Understanding mileage reimbursement is crucial for anyone using their car for work. It’s a simple way to reduce your tax liability and get compensated for business driving. You should make sure you’re getting the most out of your benefits while following tax rules. This guide will explain everything you need to know about mileage reimbursement for 2024.

Table of Contents

What is Mileage Reimbursement?

Mileage Reimbursement is the compensation you can receive for using your own car for business. It covers costs like fuel, wear and tear, and other vehicle-related expenses. Employees might receive a custom reimbursement from their employers. However, self-employed professionals have to claim their reimbursement according to IRS guidelines.

Calculating Mileage Reimbursement for 2024

If you are self-employed, you have two options to claim your business vehicle costs:

The Standard Mileage Rate

Each year, the IRS updates the standard mileage rate to cover vehicle expenses. For 2024, the IRS standard mileage rate is set at 67 cents per mile. This federal rate is essential for estimating how much you’ll receive as reimbursement. To claim this deduction, you must keep a detailed mileage log of your business miles.

To calculate your mileage deduction, multiply your total business miles by the current standard mileage rate. Stay updated, as rates change annually or even within the same tax year.

The Actual Expense Method

This method allows you to deduct the actual costs of operating your vehicle. These expenses include fuel, repairs, and depreciation among others. Remember to keep a detailed log of your vehicle expenses and keep your receipts.

To calculate your deduction, determine the percentage that you use your vehicle for business. Then, multiply it by the amount of your deductible vehicle expenses.

Choose the method that will result in the largest deduction for your case. Usually, the standard mileage rate yields larger deductions. But, the actual expense method may be better if you operate a car with exceptionally high costs.

Federal Laws and Employer Policies on Mileage Deduction

Mileage compensation rules are different depending on the state and the employer. Federal law doesn’t require businesses to pay employees back for mileage, but some states have their own rules. In California, Massachusetts, and Illinois, employers must pay employees for using their cars for work.

To avoid confusion, employers should create a clear mileage reimbursement policy. This way, employees know what to expect and avoid disputes down the road.

Tax Implications of Mileage Reimbursement

When it comes to taxes, mileage deductions can be a little tricky. As an employee, if you’re reimbursed at or below the IRS standard mileage rate, the amount is non-taxable. But if you’re reimbursed above that rate, the excess amount could be considered taxable income.

To stay compliant with the IRS, ask employees to keep accurate records. This is key to making sure you’re not left with any unexpected tax liabilities.

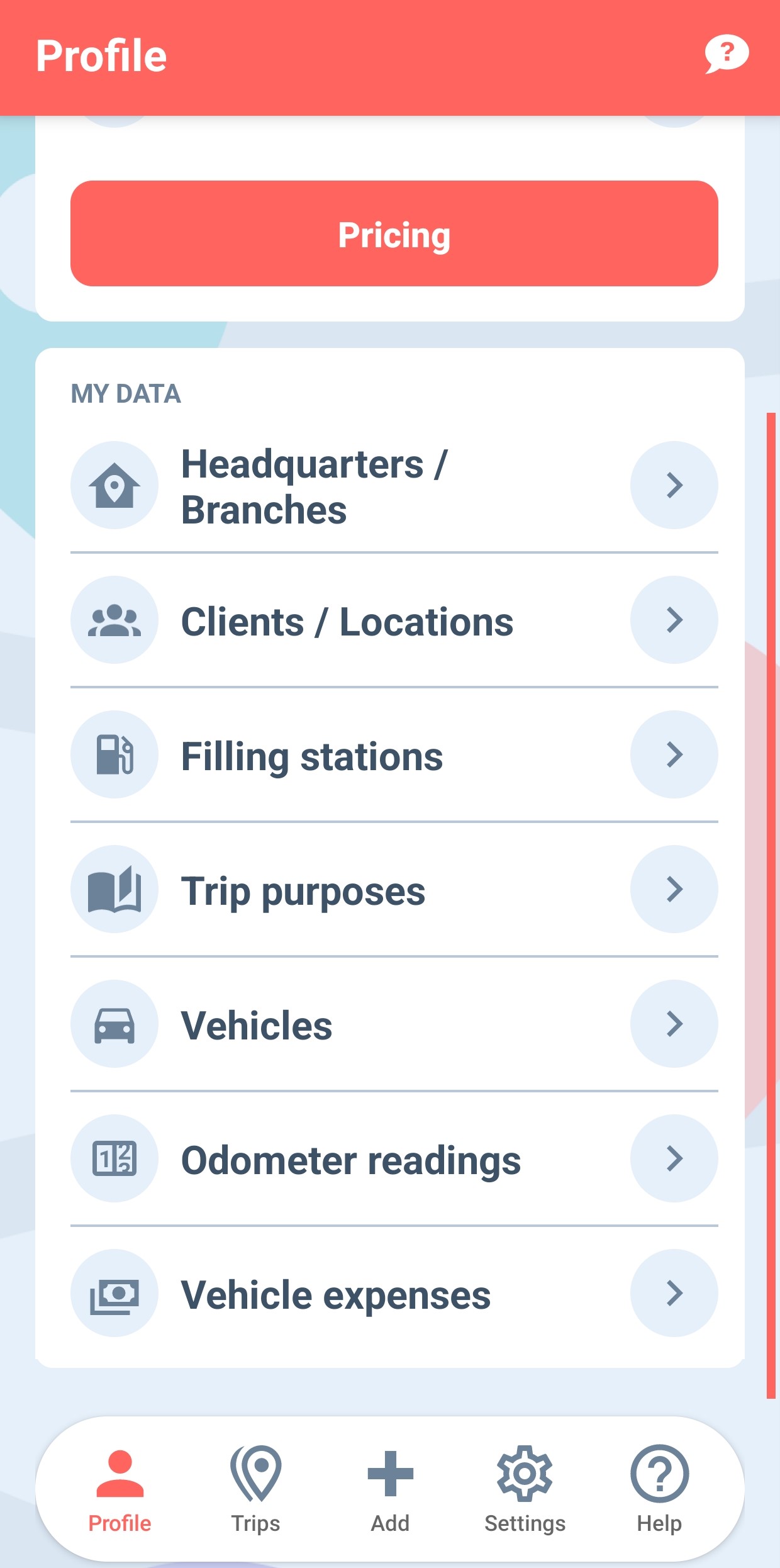

Tip: Introduce a mileage tracker app for your employees to use. These apps make tracking miles a breeze. Furthermore, it gives you one platform where you can keep track of employee mileage.

Mileage Tracking Tools and Technology

Accurate tracking is critical for both employers and employees. Thankfully, tools like MileageWise simplify your mileage tracking. MileageWise offers an AI-powered tool that recreates your business miles and fills in gaps in your log. Hence, this technology ensures that mileage reimbursement claims are accurate and compliant with IRS standards.

By using a mileage tracking app, you can save time, reduce administrative headaches, and avoid disputes over mileage claims.

Conclusion

Mileage reimbursement helps cover the costs of using your personal car for work. Keeping up with federal rates and IRS rules makes sure you get the most from it. Use tools like MileageWise to make the process easier and to keep everything accurate and in line with the rules. This makes MileageWise the best mileage tracking app for tex deductions.

FAQs

How does mileage reimbursement work?

Mileage reimbursement compensates employees or self-employed individuals for business-related driving in their personal vehicles, based on the miles driven.

How is mileage reimbursement calculated?

Mileage reimbursement is calculated by multiplying the number of business miles driven by the IRS standard mileage rate, which is 67 cents per mile for 2024. Companies can have a different system for vehicle expense reimbursement.

What does mileage reimbursement cover?

It covers the cost of fuel, wear and tear, maintenance, and other vehicle-related expenses for business trips.

What is mileage reimbursement in California?

In California, employers are required by law to reimburse employees for business use of their personal vehicles, following state guidelines.

What is the best way to get mileage reimbursement?

Use a mileage tracker like MileageWise, which also works as a gas mileage tracker, and you’ll have an IRS-proof mileage log for every business mile you drive.

Rebeka Barefield

Level Up Your Mileage Tracking

Automatic Tracking: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |