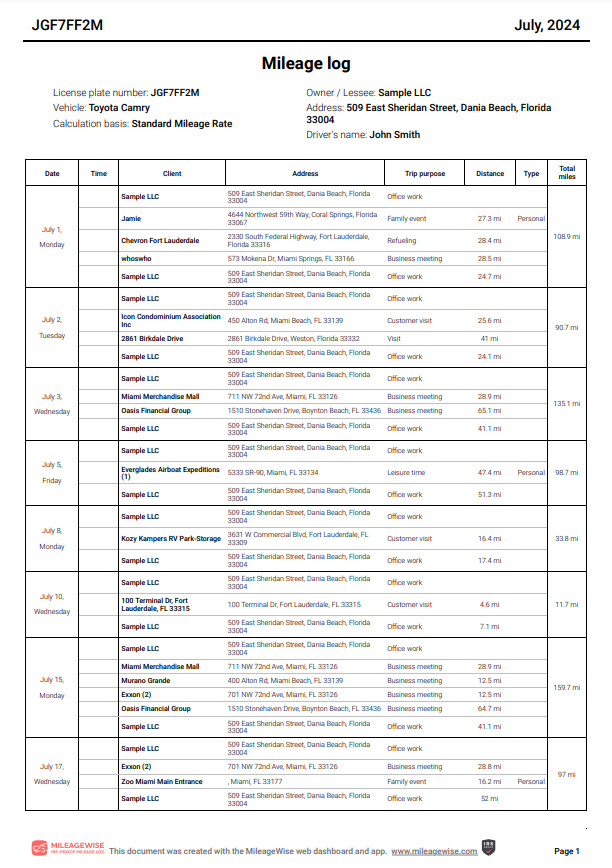

Mileage Log Sample For IRS – Standard Mileage Rate

The standard mileage rate method is a simple and straightforward way to calculate your vehicle expenses. With this method, you’ll be reimbursed a fixed rate per mile driven for business purposes. For the past & current rates set by the IRS, see our article dedicated to mileage rates. Download the sample here.

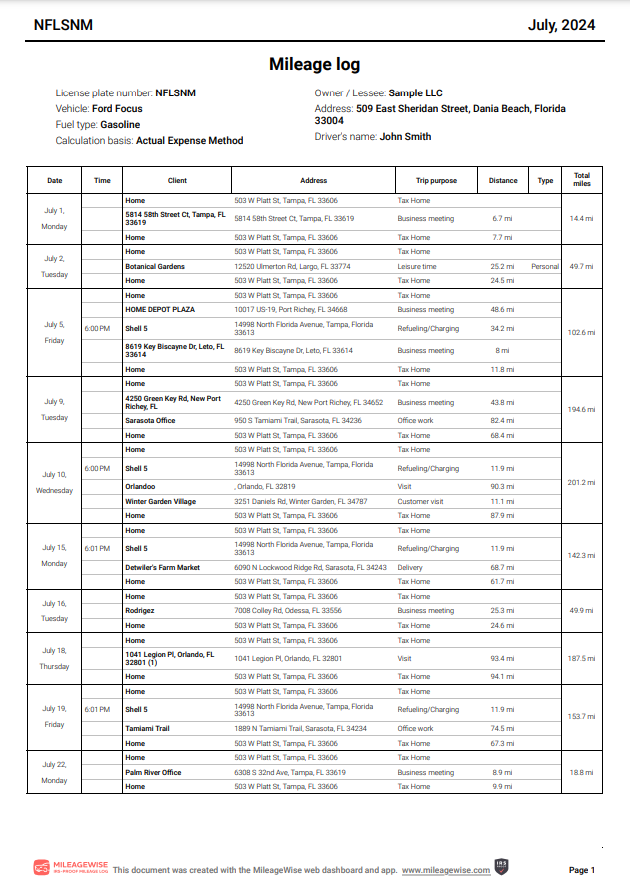

Mileage Log Example – Actual Expense Method

The actual expenses method allows you to calculate your vehicle expenses based on the actual costs incurred for your vehicle’s operation. Sample download here. This includes costs such as gas, oil, tires, insurance, registration fees, repairs, and depreciation. To use this method, you’ll need to keep detailed records of all expenses related to your vehicle.