In today’s fast-paced world, effective mileage tracking is essential for both individuals and businesses. With a myriad of apps available, choosing the right one can significantly impact your tax deductions and mileage reimbursements.

This article compares three top mileage tracking apps: MileIQ, Everlance, and MileageWise. Each of these apps offers unique features and pricing models, catering to a diverse range of needs.

Whether you’re a freelancer, a small business owner, or someone who frequently travels for work, understanding the nuances of these apps will help you make an informed decision. We’ll explore their user interfaces, feature sets, and pricing plans, providing a detailed overview that can guide you in selecting the app that best aligns with your mileage tracking requirements.

Try MileageWise for free for 14 days. No credit card required!

Dashboard

Comparing User Interface and Experience: MileIQ vs. Everlance

When choosing a mileage tracking app, the user interface (UI) and overall experience (UX) play a crucial role. Here’s an insightful look at how MileIQ and Everlance stack up in these aspects.

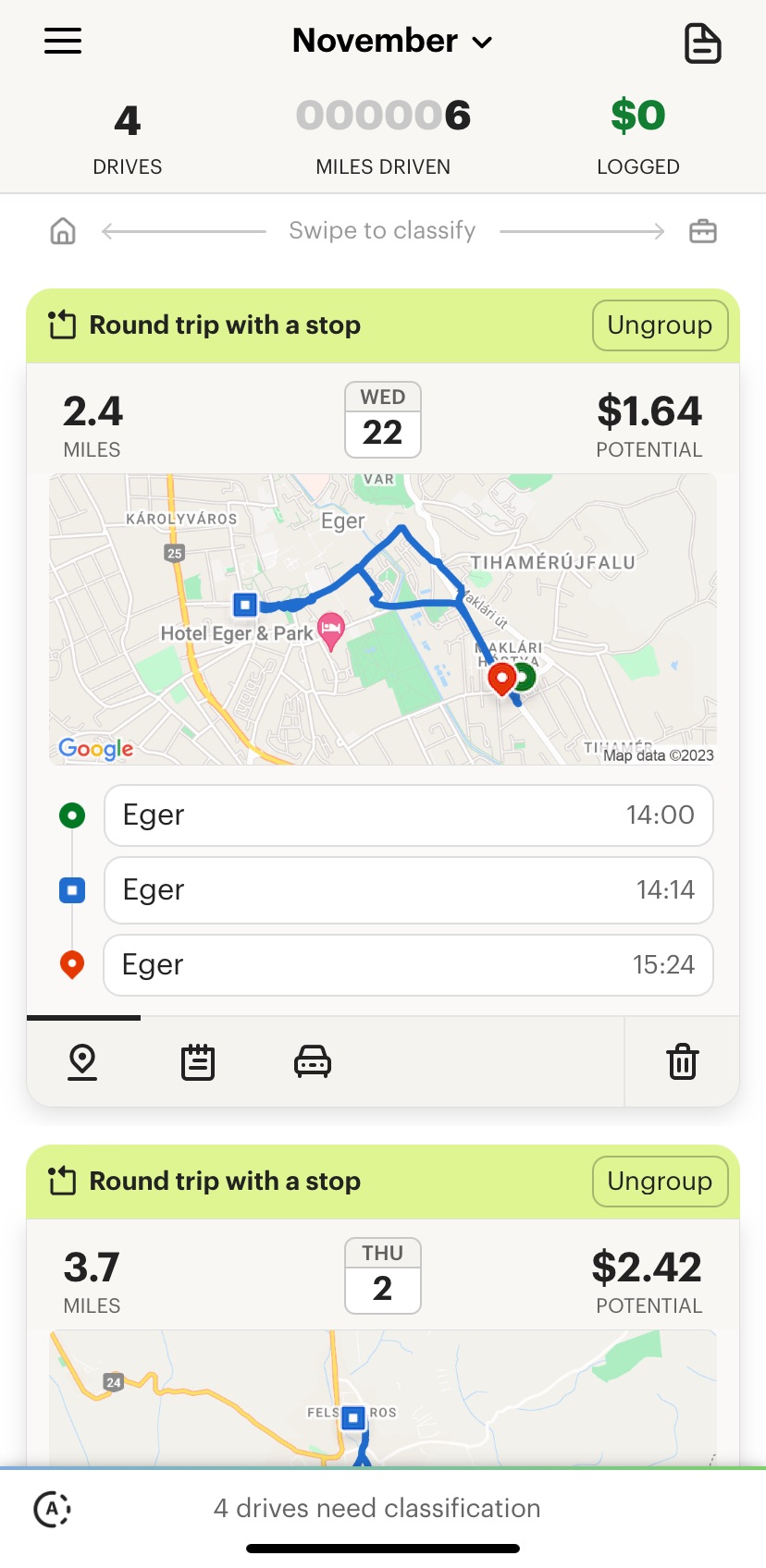

MileIQ: Streamlined and Simple

MileIQ is known for its straightforward and user-friendly interface. Here are some key points:

- Automatic Drive Detection: MileIQ uses GPS to automatically detect and log drives, requiring minimal user intervention.

- Easy Classification: The app features a simple swipe mechanism – swipe right for business drives and left for personal ones.

- Drive Records: It maintains a comprehensive log of all drives, which can be easily classified or edited if needed.

User Experience Highlights:

- Intuitive Navigation: Users find the app easy to navigate, enhancing the overall experience.

- Battery Usage: A downside noted by users is the app’s significant battery consumption due to continuous GPS use.

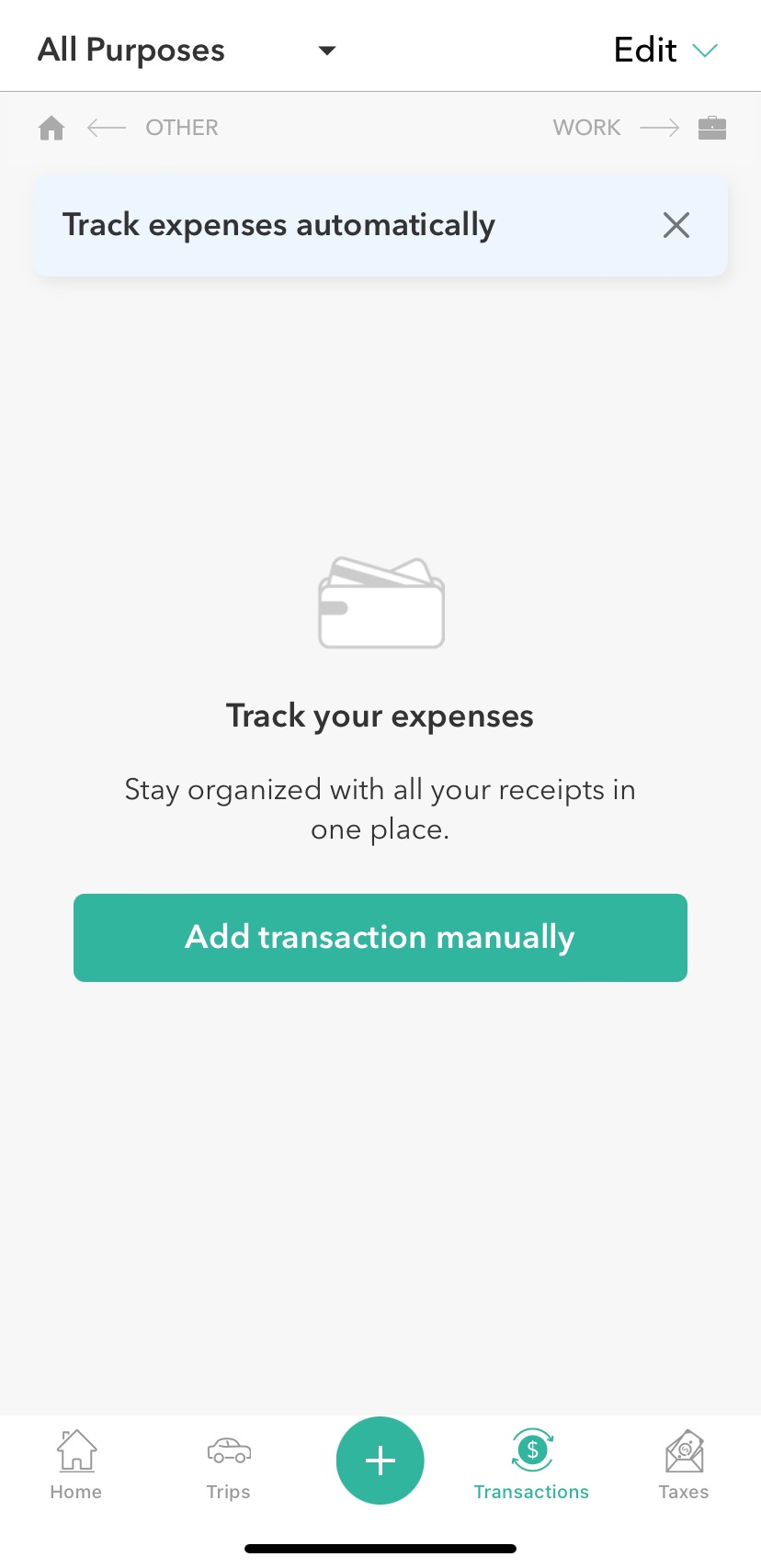

Everlance: Comprehensive and Versatile

Everlance offers a broader set of features with a focus on versatility:

- Multiple Tracking Options: Includes auto-detection, manual entry, and a ‘Start Tracker’ feature for mileage tracking.

- Expense Management: Allows users to track expenses, categorize them, and even integrate bank and credit card transactions.

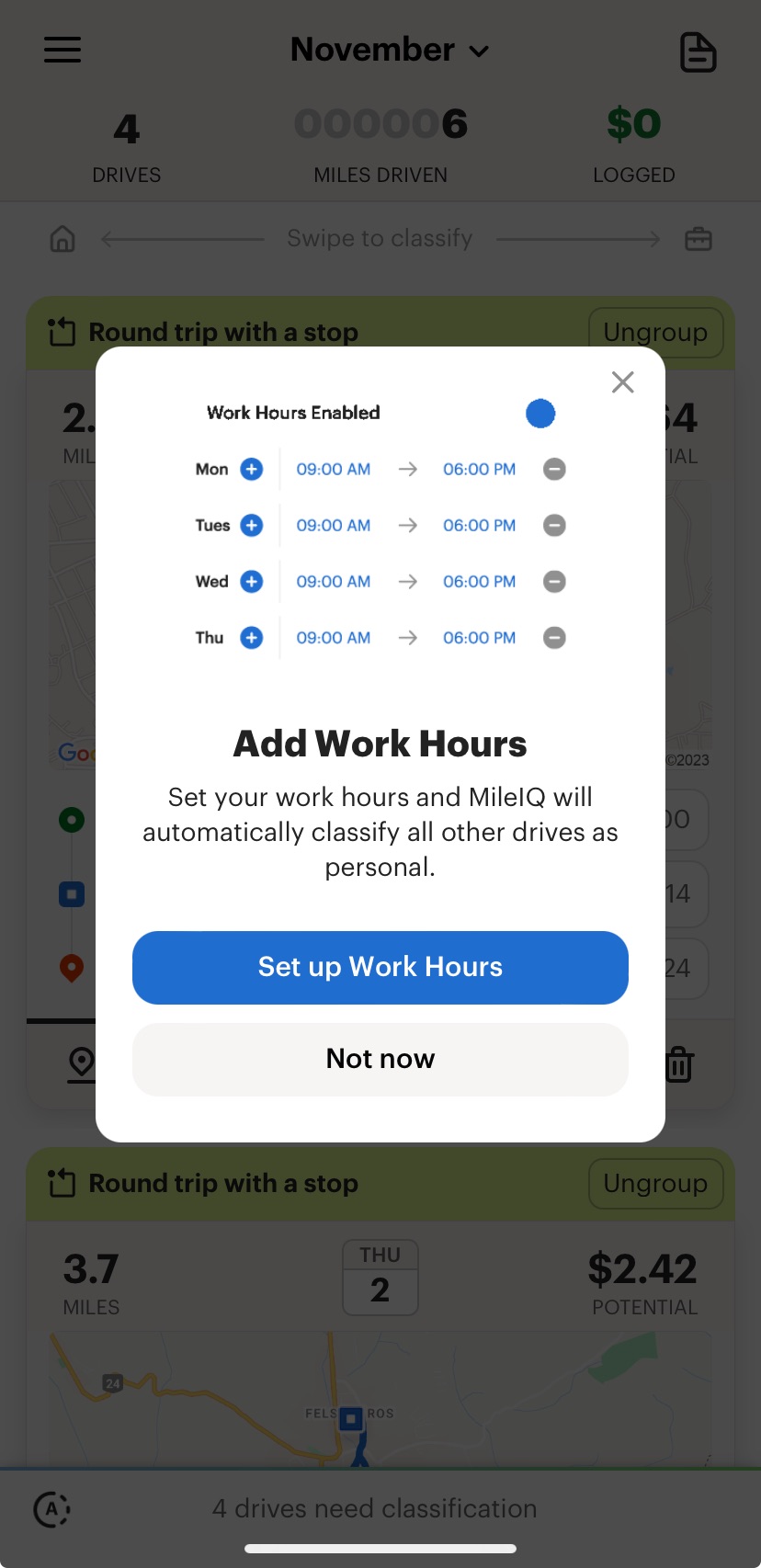

3. Customization: Users can set work hours for automatic tracking, reducing the need for manual classification of trips.

User Experience Highlights:

- Expansive Features: Everlance’s UI accommodates a wider range of functionalities compared to MileIQ.

- App Integration: The ability to integrate with banking services adds convenience but might be overwhelming for users looking for a simple mileage tracker.

FAQs

- What is Everlance? Is it legit?

- Everlance is a digital mileage and expense tracking application designed to simplify record-keeping for freelancers, small business owners, and anyone needing to manage business-related driving and expenses. It is a legitimate tool that offers a range of features from automatic mileage logging to generating tax-ready financial reports.

- How does Everlance work?

- Everlance works by using GPS technology to automatically track mileage whenever you start a trip. It records each journey in a digital logbook, categorizes trips as business or personal, and allows users to manually add expenses. This data can then be used to generate detailed reports for tax or reimbursement purposes.

- What is MileIQ?

- MileIQ is a mobile app that automates mileage tracking for business purposes, using GPS technology to log every trip accurately. It’s designed to help users easily classify drives as business or personal and generate reports for tax deductions or reimbursements.

Is MileIQ easier to use than Everlance?

- MileIQ is generally considered more straightforward, focusing primarily on mileage tracking, whereas Everlance offers a wider range of features which can be more complex.

- Can Everlance track expenses automatically?

- Yes, Everlance can automatically track expenses, especially with bank and credit card integration.

- Does MileIQ offer detailed drive reports?

- Yes, MileIQ provides detailed reports of your drives, which can be accessed and edited easily.

- Which app is better for batter life?

- Both apps can impact battery life due to GPS use, but MileIQ has been specifically noted for significant battery consumption.

Feature Comparison

When comparing the feature sets of MileIQ and Everlance, several key aspects stand out:

MileIQ Features

- Automatic Mileage Tracking: MileIQ is renowned for its automatic drive detection, using cell phone data, Wi-Fi, and GPS to track drives over half a mile.

- Drive Classification: The app allows easy classification of drives as business or personal with a simple swipe feature.

- Battery Usage: A notable concern with MileIQ is its significant impact on battery life due to constant GPS usage.

- Simplicity: It’s best suited for those who need straightforward mileage tracking without additional complex financial features.

- Work Hours Management: Users can set their work ours to be auto-classified as business and all other drives will be considered personal.

Everlance Features

- Versatile Tracking Options: Everlance offers auto-detection, manual entry, and a ‘Start Tracker’ feature for mileage tracking. It allows users to categorize trips as business, personal, or other (like commute or charity) with a swipe feature.

- Expense and Receipt Management: The app allows for expense tracking with options to upload receipts and sync bank and credit card transactions.

- Income Tracking and Deduction Finder: Users can track income and utilize Everlance’s deduction finder to identify potential tax deductions.

- App Integrations and Tax Reports: Everlance integrates with accounting platforms like Xero and Freshbooks and provides easy export of data for tax reporting.

- Battery Drain Concerns: Similar to MileIQ, Everlance also tends to drain battery life due to background running.

- Lack of Route-Planning and Time Tracking: Everlance doesn’t offer route-planning or time tracking features, which might be a downside for some users.

FAQs

Which app offers more comprehensive features, MileIQ or Everlance?

- Everlance offers a more comprehensive set of features, including expense tracking, income tracking, and deduction finder, whereas MileIQ focuses primarily on mileage tracking.

Are there any major limitations with the free versions of these apps?

- The free version of Everlance is limited to 30 automatic trips per month. In contrast, MileIQ’s free version limitations aren’t specified but may include a cap on the number of trips.

Can Everlance integrate with accounting software?

Yes, Everlance offers integrations with accounting platforms like Xero and Freshbooks.- What is Everlance Premium?Everlance Premium is the paid version of the Everlance app. It offers more features to help track expenses and mileage better. The free version is basic, but Everlance Premium has advanced tools for better financial management.Key Features of Everlance Premium:

- Automatic Mileage Tracking: Everlance Premium uses GPS to track your mileage automatically. You don’t have to log trips manually.

- Expense Tracking: Capture receipts by taking pictures. Everlance will categorize your expenses for you.

- Custom Categories: Create custom categories for your expenses. This makes it easier to see where your money goes.

- Financial Reports: Generate detailed reports for tax purposes or reimbursement submissions.

- Tax Deduction Estimator: Get insights on possible tax deductions based on your tracked mileage and expenses.

- Multi-User Support: Perfect for teams or partnerships. Multiple users can track expenses and mileage in one account.

- Priority Support: Premium users get priority customer support for any questions or issues.

What are the benefits of Using Everlance Premium? Everlance Premium offers many benefits for better financial management:

- Saves Time: Automatic tracking saves you time. You can focus on your work instead of logging trips and expenses.

- Maximizes Deductions: Accurate tracking helps you not miss out on tax deductions.

- Easy to Use: The app is user-friendly. It’s easy for anyone to use and get the most out of it.

- Informed Financial Decisions: With detailed reports, you can make better financial decisions.

- Peace of Mind: Knowing your mileage and expenses are tracked accurately gives you confidence during tax season.

Is battery drainage a concern for both apps?

- Yes, both apps can significantly drain your device’s battery as they run continuously in the background for tracking.

Pricing and Subscription Plans

Let’s analyze the cost-effectiveness of MileIQ vs. Everlance for different users.

MileIQ Pricing

MileIQ offers a range of plans suitable for different user needs:

- Free Mileage Tracker Plan: Allows for up to 40 drives every month without any cost.

- Monthly Plan: Priced at $5.99 per month, this plan offers unlimited drive tracking and mileage logging.

- Annual Plan: At $59.99 per year, this plan also allows for unlimited drive tracking and logging, with a savings of $12 compared to the monthly plan.

The free plan is ideal for those who don’t drive frequently for business purposes, while the unlimited plans are more suited for regular business travelers or freelancers who need extensive tracking capabilities.

Everlance Pricing

Everlance, on the other hand, has a slightly different pricing structure:

- Free Version: Limits users to 30 automatic trips per month.

- Paid Plans: These start at $8 per month for self-employed individuals and $12 per month for businesses. Paid plans offer more features, including automatic trip classification and bank & credit card integration.

Everlance’s paid plans also offer VIP customer support and additional features like live admin and user training, making them suitable for users who require more comprehensive tracking and reporting capabilities.

Key Considerations

- Usage Needs: If you’re someone who doesn’t drive frequently for business, the free plans offered by both apps might suffice. For more extensive use, the paid plans would be more appropriate.

- Budget: Everlance’s plans are slightly more expensive, but they also offer more features, especially in expense management.

- Feature Requirements: If you need more than just mileage tracking, such as expense tracking and bank integration, Everlance’s plans might be more suitable.

FAQs

Can I use MileIQ for free?

- Yes, MileIQ offers a free plan that includes 40 drives per month.

Does Everlance offer a free version?

- Yes, Everlance has a free version limited to 30 automatic trips per month.

What additional features does Everlance offer in its paid plans?

- Everlance’s paid plans include features like automatic trip classification, bank & credit card integration, and VIP customer support.

Is there a significant price difference between MileIQ and Everlance?

- Everlance tends to be slightly more expensive than MileIQ, especially for its business plans.

How Does MileageWise Stand Up Against MileIQ And Everlance?

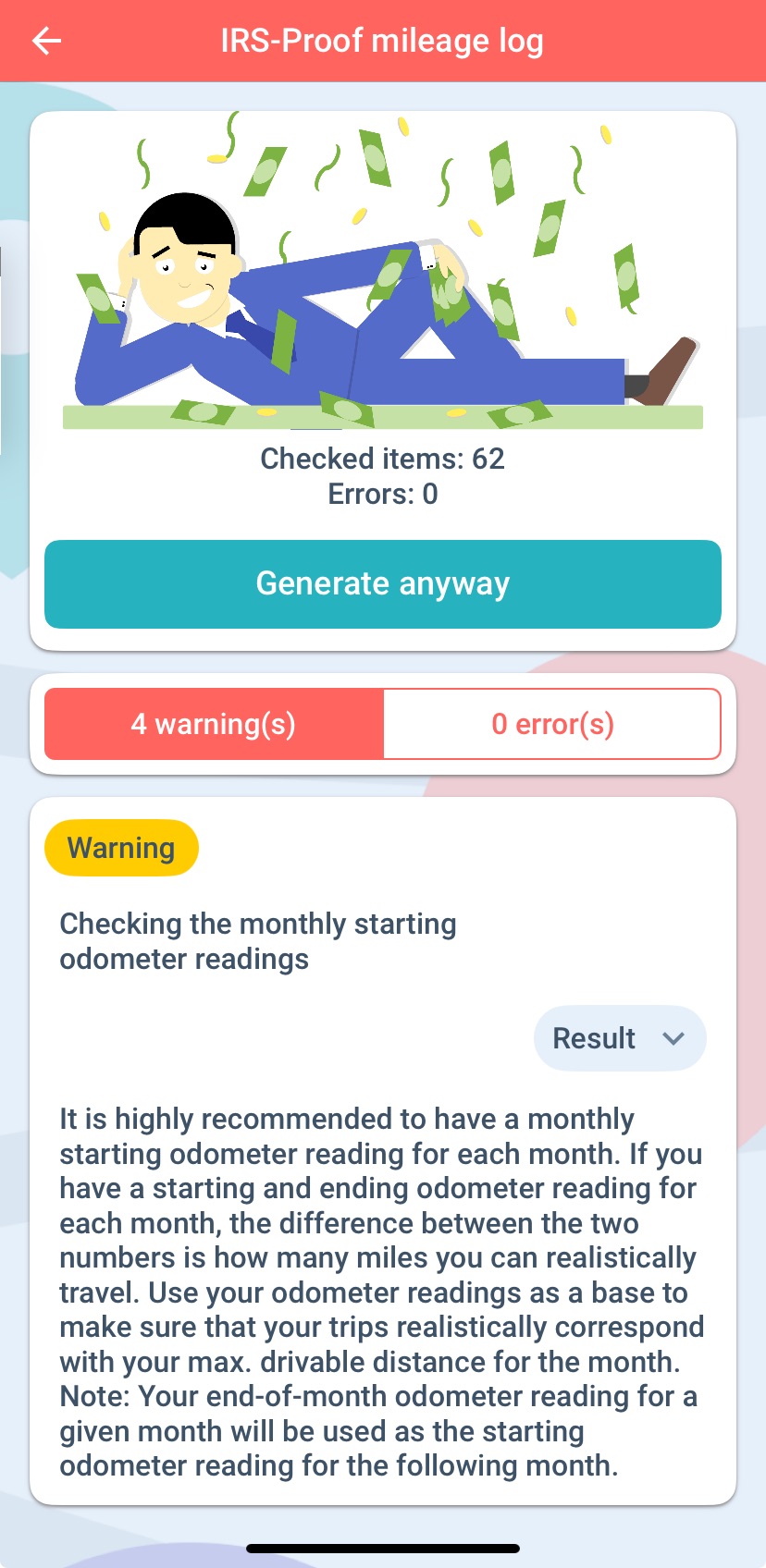

MileageWise distinguishes itself from MileIQ and Everlance in several key ways, particularly in its focus on creating IRS-compliant mileage logs and its built-in features for ensuring compliance and accuracy.

Key Features of MileageWise:

- IRS Compliance and Audit Features: MileageWise has a built-in IRS auditor that checks and corrects potential red flags in your mileage log, ensuring they are IRS-Proof. This feature is particularly beneficial for users who need to provide accurate and compliant mileage reports for tax purposes.

- Expense Tracking: A notable feature of MileageWise is its built-in expense tracking for vehicle-related business expenses and car repairs. However, this is only available to users who opt for the actual expense method for mileage deductions.

- Detailed Reporting: The app allows users to categorize their trips for reimbursement or tax purposes, showing the exact distance and route driven after the trip.

- AI Wizard Mileage Log Generator: This AI-powered feature provides trip recommendations to fill any trip gaps, auto-populating your trips based on previously visited locations and client addresses.

- Google Maps Timeline Export to Mileage Log: If a user faces several trip gaps in their mileage logs, this feature allows them to turn their Google Maps data into IRS-compliant mileage logs.

- Tax Preparation Services: Since MileageWise places great emphasis on ensuring IRS-Proof mileage logs for its users, its team also offers various tax-related services such as the Mileage Log Tax Preparation Service, and the Prepaid Mileage Log Audit Defense Service.

- Integration with Tools: MileageWise offers integrations with various tools like Freshbooks, Volvo car apps, and Waze, enhancing its functionality and ease of use.

Comparison with MileIQ and Everlance:

- Feature Set: Unlike MileIQ and Everlance, MileageWise does not offer features like invoicing, reimbursements, and general accounting. However, its strengths lie in mileage tracking and IRS compliance, which are critical for users who prioritize accuracy and adherence to tax regulations.

- Real-Time Tracking the Private Way: MileageWise does not monitor movement constantly during trips. Instead, it provides details after you arrive at your destination, including distance covered and mileage.

- Pricing: MileageWise’s pricing starts at $9.99 per vehicle per month for its Small Monthly Plan, with various annual and lifetime packages available. This pricing structure is different from MileIQ and Everlance, which have different plans and pricing models.

Who Is MileageWise For?

MileageWise is best suited for individuals and businesses that require detailed, IRS-compliant mileage tracking and are less concerned with additional features like invoicing or general accounting. Its focus on compliance and accuracy makes it a strong contender for users who need to ensure their mileage logs meet strict IRS standards.

And The Winner Is…You

In conclusion, choosing the right mileage tracking app—be it MileIQ, Everlance, or MileageWise—depends heavily on your specific needs and preferences.

MileIQ stands out for its simplicity and efficient mileage tracking, making it ideal for those who prioritize ease of use. Everlance, with its expansive features including expense tracking and integration capabilities, caters well to users seeking a comprehensive financial tool. MileageWise, distinct in its focus on IRS compliance and detailed reporting, is a strong contender for those who need meticulous mileage logging.

Each app has its unique strengths and potential limitations, and your decision should align with your requirements for tracking, reporting, and additional financial management functionalities. By carefully considering these aspects, you can select the app that not only simplifies your mileage tracking but also maximizes your reimbursements and tax deductions.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |