IRS Mileage Log Guide

Home » IRS-Compliant Mileage Log » Mileage Log Template

Last Updated: June 20, 2025

A mileage log template is a must-have tool for anyone who uses a vehicle for business, work, or charitable purposes. Whether you’re self-employed, a gig worker, or manage a fleet, keeping an IRS-compliant mileage log helps you get every tax deduction you deserve. Plus, it protects you in case of an IRS audit. These templates and samples are becoming increasingly important as the IRS is doubling down on mileage audits for non-filers. However, more people switch to digital ways of tracking their trips. Read on to learn more about your choices!

Table of Contents

What Makes a Mileage Log Template Essential?

Think of a mileage log template as your official record book for your car trips. It’s usually a simple table or spreadsheet where you write down details about each drive. This structure helps you capture all the important info the IRS requires for mileage deduction. To make sure your mileage log spreadsheet is IRS-compliant and can handle any audit, include these key pieces of information:

- Date of every trip

- Starting and ending locations for each drive

- Total business miles driven on that trip

- Reason for the trip (like going to a meeting, making a delivery, or visiting a client site)

- Starting and ending odometer readings for the year

- Details about the vehicle and driver

You can track mileage using pen and paper, spreadsheets, or electronic systems, as long as you consistently record all the necessary data.

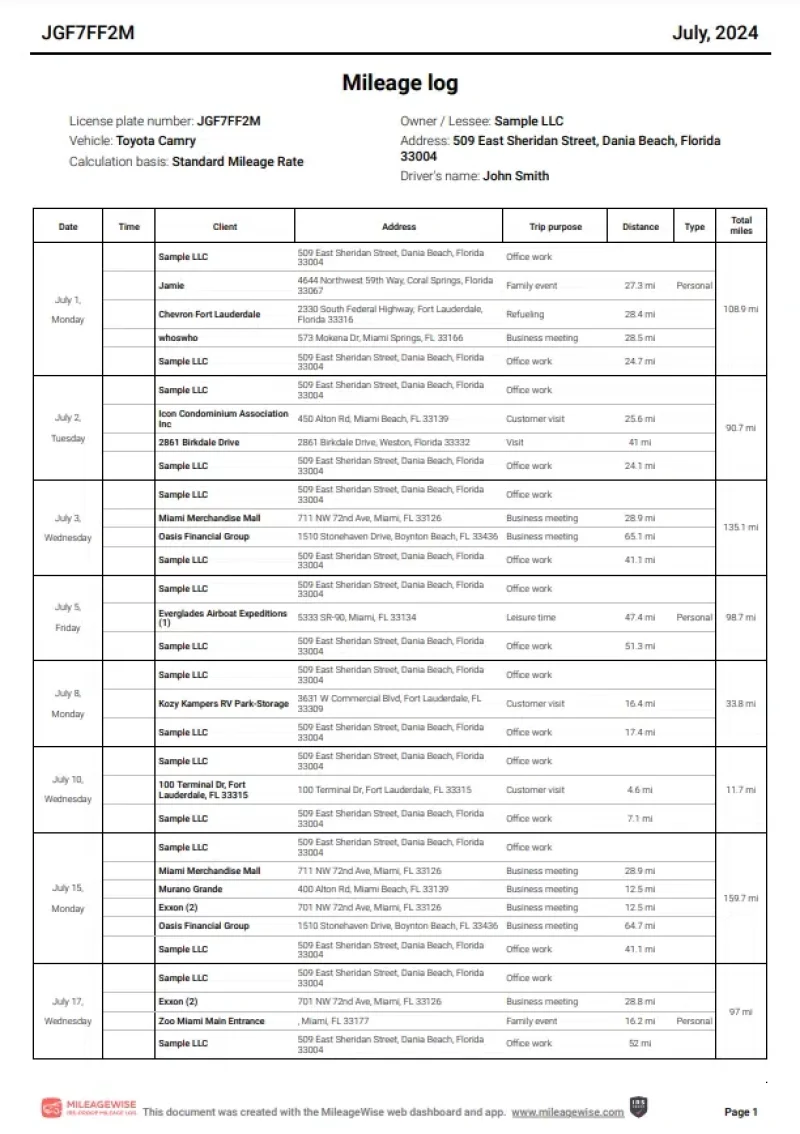

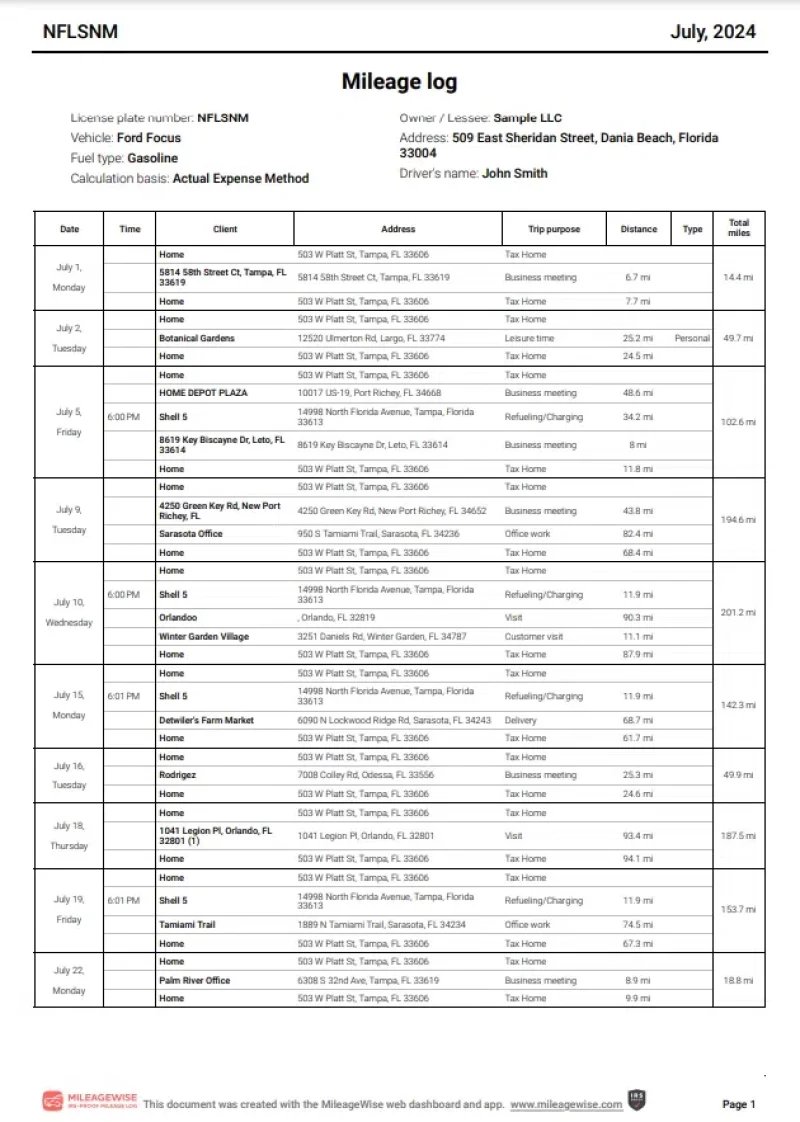

Now that you know why you need a mileage log and what it should contain, here are some small business mileage log samples to look at:

Why Use a Mileage Log Template? Real Benefits & Results

Using a mileage log template isn’t just about following rules; it directly impacts your wallet and peace of mind. Businesses and individuals use them every day to save money and stay organized.

Boosting Tax Deductions

Mileage log templates help you get the most out of mileage deduction. If you track accurately, you will be able to deduct much more than if you just wrote down a few longer drives.

Staying Ready for IRS Audits

An organized mileage tracker spreadsheet is your best defense if the IRS questions your deductions. Having clear, detailed records made with a standard template means you have solid proof.

Gaining Operational Insights

For businesses managing multiple vehicles, small business mileage logs offer more than just tax data. They provide visibility into how vehicles are used, helping managers spot unusual driving patterns or optimize routes.

Download & Get Started

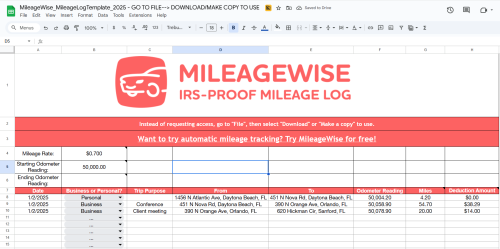

Many free mileage log template options are available online, suitable for different needs and tech comfort levels. You can easily find reliable templates in various formats, such as Excel (great for calculations and customization), Google Sheets (Perfect for sharing and accessing from anywhere), and PDF (Simple, printable format for manual tracking).

Download MileageWise’s Free Google Sheets Mileage Log Templates here:

Step-By-Step: How to Use a Mileage Log Template Effectively

Using a self-employed or small business mileage log template is simple once you get into the habit. The key is consistency.

Basic Workflow

- Record Immediately: The best way to ensure accuracy is to fill in trip details right after you finish driving.

- Categorize Trips: Clearly mark the purpose of each trip (business, medical, charity, or personal). Remember that only business, medical, and charity trips are usually deductible.

- Calculate Miles: Note the ending odometer reading and subtract the starting reading to find the total miles for the trip. A good Excel or Google Sheets mileage log automates this process for you.

Workflow Optimization

Depending on your work, you might summarize trips daily, weekly, or monthly. This can work well for sales reps, technicians, or business owners who have many trips. Furthermore, you might need to customize your mileage log template. For example, your employer might offer a different kind of reimbursement as opposed to the IRS if you were self-employed. Mileage log templates in Excel or Google Sheets are great choices for customization. But there are plenty of resources and video help if you want to assemble your mileage log yourself.

Tips for Creating Audit-Proof Records

- Be Consistent: Log every trip, even short ones. Missing entries can make your log look incomplete.

- Secure Your Data: Save your electronic logs regularly and consider keeping backups.

- Stay Updated: The IRS standard mileage rate changes yearly. Make sure your log aligns with the current year’s rate. You can find the official rate and more details on the IRS website here.

Streamlining Your Mileage Tracking with MileageWise

Keeping a manual mileage log template using spreadsheets is simple, but it can be time-consuming. If you’re looking for a more accurate and efficient way to create IRS-compliant mileage logs (and especially if you need to recreate past trips or want a hands-off tracking solution) MileageWise offers advanced features designed for accuracy and compliance.

MileageWise provides solutions that go beyond simple templates, including automatic tracking through a mobile app:

MileageWise Mobile App Features

- Quick Setup: Get started in minutes and avoid the time-consuming process of setting up or customizing templates for your trips.

- Automatic Mileage Tracking: Track your daily drives automatically with multiple recording modes, offering more precision than filling in static templates.

- Flexible Routing/Distance Calculations: Choose to record exact routes or use calculated distances.

- Backup Mileage Capture: Ensures your daily logs start from the right point, solving issues that many other mileage apps face.

- Ad-Free & Privacy-Focused: Enjoy smooth daily tracking without ads or worrying about how your data might be shared.

- Expense Tracking Integration: Keep daily mileage and expenses organized together, avoiding the need for separate spreadsheets or templates.

- Routing Integration with Waze: Navigate your day with Waze while MileageWise logs trips in the background.

Unique Advantages of MileageWise

- Dedicated Support: Get access to expert customer service ready to help you with any questions.

- Lifetime Plans: MileageWise is the first to offer lifetime deals, saving you money over time compared to monthly subscriptions.

Try MileageWise for free for 14 days. No credit card required!

A Story of Getting Back on Track

I’m a freelance photographer in Phoenix, and I’m on the road constantly. Shoots, client meetings, location scouting, you name it. For the longest time, I scribbled my mileage on random notepads and stuffed them in my glove box. A client once gave me a great mileage log template to stay organized, and I really tried… but I wasn’t consistent. I still missed trips, worried about messing up dates, and constantly stressed about getting audited. It just didn’t give me peace of mind. Then I found MileageWise. Their AI Wizard pulled trips from my Google Maps history and helped me fill in the gaps with simple prompts. Suddenly, I had an IRS-proof mileage log built almost automatically. No more guessing, no more fear. I finally felt in control, and I got thousands back in deductions.

Conclusion: Start Tracking, Start Saving

Using a mileage log template is absolutely essential for maximizing tax deductions and staying compliant with IRS rules. Whether you start with a simple spreadsheet or move to a more advanced solution like MileageWise, the important thing is to start tracking consistently. Don’t leave money on the table and reduce your audit risk.

Here’s how to get started:

- Understand the Requirements: Know what information the IRS needs in your log. Look for a mileage log sample for easy understanding.

- Choose Your Method: Decide if a manual mileage log spreadsheet or an automated app is best for you.

- Download a Template or App: Find a reliable source for a template or sign up for a tracking solution.

- Start Logging Every Trip: Make it a habit to record trip details right away.

- Review Regularly: Check your logs for accuracy and completeness.

- Keep it Safe: Store your logs securely for tax time and potential audits.

FAQ

What is a mileage log template?

A mileage log template is a pre-designed spreadsheet or document used to record business, personal, or charitable vehicle mileage. The template typically includes columns for date, starting location, destination, purpose of trip, starting and ending odometer readings, total miles driven, and notes.

Why do I need a mileage log template?

A mileage log template helps individuals and small businesses accurately track vehicle mileage for tax deductions, reimbursement, or compliance with IRS requirements. Using a template helps consistent and organized record-keeping, making it easier to substantiate mileage claims during audits.

Is there an official IRS mileage log template?

The IRS does not provide an official mileage log template, but it lists the required information that logs should include. Many third-party websites offer templates that comply with IRS guidelines, often in Excel, Google Sheets, PDF, or other printable formats.

How often should I update my mileage log?

Ideally, you should update your mileage log daily or immediately after each trip. Delayed entries can lead to missing information and potentially disallowed deductions if audited.

How long do I need to keep my mileage logs?

You should keep your mileage logs for at least three years from the date you file your tax return, as that’s how long the IRS typically has to audit you. If you claim a deduction for a vehicle you own and depreciate, keep the records for six years. Always hold onto them longer if there’s a risk of underreporting income.

Is a mileage log sample helpful?

Yes! A mileage log sample is very helpful because it shows you exactly what details to record, like dates, destinations, and business purposes, so you stay IRS-compliant. It can save you time, reduce errors, and make your own mileage tracking much easier to organize.