Last updated: March 07, 2025

Are you looking for a free printable mileage logbook for taxes that meets all your needs? With 20 years of experience helping clients to manage their mileage logging we’ve created the perfect files that meet all standards.

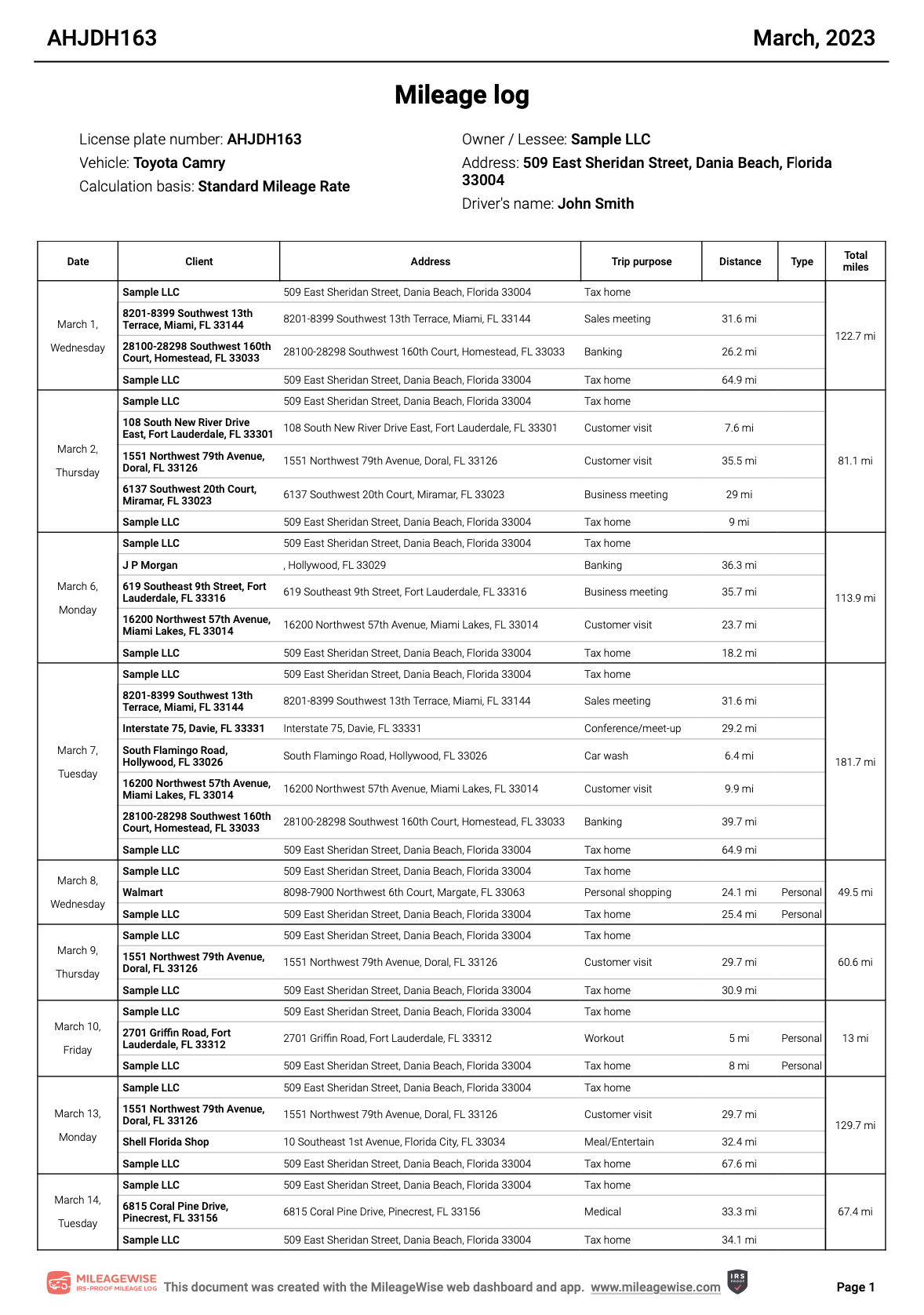

Below you will find printable mileage logbooks for 2021, 2022, 2023, 2024, 2025. Each filled our with sample data for the ease of use. Scroll down and pick the one you need for your tax preparation.

Since the IRS can request mileage logs retrospectively for up to three years, we have a free mileage log template for each year as well:

Free Compliant Mileage Tracking Logbook Template for 2021

Free Compliant Mileage Tracking Logbook Template for 2022

Free Compliant Mileage Tracking Logbook Template for 2023

Free Compliant Mileage Tracking Logbook Template for 2024

Free Compliant Mileage Tracking Logbook Template for 2025

Try MileageWise for free for 14 days. No credit card required!

Dashboard

How to Create a Compliant Mileage Log Book For Taxes

If you choose to use our mileage tracker spreadsheet, you will first need to copy the one we have linked here and paste it into your own Google Docs, as this one is publicly available and therefore cannot be altered.

From there, you can edit your simple mileage log template as you choose, and when you are ready with your logbook for mileage taxes you can either print the file directly or download it into one of many formats, namely PDF or excel format (XLXS files), or even CSV files, all of which are accepted by the IRS.

On the other hand, if you are looking to join the many efficient business people who now use a mileage logging app to create flawless printable mileage logs, then read on.

What is a Mileage Logbook?

In the case of employees, taxes are already withheld from their payment, whereas business owners and self-employed people have to manage their taxes themselves. These generally include the self-employment tax, which covers Social Security and Medicare, and the income tax.

You may be eligible for various deductions from your income taxes, depending on your work type. For example, deductions of office supply costs, internet and phone bills, meals, and vehicle expenses.

This is where the mileage log comes into the picture. You have the option to record all vehicle-related expenses or your miles traveled in a detailed trip log to deduct a set amount of cents per mile.

What Are the Advantages of Keeping a Mileage Log Book For Your Taxes?

There are several benefits to creating a vehicle mileage log book from your logged miles. First, tracking the miles that you traveled is much easier than tracking your car expenses. There is no need to hoard receipts and keep an expense log book on fueling or recharging, repairs and maintenance, parking, insurance, and more.

Moreover, the IRS mileage rate encompasses all vehicle-related deductible expenses and usually results in more tax savings. Furthermore, you get an overview of your daily operations, which helps you identify areas where you can improve and save more.

Mileage LogBooks, and the Standard Mileage Rate

Before we delve any deeper, it’s worth talking about the standard mileage rate, since a car mileage logbook or log is only required for those who choose this mileage calculation approach. Most people do – indeed; contractors, small business owners, and self-employed persons most commonly use this method. It is also worth noting that if this is your first year using a vehicle for business purposes, you must use the standard mileage rate if you ever plan to switch between that and the actual expense method in the future.

From a financial standpoint, this method offers sizeable kickbacks on the miles that you drive – allowing you to deduct 67 cents from every mile for business purposes in 2024.

For example, if you drive 20,000 business miles in a year, the standard mileage rate will provide you with tax deductions totaling $13,400 – provided that you submit an IRS-compliant mileage logbook.

Actual Mileage Expense

The alternative is the above-mentioned actual expenses method, where you must instead keep itemized receipts of all of your vehicle expenses. These expenses include things such as oil, gas, insurance premiums, depreciation, repairs, tires, registration fees, and more.

IRS Compliant Mileage Log Requirements

There are some basic requirements that your mileage log needs to meet in order to be IRS-compliant. Let’s take a look at some of these:

- You must record the date and purpose of any trips you make for business purposes

- You also have to record both the departing and the arrival point

- You have to own or be leasing the vehicle in question

Currently, there is no law suggesting that you need to record your odometer at the beginning and the end of each trip other than the yearly starting and ending odometers, but we do recommend that you record your closing odometer reading at least every month and at refuelings. If you need to reconstruct your mileage log, a past odometer reading calculator is going to come in handy for you.

Here’s a sample for a monthly mileage logbook:

What about my personal mileage?

Although the IRS doesn’t require personal trips in your mileage log, it’s strongly recommended that you include them because it will provide clarity for both yourself and the IRS since you need to separate your total business mileage, total personal mileage, and total commuting mileage for the year.

Also, logging your personal trips boosts the proficiency of MileageWise’s built-in IRS auditor function, which you need for an IRS-Proof result.

Is a Driving Log Required At All for Accounting Purposes?

You do not specifically need a paper mileage logbook for taxes – a simple printable logbook will suffice, but a mileage log that is created in software is an even better choice. In other words:

Can I still deduct mileage without a compliant mileage record book?

In fact, you should. The log does, naturally, need to be IRS-compliant, though most people simply use an app to record their mileage along with a web dashboard to actually print that log. If you’re new to all this – the app is what you take with you on your phone, and the web dashboard is only usable on a PC or a laptop.

Should you use a printable mileage logbook?

While the IRS still accepts them, it is becoming increasingly uncommon to submit them. The vast majority of people submitting these logs do not know that there is an easier way to do things. With that in mind, let’s examine the benefits of using a mileage logbook app over a paper-based mileage deduction logbook.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Printable vs Digital Mileage Logbooks

The truth is that there’s no real comparison. MileageWise offers the best mileage logbook app for taxes which is unrivaled in features and precision.

Let’s take a look at some reasons why an electronic mileage logbook tool is clearly better than a paper-based logbook:

IRS-Proof Mileage Log

If you’re using a paper-based mileage logbook, you’re going to make mistakes, eventually leading to an IRS audit and rejected mileage logs. That’s nothing personal – it’s just human nature. With MileageWise’s software, however, you can use our AI Wizard technology to correct those errors, provided that you have some idea of your odometer readings at various points throughout the year.

Automatic Mileage Tracker App

With our software’s auto-tracking features, you don’t even need to worry about recording each trip individually – you can simply use Bluetooth or plug in your phone and you’re ready to go. MileageWise’s mileage tracker app and accompanying web dashboard companion also allow you to manually put in your trips if that’s what you prefer. It can also automatically create a compliant mileage log. The app runs in the background and your mileage logbook automatically updates logging your mileage.

Retrospective Mileage Logs

If you’re using paper, you might find yourself in a bind when you realize that you have lost old logs, or forgot to keep mileage logs and now you need all of your documentation because you are facing an IRS audit. The good news is, that you can reconstruct those logs as long as you can provide your odometer readings and a list of destinations you typically travel to for business purposes.

Perhaps the ultimate reason why using MileageWise’s software is so superior is because it saves you time and therefore money. Any business person worth their salt understands that time is money. You could spend hours upon hours every month making sure that your paper-based logbook fits the needs of the IRS (and you still won’t be sure), or, you could finalize all of your logs in just 7 minutes per month – with our software. The choice is yours.

For a full list of all of our software’s benefits vs our competitors, you can find a mileage tracker app comparison table. We strongly believe that MileageWise is the best mileage tracking app for creating an auto mileage log book out there.

Tracking Your Mileage as an Employee

If you receive mileage reimbursement for using your vehicle for work—whether for a small business or a larger enterprise—keeping a mileage log is typically the same as if you were self-employed. The specifics depend on your employer’s reimbursement plan, but many companies follow the standard mileage rate (70 cents per mile in 2025) for personal vehicles used for business purposes.

However, there are alternative reimbursement methods. Some employers offer a fixed car allowance, while others calculate a customized cost-per-mile rate based on company expenses for that vehicle. If your employer provides a company car, they may cover certain costs directly and offer a reduced mileage rate to reimburse your variable expenses.

Regardless of the reimbursement method, keeping a mileage log is usually required. It’s also a good idea to check with your employer to discuss how they prefer you to track it. Many modern businesses streamline this process with software like MileageWise, making mileage tracking efficient and hassle-free for employees, while granting instant access to employers.

FAQs

Do I need an IRS compliant car mileage log book for tax return?

Yes, you need a mileage log for tax purposes if you plan to deduct vehicle expenses using the standard mileage rate. This log helps you track your business miles and ensure you have an IRS compliant mileage log with IRS requirements, which allows you to claim deductions effectively.

Do you need an odometer reading for taxes?

While there is currently no law that mandates recording your odometer reading at the beginning and the end of each trip, it is recommended to record your closing odometer reading at least every month and at refuelings. You must, however, record the yearly starting and ending odometers to ensure your mileage log is IRS-compliant.

How long do you need to keep a logbook for tax purposes?

You need to keep your mileage logbook for at least three years, as the IRS can request mileage records retrospectively for up to three years. It’s important to maintain these records to substantiate your mileage deductions if audited by the IRS.

What is a mileage logbook and why is it important for taxes?

A mileage logbook is a record-keeping tool used to document the miles driven for business purposes. This log is essential for self-employed individuals and small business owners, as it allows them to track mileage accurately and claim mileage deductions on their tax returns. Keeping an accurate log not only simplifies the process of filing taxes but also provides evidence in case of an IRS audit. By maintaining a detailed mileage log, you can maximize your tax deduction and ensure compliance with IRS regulations.

How can I download and print a free IRS-compliant mileage logbook template?

There are many resources available online where you can download and print a free mileage log book for car template. Simply search for terms like “free mileage log template” or “mileage logbook for taxes” to find various options in both PDF and Excel formats. Choose the format that best suits your needs, then download the file and print it. A logbook can help you stay organized and compliant when tracking mileage for business or mileage reimbursement purposes.

How do I fill out an IRS mileage log for compliance?

To fill out a mileage log for IRS compliance, you need to include several key details for each trip. Start by recording the date of the trip, the destination, the purpose of the trip (business purposes), and the total number of miles driven. Additionally, note the starting and ending odometer readings. This level of detail helps verify that your mileage tracking is accurate and IRS compliant, ensuring that you can claim the appropriate mileage deductions when filing your tax return.

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Log Generator: Our AI tool helps reconstruct past mileage logs and fill gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |