Last updated on October 24, 2023

Tracking mileage for business purposes is crucial for accurately claiming tax deductions. It helps you offset the costs of using your vehicle for work-related activities. While there are multiple methods to track mileage, an automatic mileage tracker app offers several advantages over traditional techniques like manual logging or a physical mileage logbook, making it the easiest and most reliable way to track mileage for taxes.

Let us look at eight benefits you can enjoy when using a mileage log app to track and assemble your monthly mileage logs.

- Accuracy and Reliability: Automatic mileage trackers use GPS technology to automatically record your trips. This ensures high accuracy, as distances are calculated using precise coordinates. On the other hand, manual tracking is prone to errors due to human oversight or miscalculations.

- Efficiency: With an automatic app, tracking your mileage becomes effortless. You don’t need to remember to start and stop tracking for each trip, reducing the chances of missing any deductible miles. This efficiency saves you time and reduces the hassle of maintaining detailed records.

- Real-Time Tracking: Automatic apps provide real-time mileage tracking, allowing you to view your mileage logs instantly. This is particularly beneficial if you need to monitor your mileage for multiple trips in a day or if you want to review your progress toward meeting business goals.

- Data Storage and Accessibility: Tracking apps store your records electronically, eliminating the need for physical paperwork. This electronic format makes it easier to organize and retrieve your mileage data when needed. Traditional methods, like paper logbooks, can be susceptible to loss or damage.

- Integration with Business Tools: Many automatic mileage logger apps offer integration with accounting or expense management software. This simplifies the process of transferring your mileage data for tax purposes, reducing the likelihood of errors during data entry.

- Automated Calculations: When tax season arrives, many apps can automatically calculate the deductible mileage and expenses based on your recorded data. This reduces the chances of making mistakes during tax preparation and ensures you receive the maximum deduction you’re entitled to.

- Documentation for Audit: Automatic mileage tracking provides a detailed digital trail of your trips, which can serve as solid evidence in case of an IRS audit. It’s easier to substantiate your deductions with accurate electronic records compared to handwritten logs.

- User-Friendly Experience: Most automatic mileage tracker apps are designed with user-friendly interfaces, making them accessible even to those with limited technical expertise. The apps often have features like categorizing trips and adding notes, which can help you keep track of the purpose of each trip.

Ultimately, an automatic mileage tracker app streamlines the process of tracking and documenting your business mileage, ensuring accuracy, efficiency, and ease of use.

I assume if you have read this far, you are now considering giving a mileage tracker app a whirl, but you might be intimidated by the prospect of setting up one if you are not that tech-savvy. You might also want to test a free mileage tracker version first to ensure that such an app warrants the long-term investment. The good news is that MileageWise is straightforward to set up and you can get started with a 14-day free trial. It even offers you an IRS mileage log example sheet so you will know exactly what data you need to cover all IRS mileage tracking requirements.

Let me walk you through the steps required to record your IRS mileage logs every month.

So you will have two platforms to follow: the app and the web dashboard which work in unison to help you create monthly mileage logs for IRS tax audits. You collect data using your mobile app as a monthly mileage tracker and finalize the data in your web dashboard.

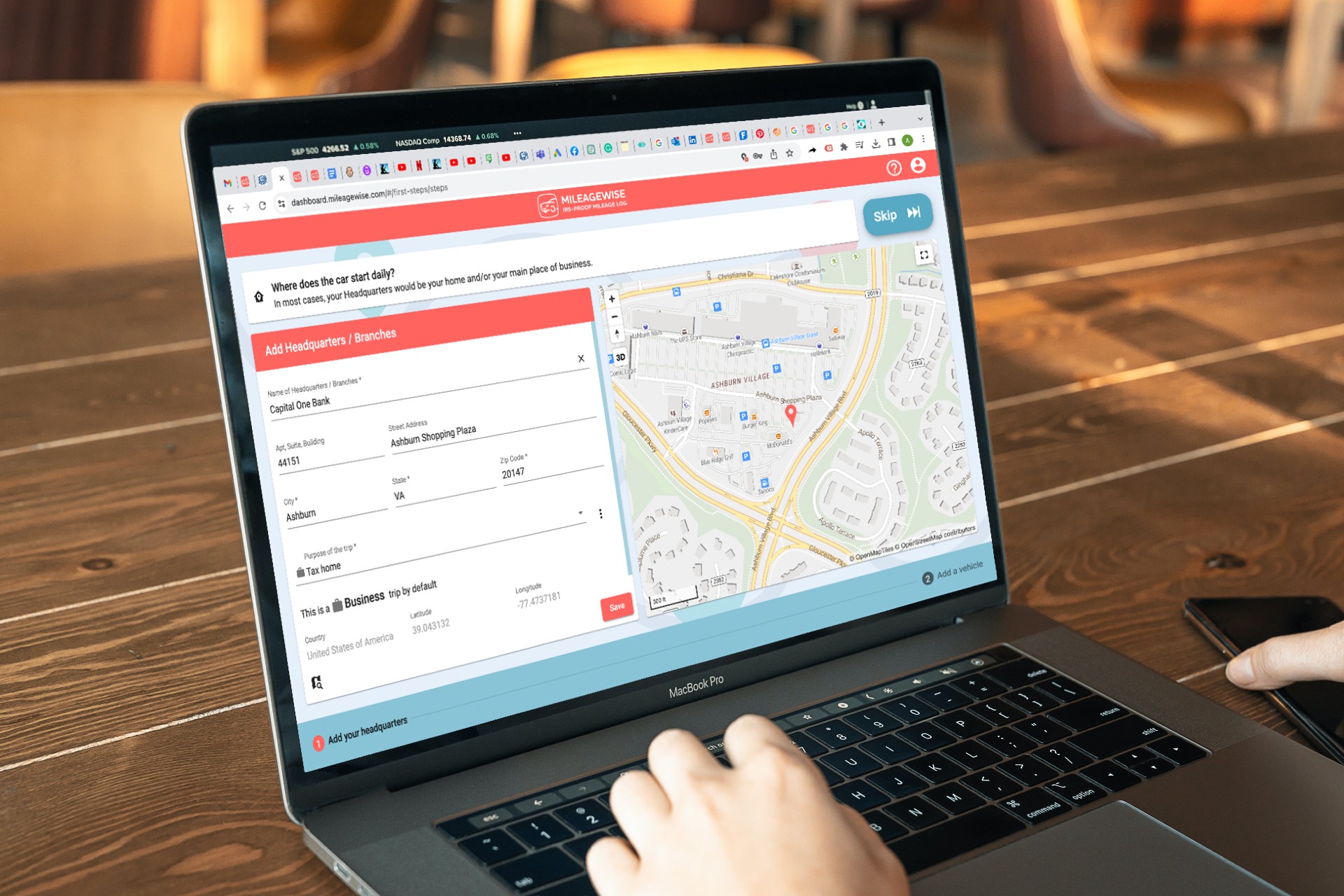

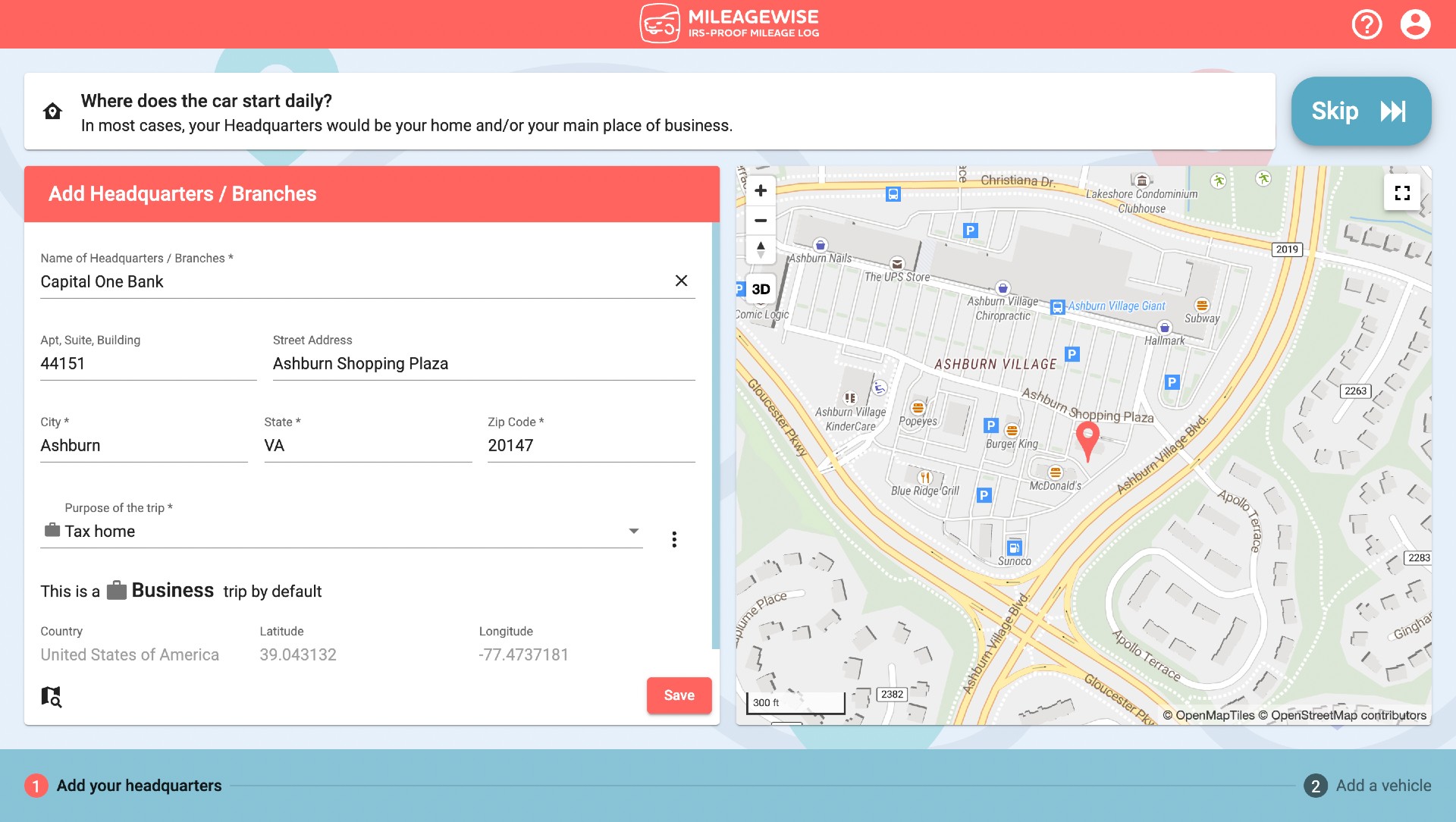

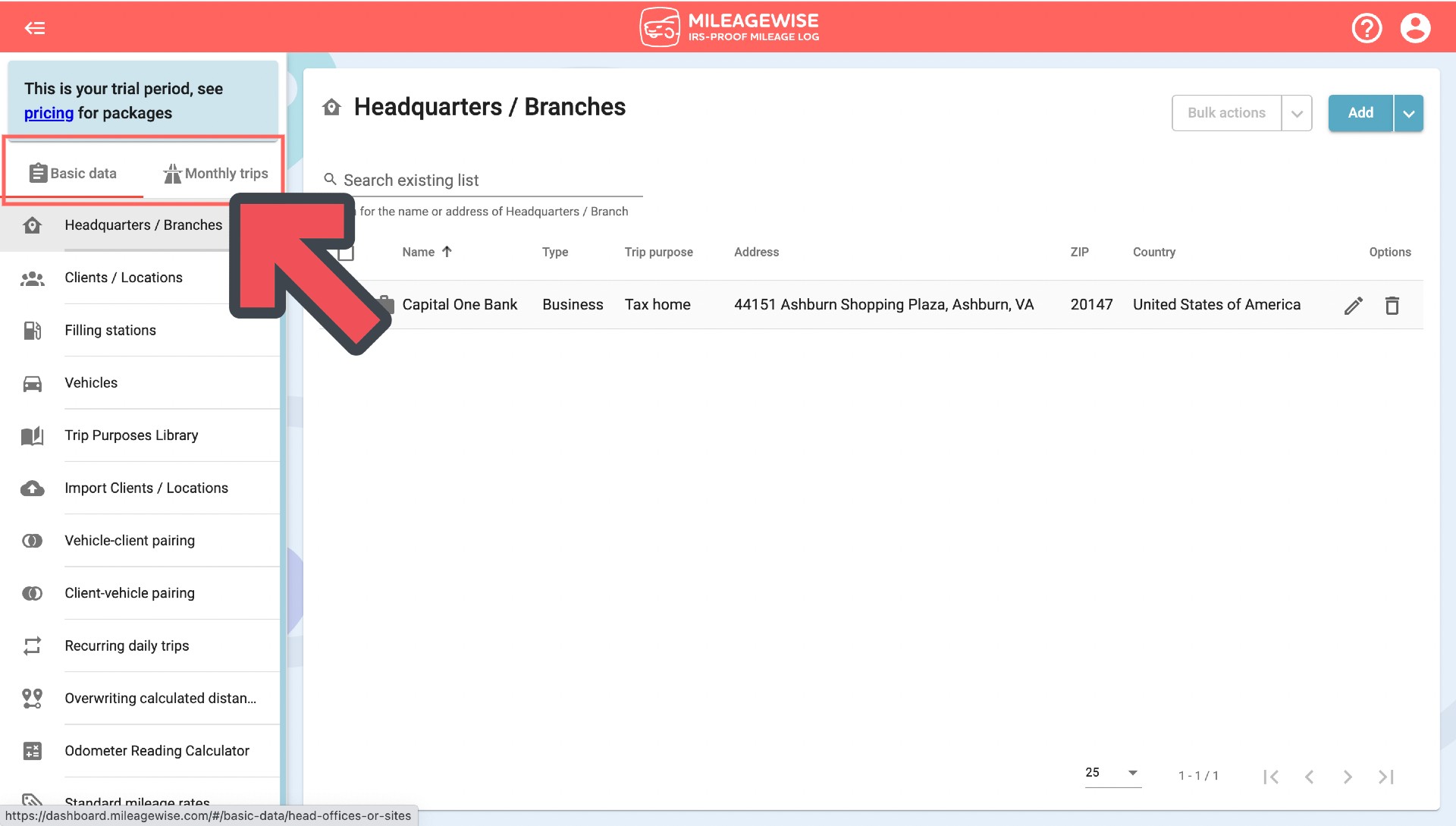

As a first step, sign up here and also download the app to your mobile from Google Play. Log in to access your web dashboard. Once in the Dashboard, you can start filling up the Basic Data section such as headquarters location, details of the vehicle(s) to be tracked, and so on.

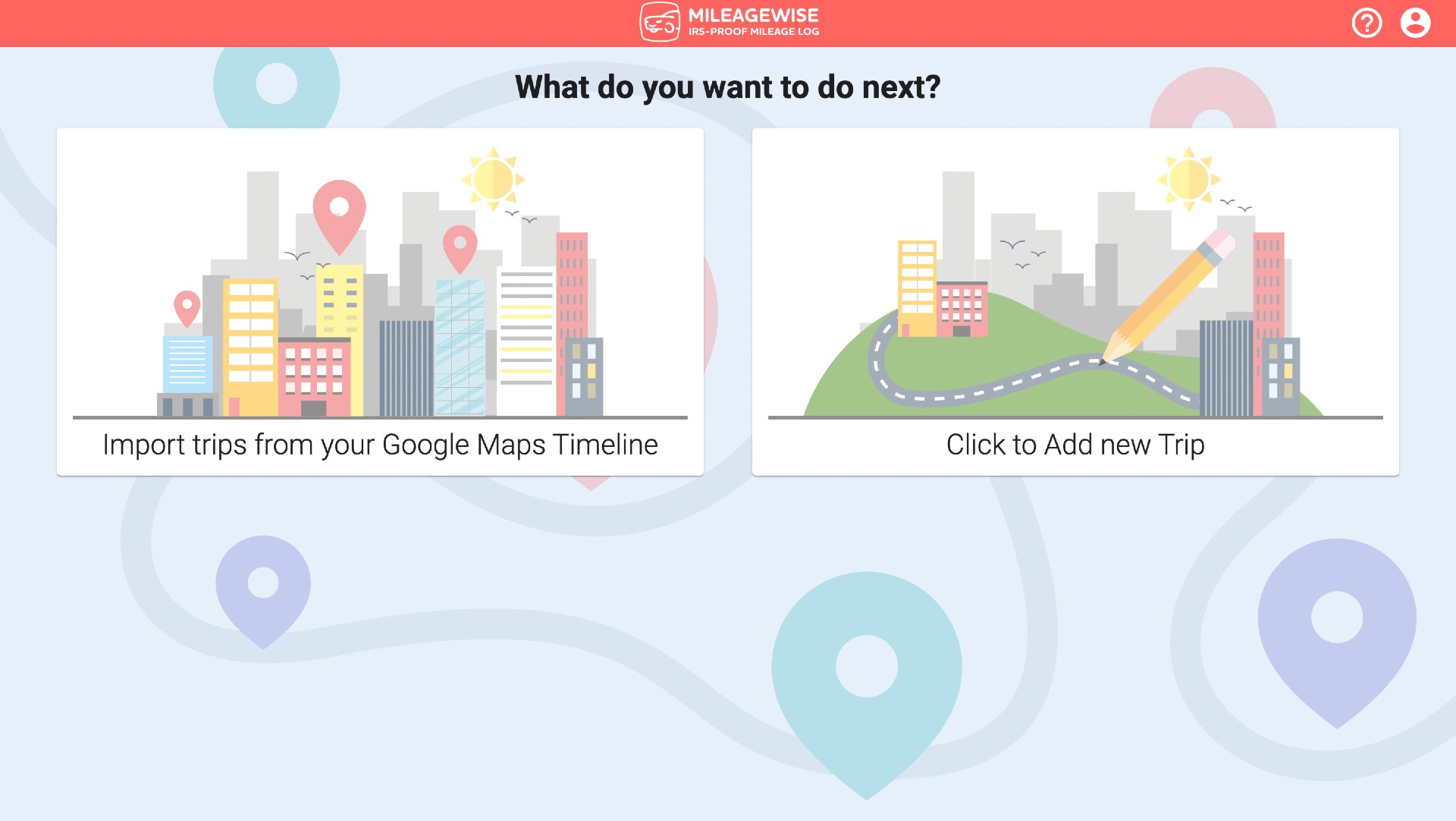

Once you are ready to save your basic data, you can get started by either importing trips from your Google Maps Timeline or starting from scratch in the Click to Add new Trip section. Let us now follow the latter route.

You will be working in the two major tabs: Basic Data and Monthly Trips.

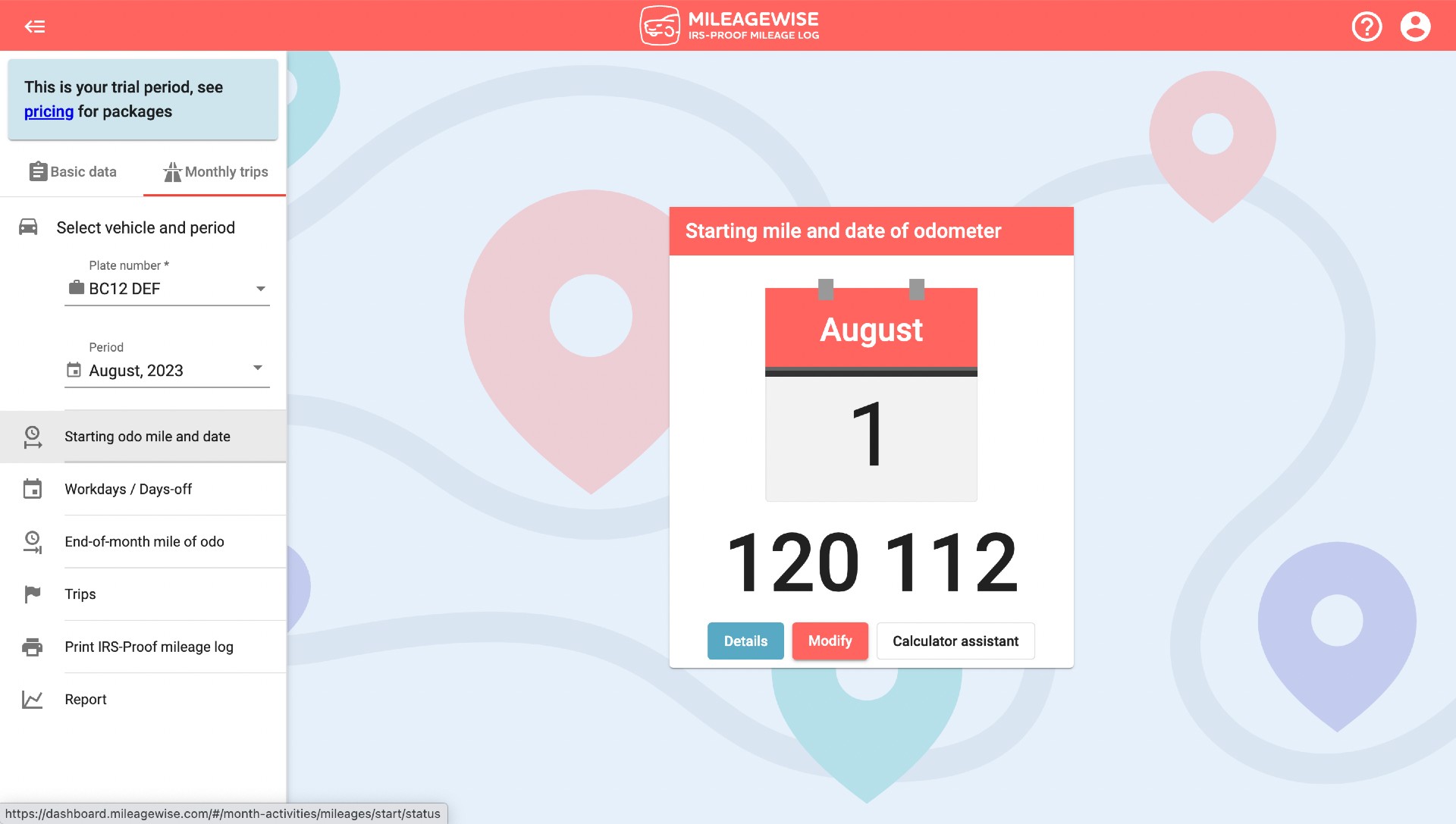

To get started with assembling a monthly mileage log, select the vehicle you want to track and set the Starting Odometer reading.

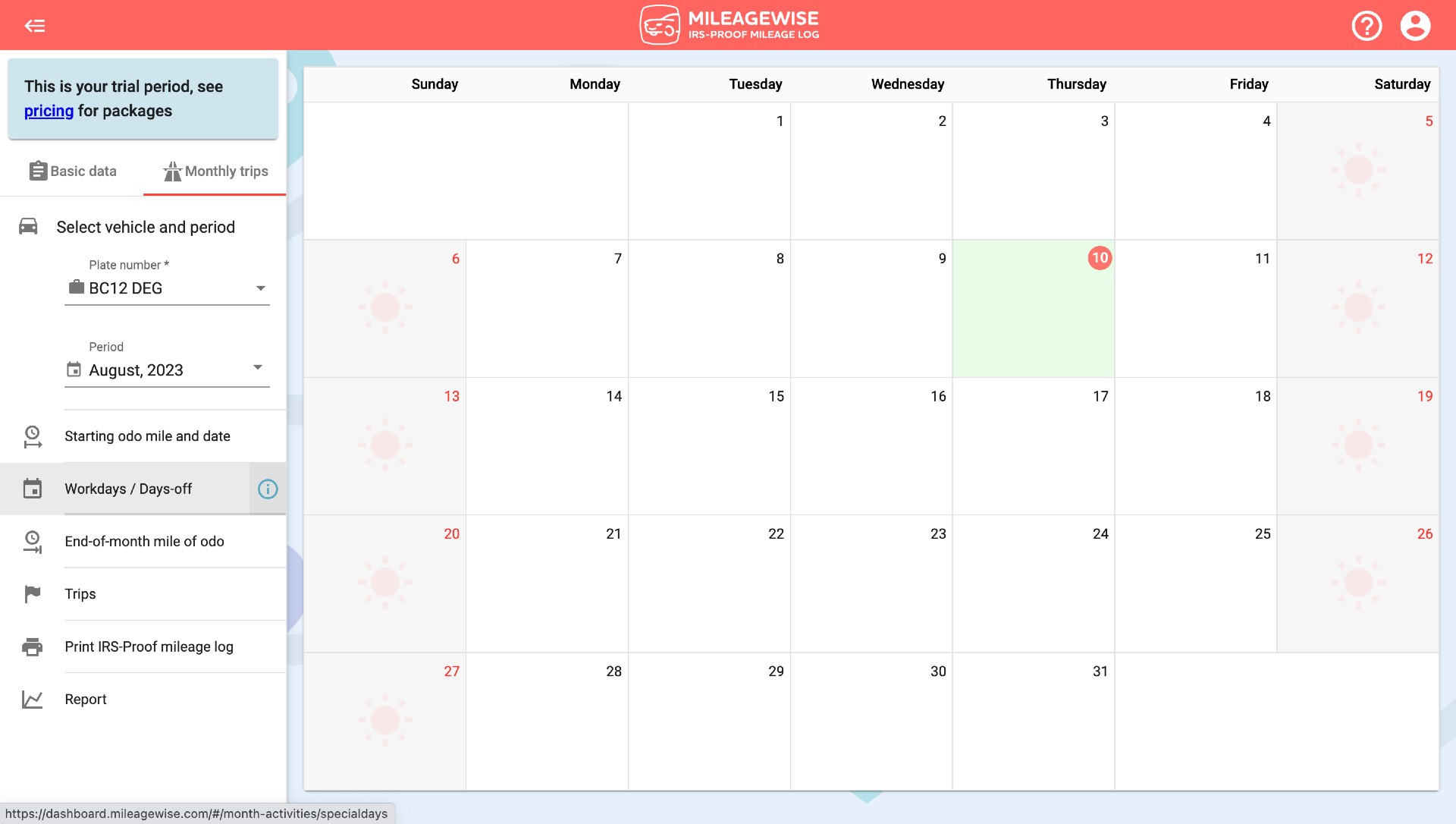

Let us now move to the next tab in the left-side menu panel. In the Workdays/Day off section, you can change a workday to a day off and vice versa by clicking on any day in the calendar and manually changing the settings. This can come in handy if you take a longer vacation or work on weekends.

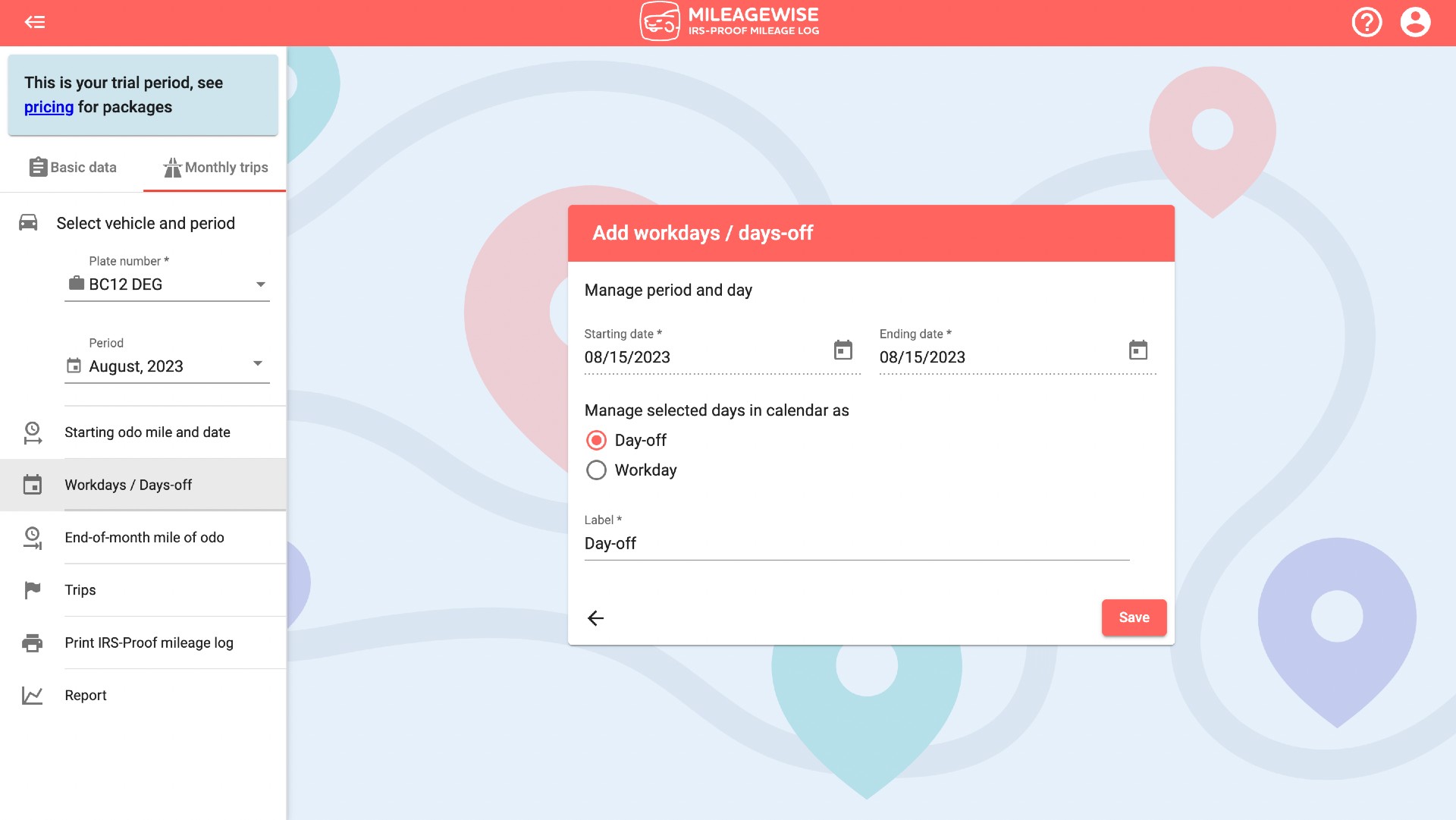

This is how to set a day-to-work day/day off:

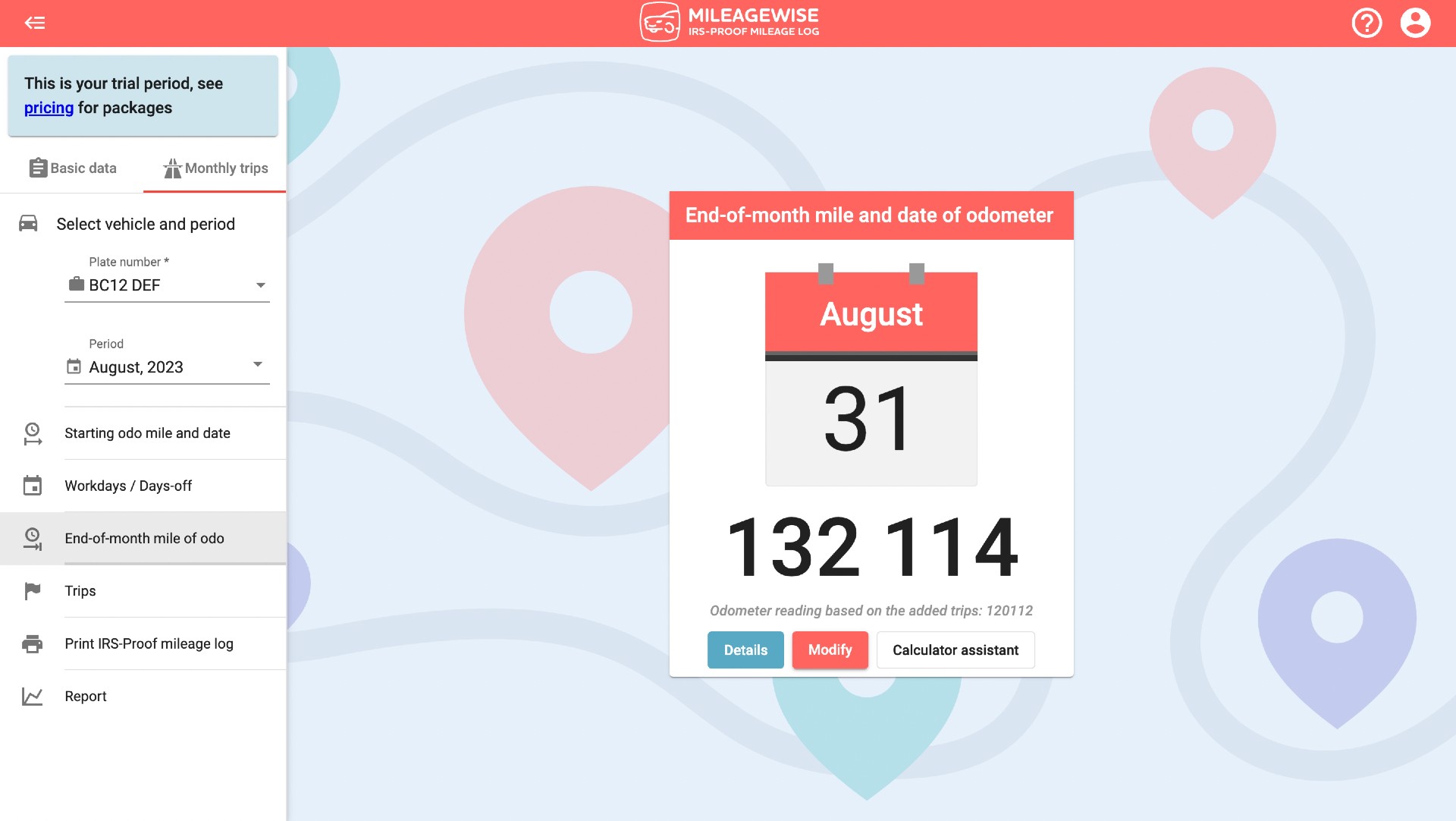

Also, make sure to record the End-of-month mile and Date of the odometer.

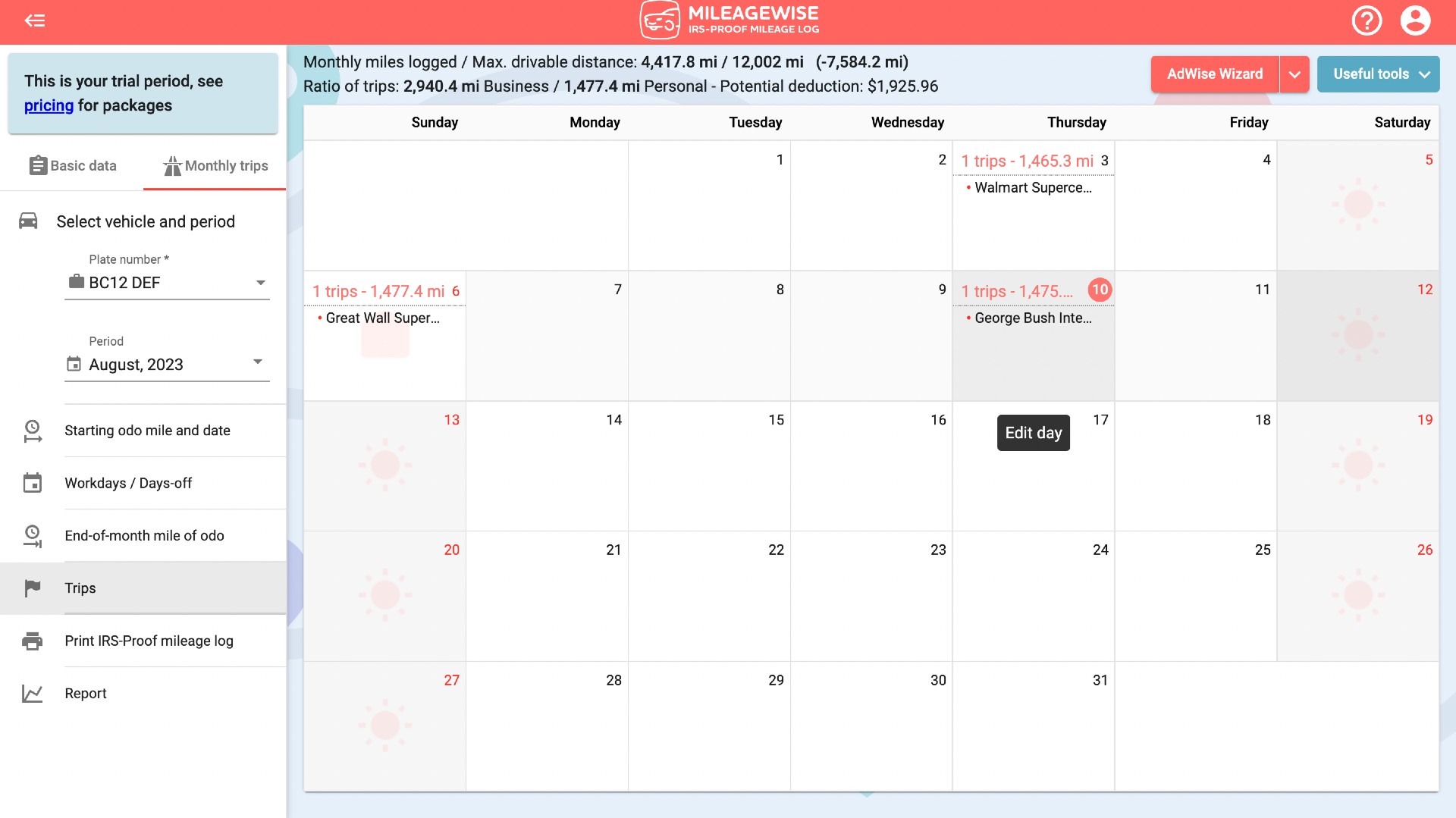

Now head to the Trips tab to see a summary of your monthly trips in the calendar view:

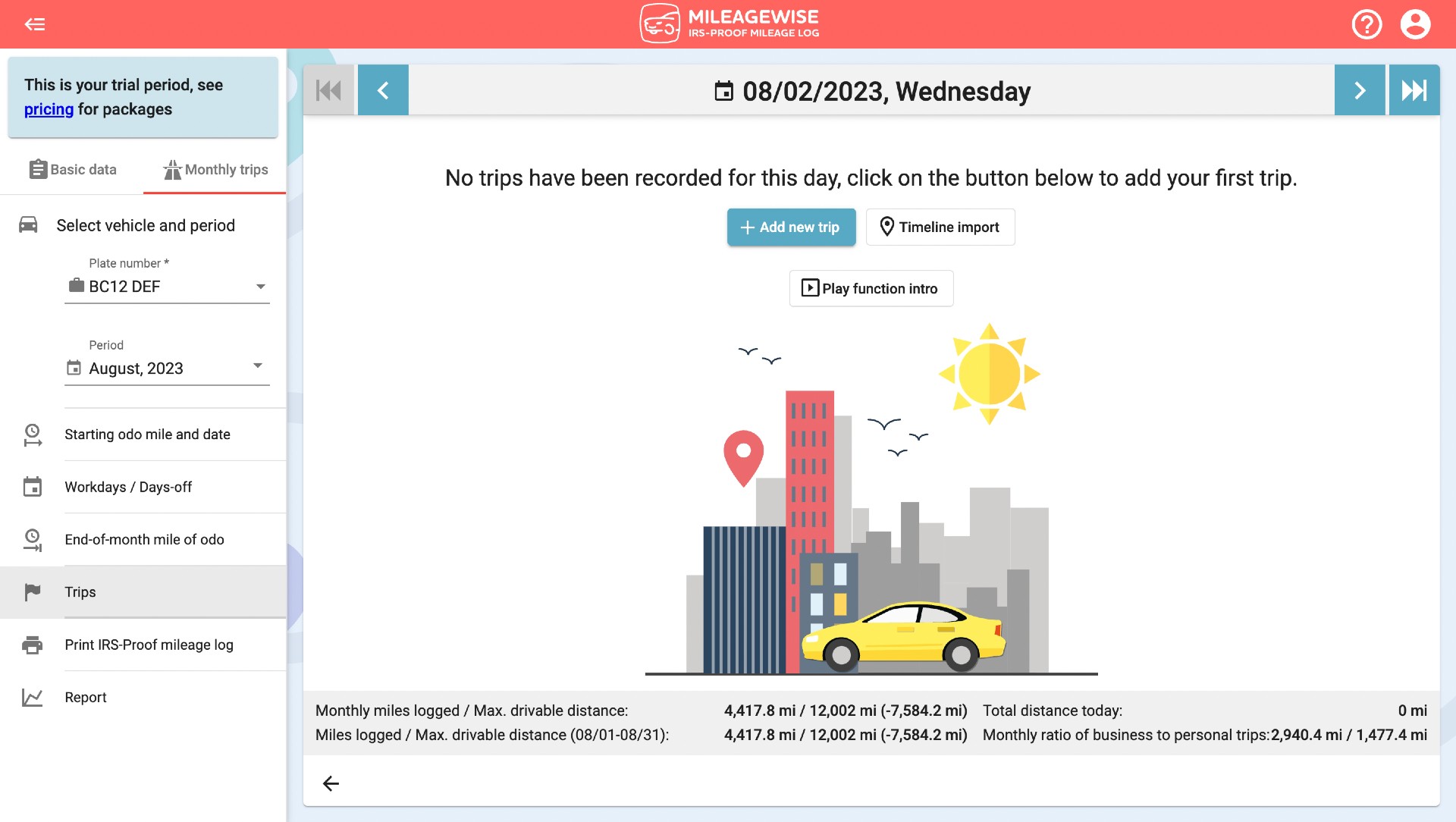

You can also add trips manually. Pick the day you want to add the trip to and select Add new trip:

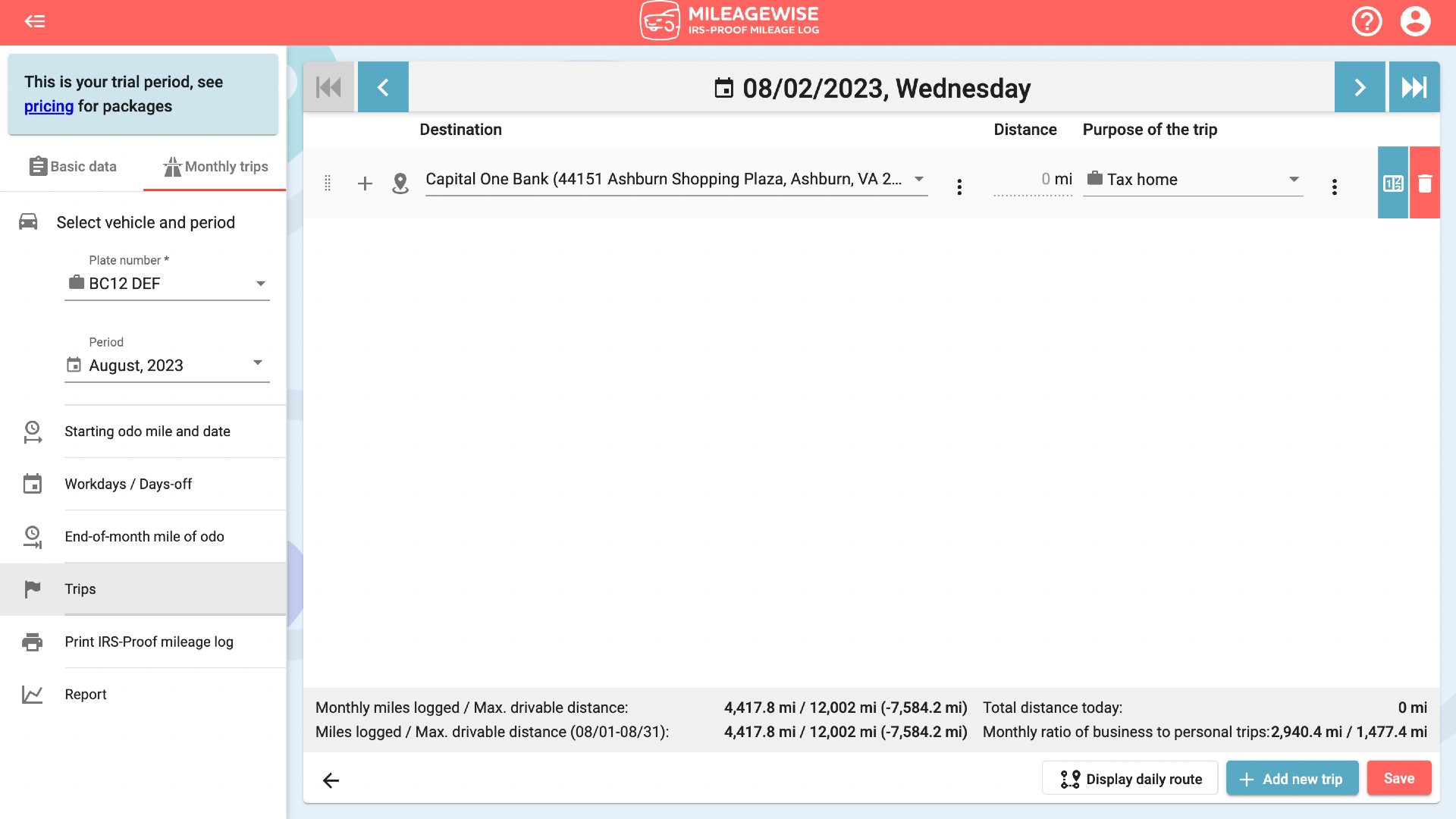

In the resulting windows select the departure address and also add the destination address by clicking the + symbol.

In the upper section of the summary page, you will find your most important figures. Here the Monthly added and the Deductible distance figures need to add up by the end of the given month. And, most importantly, you can also see the amount you can potentially claim.

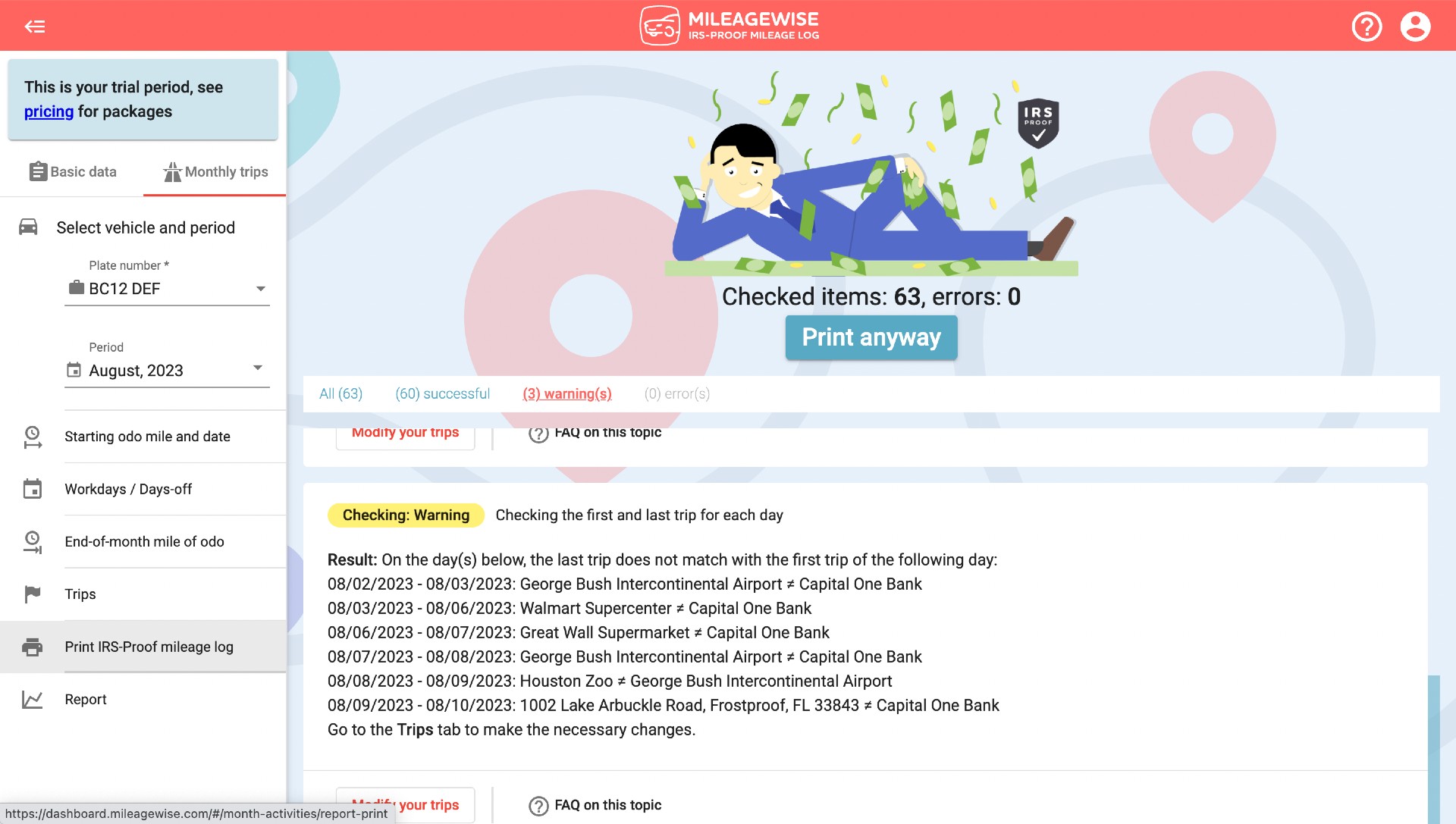

Now let us head to the final tab, which is the Print IRS-proof mileage log. This feature offers you IRS red flag monitoring to filter out trip gaps and other possible issues:

In conclusion, MileageWise ensures that your records are IRS-proof. The software features a built-in IRS auditor that checks and corrects 70 potential IRS red flags in your mileage log before letting you generate it. Its AI Wizard offers you trip recommendations in a fast and reliable manner for retrospective evidence. It is safe to say that this level of ease and accuracy would be impossible to guarantee using other methods. So if you are ready to start tracking and assembling your monthly mileage logs, click the link below.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card is required!

See Why The Wise Choose MileageWise:

| MileageWise | Other Mileage Tracker Apps | Other GPS Based Trackers | Excel | Tax Professional | |

| Mobile App for Ongoing Tracking | |||||

| Web Dashboard to Manage Trips | |||||

| Imports Trips and Locations from Google Timeline | |||||

| Lifetime Deals Available | |||||

| Average Reported Business Mileage Deduction | $12,000 | $710-$8500 | $400-$5,700 | $200-$2,000 | |

| Average Time Creating Retrospective Mileage Log (Yearly) | 7 minutes | 180 minutes | 180 minutes | 180 minutes | N/A |

| AI Wizard Mileage Log Generator for Retroactive Mileage Recovery | |||||

| Produces IRS-Proof Mileage Logs | |||||

| Free Phone Support with Live Agent | |||||

| Mileage Log Preparation Service | |||||

| Data Accessible in the Cloud |