Are You Being Audited For Mileage?

Have you received a notice of an IRS audit? Is the IRS asking for supporting documentation for your mileage tax return? Perhaps you don’t have the records to support your claims, or your old logs aren’t good enough. Facing an IRS audit unprepared can be a real headache, but don’t worry, we’ve got you covered.

WHAT HAPPENS DURING AN IRS AUDIT?

If the IRS audits your mileage, they’ll typically contact you by mail. If the IRS did not accept the mileage log you submitted, you’ll need to get your records in order and create an IRS-proof mileage log that matches your claimed deductions.

THE DEVIL IS IN THE DETAILS

Would your Excel sheets / templates / samples / paper logs hold up during an IRS audit? Submitting inaccurate mileage logs could lead to penalties from the IRS. Depending on the average business miles claimed on your taxes, those fines could be huge!

TIME IS OF THE ESSENCE

The IRS typically expects a response within 30 days of their notice. Depending on the number of miles you’ve claimed and the number of years under review, going through all that data can be extremely time-consuming.

Failing to respond by the deadline or turning in requested documents late can have serious consequences. The IRS may disallow your deductions, assess additional taxes, and even issue penalties for late submissions.

HOW TO PROVE MILEAGE TO IRS?

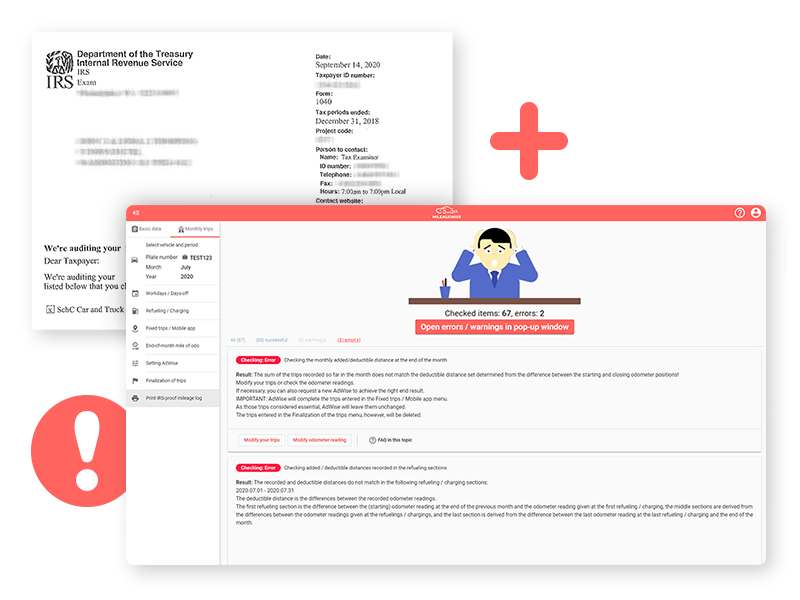

Whether you have a lost or incomplete mileage log, MileageWise is your go-to software. It helps you reconstruct your past trips and it retroactively applies all applicable laws and regulations when assembling your records.

Creating a flawless online mileage log with MileageWise takes only 7 minutes per month. Get $1000s out of your income tax savings with us!

AN IRS-PROOF MILEAGE LOG

A mileage log is considered sufficient if it includes the mileage, addresses, dates, and purposes (e.g., business meetings, personal shopping) for each trip. You’ll also need to provide your total mileage for the year and your odometer readings at the start and end of the year.

If your mileage log contains all these details and the numbers add up you’re ready to file your taxes with the IRS.

“ARE MILEAGEWISE LOGS IRS-PROOF?”

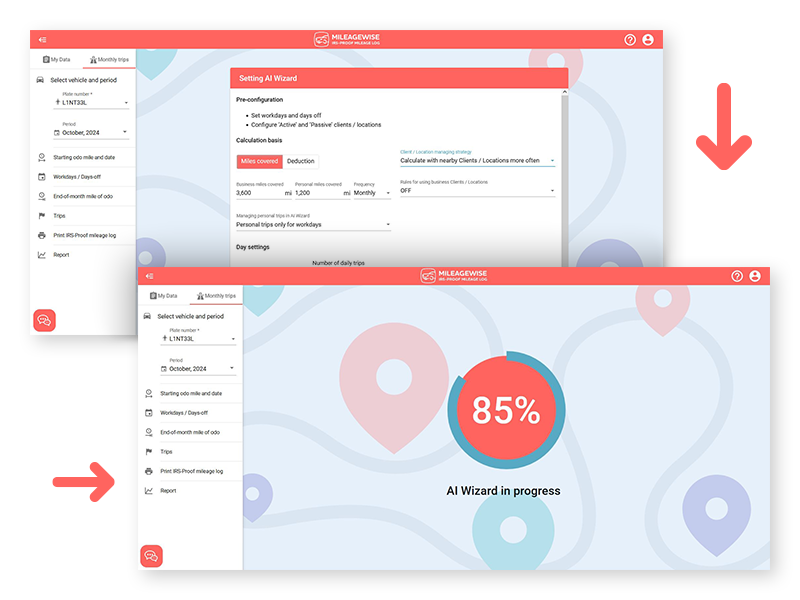

Our AI Wizard Mileage Log Generator recommends trips you may have forgotten and automatically adds them to your log. Meanwhile, the software’s built-in IRS auditor checks and corrects 70 potential red flags before you generate your mileage log — ensuring it meets all IRS mileage log requirements.