If you’ve ever worked with QuickBooks, you are probably familiar with its most well-known bookkeeping functions. However, if you have ever filed for mileage deductions, the question ‘Does QuickBooks track mileage?’ might have occurred to you. The answer is yes: the QuickBooks Mileage Tracker App is part of a larger suite, the QuickBooks Self-Employed, targeted at freelancers and sole proprietors, offering an array of features for managing income, expenses, and tax obligations.

It’s particularly useful for those who don’t have separate business and personal accounts, helping to track and categorize transactions. Its features include automatic mileage tracking, distinguishing between business and personal expenses, calculating estimated taxes, organizing expenses into Schedule C categories, and basic invoice tracking.

QuickBooks Mileage Tracker

The QuickBooks Online Mileage Tracker, an integral part of QuickBooks’ suite, is designed to automate and streamline the process of tracking mileage for businesses and self-employed individuals. It’s essential to highlight that this feature is available across different QuickBooks products, such as QuickBooks Online, QuickBooks Time, and QuickBooks Self-Employed.

We took QuickBooks Online Mileage Tracker for a ride to see how it stands up against similar products and MileageWise. The software consists of the QuickBooks Online Mileage Tracker App and a complimentary dashboard.

Who Is It For?

This app is tailored for freelancers and sole proprietors, focusing on income, expenses, and tax obligations. It automatically calculates mileage deductions using the current IRS mileage rate and allows users to easily classify trips as business-related.

How to Track Mileage with QuickBooks Online

Getting Started

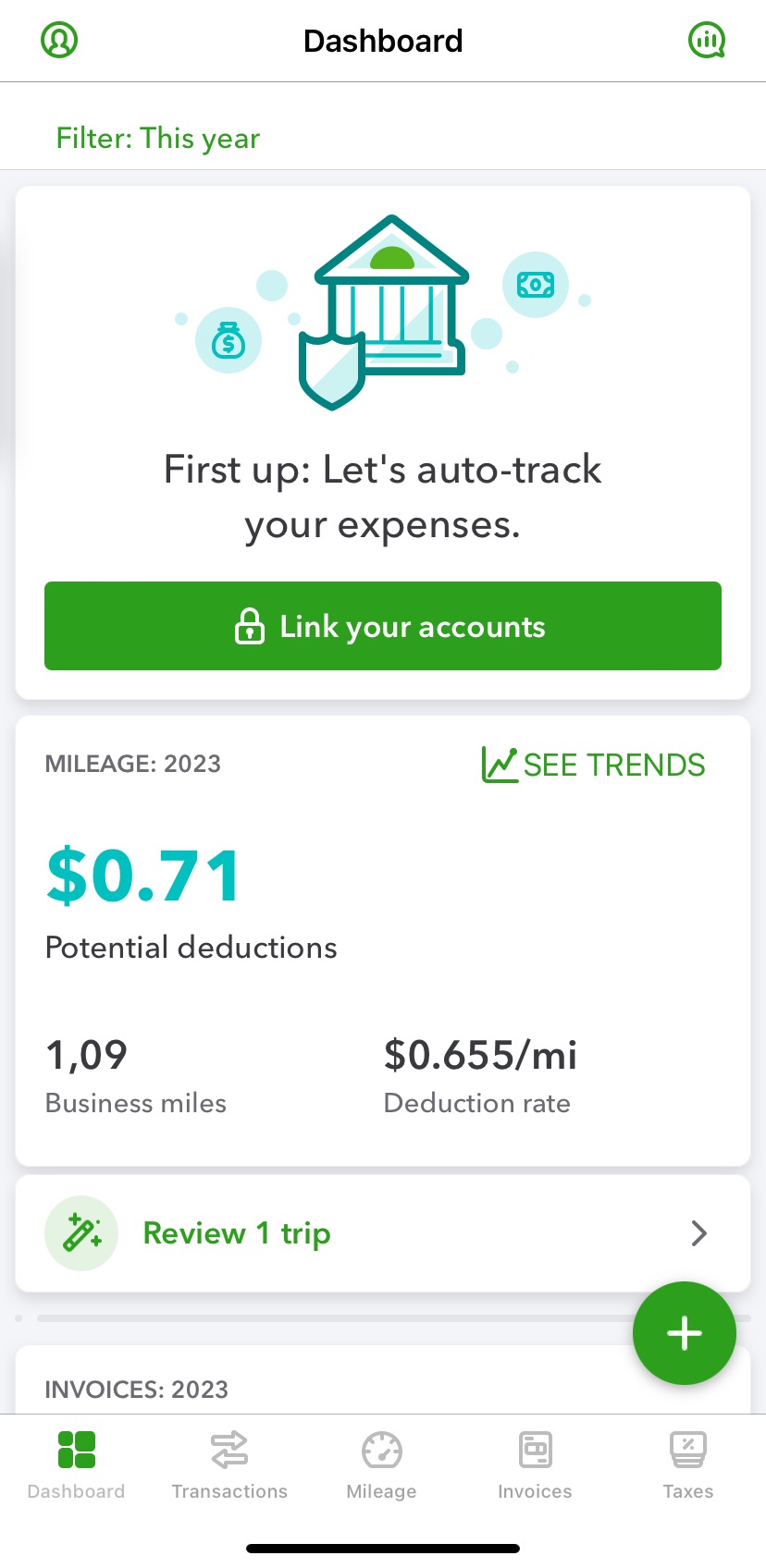

It’s pretty standard and straightforward to set up your account. After signing up, make sure to link your accounts for the service to work as expected. Also, add your vehicle details and similar data that’ll be needed.

Mileage Tracking

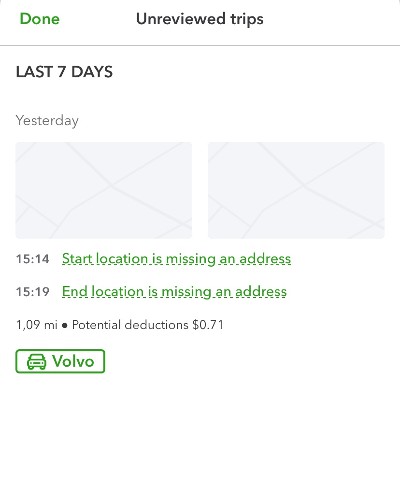

The app worked as expected, at least in terms of working in a fully automatic fashion. Good thing it even works offline, without the need for an internet connection running. However, and this might be the trade-off, it failed to capture my start and end location address:

Once you’re done with driving, you get an instant deduction estimation.

Income and Expense Tracking

As you know, mileage reimbursement and mileage expense tracking are integral parts of the larger picture.

The mileage tracker uses the current IRS mileage rate to calculate deductions for work-related travel. You can opt-in to have all your car travel logged automatically, and then mark which trips were for business to calculate the corresponding deduction.

The app also allows you to easily categorize transactions as either business or personal. You can connect your accounts (checking, credit cards, PayPal, etc.) to see all your transactions in one place. This feature helps in keeping track of income and expenses effectively.

Transaction Categorization

QuickBooks Self-Employed enables users to classify income and expenses using categories that align with the IRS Schedule C, simplifying tax filing. But please remember to link your account first!

Invoicing

You can create, send, and track basic invoices directly from the app, although customization options are minimal and it doesn’t support estimates.

Tax Calculations

The app automatically calculates quarterly estimated taxes and organizes expenses into Schedule C categories, which aids in tax preparation.

Easy Sharing with Accountants

It allows easy sharing of your financial data with accountants via email invites.

Reports Generation

QuickBooks Self-Employed can generate various business reports including mileage logs, profit and loss statements, receipts, tax summaries, and tax details.

Pricing

The pricing for QuickBooks Self-Employed starts at $20 per month. There are also higher-tier plans available, like the Self-Employed Tax Bundle for $30 per month and the Self-Employed Live Tax Bundle for $40 per month, which offer additional features like online tax payment and access to TurboTax Live experts.

However, QuickBooks Self-Employed is limited in scalability and doesn’t accommodate multiple businesses under one account. Users may need to switch to more advanced services like QuickBooks Online as their business grows, which starts at $25 per month for its Simple Start plan. Migrating data between these services can be complex, especially as mileage data can’t be imported into a new QuickBooks account.

A significant limitation is that QuickBooks Self-Employed does not support multiple businesses under one account and is not scalable. When users outgrow this service, they need to switch to another QuickBooks product, which can be a complex process as mileage data cannot be imported directly into a new QuickBooks account.

What’s Missing?

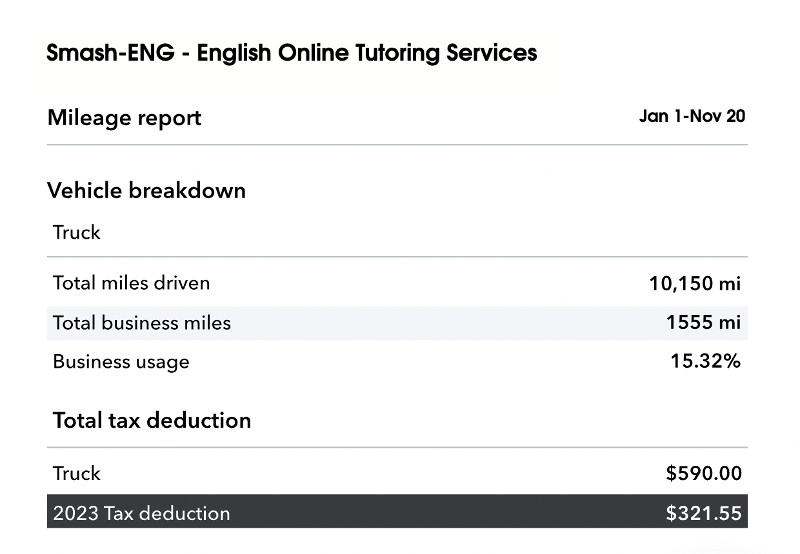

While QuickBooks Mileage Tracker seems to deliver on many fronts, we found that it might “miss the point” when it comes to helping users with actual IRS-Proof mileage logs. If you compare a sample report from QuickBooks and then from MileageWise, the difference speaks for itself.

First, the QuickBooks sample:

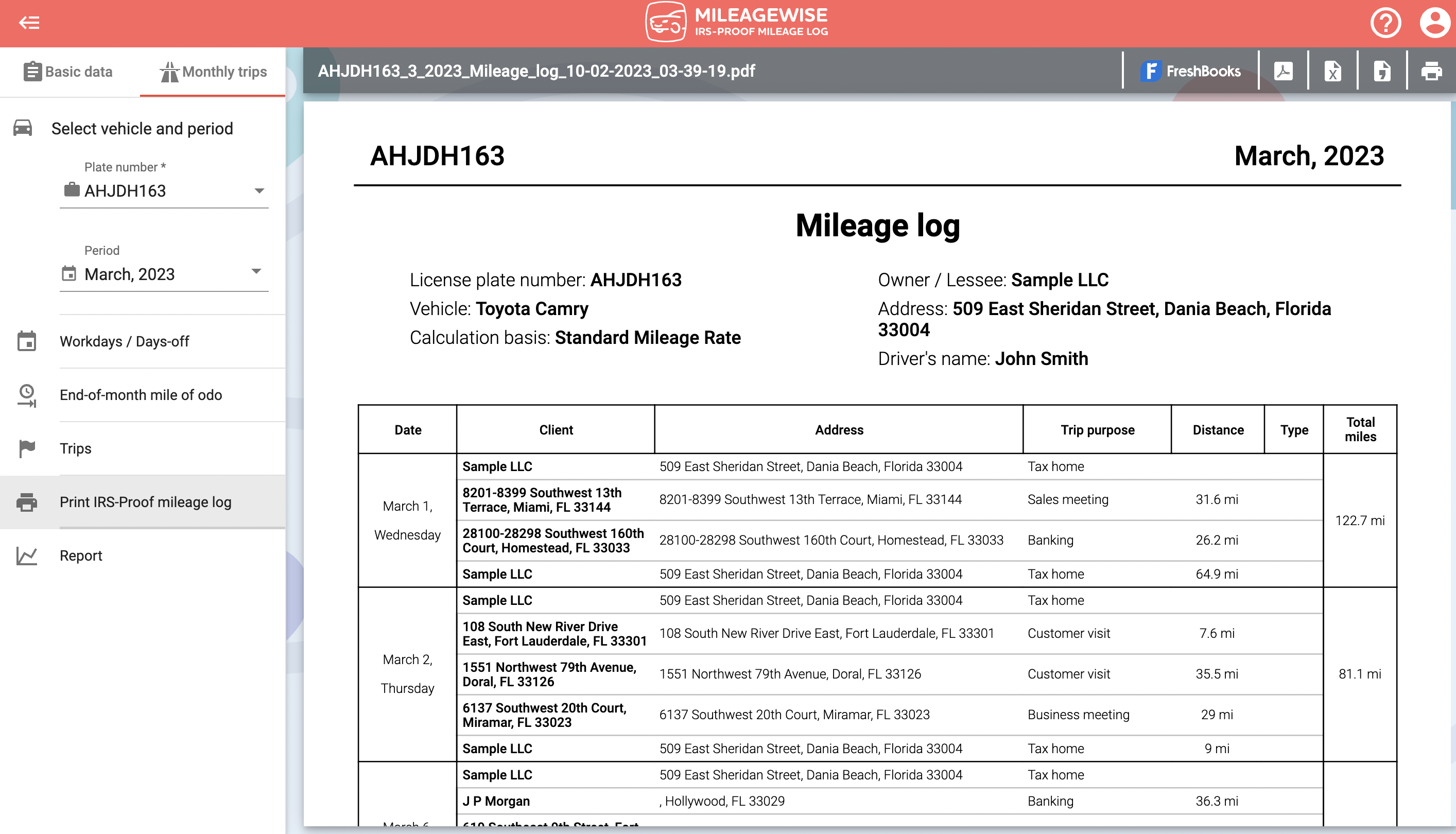

Now, MileageWise:

MileageWise also offers a range of features and services we couldn’t find it QuickBooks. These include:

IRS-Proof Mileage Logs: Expertise in creating logs that meet IRS standards.

Retrospective Mileage Logging: Offers the ability to generate logs for past timeframes, useful for audits or overlooked records.

Advanced AI Wizard: Aids in reclaiming mileage using cutting-edge technology.

Integration with Google Timeline: Allows for importing of trips and locations for comprehensive backdated logging, especially useful when there are gaps in your log.

Internal IRS Audit Tool: Identifies and assists in resolving logical inconsistencies.

Team Collaboration Dashboard: Designed for shared use, perfect for businesses managing vehicle fleets.

So, What’s the Verdict?

So how did our QuickBooks mileage tracker review go? In summary, MileageWise is more specialized in mileage tracking with a focus on IRS compliance and is suitable for businesses with a large fleet of vehicles, especially those using FreshBooks.

QuickBooks Online, on the other hand, offers an integrated solution for businesses that need both accounting and mileage tracking, with the convenience of automatic tracking and powerful reporting capabilities. The choice between the two would depend on the specific needs of the business, particularly in terms of integration with existing accounting solutions and the focus on compliance versus comprehensive business management. Deciding on the best mileage tracker app for your business often needs to take several factors into account.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!