In a world where efficiency drives success and every cent matters, having a reliable mileage recorder can make all the difference. Whether you’re a business owner managing a fleet or a professional on the move, tracking mileage accurately can transform how you handle expenses, maximize tax deductions, and optimize operations. But how do you choose the right tool for the job? What makes one mileage tracker app stand out from the rest? Let’s delve into why mileage tracking matters and uncover the features that set the best mileage tracker apps apart.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

The Importance of Recording Your Mileage

Tracking your mileage isn’t just about noting down numbers. It’s a powerful way to take control of your financial and operational efficiency. From freelancers managing personal finances to large businesses optimizing fleet operations, a mileage recorder can offer invaluable benefits. Here’s why recording mileage matters:

- Maximized Tax Savings: Proper mileage tracking ensures you can claim deductions and reimbursements accurately. Whether you’re self-employed or using a personal vehicle for work, every mile counts during tax season.

- Improved Budgeting: With a mileage tracker, you can monitor travel expenses, identify patterns, and make better financial decisions. For businesses, this can mean reallocating resources to boost profitability.

- Operational Efficiency: For businesses, knowing how your fleet operates in real-time can help optimize routes, reduce fuel consumption, and enhance overall productivity.

Why Use a Mileage Tracker App?

Gone are the days of paper logs and tedious manual entries. Mileage tracker apps have revolutionized mileage recording, making it faster, easier, and more accurate. Here’s how they simplify the process:

- Automatic Tracking: Say goodbye to manual input. Modern apps automate tracking, using GPS to log trips seamlessly.

- Detailed Reports: Generate IRS-compliant reports for tax purposes or financial analysis, saving you time and effort.

- Historical Data Access: Retrieve trip details from months or even years ago with apps like MileageWise.

- Peace of Mind: With accurate logging, you’ll always be prepared for audits or financial reviews, giving you one less thing to worry about.

Features to Look for in a Mileage Tracker

Not all mileage trackers are created equal. The best ones combine ease of use, accuracy, and advanced features tailored to your needs. Here are the top features to consider:

- Automatic Mileage Tracking: Look for apps that log miles automatically via GPS, eliminating manual errors.

- Accurate Expense Reporting: Choose a tracker that generates detailed reports for tax deductions or reimbursements with minimal effort.

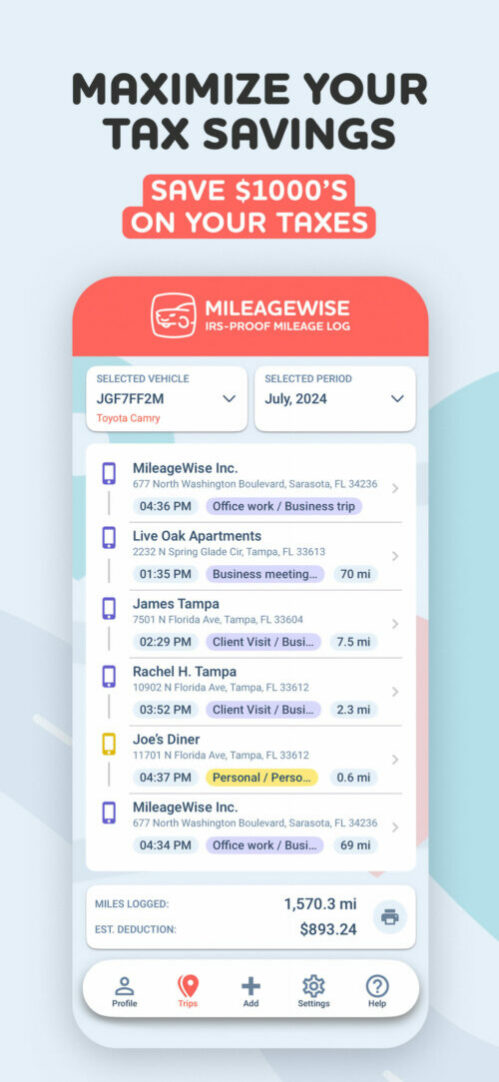

- Customizable Categories: Apps like MileageWise allow you to categorize trips as personal or business, offering flexibility and precision.

- App Integration: Ensure the app syncs with accounting tools to streamline expense management.

- Cloud Backup: Protect your data with cloud storage, enabling access from multiple devices anytime, anywhere.

Maximizing Tax Deductions with Mileage Tracker Apps

Mileage tracker apps can help you unlock significant tax savings. Here’s how you can make the most of them:

- Diligent Tracking: Use automatic tracking features to log every business mile without fail.

- Understand Tax Laws: Familiarize yourself with IRS mileage guidelines to ensure compliance and maximize deductions.

- Regular Reporting: Generate and review reports frequently to stay organized for tax season.

- Track Additional Expenses: Log tolls, parking fees, and other related costs to maximize your savings.

See How Much You Can Save with MileageWise:

So, What Is the Best Mileage Tracker App?

If you’re looking for the best app, MileageWise stands out for its accuracy, automatic trip classification, and IRS-compliant reporting. Whether you need cloud backup, advanced reporting features, or seamless integration, MileageWise offers all this and more.

Wrapping It Up

Choosing the right mileage tracker can transform how you manage your expenses and optimize your operations. With features like automation, detailed reporting, and seamless integration, a great app should save you time and money. Start exploring apps like MileageWise and take the first step towards smarter mileage management today!

FAQ

Why is mileage tracking important?

Mileage tracking helps you maximize tax deductions, improve budgeting, and enhance operational efficiency. It’s essential for freelancers, employees, and businesses using personal or company vehicles for work.

How can a mileage tracker app simplify mileage tracking?

Mileage tracker apps automate the logging process using GPS, generate IRS-compliant reports, and allow you to access historical data for audits or financial reviews.

What features should I look for in a mileage tracker app?

Key features include automatic mileage tracking, accurate expense reporting, customizable categories, app integration, and cloud backup for secure, easy access to your data.

Can I track additional expenses with a mileage tracker?

Yes! Many apps allow you to log related expenses like tolls and parking fees, helping you maximize your savings.

Rebeka Barefield

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Similar blog posts:

Motus Acquires Everlance: What’s Next?

Big news in the world of mileage tracking: Motus acquires Everlance. Motus, a leader in corporate mileage reimbursement, has officially purchased Everlance, a popular mileage

Up-to-Date vs. Outdated Apps: What’s at Stake?

When choosing an app, most people focus on its description, features, and visuals. You check ratings and maybe even read some reviews. But do you

How Mileage Tracking can Boost Productivity

Think mileage tracking is just about jotting down trips? Let’s hit the brakes on that idea. Your mileage log can do so much more than

Mileage Tracking App vs. Manual Log: A Tale of Two Drivers

Imagine this: You’re a regular driver because of your work. You arrive at your destination, then fumble in your pockets for a pen and a

Trip Tracking with Mileage Counter Apps

Tracking your miles accurately has never been more important, whether for personal use or business purposes. A mileage counter app offers a simple, efficient way

Which is the Best Mile Tracker For Work and Efficient Logging?

Are you tired of manually tracking your miles for work? Do you lose out on tax deductions because of it? Do you spend hours sorting