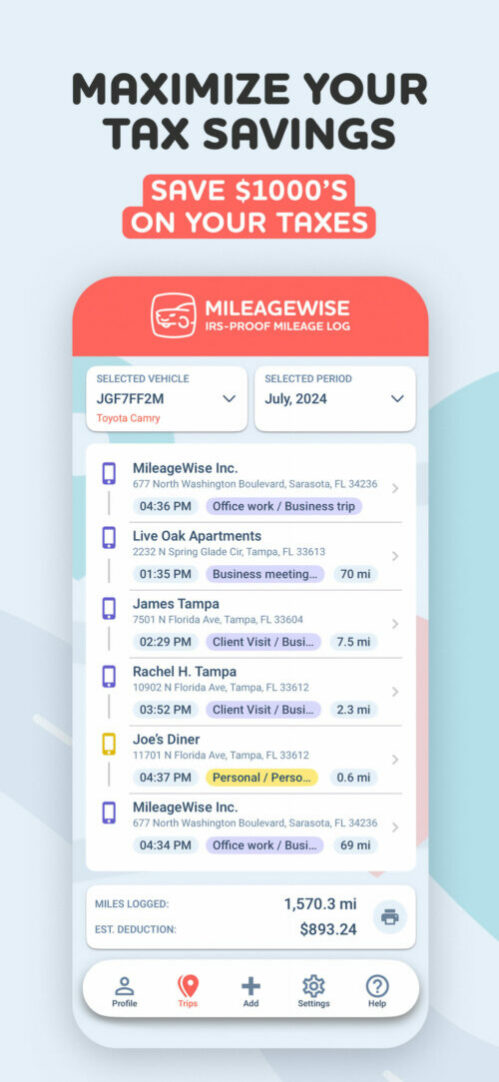

Ever wondered how much money you’re leaving on the table by not tracking your car mileage? With MileageWise 22506 Companies and 29268 cars have gotten thousands in deductions and reimbursements. This shows how important a good mileage tracker for your car is.

The best mileage tracker can change how you handle business trips and expenses. It makes sure you never miss a deductible mile. Apps like MileageWise, MileIQ and Driversnote make logging car mileage easy, helping you get the most from your tax deductions.

Try it for free for 14 days. No credit card required!

Dashboard

Table of Contents

These apps have cool features like automatic trip detection and expense categorization. They’re great for rideshare drivers, delivery workers, and business folks. They help you track mileage conveniently and accurately and make sure you get all your tax benefits.

Using a top-rated mileage tracker for car saves time and boosts your tax deductions. With MileageWise, drivers save an average of $12,000 per year per vehicle tracked. Finding the right app for you is now easier than ever.

Understanding the Importance of Mileage Tracking for Businesses

Tracking business mileage is key for companies to manage costs and get tax benefits. Good mileage logs help save money, follow IRS rules, and make expense tracking easier.

Tax Deductions and Reimbursements

Accurate mileage tracking lets businesses claim big tax deductions. They can deduct up to $0.67 per mile for work travel. This can save thousands of dollars each year. It also makes sure employees get fair pay for work trips in their cars. It’s super important to pick an app that won’t leave you with incomplete logs or missed trips — after all, every mile matters!

IRS Compliance Requirements

The IRS needs certain details for mileage logs to be compliant. A log must have trip dates, where you went, why, and how far. Using a good tracking helps meet these needs and lowers audit risk to under 1%.

To stay under the radar, your mileage log should include personal miles too. This helps keep a good balance between business and personal trips. With MileageWise’s AI Wizard, you can make sure your ratio won’t look suspicious or trigger an IRS audit.

Calculate How Much You Could Save With MileageWise Car Mileage Tracker

Types of Mileage Tracker for Car Solutions

Tracking your car’s mileage is key for business owners and employees. Let’s look at the different types of tracker apps. This will help you pick the best one for your needs.

Smartphone Applications

Mileage tracking apps are very popular. They are easy to use and always with you. These apps use your phone’s GPS to track your trips automatically. They also let you log expenses and create reports.

GPS Tracking Devices

GPS trackers are devices that plug into your car’s OBD-II port. They give exact location data and track mileage on their own. This is great for those who want a dedicated device or manage many vehicles.

Bluetooth-Enabled Solutions

Bluetooth car mileage trackers connect with your smartphone using. They start tracking when you drive, making it easy. They’re good for those who want automatic tracking without using up their phone’s battery.

| Solution Type | Pros | Cons |

|---|---|---|

| Smartphone Apps | Convenient, often free or low-cost mileage tracker | May drain phone battery |

| GPS Trackers | Accurate, dedicated device | Higher upfront cost |

| Bluetooth Devices | Automatic tracking, battery-friendly | Requires additional hardware |

When picking a tracker app for your car, think about ease of use, accuracy, and if it fits with what you already have. Whether you choose a smartphone app, GPS tracker, or Bluetooth solution, today’s tech makes tracking easier.

Even though MileageWise is a smartphone app, it combines the best features of GPS trackers and Bluetooth solutions. When you set it up, you can start tracking using your car’s GPS signal. Plus, MileageWise can also use any data you’ve already recorded with your GPS tracker to produce flawless mileage log documentation.

Level Up Your Mileage Tracking

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Recovery: The AI Wizard helps reconstruct past mileage logs, filling gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 logical errors in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

Top Features to Look for in Mileage Tracking Apps

When picking the best mileage tracker app, look for key features. A good app should automatically detect trips. This saves you time and effort.

Expense categorization is also important. It lets you sort trips into business and personal categories. This makes it easier to keep accurate records for taxes.

IRS-compliant reports are a must. These reports help you claim tax deductions correctly. Some apps even work with popular accounting software.

Cloud synchronization is essential. It keeps your data safe and lets you access it on different devices. This means you can see your mileage logs on your phone, tablet, or computer anytime.

Multi-device support is also key. It lets you easily switch between devices. This makes tracking your mileage convenient, no matter which device you’re using.

- User-friendly interface for easy navigation

- Offline functionality for areas with poor network coverage

- Route optimization to help plan efficient trips

- Fuel economy tracking for better cost management

Choosing an app with these features makes tracking your mileage easier. It also ensures you have accurate, IRS-compliant records for work or personal use.

Automatic vs Manual Tracking Methods

Choosing between automatic mileage tracking and manual mileage logs is key for your business. Each method has its own benefits. MileageWise offers solutions for both.

Benefits of Automatic Tracking

Automatic mileage tracking is super convenient and accurate. It saves time and money by avoiding overreporting. Companies see big improvements in approval processes and mileage accuracy.

When to Use Manual Tracking

Manual mileage logs are still useful. They’re great for occasional trips or when privacy matters. They offer more control over trip details, perfect for small businesses or those who travel less.

MileageWise’s Manual Logging Functions

MileageWise has strong manual logging features. It makes logging trips easy and accurate. Our system includes:

- Easy trip classification

- Editing capabilities for trip details

- IRS-compliant record keeping

- Manually end your trip as an extra safety net for accuracy

| Feature | Automatic Tracking | Manual Logging |

|---|---|---|

| Accuracy | High | Prone to Errors |

| Time Efficiency | Conveniently saving time | Takes a lot of time |

| Control Over Details | Limited | High |

| Privacy | Varies | High |

MileageWise lets businesses pick the best tracking method for themselves. It offers fully automatic tracking with the possibility of manual editing up to the finest details. This way, they keep their mileage records accurate.

Popular Mileage Tracking Applications Compared

Mileage tracking apps are key for business drivers. We’ll look at top choices to find the best for you.

MileageWise leads with a built in IRS auditor that checks for and corrects 70 potential IRS red flags in your mileage logs (also comes with a software solution that can create IRS compliant retrospective mileage logs with partial log data via it’s online dashboard), rated 4.7 on iOS and 4.6 on Google Play. Stride has free basic tracking and a 4.8 iOS rating. Everlance combines expense management with high ratings on all platforms.

Hurdlr is great for self-employed with tax tools, and TripLog has various tracking options. MileIQ is simple with swipe-based tracking. Both have ratings over 4.5 on app stores.

| App | iOS Rating | Google Play Rating | Key Feature |

|---|---|---|---|

| MileageWise | 4.7 | 4.6 | AI-powered mileage log reconstruction, trip auto classification |

| Stride | 4.8 | 3.5 | Free basic tracking |

| Everlance | 4.8 | 4.4 | Expense management |

| Hurdlr | 4.6 | 4.5 | Tax calculation tools |

| TripLog | 4.6 | 4.5 | Multiple tracking modes |

| MileIQ | 4.7 | 4.4 | Swipe-based classification |

SherpaShare is for rideshare drivers, and QuickBooks Self-Employed links with accounting. These apps meet various business needs, from simple tracking to detailed expense management.

Advanced Tracking Technologies and Integration Options

Modern mile trackers have cool features to help you work better. They do more than just track miles. Convenience is the service they are striving for. They also fit well with your current systems saving you time and money.

What MileageWise offers to make tracking effortless, protect you from data loss, streamlines your accounting, and doesn’t disturb your operations with cross-device support:

Multipe Tracking Options

Simply put your phone on the car’s charger, connect it to its Bluetooth, or use motion detection to start and stop tracking your trips. MileageWise has you covered with the most accurate and automated options. If you don’t want to spend time categorizing your trips as business or personal, just upload your client’s addresses, and the app will handle it for you saving precious hours at the end of each month.

Cloud sync lets you access your data anywhere. Start a trip on your phone and log it on your computer later. This way, you never forget to log your miles, no matter where you are. More importantly, there is no chance of losing any data.

Are you using another app that made you end up with partial logs and want to change to Mileagewise? Our AI Wizard can help you reconstruct your mileage log making it IRS compliant.

With our easy-to-use interface, you can optimize your mileage returns in just minutes, avoiding the headaches of fixing Excel tables before tax season.

Accounting Software Integration

FreshBooks makes tracking expenses easy. They let you import mileage data directly. This saves time and makes sure your records are right for tax season. Freshbooks in itself doesn’t give you compliant mileage logs but Mileagewise combined with FreshBooks is a surefire way to get maximum tax returns for the year.

With just a click of a button, our AI wizard Mileage LOg Generator fixes 70 potential IRS red flags in our mileage log before finalizing your log for submission.

Multi-Device Support

Today’s workers use many devices. Your mileage tracker should work on both iOS and Android. At MileageWise we make sure that tracking works on any device you may use in your day to day routine.

Backing up your data is essential, and good trackers save your trips securely while using minimal phone data. MileageWise takes it a step further by not using any phone data for tracking. Instead, it relies solely on GPS signals to record your trip’s start and end points. This way, it won’t drain your battery or eat into your mobile data, while still safely storing your logs in the cloud.

These advanced features make a strong system for your business. From cloud access to easy accounting integration, modern trackers help your business move forward smoothly.

Try it for free for 14 days. No credit card required!

Dashboard

Best Practices for Implementing Mileage Tracking

Setting up a good mileage tracking system is key for businesses. It helps with accurate paybacks and tax cuts by logging every mile you drive. With many using apps for this, it’s vital to follow the best ways.

Employee Training Tips

Teaching employees well is crucial for good mileage tracking. Make a detailed policy and hold practice sessions. Show them how to use the app right, stressing the need for regular tracking. With MileageWise we wanted this step to be as convenient as it can be. Simply install the app, set up the Automatic Tracking method, and grant the necessary permissions. MileageWise will then track their trips automatically, without needing to open the car tracking app again.

Classifying Business vs. Personal Trips

Accurately classify each trip as business or personal to maximize tax deductions and ensure IRS-compliant mileage logs. Uploading all of your client’s addresses and fuel stations as an Excel file when setting up the app will make this process automated. It is just one of the many set and forget features of our app.

Data Management Guidelines

Keep your data safe in your mileage tracking system. Choose apps like Timeero that only track during work hours. Use secure cloud syncing for keeping records safe. Regular backups help keep logs correct for audits.

Compliance Protocols

Make strict rules that follow IRS rules. Check mileage logs often to spot mistakes early. Use apps that make reports for taxes to make things easier. Having good records helps avoid fines in audits. Our build in IRS auditor fixes 70 types of IRS red flags in your mileage data making sure you won’t get an IRS audit.

By following these tips, you can get the most out of your mileage tracking. Doing it right means you follow IRS rules and save money on expenses and taxes.

Conclusion

Choosing the best mileage tracker for your car is a big deal. It helps you track business expenses better. This way, you can get more tax deductions and manage your money easier.

MileageWise is a top pick because it lets you deduct up to $12,000 in business miles. It has smart technology and checks your records for accuracy. This makes it great for keeping your taxes in order.

Automated mileage logging saves you about 20 hours a year. With the IRS rate at 67 cents per mile, tracking every mile is important. You can choose between the standard mileage rate or actual expenses, and a good tracker helps you do it right.

Getting a good mileage tracker saves you time and can increase your tax savings. Look around and pick the one that works best for your business. You’ll be happy when tax time comes.

FAQ

What are the best mile tracker apps for car use?

Best apps for tracking car miles include Solo, Stride, and Everlance. Hurdlr, TripLog, MileIQ, SherpaShare, and QuickBooks Self-Employed are also great. They have features like automatic trip detection and expense categorization.

How do mile tracker apps help with tax deductions?

These apps help with tax deductions by accurately logging business miles. They give you reports that meet IRS standards. This can save you money and make tax time easier.

What's the difference between automatic and manual mile tracking?

Automatic tracking uses GPS to log trips without you needing to do anything. Manual tracking lets you enter trip details yourself. Apps like MileageWise offer both for different needs.

Are mileage tracking apps accurate for IRS purposes?

Yes, most apps are made to meet IRS standards for accuracy. They give detailed reports that are good for tax deductions and audits.

How much do mileage tracking apps typically cost?

Prices vary, with some apps free and others costing $5-10 a month. The cost can be worth it for the tax savings and time saved.

Can mileage tracking apps integrate with accounting software?

Yes, many apps work with popular accounting software like QuickBooks and Xero. This makes managing expenses and taxes easier.

What features should I look for in a mileage tracking app?

Look for automatic trip detection, expense categorization, and IRS-compliant reporting. Cloud syncing and support for multiple devices are also important. Features like route optimization and fuel economy tracking are nice too.

How do GPS tracking devices differ from smartphone apps for mile tracking?

GPS devices offer more accurate location data and don’t use phone battery. But, apps are more convenient and offer features like expense categorization.

How can businesses implement effective mileage tracking policies?

Businesses should give clear guidelines and train employees on app use. They should also manage data for privacy and security. Following IRS rules and doing regular audits helps too.

Norbert Szabo

Similar blog posts:

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |