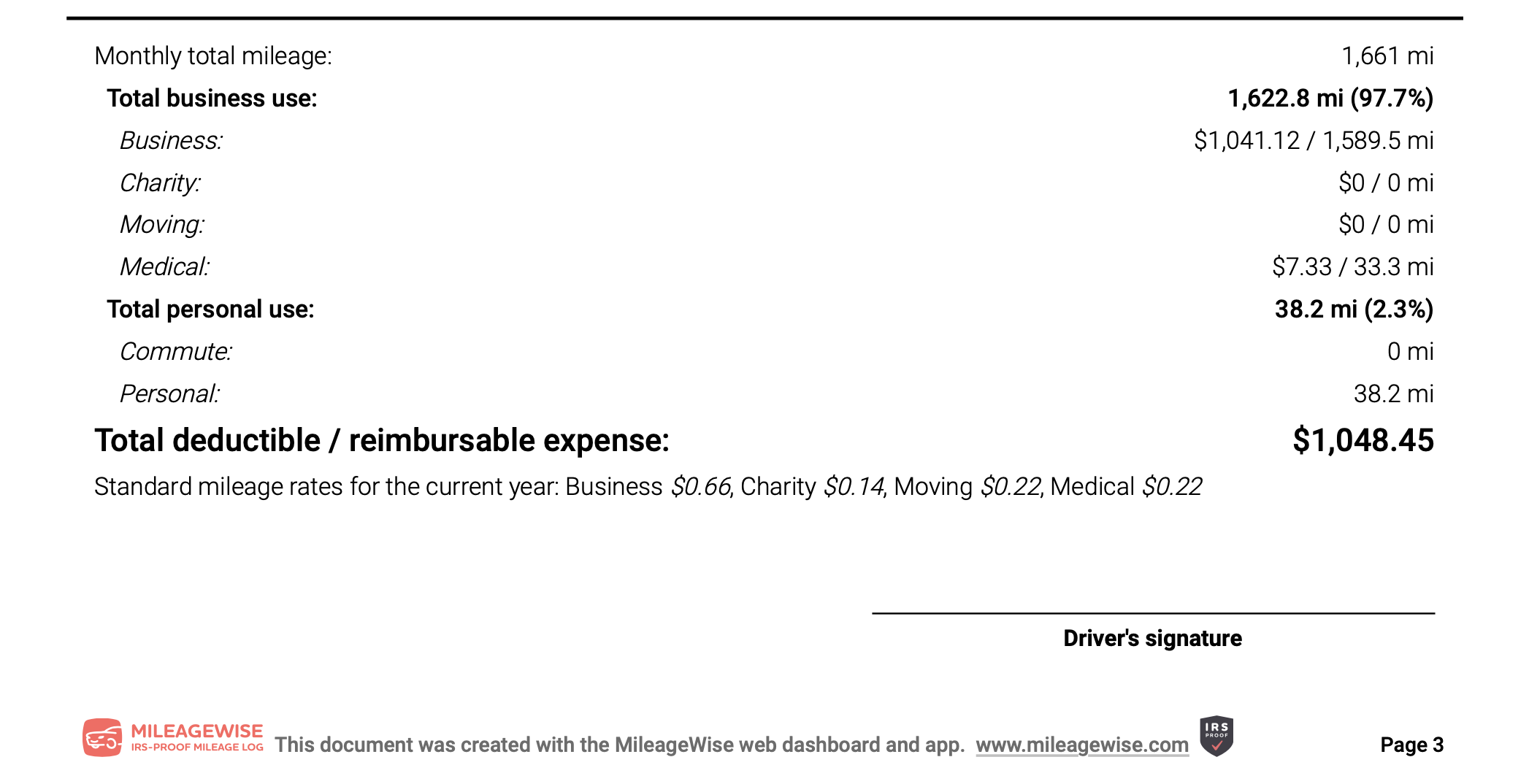

And finally the summary data:

Additional Tips for an Effective Mileage Log:

Beyond the basics, consider these tips to enhance your log’s effectiveness:

- Organize and Categorize: Keep your log structured and easy to navigate. Categorize trips by type (and further as business, medical, charitable, etc.) if applicable.

- Regular Updates: Update your log regularly. A daily or weekly routine can help ensure accuracy and completeness.

FAQs on IRS Mileage Logs:

- Q: Can I round off my mileage readings?

- A: It’s best to be as exact as possible. Round numbers can appear imprecise or fabricated.

- Q: How long should I keep my mileage logs?

- A: Keep your logs for at least three years from the date you file your income tax return.

- Q: What if I use multiple vehicles for business purposes?

- A: Maintain separate logs for each vehicle. This helps in accurately tracking the usage and deductions for each.

- Q: What if I forget to log a trip?

- A: Rectify as soon as possible. Consistent logging habits are crucial. But if you’re just starting out and need to recover trips retrospectively, MileageWise is here to help you.

- Q: Is there a mileage form for taxes? Are digital logs acceptable to the IRS?

- A: Yes, digital logs are acceptable and often more convenient and accurate.

- A: Maintain separate logs for each vehicle. This helps in accurately tracking the usage and deductions for each.

Ensuring Compliance and Accuracy:

- Use Digital Tools: Consider using mileage tracking apps or software to maintain accurate and organized logs.

- Backup Your Data: Always have a backup of your mileage log, either digitally or physically, to safeguard against data loss.

Understanding the IRS Mileage Rate: How It’s Calculated and Updated

Navigating the IRS rules can often feel like traversing a labyrinth, but understanding the IRS mileage rate doesn’t have to be complicated. Whether you’re a seasoned business professional or just starting out, knowing how this rate works is essential for maximizing your tax deductions. Let’s dive into the nitty-gritty of the IRS mileage rate.

How the IRS Mileage Rate is Determined:

- Annual Review: The IRS sets the standard mileage rates each year. These rates are not random; they are carefully calculated based on a variety of factors.

- Key Factors:

- Fuel Prices: Fluctuating gas prices play a significant role.

- Wear and Tear: Consideration of vehicle depreciation.

- Maintenance Costs: Including repairs, oil changes, and other maintenance essentials.

- Other Expenses: Factors like insurance and registration fees also contribute.

FAQs on IRS Mileage Rate:

- Q: Does the IRS mileage rate vary for different types of vehicle uses?

- A: Absolutely! The IRS recognizes different rates for business, medical or moving purposes, and services for charitable organizations.

- Q: Can I use the IRS mileage rate for all my vehicles?

- A: The standard rate applies to cars, vans, pickups, and panel trucks. However, there are nuances to consider for each vehicle type.

- Q: How often does the IRS update the mileage rate?

- A: The rate is typically updated once a year, but it can change mid-year in response to significant shifts in fuel prices.

Understanding Rate Fluctuations:

The IRS mileage rate isn’t static; it changes to reflect the economy. For example, a surge in fuel prices might lead to a higher rate mid-year. Conversely, if operating costs drop, the rate might decrease. It’s crucial for taxpayers to stay informed about these changes.

Key Takeaways:

- Stay Updated: Always check the latest IRS mileage rates before filing your taxes.

- Understand the Breakdown: Knowing what factors into the rate can help in planning your vehicle usage more effectively.

- Compliance is Key: Using the correct rate is essential for IRS compliance and maximizing your deductions.

Eligibility Criteria: Who Can Claim Mileage Deductions?

Ever wondered if you could reduce your tax bill simply by driving? The IRS allows certain individuals to claim mileage deductions, but who exactly qualifies? This section is your golden ticket to understanding the eligibility maze for mileage deductions.

Who’s Eligible? Breaking Down the Categories:

Eligibility for mileage deductions isn’t a one-size-fits-all situation. Here’s a breakdown of who might be eligible:

- Business Owners and Self-Employed Individuals:

- If you’re driving for business purposes, you’re in the right lane for deductions.

- Employees Travelling for Work:

- Not just any travel qualifies. Commuting to your regular workplace? That’s a no. Driving from your office to a client site? That’s a yes.

- Medical or Moving Purposes (Subject to Conditions):

- Driven for medical appointments or a recent move? There might be deductions waiting for you.

- Charitable Activities:

- Volunteering your time and car for a charity? The IRS might have a small thank-you in the form of a deduction by the charitable mileage rate.

FAQs on Eligibility for Mileage Deductions:

- Q: Can I claim mileage for driving to and from work?

- A: Unfortunately, no. The IRS considers commuting as a personal expense.

- Q: What if I’m self-employed and work from home?

- A: Good news! Drives to meet clients or perform business tasks can be deductible.

- Q: Does driving for a side gig qualify me for deductions?

- A: Yes, if the driving is essential for your side business, it counts.

Understanding Eligibility Nuances:

Eligibility can be twisty. For instance, even if you’re eligible, you must keep an accurate log of your miles. And remember, the IRS looks for a clear distinction between personal and business travel.

Key Takeaways:

- Know Your Category: Understand where you fit in the eligibility criteria.

- Documentation is Key: Keep detailed records – they’re your best friend in case of an audit.

- Stay Informed: Rules can change, so keep up with the latest IRS updates.

Common Mistakes to Avoid in Mileage Logging and Reporting

When it comes to mileage logging for IRS purposes, it’s like walking a tightrope – one slip and you might find yourself in a tangle of tax troubles. But fear not! Steering clear of common pitfalls is easier than you think. Let’s navigate the common mistakes to ensure your mileage log is as smooth as a Sunday drive.

Watch Out for These Roadblocks: Key Mistakes to Avoid

Dodging these common errors can keep your mileage log on the right track:

- Mixing Personal and Business Trips:

- This is a big no-no. Always clearly differentiate between business and personal travel in your logs.

- Inconsistent or Incomplete Records:

- Sporadic logging or missing details can raise red flags during an audit.

- Forgetting to Record the Purpose of the Trip:

- Just noting the miles isn’t enough. The IRS wants to know why you made the trip.

- Relying on Estimates Instead of Actual Readings:

- Guesstimates can lead to audits. Always use actual odometer readings.

- Not Keeping Your Logs for Long Enough:

- The IRS can audit past returns, so keep your logs for at least three years.

FAQs on Mileage Log Mistakes:

- Q: How accurate do my mileage logs need to be?

- A: Precision is key. Ensure every entry is as accurate as possible to avoid issues with the IRS.

- Q: Can I use a GPS app to track my mileage?

- A: Absolutely! GPS apps can be a reliable way to track your trips, as long as they record all the necessary details.

- Q: What if I use my vehicle for both personal and business purposes?

- A: You’ll need to log only the business-related mileage, ensuring clear separation from personal use.

Navigating Towards a Flawless Mileage Log For IRS Audit:

A. Be Methodical: Make logging a part of your daily routine.

B. Details Matter: Record all required details without cutting corners.

C. Review Regularly: Periodically check your log for accuracy and completeness.

Key Takeaways:

- Stay Organized: A well-maintained log is your best defense in an audit.

- Embrace Technology: Use apps and tools to make logging easier and more accurate.

- Know the Rules: Familiarize yourself with IRS guidelines to ensure compliance.

Leveraging Technology: Best Apps and Tools for Mileage Tracking

In the digital age, why stick to pen and paper for tracking your miles? With the right apps and tools, mileage tracking becomes a breeze, not a chore. Let’s explore the technological sidekicks that can make your IRS mileage log as seamless as syncing your smartphone!

Top Apps and Tools for Effortless Mileage Tracking:

Embrace the digital revolution with these game-changing tools:

- Dedicated Mileage Tracking Apps:

- Look for apps that automatically track your trips, categorize them, and generate IRS-compliant reports.

- GPS-Enabled Devices:

- Devices that use GPS to track your routes and distances offer pinpoint accuracy.

- Spreadsheet Programs:

- For the tech-savvy, customizing a spreadsheet can provide flexibility and detailed record-keeping so you get your mileage spreadsheet for taxes.

- Cloud Storage Solutions:

- Keep your logs safe and accessible anywhere by storing them in the cloud.

FAQs on Using Technology for Mileage Logs:

- Q: Are digital logs as valid as paper logs for the IRS?

- A: Absolutely! As long as they contain all the necessary information, digital logs are completely valid.

- Q: What should I look for in a mileage tracking app?

- A: Key features include automatic tracking, easy categorization, and the ability to export data in a format the IRS accepts.

- Q: Can I switch from paper to digital partway through the year?

- A: Yes, you can. Just ensure continuity and accuracy in your records when you switch.

Making the Most of Technology in Mileage Logging:

A. Test Different Apps: Find one that suits your specific needs and preferences.

B. Regular Backups: Always back up your data to avoid losing your meticulous records.

C. Integration with Other Tools: Choose tools that work well with other business software you use for a streamlined process.

Key Takeaways:

- Embrace Automation: Let technology handle the tracking while you focus on your business.

- Stay Updated: Keep your chosen apps or tools updated for the best performance.

- Understand Compatibility: Ensure your tools are compatible with IRS requirements.

MileageWise: Your Digital Companion for IRS-Compliant Mileage Logs

Navigating the complexities of IRS mileage logs can be daunting, but MileageWise is here to simplify the process. Designed to cater to the needs of both individuals and businesses, this tool transforms mileage tracking from a tedious task into a streamlined, efficient process. Let’s explore how MileageWise can be your ultimate ally in mileage logging, serving as your IRS mileage tracking app.

Automated Mileage Tracking:

One of MileageWise’s standout features is its ability to automate the mileage tracking process. This means:

- Effortless Trip Logging: With automatic trip detection, the app records every journey without you having to manually log each trip.

- Accurate Distance Calculation: It uses advanced GPS technology to calculate distances with precision, ensuring your logs are accurate down to the last mile.

- Retrospective Logging: As an industry-first solution, MileageWise caters for your needs if there are trips gaps in your mileage log. Its AI Wizard and Google Timeline Exporter can guarantee IRS-Proof logs.

- Built-In IRS Auditor: This feature checks and corrects 70 potential red flags to save you from an IRS-audit.

Customizable Reporting for IRS Compliance:

MileageWise understands the importance of adhering to IRS guidelines, offering:

- Customizable Reports: Tailor your mileage reports to meet the specific requirements of the IRS, ensuring your logs are compliant and audit-proof.

- Detailed Record-Keeping: The app allows you to record all necessary details like date, purpose, and distance for each trip.

- Easy Export Options: You can easily export your mileage reports in formats that are convenient for submission or personal record-keeping.

- Prepaid IRS Mileage Audit Defense: MileageWise offers a Prepaid Mileage Log Audit Defense Service, providing users with proactive assistance and expert support in case of an IRS audit or rejected mileage logs. This service includes the preparation of a detailed and compliant mileage log, ensuring all entries meet IRS standards. In the event of an audit, MileageWise experts will guide and represent the user, offering advice and defending the accuracy of the mileage records.

FAQs on Using MileageWise:

- Q: How user-friendly is MileageWise for beginners?

- A: MileageWise is designed with a user-friendly interface, making it accessible even for those new to digital mileage tracking.

- Q: Can MileageWise help if I’ve forgotten to log past trips?

- A: Yes, the app includes features to help reconstruct past mileage logs accurately.

- Q: Is the data stored in MileageWise secure?

- A: Yes, MileageWise employs robust security measures to protect your data.

Integration with Your Daily Routine:

MileageWise seamlessly integrates into your daily routine:

- Mobile and Desktop Accessibility: Access your mileage logs on both mobile and desktop platforms, offering flexibility and convenience.

- Cloud-Based Storage: Your data is stored securely in the cloud, ensuring it is always accessible and backed up.

Key Takeaways:

- Embrace Efficiency: MileageWise’s automation saves you time and effort.

- Stay IRS-Compliant: The app’s customizable reports ensure your logs meet IRS standards.

- Enjoy Peace of Mind: With secure, accurate, and easy-to-use features, MileageWise takes the stress out of mileage logging.

Let’s Wrap It Up

As we reach the end of our comprehensive journey through the intricacies of IRS mileage logs, it’s clear that the road to accurate and efficient mileage tracking is paved with diligence and knowledge. From understanding the critical elements of a compliant log, embracing the power of technology for seamless tracking, to steering clear of common mistakes, we’ve covered the full spectrum of what it takes to master this essential aspect of tax preparation.

Remember, maintaining an accurate mileage log for taxes not only ensures compliance with IRS regulations but also maximizes your potential deductions, ultimately contributing to a healthier financial landscape for your business or personal finances. Armed with this guide, you’re now better equipped to navigate the byways of mileage logging with confidence and precision. May your journey through the realm of mileage tracking be smooth, and your deductions be maximized!

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!