No one wants to deal with an IRS penalty, but if you’ve received one, you’re not alone. The IRS issues millions of penalties each year for reasons like late tax filings, underpayment of taxes, and accuracy-related errors. These penalties can quickly add up, with interest charges making the total amount even higher. But the good news? Many penalties can be reduced, removed, or even avoided altogether—if you know the right steps to take.

In this guide, we’ll break down the most common IRS penalties, how they are calculated, and, most importantly, the best ways to dispute, lower, or prevent them. Keep reading to learn how to protect your finances and avoid costly mistakes.

What Is an IRS Penalty?

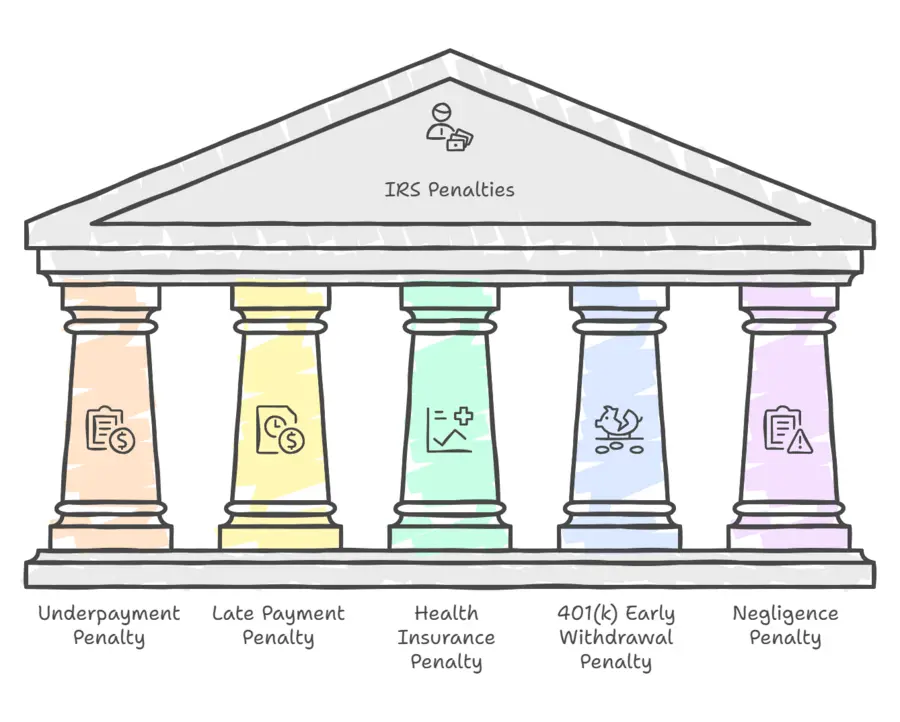

An IRS penalty is a fee charged to taxpayers who don’t meet certain obligations, like filing taxes late or paying less than what they owe. Each situation can lead to a specific type of penalty, and it’s important to know the types of penalties you might face:

IRS Penalty for Underpayment of Taxes

If you don’t pay enough taxes throughout the year, you may be hit with an IRS penalty. This happens when your total withholding and estimated tax payments fall short of what you owe. The penalty for underpayment is typically calculated from the amount of the underpayment, the period when the underpayment was due, and the interest rate for underpayments that the IRS publishes quarterly.

Additionally, the IRS may charge different rates for different types of taxpayers, such as corporations. For exact penalty rates applicable to your situation, refer to the IRS’s official website, or consult with a tax advisor.

To avoid underpayment penalties, pay estimated taxes or adjust your tax withholding through your employer. In addition, use an IRS penalty and interest calculator for underpayment to estimate how much you may owe if you fall short.

IRS Penalty for Late Payment

Paying late can also result in an IRS penalty. This is charged when you don’t pay the taxes owed by the deadline, even if you file your return on time. The longer you wait to pay, the more you will owe due to interest building up over time.

If you’re facing a late payment, the IRS allows taxpayers to settle their IRS penalty payment online, making it convenient to avoid further penalties and the accumulation of interest.

Penalty for Not Having Health Insurance

While there is no longer a penalty for not having health insurance on the federal level, some states still impose their own penalties for residents who don’t have health coverage. Check if your state requires you to have health insurance here.

IRS Penalty for Retirement Account 401(k) Early Withdrawal

If you take money out of your retirement account early (before you turn 59 ½), you may need to pay what many refer to as the tax penalty for 401(k) early withdrawal. On the other hand, the result of an early 401(k) withdrawal is usually an additional income tax of 10%. To avoid this penalty, try to keep your retirement savings intact until you’re eligible for penalty-free withdrawals.

IRS Negligence Penalty

You might receive a negligence penalty from the IRS if you fail to take reasonable care in filing your tax return. This can happen if you underreport income or overstate deductions without a valid reason. Negligence penalties are usually 20% of the unpaid taxes. To avoid this, double-check your tax return and keep records organized.

IRS Penalty Relief and Abatement

If you’re facing penalties, you may qualify for IRS penalty relief. The IRS offers relief through first-time penalty abatement, reasonable cause abatement, and other methods. If this is your first penalty, you can request a first-time abatement by proving that you’ve filed and paid taxes on time in the past three years.

To apply, fill out the IRS penalty waiver form or write a letter with the help of IRS penalty abatement letter samples online. Be sure to explain your situation clearly and provide supporting documents. If approved, the IRS may waive the penalty.

Dealing with Missing Documents

One of the most common challenges taxpayers face is dealing with missing documents. Whether it’s a misplaced W-2, a missing 1099, or lost receipts for deductible expenses, not having all the necessary records may lead to IRS penalties. If you find yourself missing important documents, don’t panic. Here are a few steps you can take to recover the information:

- Contact the Issuer: If you’re missing income-related forms, reach out to your employer, financial institution, or any organization that issued the form. They can often provide duplicates.

- Access IRS Transcripts: The IRS provides tax transcripts, which can be useful if you’re missing wage and income forms. You can request these transcripts online through the IRS’s “Get Transcript” tool.

- Estimate with Reasonable Accuracy: If you can’t recover the exact numbers but have a reasonable estimate, you can still file your return. However, you must make it clear that the figures are estimates, and you may need to amend the return later.

- Use Prior Year’s Records: Sometimes, referring to past returns can give you a good indication of any recurring income or deductions you may have forgotten.

The Importance of Keeping Accurate Mileage Logs for Tax Deductions

Missing documents that can lead to especially big trouble includes the mileage log for taxes. If you use your vehicle for business, medical, moving, or charitable purposes, you may be eligible for a deduction based on your mileage. However, to claim this deduction, the IRS requires detailed mileage logs. These logs must include:

- Starting and ending odometer readings of your vehicle for the year

- Date of each non-personal trip: The exact date of the trip

- Purpose of the trip: Why you were traveling (business, medical, charitable, etc.).

- Miles driven: The number of miles driven for deductible trips.

- Starting and ending locations: Where you traveled from and to.

Keeping a mileage log is essential because if you’re ever audited by the IRS, they will require documentation to verify your mileage claims. Missing or incomplete mileage records can result in you missing out on valuable deductions and facing penalties. However, using apps or digital tools to track mileage can be helpful in maintaining accurate logs. These apps automatically log trips and save data, reducing the chance of human error or missing entries.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Are you being audited and have missing or insufficient mileage logs? Use our AI-Wizard feature to recreate your lost trips or let our Mileage Log Tax Preparation Service do it for you!

Conclusion

Understanding IRS penalties and how they apply to different situations, from underpayments to early withdrawals, can help you stay on top of your tax obligations. By keeping accurate records and making sure you file your return on time, you can avoid many of the common mistakes that lead to penalties. If you do face penalties, remember that options like IRS penalty relief and first-time abatement are available to help you reduce or eliminate fines. Furthermore, don’t forget to keep track of essential tax documents and maintain detailed mileage logs to ensure you’re maximizing your deductions and staying compliant with IRS rules.

FAQs

What triggers IRS underpayment penalty?

The IRS underpayment penalty is triggered when you don’t pay enough in taxes throughout the year. This can happen if your withholdings or estimated tax payments fall short of the total taxes due.

How much is the tax penalty for early 401(k) withdrawal?

The IRS requires you to pay income tax in case of early withdrawal, which is 10% of the amount withdrawn.

How much is the tax penalty for underpayment?

The IRS penalty for underpayment of taxes is calculated based on the amount you underpaid and how long the balance remains unpaid. Use an IRS penalty calculator for underpayment to estimate your liability.

How much is the penalty for no health insurance?

While there is no federal IRS penalty for no health insurance, some states impose their own penalties for not having coverage.

How much is the IRS penalty for filing late?

The IRS penalty for filing late is typically 5% of the unpaid taxes for each month your return is late, up to 25%.

Is there a penalty for overpayment?

No, you won’t face a penalty for overpayment to the IRS. You will receive a refund in 4 to 6 weeks once you have been notified.

Will the IRS waive penalties?

Yes, the IRS may waive penalties if you qualify for IRS penalty relief through first-time abatement or reasonable cause. Filing a well-documented IRS penalty waiver form or abatement request can improve your chances of having penalties waived.

How do I pay IRS penalties online?

To pay IRS penalties online, visit the IRS website and use their online payment portal. This allows you to settle your balance quickly and avoid accruing further interest.

What are mileage logs, and why are they important for tax deductions?

Mileage logs are detailed records of the miles you drive for business, medical, charitable, or moving purposes. The IRS requires that you maintain accurate and complete mileage logs if you plan to claim deductions for these miles. To stay compliant, make sure to update your log regularly and keep it in a safe, accessible location. Using digital tools or apps can help simplify this process.

What are mileage tracker apps, and how can they help with tax deductions?

Mileage tracker apps are digital tools that automatically track and log your mileage using GPS technology. These apps are incredibly helpful for anyone who uses their vehicle for business or other deductible purposes, as they ensure you maintain accurate, IRS-Proof mileage records without the need for manual entry.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Rebeka Barefield

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |