Imagine this: You’re a regular driver because of your work. You arrive at your destination, then fumble in your pockets for a pen and a crumpled notebook to jot down your mileage. Sounds familiar? This was the reality for Bernard, a furniture maker who drove a lot to deliver handcrafted goods. He was a true believer in the “old-school” method of mileage tracking. Up until one day that has ultimately changed his perspective…

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Table of Contents

Bernard, the Old-School Driver

Bernard, a man who cherished the feel of pen on paper, meticulously recorded every mile driven in his trusty notebook. However, this traditional approach came with its own set of challenges. His handwriting, even to him, often resembled ancient hieroglyphics. Receipts, like socks after laundry, vanished into the abyss of his truck’s interior. And at the end of the month, the dreaded task of calculating his mileage loomed large. His poor mileage tracking practices led to a daunting puzzle that often stretched into the long hours of the morning.

Emily, the Tech Enthusiast

Meanwhile, Emily, a tech-savvy real estate agent, navigated the world of mileage tracking with ease and efficiency. Emily embraced the digital age, utilizing a free mile tracker app on her smartphone. With a few taps and a GPS signal, her app automatically recorded every mile driven for business purposes. Categorizing trips for tax purposes was a breeze, and generating a mileage report for reimbursement was as simple as pressing a button.

Mileage Tracking App vs. Manual Log

The contrast between Bernard and Emily was stark. Bernard, burdened by his manual system, spent hours wrestling with calculations and grappling with the constant anxiety of missing a crucial entry. Emily, on the other hand, enjoyed the freedom that came with automated tracking. She had more time to focus on what she loved – connecting with clients and showcasing stunning properties.

The Clash of Generations

One gloomy Monday afternoon, Bernard, exasperated by the sheer volume of receipts piling up on his desk, happened to visit Emily for lunch at her office. When he arrived he found his daughter laid back on a couch. She said she is working on her mileage log, yet to Bernard’s surprise, she was buried in her phone instead of sitting at her desk shuffling through papers. Curiosity got the better of him, as he peered over his daughter’s shoulder.

That is when he witnessed firsthand the magic of her mileage log app. With a few taps on her phone, Emily generated a detailed report of her business mileage. Bernard, initially skeptical, was astonished by the simplicity and efficiency of the app.

The Benefits of Digital Mileage Tracking

Emily, ever the gracious host, patiently explained the benefits of using a mileage tracker app. “Imagine,” she said, “no more lost receipts, no more tedious calculations, and no more stress during tax season. It’s worth it.” Bernard, intrigued, began to consider something alien to him. Perhaps, just perhaps, the digital age had something to offer even a die-hard traditionalist like him.

Conclusion

In conclusion, the mileage tracking app vs. manual log battle is a clear victory for technology. While Bernard’s dedication to the “old ways” was admirable, the efficiency and accuracy of a modern mileage tracker simply couldn’t be ignored.

If you’re still relying on pen and paper for your mileage tracking, consider making the switch. You’ll likely find that a mileage tracker app can save you time, reduce stress, and even help you save money on taxes. Explore the various options available and discover the digital revolution in mileage tracking for yourself.

Level Up Your Mileage Tracking

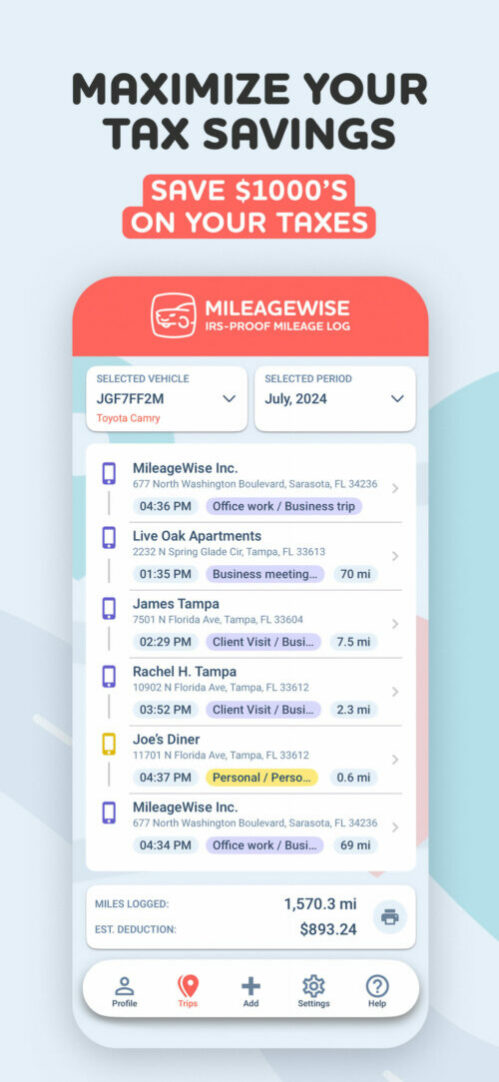

MileageWise: Tracks trips automatically via vehicle movement, Bluetooth, and Plug’N’Go without draining your battery.

AI-Powered Mileage Log Generator: Our AI tool helps reconstruct past mileage logs and fill gaps in your log to ensure compliance.

Built-in IRS Auditor: Checks and corrects up to 70 potential red flags in logs, ensuring they meet IRS standards for tax deductions.

Web Dashboard & Team Collaboration: Manage logs, import trips, and collaborate with teams through the web dashboard, ideal for businesses.

Try it for free for 14 days. No credit card required!

FAQs about Mileage Tracker Apps

What are the benefits of using a mileage tracking app?

Mileage tracking apps offer numerous benefits, including increased accuracy, reduced time spent on manual tracking, streamlined tax preparation, and improved reimbursement processes.

Are mileage tracking apps accurate?

Yes, most modern mileage tracking apps utilize GPS technology for highly accurate distance calculations.

Do mileage tracking apps integrate with other business tools?

Many apps integrate with accounting software, expense management platforms, and other business tools for seamless data flow.

Are mileage tracking apps free?

Some apps offer basic features for free, while others require a subscription for premium features such as advanced reporting and unlimited tracking.

How do I choose the best mileage tracking app for my needs?

Consider factors such as ease of use, features, pricing, customer support, and user reviews when selecting the perfect mileage tracking app.

Rebeka Barefield

Similar Blog Posts

Motus Acquires Everlance: What’s Next?

Big news in the world of mileage tracking: Motus acquires Everlance. Motus, a leader in corporate mileage reimbursement, has officially purchased Everlance, a popular mileage

Up-to-Date vs. Outdated Apps: What’s at Stake?

When choosing an app, most people focus on its description, features, and visuals. You check ratings and maybe even read some reviews. But do you

How Mileage Tracking can Boost Productivity

Think mileage tracking is just about jotting down trips? Let’s hit the brakes on that idea. Your mileage log can do so much more than

Mileage Tracking App vs. Manual Log: A Tale of Two Drivers

Imagine this: You’re a regular driver because of your work. You arrive at your destination, then fumble in your pockets for a pen and a

Trip Tracking with Mileage Counter Apps

Tracking your miles accurately has never been more important, whether for personal use or business purposes. A mileage counter app offers a simple, efficient way

Which is the Best Mile Tracker For Work and Efficient Logging?

Are you tired of manually tracking your miles for work? Do you lose out on tax deductions because of it? Do you spend hours sorting